by Calculated Risk on 7/09/2011 05:57:00 PM

Saturday, July 09, 2011

Schedule for Week of July 10th

Earlier:

• Summary for Week Ending July 8th

Employment posts yesterday:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery

Several key reports will be released this week: U.S. Trade, Retail Sales, Industrial Production, and the Consumer Price Index (CPI). In addition, Fed Chairman Ben Bernanke will present his semiannual Monetary Policy Report to Congress.

Retail sales were probably weak in June due to lower auto sales and lower gasoline prices - and many people will focus on retail sales excluding autos and gasoline. Also the Empire State manufacturing survey for July might show a return to expansion.

The Consumer Price Index (CPI) and the Producer Price Index (PPI) will probably show less inflation in June since energy prices declined last month.

Note: The European bank stress tests will be released on Friday.

No scheduled releases.

7:30 AM: NFIB Small Business Optimism Index for June.

7:30 AM: NFIB Small Business Optimism Index for June. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index decreased to 90.9 in May from in 91.2 in April. This index had been trending up, although optimism has declined for three consecutive months now.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the monthly U.S. exports and imports in dollars through April 2011.

The consensus is for the U.S. trade deficit to be around $42.7 billion, down slightly from $43.7 billion in April.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. In general job openings have been trending up, however overall labor turnover remains low.

2:00 PM: FOMC Minutes, Meeting of June 21-22, 2011

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through summer (not counting all cash purchases).

8:30 AM: Import and Export Prices for June. The consensus is a for a 0.7% decrease in import prices.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for June (a measure of transportation). Some increase in transportation is expected.

10:00 AM: Fed Chairman Ben Bernanke, "Semiannual Monetary Policy Report to the Congress", Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims has been elevated for the last couple of months. The consensus is for a decrease to 405,000 from 418,000 last week.

8:30 AM: Producer Price Index for June. The consensus is for a 0.3% decrease in producer prices (0.2% increase in core).

8:30 AM: Retail Sales for June.

8:30 AM: Retail Sales for June. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The consensus is for retail sales to be flat in June, and for a 0.1% increase ex-auto.

Retail sales were impacted by falling gasoline prices, so ex-gasoline will be the key number.

10:00 AM: Manufacturing and Trade: Inventories and Sales for May. The consensus is for a 0.8% increase in inventories.

10:00 AM: Fed Chairman Ben Bernanke, "Semiannual Monetary Policy Report to the Congress", Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

8:30 AM: Consumer Price Index for June. The consensus is for a 0.2% decrease in prices. The consensus for core CPI is an increase of 0.2%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for July. This is the first of regional surveys for July. The consensus is for a reading of 8.0, indicating expansion, after a reading of -7.8 in June (contraction).

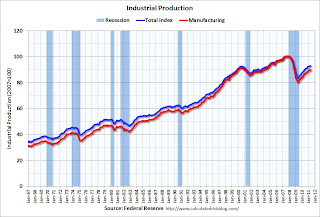

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June. This graph shows industrial production since 1967. Industrial production edged up slightly in May to 93.0.

The consensus is for a 0.4% increase in Industrial Production in June, and an increase to 76.9% (from 76.7%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for July. The consensus is for a slight decrease to 71.0 from 71.5 in June.

Unofficial Problem Bank list increases to 1,004 Institutions

by Calculated Risk on 7/09/2011 02:43:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources. This post includes an update to stress rates at the state level (see comments and sortable table at bottom).

Here is the unofficial problem bank list for July 8, 2011.

Changes and comments from surferdude808:

The FDIC decided to send Chairman Bair off with a small salute by closing three banks this Friday. The failures were in Colorado and Illinois, but given the 65 failures in the state of Georgia on Chair Bair’s watch, perhaps it may have been more fitting to have another failure in Georgia. This week there were four additions and three removals. The changes result in the Unofficial Problem Bank List having 1,004 institutions with assets of $418.8 billion.And a related article from Dow Jones: US Bank Failures Abate In 1st Half But Likely To Stay Elevated

The removals are the three failures this week including First Chicago Bank & Trust, Chicago, IL ($959 million); Colorado Capital Bank, Castle Rock, CO ($718 million); and Signature Bank, Windsor, CO ($67 million).

The additions include Greeneville Federal Bank, FSB, Greeneville, TN ($207 million); Worthington Federal Bank, Huntsville, AL ($177 million); Pacific Global Bank, Chicago, IL ($162 million); and Belt Valley Bank, Belt, MT ($65 million).

Other changes this week include Prompt Corrective Action Orders issued against Bank of the Commonwealth, Norfolk, VA ($1.0 billion Ticker: CWBS); and American Eagle Savings Bank, Boothwyn, PA ($21 million). Next week we anticipate for the OCC to release its actions through mid-June 2011.

U.S. bank failures have slowed in 2011 from the flood of recent years, but a large reservoir of problem banks will keep the failure rate relatively high as regulators slog through the backlog.Yes, quite a backlog!

Earlier:

• Summary for Week Ending July 8th

Employment posts yesterday:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery

Summary for Week Ending July 8th

by Calculated Risk on 7/09/2011 08:21:00 AM

The key story of the week was the June employment report - and the report was dismal.

There were only 18,000 total payroll jobs added in June, and 57,000 private sector payroll jobs. Also the BLS revised down April and May payrolls showing 44,000 fewer jobs were added than previously reported.

Basically every number was ugly: The unemployment rate increased from 9.1% to 9.2%, and the participation rate declined to 64.1%. The employment population ratio fell to 58.2%, matching the lowest level during the current employment recession. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.2%, the highest level this year.

The average workweek declined slightly to 34.3 hours, and average hourly earnings ticked down.

As I noted yesterday, the only good news was that June is over.

Europe was also in the news, with more discussions about Greece, and bond yields rising sharply for Portugal, Ireland and even Italy. The results of the European bank stress tests will be released this coming Friday, and the European financial crisis will remain headline news.

Finally Reis released their Q2 office, mall and apartment vacancy rates. Apartment vacancy rates are declining, office vacancy rates are moving sideways, and mall vacancy rates are still increasing.

There wasn't much data last week, but it sure finished ugly.

Below is a summary of economic data last week mostly in graphs:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

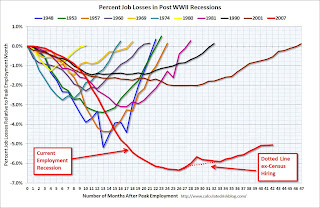

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the start of the recession.

In this post, the graph showed the job losses aligned at maximum job losses.

In terms of percentage payroll jobs, the 2007 recession is by far the worst since WWII.

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 9.2% (red line).

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 9.2% (red line).

The Labor Force Participation Rate declined to 64.1% in June (blue line). This is the percentage of the working age population in the labor force. This is the lowest level since the early '80s when

The Employment-Population ratio declined to 58.2% in June (black line). This ties the lowest level during the recession.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.552 million in June.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.552 million in June.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.2% in June from 15.8% in May. This is the highest level this year (highest since December 2010).

The next graph shows the duration of unemployment as a percent of the civilian labor force.

The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Two key categories are moving up again. The 27 weeks and more (the long term unemployed) has moved up for two consecutive months and is now at 6.3 million workers, or 4.1% of the labor force.

Also, the 'less than 5 weeks' category is increasing again and that indicates recent weakness in the labor market.

Here are the employment posts from yesterday:

1) June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

2) Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

3) Return of the Teen! and Unemployment by Duration and Education

4) Employment graph gallery

• ISM Non-Manufacturing Index indicates slower expansion in June

From the Institute for Supply Management: June 2011 Non-Manufacturing ISM Report On Business®

The June ISM Non-manufacturing index was at 53.3%, down from 54.6% in May. The employment index increased in June to 54.1%, up from 54.0% in May. Note: Above 50 indicates expansion, below 50 contraction.

The June ISM Non-manufacturing index was at 53.3%, down from 54.6% in May. The employment index increased in June to 54.1%, up from 54.0% in May. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.0%.

• Reis: Office, Mall and Apartment Vacancy Reports

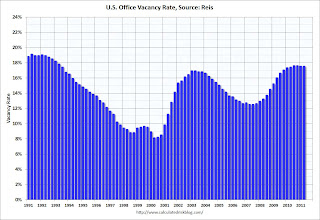

Reis reported the Q2 office, mall and apartment vacancy rates. Apartment vacancy rates are declining, office vacancy rates are moving sideways, and mall vacancy rates are still increasing.

This graph shows the office vacancy rate starting in 1991.

This graph shows the office vacancy rate starting in 1991.

Reis reported the office vacancy rate was at 17.5% in Q2 2011, the same rate as in Q1, and up from 17.4% in Q2 2010. It appears the office vacancy rate might have peaked - and is now moving sideways. It will be a good sign when the vacancy rate starts falling.

From Reuters: Sluggish economy slows US office market rebound

Reis reported that the apartment vacancy rate (82 markets) fell to 6.0% in Q2 from 6.2% in Q1. The vacancy rate was at 7.8% in Q2 2010 and peaked at 8.0% at the end of 2009.

Reis reported that the apartment vacancy rate (82 markets) fell to 6.0% in Q2 from 6.2% in Q1. The vacancy rate was at 7.8% in Q2 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Rents Rise, Vacancies Go Down

This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

From Reuters: US mall vacancies rise in 2nd quarter, rents flat

From Reuters: US mall vacancies rise in 2nd quarter, rents flat

"Preliminary figures by real estate research firm Reis show the vacancy rate at ... regional malls rose to 9.3 percent ... up from 9.1 percent in the first quarter. ... The vacancy rate at these local retail strips was 11 percent versus 10.9 percent in the first quarter, almost matching the 11.1 percent record set 20 years ago"

• Other Economic Stories ...

• From the American Bankruptcy Institute: Consumer Bankruptcy Filings Down 8 Percent Through the First Half of 2011

• From National Federation of Independent Business (NFIB): NFIB Jobs Statement: June is a Bust, but July Looks Hopeful

• ADP: Private Employment increased by 157,000 in June

Have a great weekend!

Friday, July 08, 2011

Greece: More Discussions about Debt Reduction

by Calculated Risk on 7/08/2011 10:28:00 PM

From the WSJ: Greek Bailout Talks Shift to Attack on Debt

Discussions between bankers and government officials about Greece have undergone a fundamental shift in recent days, turning toward reducing the country's mountainous debt burden instead of just staving off a near-term financial crisis ... Finance ministers from the 17 nations that use the euro are expected to discuss the proposals at a meeting Monday in Brussels. They are expected to debate options that they previously discarded, including the use of European bailout funds to finance purchases of Greek debt.The key is to reduce the debt. This is similar to the problem mortgage lenders face in reducing mortgage principal - it might make sense for one borrower, but then many other borrowers will want a principal reduction.

If Greece gets a debt reduction, Portugal, Ireland, Spain and Italy will all get in line. Every one likes free money.

Some more from the Financial Times: EU leaders differ over Greek default

Here are the earlier employment posts:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery

Bank Failure #51: Signature Bank, Windsor, Colorado

by Calculated Risk on 7/08/2011 08:02:00 PM

"Where can we turn for more cash?"

Go Points West, young man.

by Soylent Green is People

From the FDIC: Points West Community Bank, Julesburg, Colorado, Assumes All of the Deposits of Signature Bank, Windsor, Colorado

As of March 31, 2011, Signature Bank had approximately $66.7 million in total assets and $64.5 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $22.3 million. ... Signature Bank is the 51st FDIC-insured institution to fail in the nation this year, and the 4th in Colorado.