by Calculated Risk on 10/26/2009 11:28:00 AM

Monday, October 26, 2009

ATA Truck Tonnage Index Declines in September

From the American Trucking Association: ATA Truck Tonnage Index Slipped 0.3 Percent in September Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.3 percent in September, after increasing 2.1 percent in both July and August. The latest decline lowered the SA index to 103.9 (2000=100). ...Trucking has benefited from some inventory restocking, and exports - two key positive areas for the economy, however further growth will probably be "modest" and "choppy" until there is a pickup in domestic end demand.

Compared with September 2008, SA tonnage fell 7.3 percent, which was the best year-over-year showing since November 2008. In August, the index was down 7.5 percent from a year earlier.

ATA Chief Economist Bob Costello said that the latest reading fits with the premise that the recovery will be moderate and choppy. “The trucking industry should not be alarmed by the very small decrease in September,” Costello noted. “We took two steps forward in July and August and this was a miniscule step backward.” He added that the industry should be prepared for ups and downs in the months ahead, but the general trend should be modest improvement. ...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.2 billion tons of freight in 2008. Motor carriers collected $660.3 billion, or 83.1 percent of total revenue earned by all transport modes.

Chicago Fed Index: Near Pre-Recession Levels

by Calculated Risk on 10/26/2009 08:50:00 AM

From the Chicago Fed: Index shows economic activity approaching pre-recessionary levels

The Chicago Fed National Activity Index was –0.81 in September, down from –0.65 in August. Three of the four broad categories of indicators made negative contributions to the index in September, but the production and income category made a positive contribution for the third consecutive month.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"At –0.63 in September (up from –0.96 in the previous month), the index’s three-month moving average, CFNAI-MA3, suggests that growth in national economic activity was below its historical trend. However, the CFNAI-MA3 in September improved to a level greater than –0.7 for the first time since the early months of this recession. For the four previous recessions, the first month when the CFNAI-MA3 was above –0.7 coincided closely with the end of each recession as eventually determined by the National Bureau of Economic Research."

This index suggests that the official recession might be over. However the index is still fairly weak.

ING to Raise $11.3 Billion, Lloyds to Raise $38 Billion

by Calculated Risk on 10/26/2009 08:37:00 AM

Two articles from the NY Times Dealbook:

ING to Split in Two Amid $11.3 Billion Rights Issue

ING Group, the Dutch financial services company, said Monday that it planned to break up its insurance and banking businesses and raise up to 7.5 billion euros, or $11.3 billion, in a stock issue, after reaching a deal with the government to repay ahead of schedule half the money it received in a bailout last year, The New York Times’s Chris V. Nicholson reported.Lloyds Said Set to Raise $38 Billion

ING was propped up with 10 billion euros in emergency funds from the Dutch government in October 2008, which helped cushion the company’s core Tier One capital, a measure of financial strength, during the global financial crisis.

Lloyds Banking Group plans to will announce within days a 23 billion pound ($38 billion) fundraising plan to shore up its balance sheet and avoid a U.K. government debt insurance program, The Times of London reported.Some pretty amazing numbers ... obviously some banks think now is the time to raise capital.

...

The fundraising comes as Lloyds seeks to escape taking part a costly government insurance scheme, that would give the British government a controlling 60 percent stake in the bank ...

Sunday, October 25, 2009

Capmark Files Bankruptcy

by Calculated Risk on 10/25/2009 07:39:00 PM

No surprise ...

Press Release: Capmark Financial Group Inc. Seeks To Restructure Balance Sheet Through Chapter 11 Reorganization Process

Capmark Financial Group Inc. ("Capmark") today announced that Capmark and certain of its subsidiaries have filed voluntary petitions for relief under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware. Capmark intends to use the reorganization process to implement a restructuring that reduces its corporate debt and maximizes value for its stakeholders. Capmark`s businesses are continuing to operate in the ordinary course.More from Bloomberg: Lender Capmark Financial Group Files for Bankruptcy

Capmark Bank, which recently received $600 million of new equity from Capmark, is not part of the filing.

Summary and more ...

by Calculated Risk on 10/25/2009 02:49:00 PM

It will be a busy week ... a few coming highlights:

A few articles and graphs from last week:

Click on graph for larger image in new window.

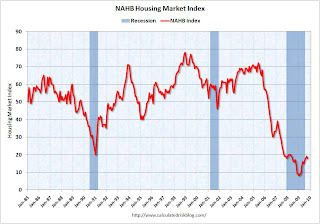

Click on graph for larger image in new window.This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 18 in October from 19 in September. The record low was 8 set in January. Note that Traffic of Prospective Buyers declined sharply.

This is still very low - and this is what I've expected - a long period of builder depression.

From NAHB: Builder Confidence Decreases Slightly in October

This graph shows a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. CRE prices only go back to December 2000.

This graph shows a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. CRE prices only go back to December 2000.The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

From Bloomberg: U.S. Commercial Property Values Fall 3% in August

The Moody’s/REAL Commercial Property Price Indices fell 3 percent in August from July, bringing the market’s decline to almost 41 percent since its peak in October 2007, Moody’s Investors Service said in a statement today.From Moody’s: CRE Prices Off 41 Percent from Peak, Off 3% in August

Total housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.

Total housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.Single-family starts were at 501 thousand (SAAR) in September, up 3.9% from the revised August rate, and 40 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for four months.

From Housing Starts in September: Moving Sideways

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment through most of 2010, if not longer.

From AIA: Architectural Billings Index Shows Contraction

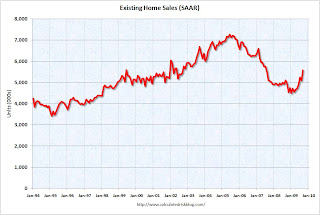

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.Sales in Sept 2009 (5.57 million SAAR) were 9.4% higher than last month, and were 9.2% higher than Sept 2008 (5.1 million SAAR).

From Existing Home Sales Increase in September

From Philly Fed State Coincident Indicators Show Widespread Weakness in September