by Calculated Risk on 4/24/2010 08:49:00 AM

Saturday, April 24, 2010

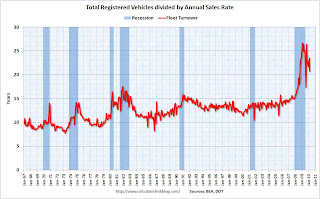

Vehicle Sales: Fleet Turnover Ratio

Way back, during the darkest days of the recession, I wrote a couple of optimistic posts about auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). By request, here is an update to the U.S. fleet turnover graph. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through March 2010 - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age or the composition of the fleet).

The recent wild gyrations were due to the cash-for-clunkers program. Note: We are getting used to wild gyrations in economic numbers - just watch the housing numbers over the next few months!

The estimated ratio for March was just under 21 years - still very high, but well below the peak of almost 27 years. The turnover ratio will probably decline further over the next few years.

As expected some vehicles were removed from the fleet during the recession (scrappage exceeded sales), from RL Polk: Polk Finds More Vehicles Scrapped than Added to Fleet:

More than 14.8 million cars and light trucks were retired from the fleet between July 1, 2008 and September 30, 2009, compared to new registrations of slightly more than 13.6 million, resulting in an overall scrap rate of 6.1 percent. This includes thousands of units scrapped during last year’s CARS program, known as ‘Cash for Clunkers,’ and follows a trend seen by Polk over the past five years.Removing vehicles from the fleet reduces the turnover ratio, but most of the expected decline in the ratio will come from further increases in sales.

Polk also reports an increase in the average age of light vehicles on the road, up 21 percent in the past 14 years. The average age for all light vehicles during the 15-month period is 10.2 years ...

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Light vehicle sales were at a 11.8 million SAAR in March. To bring the turnover ratio down to more normal levels, unit sales will probably have to rise to 14 or 15 million SAAR eventually. Of course cars are lasting longer - note the general uptrend in the first graph - so the turnover ratio probably will not decline to the previous level. Also this says nothing about the composition of the fleet (perhaps smaller cars).

Friday, April 23, 2010

Unofficial Problem Bank List April 23, 2010

by Calculated Risk on 4/23/2010 11:38:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 23, 2010.

Changes and comments from surferdude808:

Bank closings dictated many changes to the Unofficial Problem Bank List this week. The failures in Illinois -- Amcore Bank, National Association ($3.8 billion), Broadway Bank ($1.2 billion), New

Century Bank ($510 million), Wheatland Bank ($437 million), Lincoln Park Savings Bank ($205 million), Peotone Bank and Trust Company ($136 million), and Citizens Bank and Trust Company of Chicago ($77 million) -- removed seven banks and $6.3 billion of assets.

Another removal this week was Paragon Bank & Trust ($107 million), a subsidiary of Capitol Bancorp (Ticker: CBC), which merged with its affiliate Michigan Commerce Bank that is also subject to a formal action. There were four additions this week including Sun National Bank, Vineland, NJ ($3.6 billion Ticker: SNBC); Great Florida Bank, Coral Gables, FL ($1.8 billion Ticker: GFLB); Central Virginia Bank, Powhatan, VA ($472 million Ticker: CVBK); and The Bank of Currituck, Moyock, NC ($197 million).

The net of these changes result in the Unofficial Problem Bank List having 694 institutions with aggregate assets of $366.1 billion. Other changes include the termination of the Prompt Corrective Action against Heritage Bank, Topeka, KS, and a name change for AmericasBank to CFG Community Bank. Next week, we look for the FDIC to release its new actions for March 2010.

Bank Failures #55 - 57: More Illinois

by Calculated Risk on 4/23/2010 08:12:00 PM

Good banks are few, far between

Even less so now

by Soylent Green is People

From the FDIC: Northbrook Bank and Trust Company, Northbrook, Illinois, Assumes All of the Deposits of Lincoln Park Savings Bank, Chicago, Illinois

As of December 31, 2009, Lincoln Park Savings Bank had approximately $199.9 million in total assets and $171.5 million in total deposits....From the FDIC: First Midwest Bank, Itasca, Illinois, Assumes All of the Deposits of Peotone Bank and Trust Company, Peotone, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $48.4 million.... Lincoln Park Savings Bank is the 55th FDIC-insured institution to fail in the nation this year, and the eighth in Illinois. The last FDIC-insured institution closed in the state was New Century Bank, Chicago, earlier today.

As of December 31, 2009, Peotone Bank and Trust Company had approximately $130.2 million in total assets and $127.0 million in total deposits. ...From the FDIC: Wheaton Bank & Trust, Wheaton, Illinois, Assumes All of the Deposits of Wheatland Bank, Naperville, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.7 million. ... Peotone Bank and Trust Company is the 56th FDIC-insured institution to fail in the nation this year, and the ninth in Illinois. The last FDIC-insured institution closed in the state was Lincoln Park Savings Bank, Chicago, earlier today.

As of December 31, 2009, Wheatland Bank had approximately $437.2 million in total assets and $438.5 million in total deposits. ...Seven in Illinois today ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $133.0 million. ... Wheatland Bank is the 57th FDIC-insured institution to fail in the nation this year, and the tenth in Illinois. The last FDIC-insured institution closed in the state was Peotone Bank and Trust Company, Peotone, earlier today.

Bank Failures #51 -54: Illinois

by Calculated Risk on 4/23/2010 07:13:00 PM

Feds round up gangster-banksters

So much deja-vu

by Soylent Green is People

From the FDIC: Harris National Association, Chicago, Illinois, Assumes All Of The Deposits Of Amcore Bank, National Association, Rockford, Illinois

As of December 31, 2009, Amcore Bank, National Association had approximately $3.8 billion in total assets and $3.4 billion in total deposits....From the FDIC: MB Financial Bank, National Association, Chicago, Illinois, Assumes All Of The Deposits Of Broadway Bank, Chicago, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $220.3 million. .... Amcore Bank, National Association is the 51st FDIC-insured institution to fail in the nation this year, and the fourth in Illinois. The last FDIC-insured institution closed in the state was Bank of Illinois, Normal, on March 3, 2010.

As of December 31, 2009, Broadway Bank had approximately $1.2 billion in total assets and $1.1 billion in total deposits. ...From the FDIC: Republic Bank Of Chicago, Oak Brook, Illinois, Assumes All Of The Deposits Of Citizens Bank&Trust Company Of Chicago, Chicago, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $394.3 million. ... Broadway Bank is the 52nd FDIC-insured institution to fail in the nation this year, and the fifth in Illinois. The last FDIC-insured institution closed in the state was Amcore Bank, National Association, Rockford, earlier today.

As of December 31, 2009, Citizens Bank&Trust Company of Chicago had approximately $77.3 million in total assets and $74.5 million in total deposits....From the FDIC: MB Financial Bank, National Association, Chicago, Illinois, Assumes All Of The Deposits Of New Century Bank, Chicago, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.9 million. ... Citizens Bank&Trust Company of Chicago is the 53rd FDIC-insured institution to fail in the nation this year, and the sixth in Illinois. The last FDIC-insured institution closed in the state was Broadway Bank, Chicago, earlier today.

As of December 31, 2009, New Century Bank had approximately $485.6 million in total assets and $492.0 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $125.3 million..... New Century Bank is the 54th FDIC-insured institution to fail in the nation this year, and the seventh in Illinois. The last FDIC-insured institution closed in the state was Citizens Bank&Trust Company of Chicago, Chicago, earlier today.

Rating Agency Testimony: "Must say yes" to Wall Street

by Calculated Risk on 4/23/2010 03:34:00 PM

From Kevin Hall at McClatchy Newspapers: Executives testify: Bond-rating agencies corrupted themselves

Testifying under oath before the Senate Permanent Subcommittee on Investigations, officials who were closely involved in giving investment-grade ratings to complex financial instruments backed by shaky U.S. mortgages described how they were pressured to give Wall Street what it wanted.The testimony is pretty amazing, but how is this being fixed?

...

Called to appear before the panel, Richard Michalek, a former Moody's vice president and senior credit officer, described the ratings process for deals that could bring more than $1 million in fees as a "must say yes" atmosphere.