by Calculated Risk on 9/01/2010 04:00:00 PM

Wednesday, September 01, 2010

U.S. Light Vehicle Sales 11.5 Million SAAR in August

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.47 million SAAR in August. That is down 18.9% from August 2009 (cash-for-clunkers), and down 0.5% from the July sales rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for August (red, light vehicle sales of 11.47 million SAAR from Autodata Corp).

The high for the year was in March, and sales have moved mostly sideways since then. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current month sales rate. The current sales rate is still below the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

This was below most forecasts of around 11.6 million SAAR.

Some comments on August ISM Manufacturing Index

by Calculated Risk on 9/01/2010 12:15:00 PM

The Institute for Supply Management reported this morning that the PMI increased to 56.3 from 55.5 in July. Expectations were for a decrease to 53.0. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is an update to the graph showing the regional Fed manufacturing surveys and the ISM index through August.

The Fed surveys suggested that the ISM index would probably decline, but the relationship is noisy. Based on this graph I'd expect either the Fed surveys to bounce back in September - or the ISM to decline. Here is a long term graph that hopefully puts the uptick in August in perspective.

Here is a long term graph that hopefully puts the uptick in August in perspective.

In addition to the increase in the PMI, the production index increased to 59.9 from 57.0, and the employment index increased from 58.6 in July to 60.4. That suggests increased manufacturing employment in August.

However the new orders index declined in August to 53.1 from 53.5 in July (still expanding, but at a slower pace). And the inventory index was up for the 2nd month in a row to 51.4.

This report was somewhat better than expected, but I still expect the index to decline over the next couple of months.

General Motors: Sales off sharply from August 2009

by Calculated Risk on 9/01/2010 11:18:00 AM

Note: Sales in August 2009 were boosted by "Cash-for-clunkers".

From MarketWatch: GM August U.S. sales down 24.9% to 185,176 units

General Motors Co. said Wednesday that U.S. sales in August slumped 24.9% to 185,176 vehicles from 246,479 in August 2009.Note: in August 2009 U.S. light vehicle sales were 14.1 million (SAAR). This was related to "Cash-for-clunkers" - also General Motors emerged from bankruptcy on July 10, 2009.

I'll add reports from the other major auto companies as updates to this post.

Update1: From MarketWatch: Ford U.S. August sales slide 10.7% to 157,503

From MarketWatch: Chrysler U.S. August sales rise 7% to 99,611 units

NOTE: Once all the reports are released, I'll post a graph of the estimated total August light vehicle sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET. Most estimates are for an increase to 11.6 million SAAR in August from the 11.5 million SAAR in July.

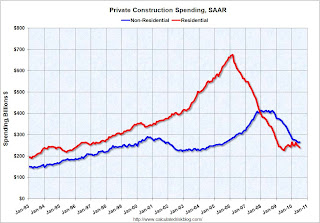

Construction Spending declines in July

by Calculated Risk on 9/01/2010 10:15:00 AM

Note: the ISM PMI increased to 56.3 from 55.5 in July (I'll have more later).

Overall construction spending decreased in July. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

From the Census Bureau: July 2010 Construction at $805.2 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during July 2010 was estimated at a seasonally adjusted annual rate of $805.2 billion, 1.0 percent (±1.4%)* below the revised June estimate of $813.1 billion. The July figure is 10.7 percent (±1.8%) below the July 2009 estimate of $901.2 billion.Private residential construction spending has turned down again - after the tax credit expired - and residential investment (RI) will be a drag on Q3 GDP. The "good" news is the overall drag from RI will be much smaller than during 2006, 2007 and 2008.

...

Spending on private construction was at a seasonally adjusted annual rate of $506.4 billion, 0.8 percent (±1.3%)* below the revised June estimate of $510.7 billion. Residential construction was at a seasonally adjusted annual rate of $240.3 billion in July, 2.6 percent (±1.3%) below the revised June estimate of $246.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $266.1 billion in July, 0.8 percent (±1.3%)* above the revised June estimate of $264.0billion.

ADP: Private Employment decreases 10,000 in August

by Calculated Risk on 9/01/2010 08:15:00 AM

ADP reports:

Private sector employment decreased by 10,000 from July to August on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from June to July was revised down slightly, from the previously reported increase of 42,000 to an increase of 37,000.Note: ADP is private nonfarm employment only (no government jobs).

The decline in private employment in August confirms a pause in the recovery already evident in other economic data.

...

Unlike the estimate of total establishment employment to be released on Friday by the Bureau of Labor Statistics (BLS), today’s figure does not include the effects of federal hiring — and now firing — for the 2010 Census.

The consensus was for ADP to show an increase of about 20,000 private sector jobs in August, so this was below consensus.

The BLS reports on Friday, and the consensus is for a decrease of 90,000 payroll jobs in August, on a seasonally adjusted (SA) basis, with the loss of around 116,000 temporary Census 2010 jobs (+26,000 ex-Census).