by Calculated Risk on 8/19/2011 07:11:00 PM

Friday, August 19, 2011

Bank Failure #68: First Choice Bank, Geneva, Illinois

The strong consume the weakened

Malthusian end

by Soylent Green is People

From the FDIC: Inland Bank & Trust, Oak Brook, Illinois, Assumes All of the Deposits of First Choice Bank, Geneva, Illinois

As of June 30, 2011, First Choice Bank had approximately $141.0 million in total assets and $137.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.0 million. ... First Choice Bank is the 68th FDIC-insured institution to fail in the nation this year, and the seventh in Illinois.Only 7 in Illinois so far this year ...

Bank Failure #67: First Southern National Bank, Statesboro, Georgia

by Calculated Risk on 8/19/2011 06:17:00 PM

Finance stars, soon behind bars,

Down in Dixie Land

by Soylent Green is People

From the FDIC: Heritage Bank of the South, Albany, Georgia, Assumes All of the Deposits of First Southern National Bank, Statesboro, Georgia

As of June 30, 2011, First Southern National Bank had approximately $164.6 million in total assets and $159.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $39.6 million. ... First Southern National Bank is the 67th FDIC-insured institution to fail in the nation this year, and the seventeenth in Georgia.The 17th failure in Georgia this year. Ouch.

Bank Failure #66: Lydian Private Bank, Palm Beach, Florida

by Calculated Risk on 8/19/2011 04:22:00 PM

There's no rest for the wicked

Bums rush to exits?

by Soylent Green is People

From the FDIC: Sabadell United Bank, National Association, Miami, Florida, Assumes All of the Deposits of Lydian Private Bank, Palm Beach, Florida

As of June 30, 2011, Lydian Private Bank had approximately $1.70 billion in total assets and $1.24 billion in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $293.2 million. ... Lydian Private Bank is the 66th FDIC-insured institution to fail in the nation this year, and the tenth in Florida.This is a pretty large failure ...

On Track for Record Low Housing Completions in 2011

by Calculated Risk on 8/19/2011 01:18:00 PM

An update: The U.S. is on pace for a record low number of total housing completions this year, and the fewest net housing units added to the housing stock since the Census Bureau started tracking completions in the '60s.

Below is a table of net housing units added to the housing stock since 1990. Note: Tom Lawler thinks scrappage is closer to 250,000 units per year.

This means there will be a record low number of housing units added to the housing stock this year (good news with all the excess inventory), and that the overhang of excess inventory should decline significantly in 2011 depending on the rate of household formation (and that depends on jobs).

| Housing Units added to Stock (000s) | ||||||

|---|---|---|---|---|---|---|

| 1 to 4 Units | 5+ Units | Manufactured Homes | Sub-Total | Demolitions / Scrappage | Total added to Stock | |

| 1990 | 1010.8 | 297.3 | 188.3 | 1496.4 | 200 | 1296.4 |

| 1991 | 874.4 | 216.6 | 170.9 | 1261.9 | 200 | 1061.9 |

| 1992 | 999.7 | 158 | 210.5 | 1368.2 | 200 | 1168.2 |

| 1993 | 1065.7 | 127.1 | 254.3 | 1447.1 | 200 | 1247.1 |

| 1994 | 1192.1 | 154.9 | 303.9 | 1650.9 | 200 | 1450.9 |

| 1995 | 1100.2 | 212.4 | 339.9 | 1652.5 | 200 | 1452.5 |

| 1996 | 1161.6 | 251.3 | 363.3 | 1776.2 | 200 | 1576.2 |

| 1997 | 1153.4 | 247.1 | 353.7 | 1754.2 | 200 | 1554.2 |

| 1998 | 1200.3 | 273.9 | 373.1 | 1847.3 | 200 | 1647.3 |

| 1999 | 1305.6 | 299.3 | 348.1 | 1953 | 200 | 1753 |

| 2000 | 1269.1 | 304.7 | 250.4 | 1824.2 | 200 | 1624.2 |

| 2001 | 1289.8 | 281 | 193.1 | 1763.9 | 200 | 1563.9 |

| 2002 | 1360.1 | 288.2 | 168.5 | 1816.8 | 200 | 1616.8 |

| 2003 | 1417.8 | 260.8 | 130.8 | 1809.4 | 200 | 1609.4 |

| 2004 | 1555 | 286.9 | 130.7 | 1972.6 | 200 | 1772.6 |

| 2005 | 1673.4 | 258 | 146.8 | 2078.2 | 200 | 1878.2 |

| 2006 | 1695.3 | 284.2 | 117.3 | 2096.8 | 200 | 1896.8 |

| 2007 | 1249.8 | 253 | 95.7 | 1598.5 | 200 | 1398.5 |

| 2008 | 842.5 | 277.2 | 81.9 | 1201.6 | 200 | 1001.6 |

| 2009 | 534.6 | 259.8 | 49.8 | 844.2 | 150 | 694.2 |

| 2010 | 505.2 | 146.5 | 50 | 701.7 | 150 | 551.7 |

| 2011 (est) | 433 | 120 | 46 | 599 | 150 | 449 |

State Unemployment Rates "little changed" in July

by Calculated Risk on 8/19/2011 10:30:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

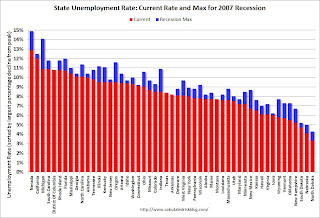

Regional and state unemployment rates were generally little changed in July. Twenty-eight states and the District of Columbia registered unemployment rate increases, nine states recorded rate decreases, and thirteen states had no rate change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 12.9 percent in July. California recorded the next highest rate, 12.0 percent. North Dakota reported the lowest jobless rate, 3.3 percent, followed by Nebraska, 4.1 percent. ...

Nevada recorded the largest jobless rate decrease from July 2010 (-2.0 percentage points). Ten additional states had smaller but also statistically significant decreases over the year: New Mexico (-1.8 percentage points), Indiana (-1.6 points), Michigan and Oklahoma (-1.5 points each), Oregon (-1.2 points), Wyoming (-1.1 points), Ohio (-1.0 point), Florida (-0.8 point), Virginia (-0.7 point), and North Dakota (-0.6 point). The remaining 39 states and the District of Columbia registered unemployment rates that were not appreciably different from those of a year earlier.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

Three states are at new 2007 recession highs: Arkansas (8.2%), Texas (8.4%) and Montana (7.7%).

The fact that 39 states and the District of Columbia have seen little or no improvement over the last year is a reminder that the unemployment crisis is ongoing.