by Calculated Risk on 10/25/2009 02:49:00 PM

Sunday, October 25, 2009

Summary and more ...

It will be a busy week ... a few coming highlights:

A few articles and graphs from last week:

Click on graph for larger image in new window.

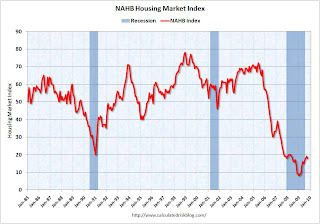

Click on graph for larger image in new window.This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 18 in October from 19 in September. The record low was 8 set in January. Note that Traffic of Prospective Buyers declined sharply.

This is still very low - and this is what I've expected - a long period of builder depression.

From NAHB: Builder Confidence Decreases Slightly in October

This graph shows a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. CRE prices only go back to December 2000.

This graph shows a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. CRE prices only go back to December 2000.The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

From Bloomberg: U.S. Commercial Property Values Fall 3% in August

The Moody’s/REAL Commercial Property Price Indices fell 3 percent in August from July, bringing the market’s decline to almost 41 percent since its peak in October 2007, Moody’s Investors Service said in a statement today.From Moody’s: CRE Prices Off 41 Percent from Peak, Off 3% in August

Total housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.

Total housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.Single-family starts were at 501 thousand (SAAR) in September, up 3.9% from the revised August rate, and 40 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for four months.

From Housing Starts in September: Moving Sideways

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment through most of 2010, if not longer.

From AIA: Architectural Billings Index Shows Contraction

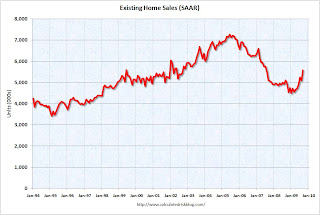

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.Sales in Sept 2009 (5.57 million SAAR) were 9.4% higher than last month, and were 9.2% higher than Sept 2008 (5.1 million SAAR).

From Existing Home Sales Increase in September

From Philly Fed State Coincident Indicators Show Widespread Weakness in September

More on the "Job Loss" Recovery

by Calculated Risk on 10/25/2009 11:29:00 AM

From Carolyn Lochhead at the San Francisco Chronicle: Experts see rebounding economy shedding jobs

Forget a jobless recovery. The economy may be entering a recovery with job losses.As I noted earlier this week, so far the current recovery is even worse than "jobless"; it is a "job-loss" recovery.

...

"It's not even a jobless recovery; it's a recovery with more job losses," said UCLA economist Lee Ohanian. "The idea of having essentially no net job creation after a remarkably severe recession is a real pathology for the U.S. economy."

...

Alarms are ringing at the White House and in Congress. But with a mind-boggling $1.4 trillion deficit this year, Democrats have used up their bullets. The word stimulus has such a bad connotation that the term has been banished from new efforts to goose the economy and help workers, such as extending unemployment benefits, sending $250 checks to seniors and a program the White House announced to help small businesses get loans.

This will be hot topic over next couple of months. Maybe the forecasts will be too pessimistic, but without jobs, it isn't much of a recovery.

Seattle Times: "Reckless strategies doomed WaMu"

by Calculated Risk on 10/25/2009 08:33:00 AM

From Drew DeSilver at the Seattle Times: Reckless strategies doomed WaMu

This is the first of two parts. Here is a section on loose lending:

"The big saying was 'A skinny file is a good file,' " said Nancy Erken, a WaMu loan consultant in Seattle. She recalled helping credit-challenged borrowers collect canceled checks, explanatory letters and other documentation that they could afford their loans.And on risk management:

"I'd take the files over to the processing center in Bellevue and they'd tell me 'Nancy, why do you have all this stuff in here? We're just going to take this stuff and throw it out,' " she said.

In time, WaMu even began allowing low- or no-documentation option ARMs, piling risk on risk. The loose standards spread through the company like a flu virus.

In an internal newsletter dated Oct. 31, 2005, and obtained by The Seattle Times, risk managers were told they needed to "shift (their) ways of thinking" away from acting as a "regulatory burden" on the company's lending operations and toward being a "customer service" that supported WaMu's five-year growth plan.Ouch. There is much more in the article - on Option ARMs, switching to originate-to-sell and more ... WaMu was definitely "doomed".

Risk managers were to rely less on examining borrowers' documentation individually and more on automated processes, Melissa Martinez, WaMu's chief compliance and risk oversight officer, wrote in the memo.

...

"The whole tone it set was that 'Maybe the next file I review I should pull back, hold off on downgrading (a loan), not take a sharp pencil to what production was doing,' " [Dale George, a former senior credit-risk officer in Irvine, Calif.] said.

"They weren't going to have risk management get in the way of what they wanted to do, which was basically lend the customers more money."

Saturday, October 24, 2009

Hutton: "Mervyn King is right"

by Calculated Risk on 10/24/2009 11:55:00 PM

From Will Hutton at the Observer: Mervyn King is right – the time has come to break up the megabanks (ht Jonathan)

Will Hutton reviews the competing proposals to reform the banking system and suggests a combination of the two ...

The first proposal, championed by BofE Governor Mervyn King and former Fed Chairman Paul Volcker is to break up the banks and separate the commercial parts from the "casino banking":

If the status quo is untenable and unfair because it leaves us with banks so big they have to be bailed out in a crisis, and if the proposed increases in bank capital advanced by the government are unlikely to act as a restraint, then there is only one course of action left: we have to break up the megabanks. The speculative, risky parts of banks must be separated from the commercial parts which lend to business, consumers and home buyers.The second proposal, championed by Lord Turner in the U.K., and I believe favored by the Obama Administration in the U.S., is to have capital requirements based on the riskiness of the business:

This, after all, is what the Americans did after the 1929-33 crash. Under the famous Glass-Steagall Act, commercial banks were forbidden to offer any form of collateral, underwriting or loan that financed stocks and shares. The same could be done today. The banking the economy needs – so-called narrow banking – could be closely regulated and casino banking could be left to its separate, freewheeling devices.

The way forward, [Lord Turner] repeated, is more capital, especially more capital for the casino parts of any bank's business. On top, banks should make "living wills", setting out how they would wind themselves up without any cost to the taxpayer.Either way - I think the time has for action.

Silicon Valley Office Vacancy Rate over 19 Percent

by Calculated Risk on 10/24/2009 08:23:00 PM

From the Mercury News: Silicon Valley office vacancies near 20 percent

Nearly one-fifth of Silicon Valley office space stood empty last quarter, while landlords lowered rents to try to retain tenants and attract new ones, according to a [report from commercial real estate firm Grubb & Ellis] released Friday.Some of the increase in the vacancy rate was because of new office space coming online, but it sounds like Grubb & Ellis expects a significant amount of sublease space to come on the market too. That is usually a bad sign for rents - and also suggests companies don't expect much growth.

...

The rising vacancy rate is "re-emphasizing that this is the slowest commercial real estate market the valley has seen since the dot-com bust in 2001," the report stated.

Empty space for research and development, the one- to three-story buildings where so many smaller tech companies reside, is also beginning to pile up, said Dick Scott, Grubb & Ellis' managing director in Silicon Valley. ...

"There was a temporary period of time where we all were naively optimistic that R&D would hold up. But it's taking a hit now," he said.

...

Said the Grubb & Ellis report: "Expect asking rents to decrease as companies put unoccupied space onto the market."