by Calculated Risk on 4/11/2010 01:01:00 PM

Sunday, April 11, 2010

Weekly Summary and a Look Ahead

There will be two key housing reports released this week: Housing Starts to be released on Friday, and the NAHB homebuilder index on Thursday. Most of the focus will be on March retail sales to be released on Wednesday.

The 19th Annual Hyman P. Minsky Conference will be held in New York this week. The topic is After the Crisis: Planning a New Financial Structure. Several Fed Presidents will be speaking; other speakers include Paul Krugman, Jan Hatzius, and Paul Volcker.

Early in the week, the March National Federation of Independent Business (NFIB) small business survey will be released and also the March rail traffic report from the Association of American Railroads (AAR). Other reports that will probably be released this week include the HAMP March report, the LoanPerformance house price index (for February) and LA port traffic for March.

On Tuesday the February Trade Balance report will be released at 8:30 AM by the Census Bureau. The consensus is for a further increase in the U.S. trade deficit to around $39 billion (from $37.3 billion).

On Wednesday March retail sales will be released at 8:30 AM. The consensus is for an increase of 1.2% from the February rate. The consumer price index (CPI) will also be released on Wednesday (the consensus is for a 0.1% increase in prices), and business inventories will be released at 10 AM. Also on Wednesday the Fed Beige Book will be released at 2 PM. The New York Fed’s Brian Sack will be speaking at 7 PM on the financial crisis.

On Thursday the closely watched initial weekly unemployment claims will be released. The consensus is for a decline to 440K this week from the Easter related increase to 460K last week The Fed will release the Industrial Production and Capacity Utilization report at 9:15 AM. Expectations are for a 0.8% increase in production and an increase in utilization to 73.3% from 72.7%.

The NAHB homebuilder survey for April will be released at 1 PM. This has been mostly moving sideways for months but might show some increase since this is the final month to sign a contract to qualify for the homebuyer tax credit. Also on Thursday, the Empire State manufacturing survey and the Philly Fed survey will both be released.

And on Friday, Housing Starts for March will be released at 8:30 AM. The consensus is for a slight increase to 605K (SAAR) in March from 575K in February. The Reuters/University of Michigan April consumer sentiment survey will be released at 9:55 AM. In addition, the BLS will release the Regional and State Employment and Unemployment report for March at 10 AM.

Also on Friday the FDIC might close several more banks ...

And a summary of last week:

1) Offices: From the Financial Times: Signs that worst is over for commercial property

New figures from Reis ... showed that the vacancy rate in the US office sector climbed to 17.2 per cent during the first three months of the year..2) Apartments: From Nick Timiraos at the WSJ: Apartment Rents Rise as Sector Stabilizes

...

"We expect less of a bloodbath in fundamentals in 2010 versus 2009, but rents will still decline and vacancies will still continue to rise," said Victor Calanog, director of research at Reis. ... During the first quarter, asking rents and effective rents, which include special offers and concessions, both fell by just 0.8 per cent.

excerpts with permission

Nationally, the apartment vacancy rate stayed flat at 8%, the highest level since Reis Inc., a New York research firm, began its tally in 1980...3) Malls: From the WSJ: Shopping-Center Malaise

Vacancies at shopping centers in the top 77 U.S. markets increased to 10.8% in the first quarter ... according to Reis.

It is the highest vacancy rate since 1991, when vacancies reached 11%.

First American Corelogic released their first distressed sales report this morning: Distressed Sales Again on the Rise, Reaching 29% in January

Click on graph for larger image in new window.

Click on graph for larger image in new window.Credit: First American Corelogic.

This graph shows the total percent of distressed sales broken down by REO and Short Sales. Notice that the percent short sales has increased significantly over the last year - that trend will probably continue.

NOTE: This was before the bailout was announced this weekend.

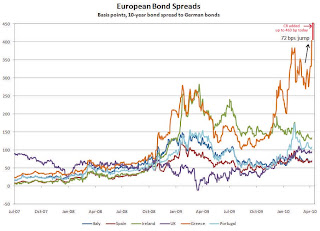

Here is a graph from the Atlanta Fed weekly Financial Highlights:

From the Atlanta Fed:

From the Atlanta Fed: European bond spreads (over German bonds) reflectAccording to The Times: Greece on the brink as bond rates surge to record highs the Greek Bond spread increased to an all time record 463 bps today (shown on graph in red).

investors’ worries about Greece’s sovereign credit risk.

On April 6, the spread of the 10-year Greek bond over its German counterpart widened by 72bps to 404.5 bps, the widest since 1998, according to the Wall Street Journal.

From the BLS: Job Openings and Labor Turnover Summary

There were 2.7 million job openings on the last business day of February 2010, the U.S. Bureau of Labor Statistics reported today. The job openings rate was little changed over the month at 2.1 percent. The hires rate (3.1 percent) and the separations rate (3.1 percent) were also little changed in February.

This graph shows job openings (purple), hires (blue), Total separations (include layoffs, discharges and quits) (red) and Layoff, Discharges and other (yellow) from the JOLTS.

This graph shows job openings (purple), hires (blue), Total separations (include layoffs, discharges and quits) (red) and Layoff, Discharges and other (yellow) from the JOLTS.According to the JOLTS report, there were 3.961 million hires in February (SA), and 3.957 million total separations, or 4 thousand net jobs gained. The comparable CES report showed a loss of 14 thousand jobs in February (after revision).

Layoffs and discharges have declined sharply from early 2009 - however, hiring has not picked up.

Best wishes to all.