by Calculated Risk on 7/29/2011 09:55:00 AM

Friday, July 29, 2011

Real GDP still below Pre-Recession Peak, Chicago PMI declines, Consumer Sentiment Weak

• From the Chicago Business Barometer™: The overall index decreased to 58.8 in July from 61.1 in June. This was below consensus expectations of 60.2. Note: any number above 50 shows expansion.

The employment index decreased to 51.5 from 58.7.

• GDP: Not only has growth slowed, but the recession was significantly worse than earlier estimates suggested. Real GDP is still not back to the pre-recession peak.

The following graph shows the current estimate of real GDP and the pre-revision estimate (blue). I'll have more later on GDP.

• The final July Reuters / University of Michigan consumer sentiment index declined slightly to 63.7 from the preliminary reading of 63.8 - and down sharply from 71.5 in June.

• The final July Reuters / University of Michigan consumer sentiment index declined slightly to 63.7 from the preliminary reading of 63.8 - and down sharply from 71.5 in June.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.

Earlier ...

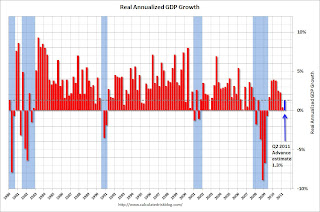

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

by Calculated Risk on 7/29/2011 08:30:00 AM

Note: This release contains a number of revisions. The recession was significantly worse than in earlier estimates. Last quarter (Q1) was revised down to just 0.4% real GDP growth.

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.3 percent in the second quarter of 2011, (that is, from the first quarter to the second quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.4 percent.The following graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q2 at 1.3% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.A few key numbers:

• Real personal consumption expenditures increased 0.1 percent in the second quarter, compared with an increase of 2.1 percent in the first.

• Investment: "Real nonresidential fixed investment increased 6.3 percent in the second quarter, compared with an increase of 2.1 percent in the first. Nonresidential structures increased 8.1 percent, in contrast to a decrease of 14.3 percent. Equipment and software increased 5.7 percent, compared with an increase of 8.7 percent. Real residential fixed investment increased 3.8 percent, in contrast to a decrease of 2.4 percent."

• Real federal government consumption expenditures and gross investment increased 2.2 percent in the second quarter, in contrast to a decrease of 9.4 percent in the first.

I'll have much more ...

Thursday, July 28, 2011

Debt Ceiling Charade impacting Short-Term Credit Markets

by Calculated Risk on 7/28/2011 10:36:00 PM

From the NY Times DealBook: Debt Ceiling Impasse Rattles Short-Term Credit Markets

Over the last week, big banks and companies have withdrawn $37.5 billion from money market funds that invest in Treasury debt and other ultra-safe securities, the biggest weekly drop this year. Meanwhile, in the vast market for repurchase agreements, in which many financial firms make short-term loans to one another, borrowers are beginning to demand higher yields.From the WSJ: Default Worries Dry Up Lending

Banks ... are scrambling to design emergency plans to avoid a trading logjam in the huge markets for Treasurys and short-term funding facilities if Congress fails to raise the U.S. borrowing limits by next Tuesday's deadline.From CNBC: Will Debt Feud Clip Future Economic Growth?

...

Trading executives from the largest Wall Street dealers agreed on a Wednesday conference call, conducted by the industry trade group the Securities Industry Financial Markets Association, to a number of procedures to trade Treasury bonds if the U.S. misses a payment on its debt.

Washington's political feuding over the deficit has damaged business and consumer sentiment in an already weak economy ...I've heard comments from several executives this week that business has slowed sharply over the last week. People are getting nervous.

I've been trying to ignore the charade - obviously Congress will agree to raise the debt ceiling and pay the bills - but it is now impacting the economy.

Housing Starts: Impact of Changes in Household Size

by Calculated Risk on 7/28/2011 06:26:00 PM

I've seen several people compare total housing starts with previous decades and ask: "Why is there still excess supply?"

Below is the long term graph of both total housing starts and single unit starts. If we look at the graph, we notice that there were more starts at the peak in the '70s than during the recent housing bubble.

Obviously there were many more multi-unit housing starts in the '70s - and that is a clue.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The key to the number of housing starts is household formation.

Household formation is a function of changes in population, and also of changes in household size. During the '70s, the baby boomers started moving out of their parents' homes, and there was a dramatic decrease in the number of persons per household. And that led to a huge demand for apartments (the surge in total starts).

The table below shows the number of persons per household for every decade from 1950 through 2010 (based on the decennial census data). Also using the decennial census data we can calculate the number of households needed because of 1) population growth, and 2) changes in household size:

| Decennial Census, Population and Households in Millions | ||||||

|---|---|---|---|---|---|---|

| Census | Population | Households | Persons per household | Increase in Households over decade | Increase in Households due to Population Growth | Increase in Households due to change in Household Size |

| 1950 | 150.7 | 42.8 | 3.52 | --- | --- | --- |

| 1960 | 179.3 | 53.0 | 3.38 | 10.2 | 8.1 | 2.1 |

| 1970 | 203.2 | 63.4 | 3.21 | 10.4 | 7.1 | 3.3 |

| 1980 | 226.5 | 80.4 | 2.82 | 17.0 | 7.3 | 9.7 |

| 1990 | 248.7 | 91.9 | 2.71 | 11.5 | 7.9 | 3.6 |

| 2000 | 281.4 | 105.5 | 2.67 | 13.6 | 12.1 | 1.5 |

| 2010 | 308.7 | 116.7 | 2.65 | 11.2 | 10.2 | 1.0 |

Because of the changes in household size, the U.S. needed far more additional housing units in the '70s than in the '00s. In the decade ending in 1980, there were 17 million households added. A majority of those households were added because of the decrease in the number of persons per household (boomers moving out!).

Unfortunately it is difficult to estimate the number of housing units needed in a given time period, even if we know the number of new households being formed (and we don't have timely data on household formation!). We also have to account for scrappage (demolitions), mobile homes and second homes. And this assume no excess supply - and right now there is a significant excess supply.

A simple formula would be:

Housing Starts + mobile homes needed = Households formed + scrappage + second homes added.

So if 1 million households are formed in a year, 200 thousand homes demolished (probably close), and say 100 thousand 2nd homes added, then the total housing starts plus mobile homes added would be 1.3 million.

Note: this doesn't account for location (most homes are not transportable), and the desires of each household (a mobile home isn't a substitute for a 4,000 square foot home).

So we can't just compare housing starts in different decades without looking at household formation. I'll have more on this ...

Fed's Williams: The Economic Outlook

by Calculated Risk on 7/28/2011 02:44:00 PM

From San Francisco Fed President John Williams: The Outlook for the Economy and Monetary Policy

Some excerpts on housing:

One of the most important currents holding back recovery has been housing. The collapse of the housing market touched off the financial crisis and recession. In most recessions, housing construction falls sharply, but then leads the economy back when growth resumes. As you well know, that snapback hasn’t occurred this time. Before the crisis, residential investment as a share of the economy was at its highest level since the Korean War. Today, housing construction remains moribund and residential investment as a share of the economy has fallen to its lowest level since World War II.These are key points: Usually housing is a key engine of recovery, but not this time because of the massive supply overhang. And looking forward:

On one level, that’s not surprising. We simply built too many—in fact, millions too many—houses during the boom and we are still feeling the effects of this overhang. Consider housing prices. From their peak in 2006 until early 2009, home prices nationwide fell by nearly a third. When you exclude distressed sales, prices appeared to bottom out in 2009 and early 2010. New housing starts also appeared to stabilize in 2009, after plummeting some 75 percent during the housing crash. ...

The $64,000 question is when will the housing market finally recover? One daunting challenge for such a recovery is the huge number of homes in foreclosure. Almost 7 million homes have entered into foreclosure since the first quarter of 2008 and some 2 million are still in the foreclosure process. In addition, there is a shadow inventory of homes currently owned by delinquent borrowers. When you add up unsold new houses left over from the boom, homes for sale by owners, foreclosed residences for sale by lenders, and the shadow inventory of houses at risk of distressed sale, you come up with a massive supply overhang.

Over time, more reasonable prices and an improving economy ought to bring buyers off the sidelines and set the stage for recovery. But high unemployment and anemic wage gains are leaving people worried about their income prospects and cautious about buying homes. Also, the dramatic plunge in home valuations since 2006 has made some first-time homebuyers wary about entering the market because of worries that prices might fall further.

It’s only a matter of time before we work off the inventory overhang and construction picks up. How much time it takes will depend in part on what happens with foreclosed properties. If we begin making progress on working down the foreclosure inventory, then single-family housing starts could plausibly rise from their current level of about 400,000 per year to an average level of perhaps 1.1 million per year in three or four years, according to research at the San Francisco Fed.4 To put this in perspective, such an increase would boost real gross domestic product, or GDP, by at least 1 percent.This is why I continue to focus on the excess supply. This is a key number for housing and the U.S. economy. See The “Excess Supply of Housing” War

4 By contrast, if we can't work down the foreclosure inventory, then a return to normal construction levels could be delayed several more years. See Hedberg and Krainer (2011).