by Calculated Risk on 9/05/2011 11:55:00 AM

Monday, September 05, 2011

Construction Employment Update

The graph below shows the number of total construction payroll jobs in the U.S., including both residential and non-residential, since 1969.

Construction employment is down 2.2 million jobs from the peak in April 2006, but up slightly this year (through the August BLS report).

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential building employees in 1985, and residential specialty trade contractors in 2001).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Mostly moving sideways ...

Usually residential investment (and residential construction) lead the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course residential investment didn't lead the economy this time because of the huge overhang of existing housing units.

This table below shows the annual change in construction jobs (total, residential and non-residential) and through August for 2011.

| Annual Change in Payroll jobs (000s) | |||

|---|---|---|---|

| Year | Total Construction Jobs | Residential Construction Jobs | Non-Residential |

| 2002 | -85 | 88 | -173 |

| 2003 | 127 | 161 | -34 |

| 2004 | 290 | 230 | 60 |

| 2005 | 416 | 268 | 148 |

| 2006 | 152 | -62 | 214 |

| 2007 | -198 | -273 | 75 |

| 2008 | -787 | -510 | -277 |

| 2009 | -1053 | -431 | -622 |

| 2010 | -149 | -113 | -36 |

| Through August 2011 | 26 | 14 | 12 |

After five consecutive years of job losses for residential construction (and four years for total construction), this is a baby step in the right direction. However there will not be a strong increase in residential construction until the excess supply of housing is absorbed.

In addition residential investment has made a positive contribution to GDP so far this year for the first time since 2005. A small contribution - but a positive one.

Europe: Service Sector Slows, Stocks Fall, Bond Yields move higher

by Calculated Risk on 9/05/2011 08:50:00 AM

From the Telegraph: "Eurozone service sector [slowed] and the Purchasing Managers Index figures show services activity slowed to its lowest rate since September 2009. The eurozone PMI figure slipped to 51.5 in August, down from 51.6 in July."

"The [U.K.] guage of services activity, which makes up the biggest part of the British economy and includes shops and restaurants, fell to 51.1 in August from 55.4 in July"

From the WSJ: U.S. Lawsuit Pressures Bank Shares

Shares in U.K. and European banks slumped Monday after several institutions were named in a lawsuit Friday alleging they sold risky home loans to U.S. housing agencies Fannie Mae and Freddie Mac.The Greek 2 year yield is at 49.99%!

The suit by the Federal Housing Finance Agency in New York and Connecticut courts alleged that units of 17 banks including Royal Bank of Scotland Group PLC, Barclays PLC, HSBC Holdings PLC, Deutsche Bank AG, Credit Suisse AG and Société Générale SA, misrepresented the risks of $196 billion in home mortgage-loan securities sold to the agencies in a four-year period, making it the largest legal action by a federal regulator over the mortgage meltdown.

Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at 365, most of the way back up to the high of 389 on Aug 4th, and the Spanish spread is at 330, still down from 398 on Aug 4th. Most of the increase in the spread is because the German 10 year yield is at 1.9%. (The U.S. Ten Year is slightly under 2% too).

The Portuguese 2 year yield is up to 13.6%. Also the Irish 2 year yield is at 8.5%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Europe Update

by Calculated Risk on 9/05/2011 12:12:00 AM

A couple of points from the WSJ: Euro Falls on Greece Worries

Rival [German] parties gained fresh support in the elections Sunday, piling further pressure on [Chancellor Angela] Merkel ... the loss of regional influence comes as Merkel's party prepares for a much-anticipated vote in the German parliament at the end of the month on changes to the euro-zone's temporary bailout mechanism.And from Reuters: German court to rule on Sept 7 on euro,Greek bailouts

...

The news follows Friday's suspension of talks between the Greek government and representatives of the International Monetary Fund, European Central Bank and European Commission over new bailout funds.

Germany's constitutional court will announce its verdict on September 7 on whether the government broke the law with last year's euro zone and Greek bailout packages, it said in a statement on Tuesday.It is unlikely the court will rule against the bailout, but Merkel is losing political support. It appears the changes to the bailout mechanism will pass the German parliament, but the vote might be close.

The European crisis is heating up again ...

Sunday, September 04, 2011

Weekly Schedule and Graph Galleries

by Calculated Risk on 9/04/2011 06:47:00 PM

By request, I've added links for the Weekly Schedule of economic releases and the graph galleries at the bottom of the first post.

The graph galleries are a collection of the most recent versions of frequently updated graphs. (Older versions are removed).

The Graph Galleries are grouped by Employment, New Home Sales, Existing Home sales and much more. There are tabs for each gallery. Clicking on a tab will load a gallery. Then thumbnails will appear below the main graph for all of the graphs in the selected gallery. Clicking on the thumbnails will display each graph.

To access the galleries, just click on a graph on the blog - or click on "Graph Galleries" at the bottom of the first post.

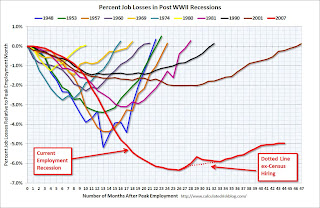

As an example, clicking on this graph (based on the most recent employment report), will open the "employment" chart gallery and display this graph - with thumbnails for other employment related graphs.

As an example, clicking on this graph (based on the most recent employment report), will open the "employment" chart gallery and display this graph - with thumbnails for other employment related graphs.

The "print" key displays the full size image of the selected graph for printing from your browser.

The title below the graph is a link to the post on Calculated Risk and also includes the date the graph was posted to the gallery.

Note: The graphs are free to use on websites or for presentations. All I ask is that online sites link to my site http://www.calculatedriskblog.com/ and that printed presentations credit www.calculatedriskblog.com.

Best to all.

Yesterday:

• Summary for Week ending September 2nd (with plenty of graphs)

Friday on employment:

• August Employment Report: 0 Jobs (unchanged), 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education and Diffusion Indexes

Survey: Small Business Hiring Plans increased in August

by Calculated Risk on 9/04/2011 11:14:00 AM

Note: This statement was released before the jobs report, and I'd like to focus on some of the details. NFIB’s monthly small business survey for August will be released on Tuesday, September 13, 2011.

From the National Federation of Independent Business (NFIB): NFIB Jobs Statement: Job Gains in August? Keep Your Expectations Low

"We wish there was good news to report, but sadly, we will give you more of the same: The prospects for a good jobs report are dim. In August, small-business owners reported job losses averaging .08 workers per firm over the last three months. This follows a loss of .23 workers per firm reported in June and .15 workers per firm in July. The good news is that the trend is moving in the right direction—losses appear to be decreasing—although it doesn’t seem to be moving fast enough to close the employment void we’ve been experiencing for the last several years." [said William C. Dunkelberg, Chief economist for (NFIB)]Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

“While the readings remain historically weak, we can find a grain of encouragement as we look at hiring prospects. Over the next three months, 11 percent plan to increase employment (up 1 point), and 12 percent plan to reduce their workforce (also up 1 point), yielding a seasonally adjusted net 5 percent of owners planning to create new jobs, which is a 3 point improvement over July."

Here is a graph of the net hiring plans for the next three months since 1986.

Here is a graph of the net hiring plans for the next three months since 1986.Hiring plans were still low in August, but positive and improving.

It is no surprise that small businesses are struggling due to the high concentration of real estate related companies in the survey. But as Dunkelberg noted, current small business hiring (fewer job losses) and hiring plans are both slowly moving in the right direction.

Yesterday:

• Summary for Week ending September 2nd (with plenty of graphs)

• Schedule for Week of September 4th

Friday on employment:

• August Employment Report: 0 Jobs (unchanged), 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery