by Calculated Risk on 4/07/2011 11:30:00 AM

Thursday, April 07, 2011

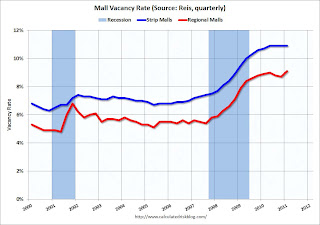

Reis: Mall Vacancy rates increase in Q1

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

From Bloomberg: Mall Vacancies Climb to Highest in Decade as U.S. Retailers Close Stores

The vacancy rate [at U.S. regional malls] climbed to 9.1 percent from 8.9 percent a year earlier and 8.7 percent in the fourth quarter, [Reis reported]. It was the highest since Reis began publishing data on regional malls in the beginning of 2000.The previous record for regional malls was 9.0% in Q2 2010 (Reis started tracking regional malls in 2000). The record vacancy rate for strip malls was in 1990 at 11.1%.

At neighborhood and community shopping centers, which usually are anchored by discount and grocery stores, the vacancy rate rose to 10.9 percent from 10.7 percent a year earlier. The rate was unchanged from the three previous quarters and the highest since it reached 11 percent in 1991, according to Reis.

As noted in the article, stores are still being closed as long term leases expire.

Earlier on Office vacancy rates:

• Reis: Office Vacancy Rate declines slightly in Q1

• When will Office Investment increase?

And apartment vacancy rates:

• Forecast: Rising Rents to slow House Price Declines

CoreLogic: House Prices declined 2.7% in February, Prices now 4.1% below 2009 Lows

by Calculated Risk on 4/07/2011 09:15:00 AM

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from January to February 2011. The CoreLogic HPI is a three month weighted average of December, January and February, and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Shows Year-Over-Year Decline for Seventh Straight Month

According to the CoreLogic HPI, national home prices, including distressed sales, declined by 6.7 percent in February 2011 compared to February 2010 after declining by 5.5 percent in January 2011 compared to January 2010. Excluding distressed sales, year-over-year prices declined by 0.1 percent in February 2011 compared to February 2010 and by 1.4 percent in January 2011 compared to January 2010. Distressed sales include short sales and real estate owned (REO) transactions.

Despite the continued overall decline, home prices excluding distressed properties are showing signs of stability according to Mark Fleming, chief economist with CoreLogic. “When you remove distressed properties from the equation, we’re seeing a significantly reduced pace of depreciation and greater stability in many markets. Price declines are increasingly isolated to the distressed segment of the market, mostly in the form of REO sales, as the stock of foreclosures is slowly cleared." he said.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 6.7% over the last year, and off 34.5% from the peak.

This is the seventh straight month of year-over-year declines, and the eighth straight month of month-to-month declines. The index is now 4.1% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

Weekly Initial Unemployment Claims decline to 382,000

by Calculated Risk on 4/07/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 2, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 10,000 from the previous week's revised figure of 392,000. The 4-week moving average was 389,500, a decrease of 5,750 from the previous week's revised average of 395,250.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 389,500.

This is the 6th consecutive week with the 4-week average below the 400,000 level. This is still elevated, and we'd like to see the number of initial claims continue to decline (and hiring pickup too). But this is a small positive step in the right direction.

Wednesday, April 06, 2011

Forecast: Rising Rents to slow House Price Declines

by Calculated Risk on 4/06/2011 08:23:00 PM

As I mentioned this morning, the sharp decline in the rental vacancy rate, to 6.2% in Q1 2011, suggests that the excess supply of housing is being absorbed. Here is a graph of the Reis apartment vacancy rate:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The vacancy rate is back to early 2008 levels, and is not far above the rate of 2006 (around 5.7%). As the vacancy rate falls, rents will rise and this will help support house prices. See this post on the price-to-rent ratio.

Housing economist Tom Lawler predicted this afternoon: 'Rising rents combined with a substantial reduction in the “excess supply” of housing (single family as well) will also help stem the recent “renewed” downturn in US home prices well before the end of this year.'

I think prices might fall for another year or two in real terms (inflation adjusted), but I agree that it is likely that nominal house prices will bottom this year.

Portugal to ask for Bailout

by Calculated Risk on 4/06/2011 03:52:00 PM

It was just a matter of when ...

From Reuters: Portugal's Finance Minister: We Now Need EU Aid After All

"In this difficult situation, which could have been avoided, I understand that it is necessary to resort to the financing mechanisms available within the European framework," said Finance Minister Fernando Teixeira dos Santos.Here is the 10 year bond yield from Bloomberg for Portugal. Everyone expected Portugal to ask for a bailout, but is this the last EU country to ask for help? That is a key quesiton.