by Calculated Risk on 4/12/2010 11:59:00 AM

Monday, April 12, 2010

Recession Measures

Calling the beginning or end of a recession takes time. The National Bureau of Economic Research (NBER) waits until the data is revised, and if the recovery is sluggish, this process can take from 18 months to two years or longer.

In addition, if the economy slides into recession again, the committee will only consider it a new recession if most major indicators were close to or above their previous highs. Otherwise it will just be considered a continuation of the previous recession.

A good example of the NBER calling two separate recessions was in the early '80s, from the NBER memo:

"The period following July 1980 will appear in the NBER chronology as an expansion. An important factor influencing that decision is that most major indicators, including real GNP, are already close to or above their previous highs."It will take some time for most major indicators to be above their previous high after the "great recession" because of the severe contraction as the graphs below show.

emphasis added

GDP is the key measure, as the NBER committee notes in their business cycle dating procedure:

The committee views real GDP as the single best measure of aggregate economic activity.This is actually two measures: 1) real GDP, and 2) real Gross Domestic Income (GDI). For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. These differences have become particularly glaring over the latest cyclical downturn, which appears considerably worse along several dimensions when looking at GDI. ...The NBER uses both real GDP and real GDI.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%. On all graphs the recent recession is marked as ending in July 2009 or Q3 2009 - this is preliminary and NOT an NBER determination. GDP is quarterly, the other data is monthly.

The first graph is for GDP and GDI:

Click on graph for larger image in new window.

Click on graph for larger image in new window.It appears that GDP bottomed in Q2 2009 and GDI in Q3 2009. This is the key measure, and the NBER will probably use GDP and GDI to determine the trough of the recession. Real GDP is only 2.0% below the pre-recession peak - and real GDP 2.7% below the previous peak - so both could be at new highs later this year or early in 2011, even with a sluggish recovery.

The second graph is for monthly industrial production based on data from the Federal Reserve.

The second graph is for monthly industrial production based on data from the Federal Reserve.Industrial production bottomed in June 2009. The NBER will consider this measure when trying to identify the month the recession ended. Note that industrial production is still substantially below the pre-recession levels - so it might be some time before this measure is at or above earlier levels.

Now for some less optimistic measures the NBER uses ...

The third graph is for employment. It appears the employment recession might have bottomed in February, but it will take a long time before this measure is at pre-recession levels.

The third graph is for employment. It appears the employment recession might have bottomed in February, but it will take a long time before this measure is at pre-recession levels. Historically employment was a coincident indicator for the end of recessions, but that hasn't been true for the previous two recessions (1990-1991 and 2001) and also will not be true for the "great recession" if the NBER determines an end date in July 2009.

If the NBER waits for employment to return to pre-recession levels, we might be waiting for an annoucement for a long time.

And the last graph is for real personal income excluding transfer payments. This bottomed in Sept 2009, but has moved sideways since then. This shows the effect of the stimulus programs that boosted GDP and income - but not income less transfer payments.

And the last graph is for real personal income excluding transfer payments. This bottomed in Sept 2009, but has moved sideways since then. This shows the effect of the stimulus programs that boosted GDP and income - but not income less transfer payments.This will be a key measure of a sustainable recovery, and once again it will take a long time to return to pre-recession levels.

These graphs are useful in trying to identify peaks and troughs in economic activity. My guess is the economy bottomed by most measure in Q3 2009 (probably July), but I don't expect an announcement from the NBER until the end of 2010 at the earliest - and perhaps well into 2011 or beyond.

NBER: "Premature" to Call end of Recession

by Calculated Risk on 4/12/2010 08:59:00 AM

Business Cycle Dating Committee statement:

The Business Cycle Dating Committee of the National Bureau of Economic Research met at the organization’s headquarters in Cambridge, Massachusetts, on April 8, 2010. The committee reviewed the most recent data for all indicators relevant to the determination of a possible date of the trough in economic activity marking the end of the recession that began in December 2007. The trough date would identify the end of contraction and the beginning of expansion. Although most indicators have turned up, the committee decided that the determination of the trough date on the basis of current data would be premature. Many indicators are quite preliminary at this time and will be revised in coming months. The committee acts only on the basis of actual indicators and does not rely on forecasts in making its determination of the dates of peaks and troughs in economic activity. The committee did review data relating to the date of the peak, previously determined to have occurred in December 2007, marking the onset of the recent recession. The committee reaffirmed that peak date.NBER always waits some time before declaring a recession over.

| Click on cartoon for larger image in new window. Repeat of cartoon from Eric G. Lewis |

The previous NBER announcements make it clear that NBER will not date the trough of the recession until certain economic indicators - like real GDP - are above the pre-recession levels. Any downturn before economic activity reaches pre-recession levels will probably be considered a continuation of the recession that started in December 2007.

Here is the NBER dating procedure.

Sunday, April 11, 2010

Report: Regulators failed to properly supervise WaMu

by Calculated Risk on 4/11/2010 11:49:00 PM

From Sewell Chan at the NY Times: U.S. Faults Regulators Over a Bank

Regulators failed for years to properly supervise the giant savings and loan Washington Mutual, even as the company wobbled ... a federal investigation has concluded.The FDIC rating system is called CAMELS and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest. Banks with ratings of 4 or 5 are included on the FDIC's official problem bank list (ratings are not made public). So WaMu wasn't considered a "problem bank" until days before it collapsed.

...

The report, prepared by the inspectors general for the Treasury Department and the Federal Deposit Insurance Corporation, is expected to be released Friday. A draft was obtained by The New York Times.

... WaMu was the largest institution regulated by the Office of Thrift Supervision ... Although regulators found problems ... the office consistently deemed WaMu “fundamentally sound,” giving it a rating of 2, the second-highest on a five-point scale ... The office did not lower the rating to 3 ... until February 2008, and to 4 ... until September 2008, days before WaMu collapsed. “It is difficult to understand how O.T.S. continued to assign WaMu a composite 2 rating year after year,” the report found.

The report will apparently be released on Friday. Earlier reports for other bank failures showed that the field examiners identified the problems early - and then for some unexplained reason, no action was taken. The regulatory system failed.

Misc: Greece and Roubini/Richardson Proposal

by Calculated Risk on 4/11/2010 05:49:00 PM

Note: The previous post is the weekly summary and a look ahead to a pretty busy week. Best wishes to all!

For those who missed the news, from the NY Times: Euro-Zone Nations Offer $40 Billion to Greece

A financial rescue of the debt-laden Greek economy moved into focus Sunday when the 16 nations that use the euro offered to lend Athens up to $40 billion, or €30 billion, at rates far below what the debt-laden country is paying now.And a proposal from Matthew Richardson and Nouriel Roubini in the WaPo: How to reduce risk on Wall Street? Make the banks pay.

...

Greece has so far not formally requested aid from the European Union ... The I.M.F. will also make financing available to Greece, though the amount was yet to be determined. Olli Rehn, the European Union’s monetary affairs commissioner, suggested that euro-zone nations might end up providing two-thirds of the final package, with one-third coming from the I.M.F.

To create a truly safe financial system, we have to focus on two goals. First, we have to drive a stake through the heart of the "too big to fail" mantra that only fattens our financial beasts. Second, we should stop focusing on the problems of individual banks and look at the broader risk that the largest and most complex financial institutions pose.I'm sure we will hear many more ideas this week at the Hyman P. Minsky Conference. The topic is After the Crisis: Planning a New Financial Structure.

We can accomplish both goals by charging such institutions an annual fee, or tax, or surcharge, or levy, or whatever the politicians need to call it.

Weekly Summary and a Look Ahead

by Calculated Risk on 4/11/2010 01:01:00 PM

There will be two key housing reports released this week: Housing Starts to be released on Friday, and the NAHB homebuilder index on Thursday. Most of the focus will be on March retail sales to be released on Wednesday.

The 19th Annual Hyman P. Minsky Conference will be held in New York this week. The topic is After the Crisis: Planning a New Financial Structure. Several Fed Presidents will be speaking; other speakers include Paul Krugman, Jan Hatzius, and Paul Volcker.

Early in the week, the March National Federation of Independent Business (NFIB) small business survey will be released and also the March rail traffic report from the Association of American Railroads (AAR). Other reports that will probably be released this week include the HAMP March report, the LoanPerformance house price index (for February) and LA port traffic for March.

On Tuesday the February Trade Balance report will be released at 8:30 AM by the Census Bureau. The consensus is for a further increase in the U.S. trade deficit to around $39 billion (from $37.3 billion).

On Wednesday March retail sales will be released at 8:30 AM. The consensus is for an increase of 1.2% from the February rate. The consumer price index (CPI) will also be released on Wednesday (the consensus is for a 0.1% increase in prices), and business inventories will be released at 10 AM. Also on Wednesday the Fed Beige Book will be released at 2 PM. The New York Fed’s Brian Sack will be speaking at 7 PM on the financial crisis.

On Thursday the closely watched initial weekly unemployment claims will be released. The consensus is for a decline to 440K this week from the Easter related increase to 460K last week The Fed will release the Industrial Production and Capacity Utilization report at 9:15 AM. Expectations are for a 0.8% increase in production and an increase in utilization to 73.3% from 72.7%.

The NAHB homebuilder survey for April will be released at 1 PM. This has been mostly moving sideways for months but might show some increase since this is the final month to sign a contract to qualify for the homebuyer tax credit. Also on Thursday, the Empire State manufacturing survey and the Philly Fed survey will both be released.

And on Friday, Housing Starts for March will be released at 8:30 AM. The consensus is for a slight increase to 605K (SAAR) in March from 575K in February. The Reuters/University of Michigan April consumer sentiment survey will be released at 9:55 AM. In addition, the BLS will release the Regional and State Employment and Unemployment report for March at 10 AM.

Also on Friday the FDIC might close several more banks ...

And a summary of last week:

1) Offices: From the Financial Times: Signs that worst is over for commercial property

New figures from Reis ... showed that the vacancy rate in the US office sector climbed to 17.2 per cent during the first three months of the year..2) Apartments: From Nick Timiraos at the WSJ: Apartment Rents Rise as Sector Stabilizes

...

"We expect less of a bloodbath in fundamentals in 2010 versus 2009, but rents will still decline and vacancies will still continue to rise," said Victor Calanog, director of research at Reis. ... During the first quarter, asking rents and effective rents, which include special offers and concessions, both fell by just 0.8 per cent.

excerpts with permission

Nationally, the apartment vacancy rate stayed flat at 8%, the highest level since Reis Inc., a New York research firm, began its tally in 1980...3) Malls: From the WSJ: Shopping-Center Malaise

Vacancies at shopping centers in the top 77 U.S. markets increased to 10.8% in the first quarter ... according to Reis.

It is the highest vacancy rate since 1991, when vacancies reached 11%.

First American Corelogic released their first distressed sales report this morning: Distressed Sales Again on the Rise, Reaching 29% in January

Click on graph for larger image in new window.

Click on graph for larger image in new window.Credit: First American Corelogic.

This graph shows the total percent of distressed sales broken down by REO and Short Sales. Notice that the percent short sales has increased significantly over the last year - that trend will probably continue.

NOTE: This was before the bailout was announced this weekend.

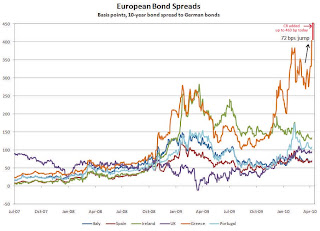

Here is a graph from the Atlanta Fed weekly Financial Highlights:

From the Atlanta Fed:

From the Atlanta Fed: European bond spreads (over German bonds) reflectAccording to The Times: Greece on the brink as bond rates surge to record highs the Greek Bond spread increased to an all time record 463 bps today (shown on graph in red).

investors’ worries about Greece’s sovereign credit risk.

On April 6, the spread of the 10-year Greek bond over its German counterpart widened by 72bps to 404.5 bps, the widest since 1998, according to the Wall Street Journal.

From the BLS: Job Openings and Labor Turnover Summary

There were 2.7 million job openings on the last business day of February 2010, the U.S. Bureau of Labor Statistics reported today. The job openings rate was little changed over the month at 2.1 percent. The hires rate (3.1 percent) and the separations rate (3.1 percent) were also little changed in February.

This graph shows job openings (purple), hires (blue), Total separations (include layoffs, discharges and quits) (red) and Layoff, Discharges and other (yellow) from the JOLTS.

This graph shows job openings (purple), hires (blue), Total separations (include layoffs, discharges and quits) (red) and Layoff, Discharges and other (yellow) from the JOLTS.According to the JOLTS report, there were 3.961 million hires in February (SA), and 3.957 million total separations, or 4 thousand net jobs gained. The comparable CES report showed a loss of 14 thousand jobs in February (after revision).

Layoffs and discharges have declined sharply from early 2009 - however, hiring has not picked up.

Best wishes to all.