by Calculated Risk on 9/17/2007 04:57:00 PM

Monday, September 17, 2007

E*Trade Warns of Mortgage Fallout

From the WSJ: E*Trade Warns of Mortgage Fallout (hat tip Mike - he has more specifics)

E*Trade Financial Corp. ... this afternoon warned investors that it has been badly stung by the recent fallout in the mortgage market.This will be an interesting week. Heck, tomorrow alone will be an interesting day: the Fed meeting, Lehman reports, and the homebuilders index will be released.

The company says it expects profits to come in 31% below the most recent guidance it had given analysts -- partly due to its exposure to the mortgage business.

The news, weeks ahead of its scheduled third-quarter earnings report, provided Wall Street with a glimpse of what may be in store tomorrow when the country's biggest brokerages, beginning with Lehman Brothers Holdings Inc., start reporting third quarter earnings.

Government Guarantees All Deposits at Northern Rock

by Calculated Risk on 9/17/2007 02:37:00 PM

Note: Video of the Day (bottom of posts) is an interview with customers in a Northern Rock queue this morning.

From the Guardian: Government guarantees Northern Rock deposits

The chancellor of the exchequer, Alistair Darling, this evening promised that the government will guarantee all savings deposits at Northern Rock amid concern that Britain is plunging into its worst banking crisis in decades.These are stunning developments in the UK. Clearly there is concern that the run at Northern Rock will spread to other institutions (like Alliance & Leicester).

The move follows a dramatic last-minute collapse in the share price of Alliance & Leicester, which fell 32% in late trading this afternoon, and sparked fears of "contagion" from Northern Rock to other financial institutions.

Mr Darling said: "I can announce today that following the discussions with the Governor (of the Bank of England) and the Chairman of the FSA, should it be necessary, we, with the Bank of England would put in place arrangements that would guarantee all the existing deposits in Northern Rock during the current instability."

This evening queues were still stretching out of the door at branches of Northern Rock across the country, with more than £2bn already taken out by anxious savers. The value of Northern Rock shares fell sharply again today, down by 35%, but in late trading it was overtaken by a startling drop in the share price of Alliance & Leicester, Britain's seventh largest bank.

...

Northern Rock, in a formal statement issued after the Mr Darlling spoke, said that "The Chancellor's statement makes it clear beyond any doubt that all savings in Northern Rock are safe and secure. Consequently anybody who is in a queue outside a branch, or who is trying to access an online account can be fully reassured that there is no cause for concern whatsoever."

It also promised to refund any penalties that savers may have paid when they withdrew their funds from the bank - so long as they put the money back in by October 5. "Any customer who paid a penalty to withdraw their funds from Northern Rock, due to concern over the current situation, will have the penalty refunded if they reinvest those funds in the same type of account with Northern Rock by 5 October 2007," it said.

The UK version of FDIC insurance actually motivates many depositors to remove their bank deposits. Only the first 2000 pounds is 100% guaranteed, and the next 30,000 (or so) is 90% guaranteed. No one wants a 10% haircut, so it makes sense to remove any deposits over 2000 pounds.

This new guarantee should calm depositor's fears.

Fed Flow of Funds for Q2

by Calculated Risk on 9/17/2007 01:27:00 PM

The Federal Reserve released the Q2 Flow of Funds report today.

Household mortgage borrowing increased to $195.4 Billion in Q2 (up from $176.3B in Q1, and $178.6B in Q4 2006). The mortgage equity withdrawal numbers will probably show an increase in Q2, before plummeting in the current quarter.

The amount withdrawn from homes was more than total home values increased (including the addition of new homes), so the total homeowner equity fell for the first time since 1994. This was not due to falling prices, rather homeowner equity declined because of the large amount of equity extracted from homes in Q2.

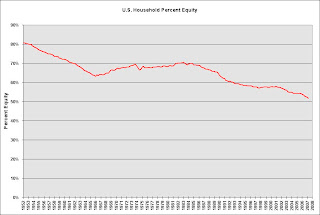

Household percent equity was at an all time low of 51.7%. Click on graph for larger image.

Click on graph for larger image.

This graph shows homeowner percent equity since 1954. Even though prices have risen dramatically in recent years, the percent homeowner equity has fallen significantly (because of mortgage equity extraction 'MEW'). With prices now falling - and expected to continue to fall - the percent homeowner equity will probably decline rapidly in the coming quarters.

For more, see Rex Nutting's article at MarketWatch: Homeowners' equity falls for 1st time in 13 years

Hovnanian "Deal of the Century" Called Successful

by Calculated Risk on 9/17/2007 12:29:00 PM

From Hovnanian: Hovnanian Enterprises Announces Successful Preliminary Sales Results for the 'Deal of the Century' Nationwide Sales Campaign

Over the course of the three-day event, the Company reported more than 2,100 gross sales including more than 1,700 contracts and more than 400 sales deposits. Due to the overwhelming number of customers who visited our communities during the 72 hour sales event and strong demand for our homes, our sales staff in some of our community locations only had enough time to take deposits from our customers rather than completing the more extensive process of taking contracts.According to Bloomberg, Hovnanian had hoped "to sell 1,000 homes this weekend".

Northern Rock Bank Run Returns

by Calculated Risk on 9/17/2007 10:47:00 AM

| From Paul in London. Northern Rock branch in Hounsditch, City of London on Monday. |  |

| From Paul in London. Northern Rock branch in Hounsditch, City of London last Friday at 3 PM. |  |

From Bloomberg: Lending Rates Surge as Northern Rock Concern Deepens

Photo: Northern Rock customers queue from the banks entrance,left, onto the pavement outside the branch in Golders Green, London, on Sept. 17, 2007. Photographer: Will Wintercross/Bloomberg News