by Calculated Risk on 7/15/2011 06:08:00 PM

Friday, July 15, 2011

Bank Failure #54: First Peoples Bank, Port Saint Lucie, FL

Sweating, clock staring bankers

F.D.I.C. Time!

by Soylent Green is People

From the FDIC: Premier American Bank, National Association, Miami, Florida, Assumes All of the Deposits of First Peoples Bank, Port Saint Lucie, Florida

As of March 31, 2011, First Peoples Bank had approximately $228.3 million in total assets and $209.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.4 million. ... First Peoples Bank is the 54th FDIC-insured institution to fail in the nation this year, and the seventh in Florida.The Friday afternoon ritual continues - three down today so far.

Earlier:

• From the NY Fed: Empire State Manufacturing Survey indicates conditions deteriorated in July

• Consumer Sentiment declines sharply in July

• Industrial Production increased 0.2% in June, Capacity Utilization unchanged

• Eight Banks Fail European Stress Tests

• Key Measures of Inflation ease in June

Bank Failure #52 & 53 in 2011: Two More in Georgia

by Calculated Risk on 7/15/2011 04:19:00 PM

Two more tumble off the tree

A bitter harvest

by Soylent Green is People

From the FDIC: Ameris Bank, Moultrie, Georgia, Acquires All the Deposits of Two Georgia Institutions: High Trust Bank, Stockbridge and One Georgia Bank, Atlanta

As of March 31, 2011, High Trust Bank had total assets of $192.5 million and total deposits of $189.5 million; and One Georgia Bank had total assets of $186.3 million and total deposits of $162.1 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for High Trust Bank will be $66.0 million and for One Georgia Bank, $44.4 million. ...The closings are the 52nd and 53rd FDIC-insured institutions to fail in the nation so far this year and the fifteenth and sixteenth in Georgia.

Key Measures of Inflation ease in June

by Calculated Risk on 7/15/2011 01:13:00 PM

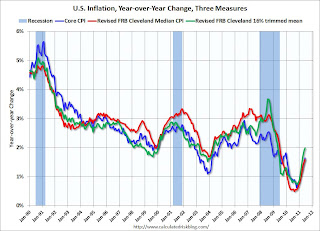

This week Fed Chairman Bernanke reiterated the Fed's position that further easing (i.e. QE3) would require both persistent economic weakness and a greater risk of deflation. From Bernanke's testimony:

[T]he possibility remains that the recent economic weakness may prove more persistent than expected and that deflationary risks might reemerge, implying a need for additional policy support.One thing to watch will be the following key measures.

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.2 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. ... The gasoline index declined sharply in June, falling 6.8 percent. ... In contrast, the index for all items less food and energy increased 0.3 percent for the second consecutive month.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.7% annualized rate) in June. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.7% annualized rate) during the month.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for June here.

Over the last 12 months, the median CPI rose 1.6%, the trimmed-mean CPI rose 2.0%, the CPI rose 3.6%, and the CPI less food and energy rose 1.6%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a year-over-year basis, these measures of inflation are increasing, but still mostly below the Fed's target. The trimmed-mean is at 2.0% year-over-year; at the Fed's target.

On a monthly basis, the median Consumer Price Index increased 1.7% at an annualized rate, down from 2.1% annualized in May. The 16% trimmed-mean Consumer Price Index also increased 1.7% annualized in June, down from 2.8% annualized in May. And core CPI increased 3.1% annualized, down from 3.5% annualized in May.

With the slack in the system, the year-over-year measures will probably stay near or be below 2% this year.

Earlier:

• From the NY Fed: Empire State Manufacturing Survey indicates conditions deteriorated in July

• Consumer Sentiment declines sharply in July

• Industrial Production increased 0.2% in June, Capacity Utilization unchanged

• Eight Banks Fail European Stress Tests

Eight Banks Fail European Stress Tests

by Calculated Risk on 7/15/2011 12:20:00 PM

Here is the page for the European Banking Authority (EBA)

EBA Press release (pdf)

Stress Test Summary report (pdf)

From the WSJ: 8 Banks Fail EU 'Stress Tests'

Eight banks flunked the European Union's "stress tests," with a combined shortfall of €2.5 billion ($3.54 billion) in capital under a simulated worst-case economic scenario, the European Banking Authority said.Only €2.5 billion in capital needed? And the banks are reported to hold an aggregate €1.1 trillion euros in government debt from Greece, Ireland, Portugal and Spain? I think investors will remain skeptical.

The EU regulator said Friday that another 16 banks narrowly passed the tests, which examined the abilities of 90 top lenders across Europe to endure a deteriorating economy and strained financial system.

By awarding a relatively clean bill of health to the vast majority of Europe's banking industry, the tests are likely to be greeted with skepticism.

Consumer Sentiment declines sharply in July

by Calculated Risk on 7/15/2011 09:55:00 AM

The preliminary July Reuters / University of Michigan consumer sentiment index declined sharply to 63.8 from 71.5 in June.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.

This was well below the consensus forecast of 71.0 and definitely in the recession range.