by Calculated Risk on 3/31/2011 02:36:00 PM

Thursday, March 31, 2011

Employment Situation Preview: More Jobs, but still Grim

Tomorrow the BLS will release the March Employment Situation Summary at 8:30 AM ET. The consensus is for an increase of 195,000 payroll jobs in March, and for the unemployment rate to hold steady at 8.9%.

• The weak payroll report in January was blamed on the weather (only 63,000 jobs added after revision). So there might have been some bounce back in February (192,000 payroll jobs added). The two month average was 127,500 payroll jobs added (145,000 private). Anything less in March would be very disappointing.

• The BLS reference period is the calendar week that contains the 12th day of the month (or pay period including the 12th for the establishment survey). There were several significant world events in March, especially in Japan (the earthquake was on March 11th) and Libya. Sometimes hiring can be delayed due to world events, but based on the timing, I don't think there will be any impact on the March report.

• Usually the ISM manufacturing and service reports are released before the BLS employment report. Not this month because the first Friday of the month is on the 1st (Happy April Fools' Day!). However all of the regional Fed manufacturing surveys and the Chicago PMI indicated strong expansion in March.

• Weekly initial unemployment claims averaged 394,250 in March, about the same as in February (392,500). That is the good news (fewer layoffs), but so far hiring hasn't picked up.

• Weekly initial unemployment claims averaged 394,250 in March, about the same as in February (392,500). That is the good news (fewer layoffs), but so far hiring hasn't picked up.

Click on graph for larger image in graph gallery.

• ADP reported Private Employment increased by 201,000 from February to March on a seasonally adjusted basis, and has averaged 211,000 over the last four months.

And some less optimistic news:

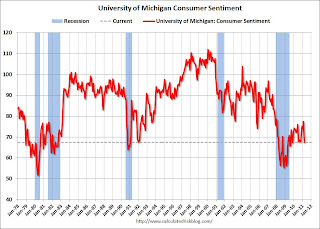

• Consumer Sentiment decreased sharply in March. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the decline in March).

• Consumer Sentiment decreased sharply in March. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the decline in March).

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009.

• And on unemployment: Gallup Finds U.S. Unemployment Rate at 10.0% in March NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. But this does suggest a seasonally adjusted unemployment rate slightly higher than the 8.9% in February.

• Even if the payroll report shows improvement, the employment situation remains grim. There are 7.4 million fewer payroll jobs now than before the recession started in 2007 with 13.7 million Americans currently unemployed. Another 8.3 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 6 million have been unemployed for six months or more.

If the BLS reports 200 thousand payroll jobs added tomorrow - that will be welcome - but it is just a small step in the right direction. Many of the unemployed and marginally employed will not see any improvement for some time.

My guess is in the 150,000 to 175,000 range for payroll jobs, with the unemployment rate increasing slightly.

Kansas City Manufacturing Survey at Record High, Chicago PMI Strong in March

by Calculated Risk on 3/31/2011 11:00:00 AM

• Note: The Irish bank stress test results will be released at 4:30 PM local time (11:30 AM ET). The Irish Times has a live blog discussing the results.

• From the Kansas City Fed: Survey of Tenth District Manufacturing

Growth in Tenth District manufacturing activity accelerated rapidly in March, posting a record high for the second straight month. Expectations moderated slightly from last month, but still remained solid. Price indexes for raw materials reached historically high levels, and more firms indicated plans to pass cost increases on to customers.This is the last of the regional Fed surveys for January. The regional surveys provide a hint about the ISM manufacturing index, as the following graph shows.

The month-over-month composite index was 27 in March, up from 19 in February and 7 in January. This reading set a new all time survey high. ... The employment index inched higher from 23 to 25, also a new survey record.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through March), and averaged five Fed surveys (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The regional surveys suggest the ISM manufacturing index will in the 60+ range (strong expansion). The ISM index for March will be released tomorrow, April 1st. The consensus is for a decrease to 61.2 from 61.4 in February.

And from earlier this morning ...

• From the Chicago Business Barometer™ Decelerated: The overall index decreased to 70.6 from 71.2 in February. This was slightly above consensus expectations of 70.0. Note: any number above 50 shows expansion, so this is a strong reading.

"EMPLOYMENT grew to its second-highest level since February 1973." The employment index increased sharply to 65.6 from 59.8. This is the highest level since December 1983.

"NEW ORDERS increased to the highest point since December 1983". The new orders index decreased to 74.5 from 75.9.

Prices were up sharply, but over all this was a strong report.

Ireland: Stress Test Results to be released at 11:30 AM ET

by Calculated Risk on 3/31/2011 10:16:00 AM

Weekly Initial Unemployment Claims at 388,000

by Calculated Risk on 3/31/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 26, the advance figure for seasonally adjusted initial claims was 388,000, a decrease of 6,000 from the previous week's revised figure of 394,000. The 4-week moving average was 394,250, a increase of 3,250 from the previous week's revised average of 391,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 394,250.

The number of weekly claims for last week was revised up - so this was reported as a decline. But what really matters is this is the 5th consecutive week with the 4-week average below the 400,000 level. There is nothing magical about 400,000, but this is a small positive step for the labor market.

Wednesday, March 30, 2011

Irish Finance Minister: Bank stress test results of "major significance"

by Calculated Risk on 3/30/2011 10:37:00 PM

The Irish bank stress test results will be released tomorrow.

From the Irish Times: Noonan to propose 'radical' bank sector restructuring

... The results of the tests will lead [Finance Minister] Michael Noonan to undertake “a radical new approach” to fix the banks, a Government source said.Here are the Irish yields from Bloomberg for 2 year and 10 year bonds.

Mr Noonan will make a “watershed” argument for a EU-wide solution around passing bank losses on to bondholders ... The Minister will speak for 20 minutes in the Dáil immediately after the announcement of the test results by the Central Bank.

Mr Noonan told Fine Gael TDs and Senators at the party’s parliamentary party meeting last night that the test results would be of major significance and would dominate the news over the weekend.

...

ECB chief Jean-Claude Trichet chaired a teleconference meeting of the bank’s governing council from China yesterday to discuss the situation in the Irish banks. A further meeting may be held today as the ECB finalises its response.

Earlier:

• CoreLogic: Shadow Inventory Declines Slightly

• Lawler: The “Shrill Cry” from Lobbyists on QRM