by Calculated Risk on 9/27/2011 08:34:00 PM

Tuesday, September 27, 2011

Europe Update: Nothing Settled Yet

A few articles ...

From the WSJ: Greece Passes Property-Tax Law, Clearing a Path for Additional Aid

Greece's parliament approved a new property-tax law in a closely watched vote Tuesday ... The approval of the property tax is expected to open the way for the return to Athens this week of a troika of inspectors from the International Monetary Fund, the European Union and the European Central Bank.The next step will be the return of the inspectors ... and the vote on the EFSF in Germany.

From the NY Times: Merkel Rallies Wary Coalition Ahead of Vote on Greek Aid

[L]awmakers in Slovenia voted Tuesday to approve their share of the rescue fund’s guarantees. Finland’s Parliament is expected to reluctantly approve the fund measure in a vote on WednesdayThe German parliament will vote on Thursday and Friday.

[T]he German finance minister, Wolfgang Schäuble, ruled out an increase in the size of the euro zone bailout fund, though not necessarily an increase in its ability to borrow. ... Mr. Schäuble also said Tuesday that it was likely that the rescue mechanism would be further “enhanced,” though he would not give details.And the Financial Times is reporting: Split opens over Greek bail-out terms. Apparently some officials (Germany and a few others) are arguing that the private sector should take a larger haircut. So this isn't settled yet.

Eurozone finance ministers had originally hoped to sign off on the next aid tranche to Greece on Monday, but a decision is now expected to delay the next €8bn payment until an emergency meeting in two weeks.Greece apparently has enough cash until mid-October ...

excerpt with permission

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

• Real House Prices and House Price-to-Rent

ATA Trucking Index decreased slightly in August

by Calculated Risk on 9/27/2011 04:53:00 PM

From ATA: ATA Truck Tonnage Index Edged 0.2% Lower in August

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index declined 0.2% in August after falling a revised 0.8% in July 2011. July’s decrease was less than the 1.3% ATA reported on August 23, 2011. The latest drop put the SA index at 114.4 (2000=100) in August, down from the July level of 114.6.

...

Compared with August 2010, SA tonnage was up a solid 5.2%. In July, the tonnage index was 4.5% above a year earlier.

“Freight has been going sideways for much of this year, but it isn’t falling significantly either, which suggests the U.S. economy just might skirt another recession,” ATA Chief Economist Bob Costello said.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.Moving sideways all year ...

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

• Real House Prices and House Price-to-Rent

Real House Prices and House Price-to-Rent

by Calculated Risk on 9/27/2011 01:42:00 PM

An update: Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through July) and CoreLogic House Price Indexes (through July) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to July 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to August 2000, and the CoreLogic index back to July 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to July 2000.

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

by Calculated Risk on 9/27/2011 11:15:00 AM

From CoreLogic: CoreLogic® Reports Shadow Inventory Continues to Decline

CoreLogic ... reported today that the current residential shadow inventory as of July 2011 declined slightly to 1.6 million units, representing a supply of 5 months. This is down from 1.9 million units, a supply of 6 months, from a year ago, and follows a decline from April 2011 when shadow inventory stood at 1.7 million units. The moderate decline in shadow inventory is being driven by a pace of new delinquencies that is slower than the disposition pace of distressed assets.

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLSs) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders.

...

Of the 1.6 million properties currently in the shadow inventory, 770,000 units are seriously delinquent (2.2-months’ supply) [down from 790,000 units in April], 430,000 are in some stage of foreclosure (1.2-months’ supply) [down from 440,000] and 390,000 are already in REO (1.1-months’ supply) [down from 440,000].

...

Mark Fleming, chief economist for CoreLogic, commented, “The steady improvement in the shadow inventory is a positive development for the housing market. However, continued price declines, high levels of negative equity and a sluggish labor market will keep the shadow supply elevated for an extended period of time.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

So the key number in this report is that as of July, there were 1.6 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale.

Note: The unlisted REO seems a little high since total REO has dropped sharply over the last couple of quarters.

Earlier:

• Case Shiller: Home Prices increased Seasonally in July

Case Shiller: Home Prices increased Seasonally in July

by Calculated Risk on 9/27/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July (actually a 3 month average of May, June and July).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data. The composite indexes were up about 0.9% in July (from June) Not Seasonally Adjusted (NSA), but flat Seasonally Adjusted (SA).

From S&P: Home Prices Continue to Show Seasonal Strength According to the S&P/Case-Shiller Home Price Indices

Data through June 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed a fourth consecutive month of increases for the 10- and 20-City Composites, with both up 0.9% in July over June. Seventeen of the 20 MSAs and both Composites posted positive monthly increases; Las Vegas and Phoenix were down over the month and Denver was unchanged.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32% from the peak, and down slightly in July (SA). The Composite 10 is 1.4% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.8% from the peak, and up slightly in July (SA). The Composite 20 is slightly above the March 2011 post-bubble bottom seasonally adjusted.

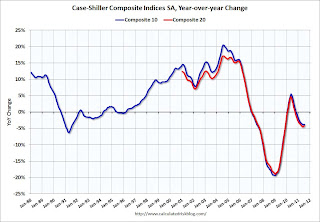

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.8% compared to July 2010.

The Composite 20 SA is down 4.2% compared to July 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.As S&P noted, prices increased in 17 of 20 cities not seasonally adjusted (NSA). However seasonally adjusted, prices only increased in 9 cities.

Most of this prices increase was mostly seasonal. As S&P's David Blitzer said: "This is still a seasonal period of stronger demand for houses, so monthly price increases are expected ... ". The question is what happens later this year. I'll have more later ...