by Calculated Risk on 1/26/2010 06:32:00 PM

Tuesday, January 26, 2010

BofA signs up for HAMP Second Lien Program

From BofA: Bank of America Becomes First Mortgage Servicer to Sign Contract for Home Affordable Second-Lien Modification Program

Bank of America announced that it is the first mortgage servicer to sign an agreement formally committing to participation in the pending second-lien component of the federal government's Home Affordable Modification Program (HAMP)And more from HousingWire: BofA Signs up as First Servicer for HAMP Second Lien Program

...

Bank of America has systems in place to begin implementing the Second Lien Modification Program (2MP) with the release of final program policies and guidelines by federal regulatory agencies, which is expected soon. 2MP will require modifications that reduce the monthly payments on qualifying home equity loans and lines of credit under certain conditions, including completion of a HAMP modification on the first mortgage on the property.

This program was announced in April 2009, and is still in process. Here are the guidelines for the HAMP 2nd lien program. I don't have high hopes for this program.

NY Times: AIG Hearing Preview

by Calculated Risk on 1/26/2010 03:49:00 PM

From the NY Times Dealbook: A Preview of the House’s A.I.G. Hearing

DealBook has obtained the prepared testimony of three of the witnesses called by the House Oversight and Government Reform Committee: Thomas C. Baxter, general counsel of the Federal Reserve Bank of New York; Stephen Friedman, the former chairman of the New York Fed, and Elias Habayeb, the former chief financial officer of A.I.G.Dealbook provides the statements of all three.

In his prepared remarks, Mr. Baxter defended the A.I.G. bailout, saying a bankruptcy by the insurer “would have had catastrophic consequences for our financial system and our economy.” He called the decision to rescue A.I.G. “a difficult one,” but one that the Fed’s policymakers felt compelled to make.The TARP Inspector General Neil Barofsky will also testify although Dealbook doesn't provide his statement. Barofsky's comments on the AIG bailout, the benefits to counterparties, and his investigations into possible misconduct will be closely scrutinized.

Mr. Baxter explained that the New York Fed felt compelled to pay out A.I.G.’s counterparties in full to unwind derivative contracts because “there was little time, and substantial execution risk and attendant harm of not getting the deal done by the deadline of Nov. 10,” when A.I.G. was scheduled to report its earning and could face downgrades from credit ratings agencies. That would have led to more collateral calls and even greater liquidity problems for A.I.G., Mr. Baxter said.

He added, “Even in a best-case scenario, we did not expect that the counterparties would offer anything more than a modest discount to par.” Under the circumstance, he said, “the Federal Reserve had little or no bargaining power.”

Oil Prices and China

by Calculated Risk on 1/26/2010 01:50:00 PM

Two weeks ago I suggested it might be time to start looking for signs of demand destruction for oil (like we did in the first half of 2008). So far domestic demand (as far as vehicle miles) is still increasing slightly, however demand growth in China might be slowing ...

From MarketWatch: Oil slumps on expected rise in supplies, China worries

Oil futures fell on Tuesday, pressured by concerns that China's attempt to slow its growth will curb demand and expectations that U.S. crude-oil supplies are rising.I think that needs a graph!

...

"China is really the driving force in this market," said Dan Flynn, energy trader at PFGBest.

...

Broad concerns about weak growth and demand globally were also heightened ahead of supply data due Tuesday and Wednesday, Flynn said.

"We still have an oil glut in the market place. All in all, [oil trading] should remain sideways to lower," he said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Shanghai SSE Composite Index and the Cushing, OK WTI Spot Price oil prices on a weekly basis (in blue).

The SSE Composite Index closed down 2.42% to 3,019.39 and oil prices are off from the recent high.

There appears to be a relationship between the two although the Shanghai Composite turned down in last 2007 and early 2008 - well before oil prices collapsed.

Case Shiller House Price Seasonal Adjustment

by Calculated Risk on 1/26/2010 11:11:00 AM

Case-Shiller released the November house price index this morning and most news reports focused on the small decrease, not seasonally adjusted (NSA), from October to November. As I noted earlier, the seasonally adjusted (SA) data showed a small price increase from October to November.

House price data has a clear seasonal pattern, and I think the headlines for this data should be the Seasonally Adjusted number.

The following graph shows the month-to-month change of the Case-Shiller Composite 10 index for both the NSA and SA data (annualized). Note that Case-Shiller uses a three-month moving average to smooth the data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Blue line is the NSA data. There is a clear seasonal pattern for house prices.

The red line is the SA data as provided by Case-Shiller.

The seasonal adjustment appears pretty good in the '90s, however it appears insufficient now. Still the SA data is probably a better indicator than the NSA data - and to be consistent I've kept reporting the SA data.

The second graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

NOTE: This is using the Seasonally Adjusted (SA) composite 10 series. The Stress Test scenarios use the Composite 10 index and starts in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and starts in December. Here are the numbers:

Case-Shiller Composite 10 Index, November: 157.66

Stress Test Baseline Scenario, November: 140.86

Stress Test More Adverse Scenario, November: 128.54

This puts house prices 12% above the baseline scenario and 22% above the more adverse scenario.

Case Shiller House Prices Increase Slightly in November

by Calculated Risk on 1/26/2010 09:00:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for November this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.4% from the peak, and up about 0.2% in November.

The Composite 20 index is off 29.5% from the peak, and up 0.2% in November.

NOTE: S&P reported this as "down", but they were using the NSA data. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 4.5% from November 2008.

The Composite 20 is off 5.3% from November 2008.

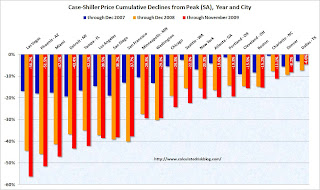

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

In Las Vegas, house prices have declined 56.2% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.6% from the peak. Several cities are showing price increases in 2009 including San Diego, San Francisco, Denver and Dallar. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

The impact of the massive government effort to support house prices led to small increases in prices over the Summer, and the question is what happens to prices as these programs end over the next 6 months. I expect further price declines in many cities.