by Calculated Risk on 4/22/2010 04:45:00 PM

Thursday, April 22, 2010

S&P Concerned about Seasonal Adjustment for House Prices

From S&P: S&P Issues Statement, Publishes Research on Seasonally-Adjusted Home Price Index Data(PDF)

Economic data which are affected by the time of the year, or the seasons, are often adjusted to remove these effects to make it easier to identify underlying changes in the economy. Seasonal adjustment increases the unadjusted values in weak months and decreases the unadjusted values in strong months to eliminate regular seasonal patterns while leaving the underlying trend unaffected. For the S&P/Case-Shiller Home Price Indices, S&P reports two data sets – before seasonal adjustment and seasonally-adjusted. In some recent reports the two series have given conflicting signals, with the seasonally-adjusted series rising month-over-month and the unadjusted series declining. After reviewing the data, the S&P/Case-Shiller Home Price Index Committee believes that, for the present, the unadjusted series is a more reliable indicator and, thus, reports should focus on the year-over-year changes where seasonal shifts are not a factor. Additionally, if monthly changes are considered, the unadjusted series should be used.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The Census X-12 program breaks down the unadjusted S&P/Case-Shiller Home Price index series into three components: trend, seasonal, and irregular. “Trend” represents the underlying trend in the data, “irregular” consists of changes with no apparent or regular pattern, and “seasonal” are the seasonal factors. Chart 2 shows the three series for the S&P/Case-Shiller Home Price 20-City Composite. The seasonal component shows the same regular pattern as on the first chart, and the trend shows the peak and subsequent drop in home prices. Beginning in January 2008, the irregular component became steadily larger. The increase in the size of the irregular component appears to be the cause of the increase in the seasonal factors ...Diana Olick mentioned this today: Even Good Housing Numbers Aren't Adding Up Right and the S&P note credits a recent note by David Rosenberg, chief economist at Gluskin Sheff. I first raised this issue in July 2009. The irregular components are just too large - and are apparently leading to a huge increase in the seasonal factors.

FHFA House Price Index Declines in February

by Calculated Risk on 4/22/2010 03:57:00 PM

The two house price indexes I usually use are from S&P Case-Shiller and First American Corelogic LoanPerformance (the one the Fed uses). The FHFA index is also a repeat sales index, but only includes GSE loans - and it has other issues too.

The LoanPerformance and Case-Shiller indexes for February will be released soon, but here is the FHFA index (and a graph of all three).

From Federal Housing Finance Agency (FHFA): U.S. Monthly House Price Index Declines 0.2 Percent from January to February

U.S. house prices fell 0.2 percent on a seasonally adjusted basis from January to February, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.6 percent decline in January was unchanged. For the 12 months ending in February, U.S. prices fell 3.4 percent. The U.S. index is 13.3 percent below its April 2007 peak.

The FHFA monthly index is calculated using purchase prices of houses backing mortgages that have been sold to or guaranteed by Fannie Mae or Freddie Mac.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the three indexes (note that LoanPeformance is NSA, Case-Shiller and FHFA are seasonally adjusted). FHFA is set to 100 in Jan 2000. The insert shows the movement of the three indexes since Jan 2008.

The FHFA index didn't match what we were seeing during the housing bubble, and I just wanted to point out why I focus on the other indexes now.

Hotel Occupancy increases 5.5% compared to same week in 2009

by Calculated Risk on 4/22/2010 01:15:00 PM

From HotelNewsNow.com: STR: Upper-upscale tops weekly numbers

Overall the U.S. industry’s occupancy increased 5.5 percent to 60.4 percent, ADR was up 1.4 percent to US$98.67, and RevPAR was up 7.0 percent to US$59.62.The following graph shows the occupancy rate for 2009 (the worst year since the Depression for hotel occupancy), 2010 and the median for 2000 through 2007.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero, and holidays don't always line up.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

The occupancy rate in 2010 has been ahead of 2009 for 8 of the last 9 weeks, and Average Daily Rate (ADR) is also up slightly. This is a little bit of good news for hotels, although the occupancy rate is still well below the normal level.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

More on Existing Home Sales and Inventory

by Calculated Risk on 4/22/2010 11:19:00 AM

Earlier the NAR released the existing home sales data for March; here are a couple more graphs ...

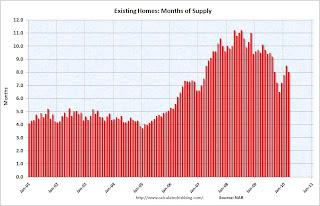

The first graph shows the year-over-year change in reported existing home inventory and months-of-supply. Click on graph for larger image in new window.

Click on graph for larger image in new window.

There was a rapid increase in inventory in the 2nd half of 2005 (that helped me call the peak of the bubble). Then the increase in inventory steadily slowed.

The YoY inventory has been decreasing for the last 20 months. However the YoY decline is getting smaller - only 1.8% in March.

This slow decline in the inventory is especially concerning with the large reported inventory and 8.0 months of supply in March - well above normal. Of course months of supply will decline over the next few months because of the increase in sales due to the tax credit, but this will be something to watch this summer and later this year. The second graph shows NSA monthly existing home sales for 2005 through 2010 (see Red columns for 2010).

The second graph shows NSA monthly existing home sales for 2005 through 2010 (see Red columns for 2010).

Sales (NSA) in March 2010 were 19.6% higher than in March 2009, and also higher than in March 2008.

We will probably see an increase in sales in May and June - perhaps to the levels of 2006 or 2007 - because of the tax credit, however I expect to see existing home sales below last year in the 2nd half of this year.

Existing Home Sales increase in March

by Calculated Risk on 4/22/2010 10:00:00 AM

The NAR reports: Existing-Home Sales Rise

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 6.8 percent to a seasonally adjusted annual rate of 5.35 million units in March from 5.01 million in February, and are 16.1 percent above the 4.61 million-unit level in March 2009.

...

Total housing inventory at the end of March rose 1.5 percent to 3.58 million existing homes available for sale, which represents an 8.0-month supply at the current sales pace, down from an 8.5-month supply in February.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2010 (5.35 million SAAR) were 6.8% higher than last month, and were 16.1% higher than March 2009 (4.61 million SAAR).

Sales surged last November when many first-time homebuyers rushed to beat the initial expiration of the tax credit. There will probably be another increase in May and June this year, although that will be probably be smaller than the November increase. Note: existing home sales are counted at closing, so even though contracts must be signed in April to qualify for the tax credit, buyers have until June 30th to close.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.58 million in March from 3.53 million in February. The all time record high was 4.57 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern - inventory should increase further in the spring. This was the 20th consecutive month of reported year-over-year decline in inventory, but the decline was only 1.8% from March 2009.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 8.0 months in March.

A normal market has under 6 months of supply, so this is high - and probably excludes some substantial shadow inventory.

I'll have more later ...