by Calculated Risk on 4/28/2010 08:49:00 AM

Wednesday, April 28, 2010

Yield on Greek two-year notes increases

From Bloomberg: Stocks Drop as Sovereign-Debt Crisis Spreads; Greek Bonds Slump

[Y]ields on Greek two-year notes jumped to a record 26 percent ... The yield soared almost 600 basis points at one stage today. Ireland’s jumped 90 basis points to 4.64 percent, Portugal’s increased 93 basis points to 6.24 percent and Spain’s rose 20 basis points to 2.26 percent.The IMF, ECB and German officials are meeting today. They have scheduled a press conference at 9 AM ET, to be followed by a press conference with German Chancellor Angela Merkel at 10:45 AM ET.

MBA: Mortgage Purchase Applications Increase

by Calculated Risk on 4/28/2010 08:19:00 AM

The MBA reports: Purchase Applications Increase, Refinance Applications Decline in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume decreased 2.9 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 8.8 percent from the previous week, while the seasonally adjusted Purchase Index increased 7.4 percent from one week earlier and reached its highest level since October 2009. The increase in the purchase index was driven largely by the government purchase index, which increased 11.9 percent ...

“Purchase activity continues to increase as we approach the end of the homebuyer tax credit program,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “Purchase applications were up almost 9 percent from a month ago, with a disproportionate share of the increase due to government purchase applications. Government applications for purchasing a home accounted for almost 49 percent of all purchase applications last week.”

The refinance share of mortgage activity decreased to 55.7 percent of total applications from 60.0 percent the previous week. The refinance share is at its lowest since August 2009 ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.08 percent from 5.04 percent, with points decreasing to 0.91 from 0.98 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

This is the highest level for the purchase index since last October.

Tuesday, April 27, 2010

CEO: Wal-Mart's Customers "still feel the pressure"

by Calculated Risk on 4/27/2010 11:55:00 PM

From Ylan Q. Mui and Neil Irwin at the WaPo: Consumer confidence is up, but test looms

"Some would say there is a recovery taking place," [Wal-Mart chief executive Mike Duke] said during a meeting with Washington Post editors and reporters. "The lower-income and middle-income customers . . . they still feel the pressure."Don't hold your breath on housing and housing related jobs.

In addition, he said that the weak housing market continued to hold back the recovery in states such as Florida and Nevada. During the boom years, many jobs in those states were fueled by a surge of construction that has since abated, drying up the demand for labor.

"It will take housing to create some of those jobs," Duke said.

And a summary paragraph in the article:

With federal stimulus spending beginning to taper off over the second half of the year, the fragile recovery in the housing markets showing signs of petering out and exports unlikely to create the same boost over the next nine months that they did over the past nine months, it will be up to American consumers to pick up the slack and drive a continued expansion.The stimulus spending peaks in Q2, and then starts to decline in Q3. And the housing market will continue to struggle with the huge overhang of existing inventory and distressed properties. Still I don't expect a 'double dip', but a slowdown in the 2nd half of the year seems likely.

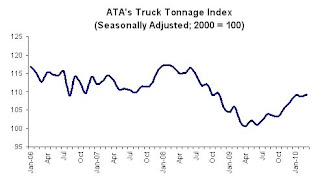

ATA Trucking Index increases in March

by Calculated Risk on 4/27/2010 07:09:00 PM

It was a busy day with the Goldman Sachs testimony, Greece and Portugal downgrades, and the "mixed" Case-Shiller House Prices for February. Here is something more upbeat ...

From the American Trucking Association: ATA Truck Tonnage Index Rose 0.4 Percent in March

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 0.4 percent in March, following a revised 0.3 percent decrease in February. The latest improvement put the SA index at 109.2 (2000=100), which is the highest level since November 2008. ...Trucking is a coincident indicator for the economy, and this suggests a solid March after the dip in February.

Compared with March 2009, SA tonnage jumped 7.5 percent, which was the fourth consecutive year-over-year gain and the largest increase since January 2005. ...

ATA Chief Economist Bob Costello said that he is getting more optimistic about the motor carrier industry’s recovery. “Freight is moving in the right direction and I continue to hear from motor carriers that both the demand and supply situations are steadily improving.” Costello attributed the first-quarter improvement in tonnage to the growing economy and to a slight inventory build after some sectors slashed inventories by too much in 2009. Costello added: “For most fleets, freight volumes feel better than reported tonnage because the supply situation, particularly in the truckload sector, is turning quickly.”

Market Update

by Calculated Risk on 4/27/2010 03:56:00 PM

Making the rounds, a little Goldman humor (ht Brian):

"You want the truth? You can't handle the truth. Son, we live in a country with an investment gap. And that gap needs to be filled by men with money. Who's gonna do it? You? You, Middle Class Consumer? Goldman Sachs has a greater responsibility than you can possibly fathom. You weep for Lehman and you curse derivatives. You have that luxury. You have the luxury of not knowing what we know: that Lehman's death, while tragic, probably saved the financial system. And that Goldman's existence, while grotesque and incomprehensible to you, saves pension funds. You don't want the truth. Because deep down, in places you don't talk about at parties, you want us to fill that investment gap. You need us to fill that gap. "We use words like credit default swaps, collateralized debt obligation, and securitization? We use these words as the backbone of a life spent investing in something. You use 'em as a punchline. We have neither the time nor the inclination to explain ourselves to a commoner who rises and sleeps under the blanket of the very credit we provide, and then questions the manner in which we provide it! We'd rather you just said thank you and paid your taxes on time. Otherwise, we suggest you get an account and start trading. Either way, we don't give a damn what you think you're entitled to!"credit: StatsGuy at Baseline Scenario.

The S&P was off 2.34% today - not much compared to the huge rally over the last year ...

From Doug Short: Bear Turns to Bull?

This graph from Doug is titled: "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.