by Calculated Risk on 3/21/2011 08:30:00 AM

Monday, March 21, 2011

Chicago Fed: Economic Growth Near Average in February

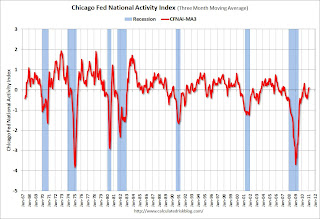

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Economic Growth Near Average in February

The Chicago Fed National Activity Index ticked down to –0.04 in February from –0.01 in January. Three of the four broad categories of indicators that make up the index made positive contributions in February, but for the second consecutive month they were offset by continued weakness in the consumption and housing category.

The index’s three-month moving average, CFNAI-MA3, increased to +0.11 in February from +0.05 in January, coming in positive for two consecutive months for the first time since April and May of 2010. February’s CFNAI-MA3 suggests that growth in national economic activity was slightly above its historical trend. With regard to inflation, the CFNAI-MA3 indicates limited inflationary pressure from economic activity over the coming year.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was growing near average in February.

Weekend:

• Summary for Week ending March 18th

• Some preliminary Census 2010 Housing Vacancy Data.

• Schedule for Week of March 20th

Sunday, March 20, 2011

Japan Nuclear Update

by Calculated Risk on 3/20/2011 08:29:00 PM

By request:

Note: The lack of hard information can be frustrating.

From the LA Times: Radiation levels may be falling at stricken nuclear plant

Radiation levels at the stricken Fukushima Daiichi nuclear power plant in Japan are still high but may be tapering off, a senior U.S. nuclear official said Sunday.From the NY Times: Progress at Japan Reactors; New Signs of Food Radiation

Indications from the plant, which houses six nuclear reactors, were levels in the range of hundreds of millisieverts per hour, said Gregory Jaczko, chairman of the U.S. Nuclear Regulatory Commission.

Japan appeared to make moderate progress in stabilizing some of the nuclear reactors at the stricken Fukushima Daiichi power plant on Sunday, but at the same time it disclosed new signs of radioactive contamination in agricultural produce and livestock.A running blog from Reuters: Japan earthquake LIVE

...

The Tokyo Electric Power Company ... appeared to have experienced a serious setback as officials said that pressure buildup at the ravaged No. 3 reactor would require the venting of more radioactive gases. But at a news conference a few hours later, officials from the power company said that the pressure had stabilized ...

The power company also said that on Sunday workers injected 40 tons of water into the storage pool containing spent fuel rods at Unit No. 2, and that firefighters began spraying water into the pool at Unit No. 4. On Saturday, firefighters sprayed water at the storage pool of Unit No. 3 for more than 13 hours.

...

The government said that power was returned to Reactor No. 2 at 3:46 p.m. Sunday, and that other reactors were also expected to gain power early in the week.

Earlier:

• Summary for Week ending March 18th

• Some preliminary Census 2010 Housing Vacancy Data.

• Schedule for Week of March 20th

Supply Chain Stress Test

by Calculated Risk on 3/20/2011 02:43:00 PM

It is hard to guess the impact of the supply chain disruption. A week or two shutdown will probably have minimal impact on sales, but a delay until May would be significant.

From Steve Lohr at the NY Times: Stress Test for the Global Supply Chain

[T]he disaster in Japan, experts say, presents a first-of-its-kind challenge, even if much remains uncertain.And from the WSJ: Supply Shortages Stall Auto Makers

Japan is the world’s third-largest economy, and a vital supplier of parts and equipment for major industries like computers, electronics and automobiles. The worst of the damage was northeast of Tokyo, near the quake’s epicenter, though Japan’s manufacturing heartland is farther south. But greater problems will emerge if rolling electrical blackouts and transportation disruptions across the country continue for long.

Throughout Japan, many plants are closed at least for days, with restart dates uncertain.

A shortage of Japanese-built electronic parts will force GM to close a plant in Zaragoza, Spain, on Monday and cancel shifts at a factory in Eisenach, Germany, on Monday and Tuesday, the company said Friday.And from the WSJ: Nissan to Resume Production in Japan

...

Japanese auto makers Toyota Motor Corp., Honda Motor Co. and Nissan Motor Co. have halted production in Japan in the way of last week's earthquake and tsunami.

... Honda [warned] U.S. dealers that it isn't sure if it will be able to resume full production at certain Japanese plants before May ...

Nissan Motor Co. said Sunday that it will start parts production and vehicle assembly operations this week in Japan, becoming the first car maker to restart its entire auto production process after a devastating quake brought the country's auto industry to a standstill.

Schedule for Week of March 20th

by Calculated Risk on 3/20/2011 08:55:00 AM

Here is the Summary for Week ending March 18th and some preliminary Census 2010 Housing Vacancy Data.

The key releases this week will be existing home sales on Monday, new home sales and Wednesday, durable goods on Thursday, and the final estimate for Q4 GDP on Friday.

8:30 AM ET: Chicago Fed National Activity Index (February). This is a composite index of other data.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for sales of 5.15 million at a Seasonally Adjusted Annual Rate (SAAR) in February, down from 5.36 million SAAR in January.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Housing economist Tom Lawler is forecasting a decline to 5 millon (SAAR) in February. This would put the months-of-supply in the low 8 months range.

Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). These revisions are expected to be announced mid-year.

8:00 AM: Cleveland Fed President Sandra Pianalto will speak at the University of Akron Economic Summit "The Economy: 2011 and Beyond."

10:00 AM: FHFA House Price Index for January. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Richmond Fed Manufacturing Survey for March. The consensus is for a slight decrease to 24 from 25 in February.

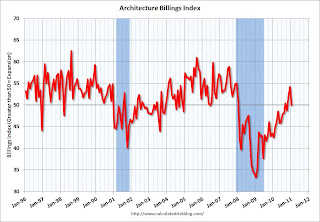

Early: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through the first few months of 2011.

10:00 AM: New Home Sales for February from the Census Bureau. The consensus is for an increase in sales to 290 thousand (SAAR) in February from 284 thousand in January.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.New home sales collapsed in May and have averaged only 293 thousand (SAAR) over the last nine months. Prior to the last nine months, the record low was 338 thousand in Sept 1981.

12:00 PM: Fed Chairman Ben Bernanke will speak at the Independent Community Bankers of America National Convention and Techworld, San Diego, California "Community Banking in a Period of Recovery and Change"

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 383,000 from 385,000 last week.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders after increasing 2.7% in January.

7:30 PM: Fed Governor Elizabeth Duke will speak at the Virginia Association of Economists Sandridge Lecture, Richmond, Virginia "Changing Circumstances: The Impact of the Financial Crisis on Wealth"

8:30 AM: Gross Domestic Product, 4th quarter 2010 (third estimate);

Corporate Profits, 4th quarter 2010. This is the third estimate for Q4 from the BEA, and the consensus is for real GDP growth to be revised to an increase of 3.1% annualized from the second estimate of 2.8%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a decrease to 68.0 from the preliminary reading of 68.2. This has declined because of higher gasoline prices, and possibly world events.

10:00 AM: Regional and State Employment and Unemployment for February 2011

12:00 PM: Industrial Production and Capacity Utilization (Annual Revision)

Note: Speeches from Philadelphia Fed President Charles Plosser, Minneapolis Fed President Narayana Kocherlakota, and Atlanta Fed president Dennis Lockhart.

After 4:00 PM: The FDIC might have a busy Friday afternoon ...

Best wishes to All!

Saturday, March 19, 2011

Birthday Houses

by Calculated Risk on 3/19/2011 09:10:00 PM

Something a little lighter from David Bracken at the newsobserver.com: Home is fine, offers are not (ht Sebastian)

When Ann Robertson first put her Raleigh home up for sale, she timed it so that it would be part of the Oakwood neighborhood's annual Candlelight Tour held each December.As Jim the Realtor always says, there's nothing that price won't fix. Instead these owners are chasing the prices down - very slowly.

...

That was 826 days ago.

Today, Robertson's house remains on the market. It is part of a growing collection of homes that real estate insiders dub "birthday houses," a term that refers to any property that has gone unsold longer than a year.

...

In the past, sellers' agents could, if they wanted, conceal the total days on the market by taking homes off for a day or two and relisting under a new MLS number. But now the MLS displays a cumulative days-on-the-market figure that is tied to a home's address.

Note: Here is the listing with "days on site" at the bottom.

Earlier:

• Unofficial Problem Bank list increases to 982 Institutions

• Census 2010 Housing Vacancy Data

• Summary for Week ending March 18th