by Calculated Risk on 3/31/2011 02:36:00 PM

Thursday, March 31, 2011

Employment Situation Preview: More Jobs, but still Grim

Tomorrow the BLS will release the March Employment Situation Summary at 8:30 AM ET. The consensus is for an increase of 195,000 payroll jobs in March, and for the unemployment rate to hold steady at 8.9%.

• The weak payroll report in January was blamed on the weather (only 63,000 jobs added after revision). So there might have been some bounce back in February (192,000 payroll jobs added). The two month average was 127,500 payroll jobs added (145,000 private). Anything less in March would be very disappointing.

• The BLS reference period is the calendar week that contains the 12th day of the month (or pay period including the 12th for the establishment survey). There were several significant world events in March, especially in Japan (the earthquake was on March 11th) and Libya. Sometimes hiring can be delayed due to world events, but based on the timing, I don't think there will be any impact on the March report.

• Usually the ISM manufacturing and service reports are released before the BLS employment report. Not this month because the first Friday of the month is on the 1st (Happy April Fools' Day!). However all of the regional Fed manufacturing surveys and the Chicago PMI indicated strong expansion in March.

• Weekly initial unemployment claims averaged 394,250 in March, about the same as in February (392,500). That is the good news (fewer layoffs), but so far hiring hasn't picked up.

• Weekly initial unemployment claims averaged 394,250 in March, about the same as in February (392,500). That is the good news (fewer layoffs), but so far hiring hasn't picked up.

Click on graph for larger image in graph gallery.

• ADP reported Private Employment increased by 201,000 from February to March on a seasonally adjusted basis, and has averaged 211,000 over the last four months.

And some less optimistic news:

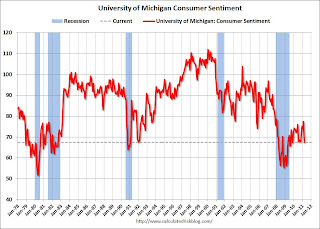

• Consumer Sentiment decreased sharply in March. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the decline in March).

• Consumer Sentiment decreased sharply in March. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the decline in March).

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009.

• And on unemployment: Gallup Finds U.S. Unemployment Rate at 10.0% in March NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. But this does suggest a seasonally adjusted unemployment rate slightly higher than the 8.9% in February.

• Even if the payroll report shows improvement, the employment situation remains grim. There are 7.4 million fewer payroll jobs now than before the recession started in 2007 with 13.7 million Americans currently unemployed. Another 8.3 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 6 million have been unemployed for six months or more.

If the BLS reports 200 thousand payroll jobs added tomorrow - that will be welcome - but it is just a small step in the right direction. Many of the unemployed and marginally employed will not see any improvement for some time.

My guess is in the 150,000 to 175,000 range for payroll jobs, with the unemployment rate increasing slightly.