by Calculated Risk on 9/30/2011 12:06:00 PM

Friday, September 30, 2011

Restaurant Performance Index declined in August

From the National Restaurant Association: Restaurant Performance Index Fell to Lowest Level in 13 Months Amid Growing Operator Uncertainty

Dampened by softer sales and traffic levels and continued uncertainty among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) declined for the second consecutive month in August. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.4 in August, down 0.3 percent from July. In addition, August marked the second consecutive month that the RPI stood below 100, the level above which signifies expansion in the index of key industry indicators.

“The August decline in the Restaurant Performance Index resulted from softening of both current situation and expectations indicators, as well as Hurricane Irene,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Although restaurant operators reported net positive same-store sales results in August, their six-month outlook for both sales growth and the economy continued to deteriorate.”

...

Although restaurant operators reported net positive same-store sales in August, the overall results were softer than recent months. ... Meanwhile, restaurant operators reported a net decline in customer traffic for the first time in three months.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The index declined to 99.4 in August (below 100 indicates contraction).

Unfortunately the data for this index only goes back to 2002.

Note: August was an especially weak economic month following the debt ceiling debate, and it will be interesting to see if these indicators show some rebound in September and October.

September Consumer Sentiment increases to 59.4, Chicago PMI fairly strong

by Calculated Risk on 9/30/2011 09:55:00 AM

• First on the Chicago PMI Chicago Business Barometer™ Rebounded: The overall index increased to 60.4 from 56.5 in August. This was above consensus expectations of 55.4. Note: any number above 50 shows expansion. The employment index increased to 60.6 from 52.1. "EMPLOYMENT expanded to highest level in 4 months". The new orders index increased to 65.3 from 56.9. "NEW ORDERS erased net declines accumulated since April"

• The final September Reuters / University of Michigan consumer sentiment index increased to 59.4 from 55.7 in August.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate.

Note: It usually takes 2 to 4 months to bounce back from an event driven decline in sentiment (if the August decline was event driven) - and any bounce back from the debt ceiling debate would be to an already weak reading.

This was still very weak, but above the consensus forecast of 57.8.

Personal Income decreased 0.1% in August, Spending increased 0.2%

by Calculated Risk on 9/30/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for August:

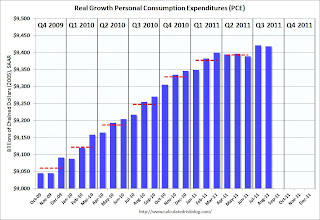

Personal income decreased $7.3 billion, or 0.1 percent ... in August ... Personal consumption expenditures (PCE) increased $22.7 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased less than 0.1 percent in August, in contrast to an increase of 0.4 percent in July. ... The price index for PCE increased 0.2 percent in August,compared with an increase of 0.4 percent in July. The PCE price index, excluding food and energy, increased 0.1 percent

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE increased 0.2 in August, and real PCE decreased slightly as the price index for PCE increased 0.2 percent in August.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

The personal saving rate was at 4.5% in August.

Personal saving -- DPI less personal outlays -- was $519.3 billion in August, compared with $550.5 billion in July. Personal saving as a percentage of disposable personal income was 4.5 percent in August, compared with 4.7 percent in July.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the August Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the August Personal Income report.Using the two month method to estimate Q3 PCE gives a 1.1% annualized rate (another weak quarter), however it appears PCE increased in September (auto sales are up) and June was especially weak in Q2 - so real PCE growth will probably be in the 1.5% range in Q3 (still weak).

Misc: Foreclosure "Closer", One in Five Modifications Redefault and More

by Calculated Risk on 9/30/2011 12:29:00 AM

• A story about the guy that checks the house after foreclosure from the NY Times: The Closer

When a lender forecloses on a property, one of the first things he does is send somebody out to see if there is a house still standing and whether there’s anybody living there. That’s my job. Sometimes the houses are crack dens or meth labs, sometimes the sites of cock- or dog-fighting operations, sometimes the backyard is filled with pot. And sometimes the house is a waterfront mansion in a gated golf community worth well over seven figures. Variety is the rule.• From Bloomberg: One in Five Modified Loans Default Again, U.S. Comptroller Says (ht Mike in Long Island)

One in five homeowners whose mortgages were modified under a program aimed at reducing foreclosures defaulted again within a year after their payments were cut, the U.S. Comptroller of the Currency reported today.• From Catherine Rampell at Economix: Job Losses Across the Developed World (ht Picosec)

Across the developed world, the biggest job losses in the 2008-9 downturn were in mining, manufacturing and utilities, according to new data from the Organization for Economic Cooperation and Development.Check out the chart. Construction job losses in the U.S. were small compared to Spain, Ireland and Portugal.

Thursday, September 29, 2011

Freddie Mac: Record Low Mortgage Rates

by Calculated Risk on 9/29/2011 05:24:00 PM

Probably deserves a mention ... from Freddie Mac: Fixed-Rate Mortgages Lowest on Record

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), coming on the heels of the Federal Reserve's recent announcements. The conventional 30-year fixed averaged an all-time record low at 4.01 percent; likewise the 15-year fixed averaged an all-time record low at 3.28 percent for the week.Earlier:

...

"Fixed mortgage rates fell to all-time record lows this week following the Federal Reserve's announcement of its Maturity Extension Program and additional purchases of mortgage-backed securities. Interest rates for ARMs, however, were nearly unchanged as the Federal Reserve plans to sell $400 billion in short-term Treasury securities, which serve as benchmarks for many ARMs." [said Frank Nothaft, vice president and chief economist, Freddie Mac]

• Weekly Initial Unemployment Claims decline sharply to 391,000

• Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

• Kansas City Manufacturing Survey: Manufacturing activity expands "modestly" in September

• Employment: Comment on preliminary annual benchmark revision