by Calculated Risk on 3/29/2010 08:30:00 AM

Monday, March 29, 2010

February Personal Income Flat, Spending Increases

From the BEA: Personal Income and Outlays, January 2010

Personal income increased $1.2 billion, or less than 0.1 percent ... Personal consumption expenditures (PCE) increased $34.7 billion, or 0.3 percent.Stagnant income and increased spending means the saving rate declined again ...

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in February, compared with an increase of 0.2 percent in January.

...

Personal saving -- DPI less personal outlays -- was $340.0 billion in February, compared with $374.9 billion in January. Personal saving as a percentage of disposable personal income was 3.1 percent in February, compared with 3.4 percent in January.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the February Personal Income report. The saving rate fell to 3.1% in February.

I still expect the saving rate to rise over the next couple of years - possibly to 8% or more - slowing the growth in PCE.

The following graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The increase in PCE in February was fairly strong (a 3.0% annual rate over the last three months). Using the Two Month average method, this suggests PCE growth in Q1 2010 will be around 3.0%. That will be the highest growth rate since Q1 2007, however this is being driven by less saving and transfer payments - not growth in income.

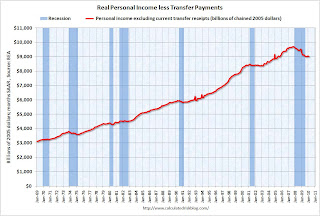

The National Bureau of Economic Research (NBER) uses several measures to determine if the economy is in recession. One of the measures is real personal income less transfer payments (see NBER memo). This declined in February to $9,006.4 billion (SAAR) from $9,020.2 billion in January, and is barely above the low of September 2009 ($9,000 billion).

This graph shows real personal income less transfer payments since 1969.

This graph shows real personal income less transfer payments since 1969.This measure of economic activity is moving sideways - similar to what happened following the 2001 recession.

To sum it up:

This is a decent report for PCE, but PCE growth is not sustainable without income growth.

Sunday, March 28, 2010

Edmunds.com: Vehicle Sales driven by Incentives in March

by Calculated Risk on 3/28/2010 08:24:00 PM

In the earlier Weekly Summary and a Look Ahead post, I forgot to mention that U.S. vehicle sales will be released on Thursday.

From Edmunds.com:

Edmunds.com analysts predict that March's Seasonally Adjusted Annualized Rate (SAAR) will be 12.4 million, up from 10.3 million in February 2010.

“Although this SAAR sounds promising, it’s too early to wave the flag and say that the economy has turned the corner,” Edmunds.com CEO Jeremy Anwyl told AutoObserver.com. “Incentives drove sales this month, but those were defensive moves in response to Toyota stepping up incentives and are unlikely to last because inventories are simply not high enough to justify them in the long term.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and a forecast for March from Edmunds.com.

Excluding the cash-for-clunkers month of August 2009, Edmunds is forecasting the highest sales rate since Sept 2008.

As Edmunds notes, the expected jump in March sales was driven by Toyota's incentive program to regain market share - and the response of the other manufacturers. As always I'll be posting the sales reports and an estimate of the SAAR around 4 PM ET on Thursday.

Weekly Summary and a Look Ahead

by Calculated Risk on 3/28/2010 12:30:00 PM

The employment report for March will be the focus this week, but there are several other key releases too.

On Monday, the Personal Income and Outlays report for February will be released by the BEA at 8:30 AM. The consensus is for a 0.1% increase in income and 0.3% increase in spending. This will provide a reasonable estimate of Q1 Personal Consumption Expenditure (PCE) growth.

On Tuesday, the January Case-Shiller house Price Index will be released at 9:00 AM. The consensus is for a small decline in prices (not seasonally adjusted). Consumer confidence will be released at 10 AM and former Fed Chairman Paul Volcker will be speaking on financial reform at noon.

On Wednesday, the ADP March employment report will be released (consensus is for 40,000 net private sector payroll jobs in March). This report excludes all government jobs and is not distorted by the temporary Census hiring. At 9:45 AM the Chicago PMI index for March will be released (consensus is for expansion, but at a slower rate than in February). At 10 AM, the Census Bureau will release the February Factory Orders report.

Also on Wednesday, Atlanta Fed President Dennis Lockhart will speak about employment.

On Thursday, the closely watched initial weekly unemployment claims will be released. Also the ISM Manufacturing Index for March at 10 AM (Consensus is for slightly less expansion in March), and Census Bureau will release February Construction Spending at 10 AM (consensus is for a decline of about 1.1%).

Also on Thursday, personal bankrutpcy filings for March will be released. Update: Also on Thursday, the auto manufacturers will releases March sales. The expectation is for a sharp rise to over 12 million units (SAAR) because of incentives.

And on Friday, the BLS will release the March employment report. The consensus is for 190,000 net payroll jobs, however this is distorted by both the February snow storms and temporary Census hiring (see Employment: March Madness). The consensus is for no change in the unemployment rate (9.7%), but historically the Census hiring has pushed down the unemployment rate in the March to May period – so we might see a slight decline. Goldman Sachs is estimate net payrolls increased 275,000 in March.

Also on Friday the FDIC will probably close several more banks. Once again I’ll be watching Puerto Rico!

And a summary of last week ...

A few stories:HAMP Principal Write-downs More on HAMP "Improvements" From David Streitfeld at the NY Times: A Bold U.S. Plan to Help Struggling Homeowners From Renae Merle at the WaPo: Second mortgages complicate efforts to help homeowners

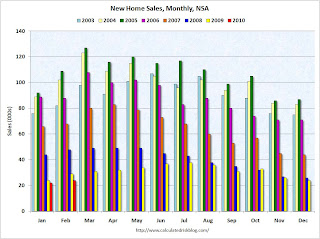

The Census Bureau reported New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 308 thousand. This is a new record low and a decrease from the revised rate of 315 thousand in January (revised from 309 thousand).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2010. In February 2010, 24 thousand new homes were sold (NSA).

This is below the previous record low of 29 thousand hit three times; in February 2009, 1982 and 1970.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009. Sales of new single-family houses in February 2010 were at a seasonally adjusted annual rate of 308,000, according to estimates released jointly today ... This is 2.2 percent (±15.3%)* below the revised January rate of 315,000 and is 13.0 percent (±12.2%) below the February 2009 estimate of 354,000.Obviously this was another extremely weak report.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2010 (5.02 million SAAR) were 0.6% lower than last month, and were 7.0% higher than February 2009 (4.69 million SAAR).

Note: existing home sales are counted at closing, so even though contracts must be signed in April to qualify for the tax credit, buyers have until June 30th to close.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.59 million in February from 3.27 million in January. The all time record high was 4.57 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern - inventory should increase further in the spring.

Note: This index is a leading indicator for Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.Historically, according to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through all of 2010, and probably longer.

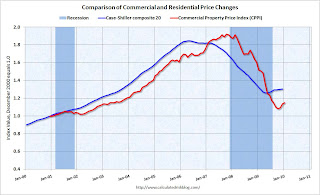

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and are now 40% below the peak in October 2007. Prices are at about the same level as early 2003.

Last week the Department of Transportation (DOT) reported that vehicle miles driven in January were down from January 2009:

Travel on all roads and streets changed by -1.6% (-3.7 billion vehicle miles) for January 2010 as compared with January 2009. Travel for the month is estimated to be 222.8 billion vehicle miles.

This graph shows the percent change from the same month of the previous year as reported by the DOT.

This graph shows the percent change from the same month of the previous year as reported by the DOT. As the DOT noted, miles driven in January 2010 were down -1.6% compared to January 2009, and miles driven have declined 2.9% compared to January 2008, and are down 4.7% compared to January 2007. This is a multi-year decline, and miles driven appear to be falling again.

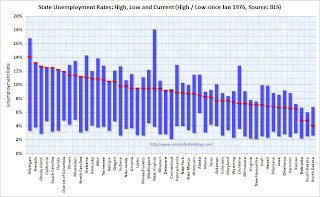

From the BLS: Regional and State Employment and Unemployment Summary

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).Fifteen states and D.C. now have double digit unemployment rates. New Jersey and Indiana are close.

Four states and set new series record highs: Florida, Nevada, Georgia and North Carolina. Three other states tied series record highs: California, Rhode Island and South Carolina.

Best wishes to all.

Aargh! Beware of reporting on the March Employment Report

by Calculated Risk on 3/28/2010 09:20:00 AM

I read this from Bloomberg this morning: Payrolls Probably Increased in March

Employers in the U.S. probably added jobs in March for the second time in more than two years, setting the stage for a broadening of the expansion, economists said before a report this week.Aargh.

Payrolls probably rose by 190,000, the most in three years, after declining 36,000 in February, according to the median forecast of 62 economists surveyed by Bloomberg News before the Labor Department’s April 2 report.

As I noted earlier this month in Employment: March Madness, a headline number of 200,000 net payroll jobs might be considered weak!

The March report will be distorted by two factors: 1) any bounce back from the snow storms in February, and 2) the decennial Census hiring that picked up sharply in March.

These are real payroll jobs, but the Census hiring is temporary - and the Census jobs that are added in March, April and May will all be lost over the following 6+ months.

What we are interested in is the underlying trend of payroll job growth. To find that number we need to adjust for the Census jobs (although they are reported NSA), and we also need to adjust for the February snow storms. Later this year we will need to add the Census jobs back to find the trend.

The important point is 190,000 is probably a weak number for March - and probably not "setting the stage for a broadening of the expansion" - although we need to see the details.

Saturday, March 27, 2010

Growth of Problem Banks (Unofficial)

by Calculated Risk on 3/27/2010 09:49:00 PM

By request here is a graph of the number of banks on the unofficial problem bank list over time.

We started posting the Unofficial Problem Bank list in early August 2009 (credit: surferdude808). The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest. Some of this data is released with a lag, for example the FDIC announced the February enforcement actions yesterday. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of banks on the unofficial list. The number has grown by almost 76% since early August 2009 - even with all the bank failures (failures are removed from the list).

The three red dots are the number of banks on the official problem bank list as announced in the FDIC quarterly banking profile for Q2, Q3, and Q4. The dots are lagged one month because of the delay in announcing formal actions.

The unofficial count is close, but is slightly lower than the official count - probably mostly due to timing issues.

Based on the current trend, there is a reasonable chance that the unofficial problem bank list will be over 1,000 banks later this year ...