by Calculated Risk on 10/04/2011 08:45:00 AM

Tuesday, October 04, 2011

Europe: Aid to Greece Delayed

From the NY Times: Rescue Aid to Greece Delayed as Pressure Rises for Reforms

Meeting in Luxembourg, the finance ministers made it clear that Greece was now unlikely to receive 8 billion euros ($10.6 billion) before November.From the WSJ: Greece: Finances Can Withstand Delay

Greece has said it could default on its debt within weeks without the aid — an outcome with potentially disastrous consequences for the euro zone.

Greece's government has enough cash to continue operating until the middle of November, the country's finance minister said Tuesday, after euro-zone finance ministers delayed the disbursement of the next tranche of promised aid for the debt-stricken country.Meanwhile, on approving the expanded European Financial Stability Facility (EFSF), Slovakia’s will vote sometime between October 11th and October 14th, there will be a vote in Malta tomorrow (Wednesday), and the Dutch vote on October 12th. The goal is to have full ratification before the EU summit on October 17th.

"Until mid-November there is no problem," Finance Minister Evangelos Venizelos said at a news conference. "We have done a cash-flow forecast and our estimates are secure."

Monday, October 03, 2011

Unofficial Problem Bank List Quarterly Transition Matrix

by Calculated Risk on 10/03/2011 10:28:00 PM

A busy day ... here are the earlier posts:

• ISM Manufacturing index increases in September

• Construction Spending increased in August

• U.S. Light Vehicle Sales at 13.1 million SAAR in September

• LPS: Foreclosure Starts increased in August, Seriously Delinquent Mortgage Loans fall to 2008 levels

CR Note: Surferdude808 started compiling the unofficial problem bank list over two years ago. Thanks!

From surferdude808:

With the third quarter of 2011 coming to an end this past Friday, it is time to update the Unofficial Problem Bank List transition matrix. The list debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table below). Over the past 25 months, about 54 percent or 210 institutions have been removed from the original list with 129 from failure, 62 from action termination, and 19 from unassisted merger. More than 33 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List.

Since the publication of the original list, another 1,052 institutions have been added. However, only 807 of those 1,052 additions remain on the current list as 245 institutions have been removed in the interim. Of the 245 inter-period removals, 155 were from failure, 55 were from an unassisted merger, 33 from action termination, and two from voluntary liquidation.

In total, 1,441 institutions have made an appearance on the Unofficial Problem Bank List and 284 or 19.7 percent have failed. Of the 455 total removals, the primary way of exit from the list is failure at 284 or nearly 63 percent. Only 95 or around 21 percent have been able to rehabilitate themselves to see their respective action terminated. Alternatively, another 74 or 16 percent found merger partners most likely to avoid failure. Total assets that have appeared on the list amount to $777.8 billion and $272.4 billion have been removed due to failure. The average asset size of removals from failure is $959 million.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 62 | (14,365,497) | |

| Unassisted Merger | 19 | (3,290,170) | |

| Voluntary Liquidation | 0 | - | |

| Failures | 129 | (174,696,774) | |

| Asset Change | (19,508,778) | ||

| Still on List at 9/30/2011 | 179 | 64,452,210 | |

| Additions | 986 | 340,680,808 | |

| End (9/30/2011) | 1001 | 405,133,018 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 33 | 23,221,613 | |

| Unassisted Merger | 55 | 39,058,992 | |

| Voluntary Liquidation | 2 | 833,567 | |

| Failures | 155 | 97,669,948 | |

| Total | 245 | 160,784,120 | |

| 1Institutions not on 8/7/2009 or 9/30/2011 list but appeared on a list between these dates. | |||

LPS: Foreclosure Starts increased in August, Seriously Delinquent Mortgage Loans fall to 2008 levels

by Calculated Risk on 10/03/2011 06:56:00 PM

From LPS Applied Analytics: LPS' Mortgage Monitor Report Shows Foreclosure Starts Rose Nearly 20 Percent in August, But Down More Than 12 Percent From Same Time Last Year

The August Mortgage Monitor report released by Lender Processing Services, Inc. shows that foreclosure starts were up in August by nearly 20 percent compared to July 2011 results, with first-time foreclosure starts reaching 2011 highs. Overall, foreclosure starts remained down more than 12 percent from this time last year. At the same time, of the approximately 4 million loans that are either 90 or more days delinquent or in foreclosure, the number in the 90 or more days category has shrunk to levels not seen since 2008.According to LPS, 8.13% of mortgages were delinquent in August, down from 8.34% in July, and down from 9.22% in August 2010.

The August data also showed that, of loans that were current six months prior, 1.4 percent had become seriously delinquent, a rate of less than half of the peak of 2.9 percent in 2009. ...

August results showed an all-time high in the number of loans shifting from foreclosure back into delinquent status, suggesting that process reviews and potential loss mitigation activity are continuing. As a result, foreclosure timelines continue to increase, with the average loan in foreclosure having been delinquent for a record 611 days.

LPS reports that 4.11% of mortgages were in the foreclosure process, unchanged from July, and up from 3.8% in August 2010. This gives a total of 12.24% delinquent or in foreclosure. It breaks down as:

• 2.38 million loans less than 90 days delinquent.

• 1.87 million loans 90+ days delinquent.

• 2.15 million loans in foreclosure process.

For a total of 6.40 million loans delinquent or in foreclosure in August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 8.13% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.15 million) - and the average loan in foreclosure has been delinquent for a record 611 days!

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by duration of delinquency.

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by duration of delinquency.The total number of loans 90+ delinquent is back to 2008 levels, but about 42% of these loans have been delinquent for more than 12 months and are still not in foreclosure. That is close to 800,000 loans.

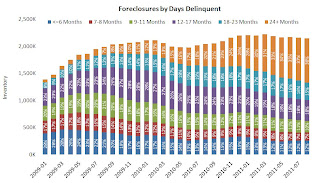

The third graph shows the number of loans in foreclosure by duration of delinquency.

The third graph shows the number of loans in foreclosure by duration of delinquency.There are 2.15 million loans in the foreclosure process and about 38% have been delinquent for more than 2 years, and another 33% have been delinquent for 1 to 2 years. Many of these loans are still in process review.

There was some good news: cure rates are increasing for all categories, “first-time” delinquencies have declined, and the number of seriously delinquent loans is back to 2008 levels. However there are still 2.15 million loans in the foreclosure process and another 1.87 million 90+ days delinquent.

Earlier:

• ISM Manufacturing index increases in September

• Construction Spending increased in August

• U.S. Light Vehicle Sales at 13.1 million SAAR in September

U.S. Light Vehicle Sales at 13.1 million SAAR in September

by Calculated Risk on 10/03/2011 03:59:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.1 million SAAR in September. That is up 11.2% from September 2010, and up 8.3% from the sales rate last month (12.1 million SAAR in Aug 2011).

This was well above the consensus forecast of 12.6 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for September (red, light vehicle sales of 13.1 million SAAR from Autodata Corp).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This was close to the sales rate in April and close to the high for the year.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a positive contribution to Q3 GDP as sales bounced back from the May and June lows. Sales in Q3 have averaged 12.5 million SAAR, above the 12.1 million SAAR average in Q2.

Earlier:

• ISM Manufacturing index increases in September

• Construction Spending increased in August

Europe Update

by Calculated Risk on 10/03/2011 02:39:00 PM

The Euro-zone finance ministers are meeting in Luxembourg today. There will be no decision on Greece; they will wait until after the inspectors issue a report next week. There is an emergency finance minister meeting tentatively scheduled on October 13th to vote on the next loan installment for Greece.

Over the weekend, Greek officials announced public sectors cuts - and that they would miss the deficit targets for 2011 and 2012.

On the meeting today from the WSJ: EU to Discuss Leveraging Rescue Fund

Euro-zone finance ministers Monday will discuss leveraging the region's bailout fund, possibly with the help of the European Central Bank, Economics Commissioner Olli Rehn said Monday.The Greek 2 year yield is down to 62.2%. The Greek 1 year yield is at 128%.

...

"We are reviewing options of optimizing the use of the EFSF in order to have more out of it and make it more effective as a financial firewall to contain contagion," said Mr. Rehn, the EU's top official for economic and monetary affairs.

The Portuguese 2 year yield is up to 17.6% and the Irish 2 year yield is down sharply to 6.8%. Clearly Portugal is perceived as next in line - and Ireland appears to be doing better.

The Spanish 10 year yield is at 5.1% and the Italian 10 year yield is at 5.5%.