by Calculated Risk on 10/05/2011 12:05:00 AM

Wednesday, October 05, 2011

Reis: Office Vacancy Rate declines slightly in Q3 to 17.4%

From the WSJ: Offices Make Slow Recovery

Overall, the amount of occupied space in U.S. office buildings increased by 6.2 million square feet during the quarter, with the vacancy rate falling by 0.1 percentage point to 17.4%, Reis said.

...

Average asking rents for office space also have been growing slowly this year and rose by 13 cents to $27.85 a square foot in the third quarter. By comparison, they hit a boom-era high of $29.37 in the third quarter of 2008 and a post-recession low of $27.50 in the third quarter of 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the office vacancy rate starting in 1991.

Reis is reporting the vacancy rate declined to 17.4% in Q3, down from 17.5% in Q2. The vacancy rate was at a cycle high of 17.6% in Q3 2010. It appears the office vacancy rate might have peaked in 2010 - and has only declined slightly since then.

Reis should release the Mall and Apartment vacancy rates over the next few days.

Tuesday, October 04, 2011

Consumer Bankruptcy filings down 10 percent through Q3

by Calculated Risk on 10/04/2011 06:50:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Down 10 Percent Through Nine Months of 2011

U.S. consumer bankruptcy filings totaled 1,044,722 nationwide during the first nine months of 2011 (Jan. 1-Sept. 30), a 10 percent decrease from the 1,165,172 total consumer filings during the same period a year ago, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). September consumer bankruptcies decreased 17 percent nationwide from September 2010 as the data showed that the overall consumer filing total for September reached 108,517 down from the 130,329 consumer filings recorded in September 2010.

“The trend of declining filings has been consistent with consumers continuing to reign in their spending, household debt, and an overall pull back in consumer credit,” said ABI Executive Director Samuel J. Gerdano. “Total consumer filings for 2011 will be less than 2010.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

Note: The spike in 2005 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005".

It is possible that consumer bankruptcy filings peaked in 2010, but filings will probably stay elevated for several years.

Market Update: Almost a new bear

by Calculated Risk on 10/04/2011 04:00:00 PM

Click on graph for larger image in new window.

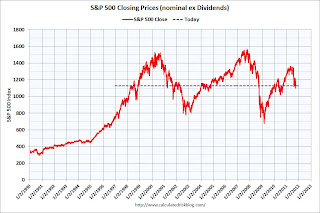

The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in April 1998; over 13 years ago.

The second graph (click on graph for larger image) from Doug Short shows the sharp decline over the last few weeks.

The S&P dipped into bear market territory (down 20%) within the day, but closed up over 2%. This puts the S&P500 down about 17.5% from the recent peak.

Goldman puts U.S. recession probability at 40% in 2012

by Calculated Risk on 10/04/2011 12:26:00 PM

The following article makes a few key points that we've been discussing:

• It is very unlikely that the U.S. economy was in a technical recession at the end of Q3. In fact, Goldman revised up their Q3 forecast to 2.5% (Merrill Lynch and others revised up their Q3 forecasts too). The recent data suggests sluggish growth, not recession (examples include the ISM manufacturing survey showing expansion in September, the Chicago PMI increasing, and auto sales back up over 13 million SAAR).

• There are clear downside risks to the U.S. economy mostly from the European financial crisis, the apparent renewed recession in Europe, and from U.S. fiscal tightening. However the potential spillover from Europe is difficult to quantify.

• Since the cyclical sectors in the U.S. remain very depressed, it is difficult for those sectors to fall significantly. Usually these sectors decline prior to a recession in the U.S., and that is not happening now.

From Jeff Cox at CNBC: Recession Chance 40% in 2012, Jobless Rate to 9.5%: Goldman

Jan Hatzius, Goldman's chief US economist, pegged recession chances at 40 percent and said the jobless rate is likely to surge to the mid-9 percent range in 2012.Here are the upside and downside risks from the research note:

While that still jibes with the firm's forecast that a recession — or two consecutive quarters of negative growth — is not the most likely scenario, the warning signs flashed Tuesday underscore concerns about European debt contagion on an already fragile US economy.

The upside risk is that either financial stresses ease--with the most likely cause of this a more aggressive and coordinated move by European policymakers to turn the tide--or that the spillovers from those financial stresses into US credit and financial conditions prove relatively limited. The quickest and easiest way to gauge the former is the behavior of borrowing spreads for sovereigns in the European periphery, and banks in the Eurozone as a whole. ... Without a clear pass-through into domestic financial or credit conditions, the base-case outlook would revert to our previous forecast of trend or slightly-below trend growth in 2012. (The "hard data" on the economy have held up sufficiently well in the third quarter that we now expect 2.5% growth in Q3, from 2.0% previously.)

The downside risk is of course that these financial spillovers--or conceivably some other shock, perhaps greater fiscal tightening in 2012 than we now anticipate--prove sufficient to push the US economy into recession; both a quantitative model and our subjective assessment put recession risk in the neighborhood of 40% at this point. For now, we still think the base case is that the US economy avoids this outcome. The cyclical sectors of the economy are already quite depressed--in particular, homebuilding is barely above the depreciation rate of housing--so downside looks more limited.

Bernanke Testimony: "Economic Outlook and Recent Monetary Policy Actions"

by Calculated Risk on 10/04/2011 10:00:00 AM

Fed Chairman Ben Bernanke's testimony, "Economic Outlook and Recent Monetary Policy Actions", Before the Joint Economic Committee, United States Congress, Washington, D.C.

Here is the CSpan feed

Prepared testimony: Economic Outlook and Recent Monetary Policy Actions

Recent revisions of government economic data show the recession as having been even deeper, and the recovery weaker, than previously estimated; indeed, by the second quarter of this year--the latest quarter for which official estimates are available--aggregate output in the United States still had not returned to the level that it had attained before the crisis. Slow economic growth has in turn led to slow rates of increase in jobs and household incomes.And on policy:

The pattern of sluggish growth was particularly evident in the first half of this year, with real gross domestic product (GDP) estimated to have increased at an average annual rate of less than 1 percent. Some of this weakness can be attributed to temporary factors. Notably, earlier this year, political unrest in the Middle East and North Africa, strong growth in emerging market economies, and other developments contributed to significant increases in the prices of oil and other commodities, which damped consumer purchasing power and spending; and the disaster in Japan disrupted global supply chains and production, particularly in the automobile industry. With commodity prices having come off their highs and manufacturers' problems with supply chains well along toward resolution, growth in the second half of the year seems likely to be more rapid than in the first half.

However, the incoming data suggest that other, more persistent factors also continue to restrain the pace of recovery. Consequently, the Federal Open Market Committee (FOMC) now expects a somewhat slower pace of economic growth over coming quarters than it did at the time of the June meeting, when Committee participants most recently submitted economic forecasts.

One crucial objective is to achieve long-run fiscal sustainability. The federal budget is clearly not on a sustainable path at present. ...

A second important objective is to avoid fiscal actions that could impede the ongoing economic recovery. These first two objectives are certainly not incompatible, as putting in place a credible plan for reducing future deficits over the longer term does not preclude attending to the implications of fiscal choices for the recovery in the near term.

...

In view of the deterioration in the economic outlook over the summer and the subdued inflation picture over the medium run, the FOMC has taken several steps recently to provide additional policy accommodation.

...

Monetary policy can be a powerful tool, but it is not a panacea for the problems currently faced by the U.S. economy. Fostering healthy growth and job creation is a shared responsibility of all economic policymakers, in close cooperation with the private sector. Fiscal policy is of critical importance, as I have noted today, but a wide range of other policies--pertaining to labor markets, housing, trade, taxation, and regulation, for example--also have important roles to play. For our part, we at the Federal Reserve will continue to work to help create an environment that provides the greatest possible economic opportunity for all Americans.