by Calculated Risk on 8/31/2011 01:41:00 PM

Wednesday, August 31, 2011

Restaurant Performance Index declined in July

From the National Restaurant Association: Restaurant Industry Outlook Softened in July as Restaurant Performance Index Slipped to Its Lowest Level in 11 Months

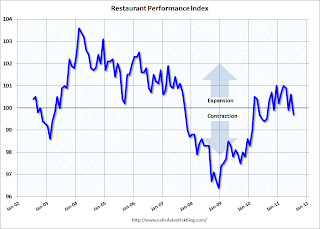

As a result of softer same-store sales and traffic levels and a dampened outlook among restaurant operators, the National Restaurant Association’s (www.restaurant.org) Restaurant Performance Index (RPI) fell below 100 in July. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.7 in July, down from 100.6 in June and the lowest level in 11 months.

“Although same-store sales and customer traffic levels remained positive in July, restaurant operators’ outlook for the economy took a pessimistic turn,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “This survey month was burdened with the debt ceiling crisis and the downgrade in the nation’s credit rating, which added an additional layer of uncertainty in an already fragile economic recovery.”

...

Restaurant operators reported somewhat softer same-store sales results in July. ... Restaurant operators also reported softer customer traffic levels in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The index declined to 99.7 in July (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

This is a minor report, but still interesting (barely "D-List" data).

CoreLogic: Home Price Index increased 0.8% in July

by Calculated Risk on 8/31/2011 10:10:00 AM

• First on the Chicago PMI Chicago Business Barometer™ Slipped: The overall index decreased to 56.5 from 58.8 in July. This was above consensus expectations of 53.5. Note: any number above 50 shows expansion. The employment index increased to 52.1 from 51.5. The new orders index decreased to 56.9 from 59.4.

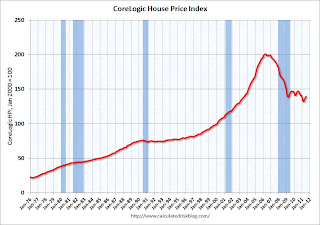

• Notes: This CoreLogic Home Price Index is for July. The Case-Shiller index released yesterday was for June. Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of May, June and July (July weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® July Home Price Index Shows Fourth Consecutive Month-Over-Month Increase

CoreLogic ... today released its July Home Price Index (HPI) which shows that home prices in the U.S. increased for the fourth consecutive month, inching up 0.8 percent on a month-over-month basis. On a year-over-year basis, however, national home prices, including distressed sales, declined by 5.2 percent in July 2011 compared to July 2010. In June 2011, prices declined by 6.0 percent* compared to June 2010. Excluding distressed sales, year-over-year prices declined by 0.6 percent in July 2011 compared to July 2010 and by 1.9* percent in June 2011 compared to June 2010. Distressed sales include short sales and real estate owned (REO) transactions. [*CR note: June index was revised up]

“While July’s numbers remained relatively positive, particularly for non-distressed sales which have been stable, seasonal influences are expected to fade in late summer. At that point the month-over-month growth will most likely turn negative. The slowdown in economic growth and increased uncertainty caused by the recent stock market volatility will continue to exert downward pressure on prices,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.8% in July, and is down 5.2% over the last year, and off 30.6% from the peak - and up 5.5% from the March low.

As Mark Fleming noted, some of this increase is seasonal (the CoreLogic index is NSA) and the index is still off 5.2% from last July. Month-to-month prices will probably turn negative later this year (the normal seasonal pattern).

Yesterday:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

• LPS: Average Loan in Foreclosure Is Delinquent for Record 599 Days

ADP: Private Employment increased 91,000 in August

by Calculated Risk on 8/31/2011 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector rose 91,000 from July to August on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated advance in employment from June to July was revised down modestly to 109,000, from the initially reported 114,000.Note: ADP is private nonfarm employment only (no government jobs).

...

Employment in the service-providing sector rose by 80,000 in August, marking 20 consecutive months of employment gains. Employment in the goods-producing sector rose by 11,000 in August, up from a loss of 2,000 jobs last month. Manufacturing employment slipped 4,000 in August.

This was slightly below the consensus forecast of an increase of 100,000 private sector jobs in August. The BLS reports on Friday, and the consensus is for an increase of 67,000 payroll jobs in August, on a seasonally adjusted (SA) basis.

Of course the ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Purchase Activity "near 15-year lows"

by Calculated Risk on 8/31/2011 07:13:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 12.2 percent from the previous week. The seasonally adjusted Purchase Index increased 0.9 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Refinance application volume declined for a second week from recent highs, despite rates staying near a 10-month low, while purchase volume remained near 15-year lows," said Mike Fratantoni, MBA's Vice President of Research and Economics.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.32 percent from 4.39 percent, with points increasing to 1.30 from 0.88 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is now at the lowest levels since August 1995!

This doesn't include the large number of cash buyers ... but purchase application activity was especially weak over the last three weeks, and this suggests weak home sales in the coming months.

Tuesday, August 30, 2011

LPS: Average Loan in Foreclosure Is Delinquent for Record 599 Days

by Calculated Risk on 8/30/2011 08:14:00 PM

LPS Applied Analytics released their July Mortgage Monitor Report today. From LPS: LPS' Mortgage Monitor Report Shows Average Loan in Foreclosure Is Delinquent for Record 599 Days; First-Time Foreclosure Starts Near Three-Year Lows

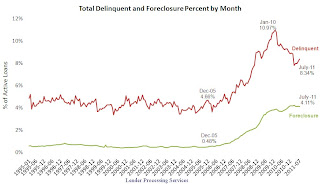

The July Mortgage Monitor report released by Lender Processing Services, Inc. shows that foreclosure timelines continue their steady upward trend, as a payment has not been made on the average loan in foreclosure in a record 599 days. Of the nearly 1.9 million loans that are 90 or more days delinquent but not yet in foreclosure, 42 percent have not made a payment in more than a year with an average delinquency of 397 days, also a new record. At the same time, first-time foreclosure starts in June were near three-year lows, and first-time delinquencies accounted for only 25 percent of new delinquent inventory.According to LPS, 8.34% of mortgages were delinquent in July, up from 8.15% in June, and down from 9.31% in July 2010.

As of the end of June, 4.1 million loans were either 90 or more days delinquent or in foreclosure, as delinquencies remain two times and foreclosures eight times pre-crisis levels. Foreclosure sales remain constricted, with foreclosure starts outnumbering sales by a factor of almost three to one.

LPS reports that 4.11% of mortgages were in the foreclosure process, down slightly from 4.12% in June, and up from 3.74% in July 2010. This gives a total of 12.45% delinquent or in foreclosure. It breaks down as:

• 2.48 million loans less than 90 days delinquent.

• 1.90 million loans 90+ days delinquent.

• 2.16 million loans in foreclosure process.

For a total of 6.54 million loans delinquent or in foreclosure in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has increased recently (part of the increase is seasonal), but the rate has fallen to 8.34% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.16 million) - and the average loan in foreclosure has been delinquent for a record 599 days!

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.Looking at this graph, one might expect the number of loans in the foreclosure process to be increasing sharply since there are so many more starts than sales.

And there are very few cures too - what is happening is a large number of loans each month have been moving from "in foreclosure" back to "90+ days delinquent" status - so the number of loans "in foreclosure" hasn't increased recently.

The third graph shows mortgage origination by the original term.

The third graph shows mortgage origination by the original term. This graph is interesting because of the surge in shorter duration loans.

This is probably being driven by two factors: 1) older borrowers are hoping to pay off their loans as part of their retirement planning and are taking out 15 year mortgages, and 2) many jumbo borrowers are probably taking out 5 year loans with a balloon payment since 30 year jumbo rates are much higher.

Earlier:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent