by Calculated Risk on 8/23/2011 06:20:00 PM

Tuesday, August 23, 2011

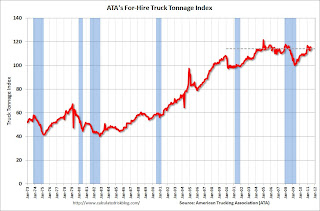

ATA Trucking index decreased 1.3% in July

From ATA: ATA Truck Tonnage Index Fell 1.3% in July

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.3% in July after rising a revised 2.6% in June 2011. ... The latest pullback put the SA index at 114 (2000=100) in July, down from the June level of 115.5.

...

Compared with July 2010, SA tonnage was up 3.9%. In June, the tonnage index was 6.5% above a year earlier.

...

“We had heard that freight weakened from a robust June, that that was true,” ATA Chief Economist Bob Costello said. Tonnage has fallen in three of the last four months on a sequential basis.

“Despite a solid June, our truck tonnage index fits with an economy that is growing very slowly,” Costello noted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.When the June index was released it was already obvious that July would be weak based on comments from UPS and others. August will probably show a decline too.

Philly Fed State Coincident Indexes for July

by Calculated Risk on 8/23/2011 03:05:00 PM

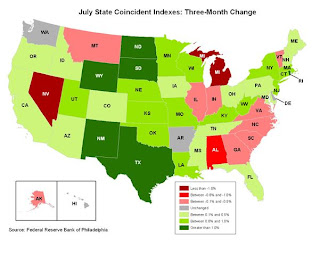

I haven't post this in some time, but the map is turning red again ...

Click on map for larger image.

Above is a map of the three month change in the Philly Fed state coincident indicators. Several states have turned red again. This map was all red during the worst of the recession, and all green not long ago. Here is the Philadelphia Fed state coincident index release (pdf) for July 2011.

In the past month, the indexes increased in 29 states, decreased in 13, and remained unchanged in eight for a one-month diffusion index of 32. Over the past three months, the indexes increased in 34 states, decreased in 12, and remained unchanged in four (Arkansas, Delaware, Hawaii, and Washington) for a three-month diffusion index of 44.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity. The indexes increased in 29 states, decreased in 13, and remained unchanged in 8. Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

Misc: Richmond Fed, FDIC Problem Banks, Home Sales Distressing Gap

by Calculated Risk on 8/23/2011 12:15:00 PM

• Richmond Fed: Manufacturing Activity Pulled Back Markedly in August; Shipments and New Orders Declined

In August, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — declined nine points to −10 from July's reading of −1.Another weak regional manufacturing survey.

...

Hiring activity at District plants slowed in August. The manufacturing employment index subtracted three points to 1 and the average workweek index moved down five points to −5. Moreover, wage growth eased, losing eight points to finish at 2.

• From the FDIC: Quarterly Banking Profile

The number of institutions on the FDIC's "Problem List" fell for the first time in 15 quarters. The number of "problem" institutions declined from 888 to 865. This is the first time since the third quarter of 2006 that the number of "problem" banks fell. Total assets of "problem" institutions declined from $397 billion to $372 billion. Twenty-two insured institutions failed during the second quarter, four fewer than in the previous quarter, and the fewest since the first quarter of 2009. This is the fourth quarter in a row that the number of failures has declined. Through the first six months of 2011, there have been 48 insured institution failures, compared to 86 failures in the same period of 2010.• Distressing Gap: The following graph shows existing home sales (left axis) and new home sales (right axis) through July. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Then along came the housing bubble and bust, and the "distressing gap" appeared due mostly to distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different. Also the National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers and I expect significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2009 and 2010. Even with these revisions, most of the "distressing gap" will remain.

On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

New Home Sales in July at 298,000 Annual Rate

by Calculated Risk on 8/23/2011 10:00:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 298 thousand. This was down from a revised 300 thousand in June (revised from 312 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in July 2011 were at a seasonally adjusted annual rate of 298,000 ... This is 0.7 percent (±12.9%)* below the revised June rate of 300,000, but is 6.8 percent (±13.5%)* above the July 2010 estimate of 279,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply was unchanged at 6.6 in July. The all time record was 12.1 months of supply in January 2009. This is still higher than normal (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of July was 165,000. This represents a supply of 6.6 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 61,000 units in July. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2011 (red column), 27 thousand new homes were sold (NSA). The record low for July was 26 thousand in 2010 (following the expiration of the homebuyer tax credit). The high for July was 117 thousand in 2005.

This was below the consensus forecast of 313 thousand, and was just above the record low for the month of July - and new home sales have averaged only 300 thousand SAAR over the 15 months since the expiration of the tax credit ... moving sideways at a very low level.

Mortgage Delinquencies by Loan Type

by Calculated Risk on 8/23/2011 08:58:00 AM

By request, the following graphs show the percent of loans delinquent by loan type: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q2 2011 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last four years; the number of subprime loans is down by about one-third. Meanwhile the number of FHA loans has increased sharply.

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q2 2011 | Change | Seriously Delinquent | |

| Prime | 33,916,830 | 31,888,314 | -2,028,516 | 1,839,956 |

| Subprime | 6,204,535 | 4,126,408 | -2,078,127 | 1,102,989 |

| FHA | 3,030,214 | 6,467,909 | 3,437,695 | 529,075 |

| VA | 1,096,450 | 1,402,208 | 305,758 | 64,502 |

| Survey Total | 44,248,029 | 43,729,247 | -518,782 | 3,536,521 |

Note: There are about 50 million total first-lien loans - the MBA survey is about 88% of the total.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph is for all prime loans. This is the key category now ("We are all subprime!").

Since there are far more prime loans than any other category (see table above), over half the loans seriously delinquent now are prime loans - even though the overall delinquency rate is lower than other loan types.

The second graph is for subprime. This category gets all the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

The second graph is for subprime. This category gets all the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans had declined sharply.

The third graph is for FHA loans. The delinquency rate increased in Q2 after declining for the last several quarters. Most of the FHA loans were made in the last couple of years.

The third graph is for FHA loans. The delinquency rate increased in Q2 after declining for the last several quarters. Most of the FHA loans were made in the last couple of years.Another reason for the previous improvement was eliminating Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were horrible.

The last graph is for VA loans.

The last graph is for VA loans.All four categories saw a slight increase in Q2.

There are still quite a few subprime loans that are in distress, but the real keys going forward are prime loans and FHA loans.

Yesterday:

• MBA: Mortgage Delinquencies increased slightly in Q2

• MBA Delinquency Survey: Comments and State Data

• Mortgage Delinquencies by State: Range and Current