by Calculated Risk on 4/08/2011 11:41:00 AM

Friday, April 08, 2011

CNBC: McConnell says Budget Deal Near

CNBC: Budget Deal is Near: GOP Senate Minority Leader McConnell

It seemed very unlikely to me that the government would be shut down. I'll have more when the deal is announced.

Europe Update: Austerity in Portugal, Bank Stress Test concerns in Germany

by Calculated Risk on 4/08/2011 09:04:00 AM

An update on the bailout for Portugal from the Irish Times: Portugal told to implement reforms ahead of bailout

Europe's rich countries pushed Portugal to make deeper-than-planned budget cuts in the heat of an election campaign in exchange for an emergency aid package estimated at €80 billion.So what the voters just turned down is a "starting point" now. Ouch.

...

In an unprecedented intervention in national politics, euro-area finance ministers said Portugal can win relief by mid-May as long as it makes cuts that go beyond measures that failed to pass parliament in March and led to the government's downfall.

"We stand ready to negotiate immediately this ambitious program, which should comprehend an ambitious fiscal adjustment, structural reforms," said European Central Bank president Jean-Claude Trichet ...

Last month's austerity plan "is a starting point", European Union economic and monetary commissioner Olli Rehn told reporters ... "It is indeed essential in Portugal to reach a cross-party agreement ensuring that such a program can be adopted in May."

And from Jack Ewing at the NY Times: European Bank Stress Tests to Hit German Banks Hard (Pay)

Banks that fail a planned health checkup by European regulators in June will be required to present a recovery plan that could force some weaker institutions, particularly in Germany, to raise more capital ...

The authority said in a statement Friday that it expected any bank “showing specific weaknesses in the stress test, to agree with the relevant supervisory authority the appropriate remedial measures and execute them in due time.”

Thursday, April 07, 2011

Mortgage Lenders lay off workers as refinance activity declines rapidly

by Calculated Risk on 4/07/2011 10:37:00 PM

From Scott Reckard at the LA Times: Home lenders shed workers as mortgage rates climb

A rebound in mortgage rates from last year's near-record low has reduced consumer demand for home loans and refinancings, leading Wells Fargo & Co. to join other industry stalwarts in laying off loan processors and related workers.Maybe they can have these workers help with modifications and foreclosures ...

The San Francisco bank, the nation's No. 1 mortgage lender, has handed pink slips to about 1,900 workers who had processed loans generated both by Wells' mortgage unit and by independent brokers, a spokesman said Thursday. ... Notifications went out March 23 telling affected workers their jobs would end in 60 days ...

It doesn't take much of an increase in rates for refinance activity to slow sharply.

The MBA refinance index has fallen sharply since last October, suggesting refinance volumes have fallen about 60% - as 30 year mortgage rates increased from 4.21% in October to the current 4.93%.

House Prices: Nominal, Real, Price-to-Rent

by Calculated Risk on 4/07/2011 05:09:00 PM

By request, here is an update to a few graphs including the CoreLogic HPI released this morning (the February report is an average of December, January and February prices).

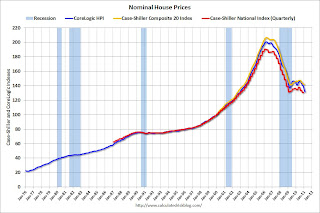

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through January release) and CoreLogic House Price Indexes (through February release) in nominal terms (as reported).

In nominal terms, the National index is back to Q1 2003 levels, the Composite 20 index is slightly above the May 2009 lows, and the CoreLogic index back to January 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to January 2000.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

An interesting point: the measure of Owners' Equivalent Rent (OER) is at about the same level as two years - so the price-to-rent ratio has mostly followed changes in nominal house prices since then. Rents are starting to increase again, and OER will probably increase in 2011 - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is just above the May 2009 levels, and the CoreLogic index is back to January 2000.

I'll have more analysis when the Case-Shiller index is released on April 26th.

Earlier:

• CoreLogic: House Prices declined 2.7% in February, Prices now 4.1% below 2009 Lows

Hotels: Occupancy Rate improves in Latest Survey

by Calculated Risk on 4/07/2011 02:29:00 PM

This was an easy comparison because of the timing of Easter.

Here is the weekly update on hotels from HotelNewsNow.com: STR: Softer comps make for strong weekly results

The weekly results were boosted by softer year-over-year comparisons. Easter, a historically low travel weekend for hotels, was on 4 April 2010.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

Overall, the U.S. hotel industry’s occupancy was up 12.2% to 60.8%, its average daily rate increased 5.3% to US$100.18, and its revenue per available room finished the week up 18.1% to US$60.91.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate.

The occupancy rate is well above the rate in 2009 and 2010, and fairly close to the rate in 2008.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com