by Calculated Risk on 3/20/2011 08:55:00 AM

Sunday, March 20, 2011

Schedule for Week of March 20th

Here is the Summary for Week ending March 18th and some preliminary Census 2010 Housing Vacancy Data.

The key releases this week will be existing home sales on Monday, new home sales and Wednesday, durable goods on Thursday, and the final estimate for Q4 GDP on Friday.

8:30 AM ET: Chicago Fed National Activity Index (February). This is a composite index of other data.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for sales of 5.15 million at a Seasonally Adjusted Annual Rate (SAAR) in February, down from 5.36 million SAAR in January.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Housing economist Tom Lawler is forecasting a decline to 5 millon (SAAR) in February. This would put the months-of-supply in the low 8 months range.

Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). These revisions are expected to be announced mid-year.

8:00 AM: Cleveland Fed President Sandra Pianalto will speak at the University of Akron Economic Summit "The Economy: 2011 and Beyond."

10:00 AM: FHFA House Price Index for January. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Richmond Fed Manufacturing Survey for March. The consensus is for a slight decrease to 24 from 25 in February.

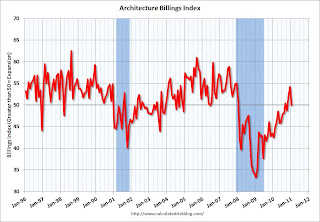

Early: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through the first few months of 2011.

10:00 AM: New Home Sales for February from the Census Bureau. The consensus is for an increase in sales to 290 thousand (SAAR) in February from 284 thousand in January.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.New home sales collapsed in May and have averaged only 293 thousand (SAAR) over the last nine months. Prior to the last nine months, the record low was 338 thousand in Sept 1981.

12:00 PM: Fed Chairman Ben Bernanke will speak at the Independent Community Bankers of America National Convention and Techworld, San Diego, California "Community Banking in a Period of Recovery and Change"

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 383,000 from 385,000 last week.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders after increasing 2.7% in January.

7:30 PM: Fed Governor Elizabeth Duke will speak at the Virginia Association of Economists Sandridge Lecture, Richmond, Virginia "Changing Circumstances: The Impact of the Financial Crisis on Wealth"

8:30 AM: Gross Domestic Product, 4th quarter 2010 (third estimate);

Corporate Profits, 4th quarter 2010. This is the third estimate for Q4 from the BEA, and the consensus is for real GDP growth to be revised to an increase of 3.1% annualized from the second estimate of 2.8%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a decrease to 68.0 from the preliminary reading of 68.2. This has declined because of higher gasoline prices, and possibly world events.

10:00 AM: Regional and State Employment and Unemployment for February 2011

12:00 PM: Industrial Production and Capacity Utilization (Annual Revision)

Note: Speeches from Philadelphia Fed President Charles Plosser, Minneapolis Fed President Narayana Kocherlakota, and Atlanta Fed president Dennis Lockhart.

After 4:00 PM: The FDIC might have a busy Friday afternoon ...

Best wishes to All!