by Calculated Risk on 9/17/2007 01:27:00 PM

Monday, September 17, 2007

Fed Flow of Funds for Q2

The Federal Reserve released the Q2 Flow of Funds report today.

Household mortgage borrowing increased to $195.4 Billion in Q2 (up from $176.3B in Q1, and $178.6B in Q4 2006). The mortgage equity withdrawal numbers will probably show an increase in Q2, before plummeting in the current quarter.

The amount withdrawn from homes was more than total home values increased (including the addition of new homes), so the total homeowner equity fell for the first time since 1994. This was not due to falling prices, rather homeowner equity declined because of the large amount of equity extracted from homes in Q2.

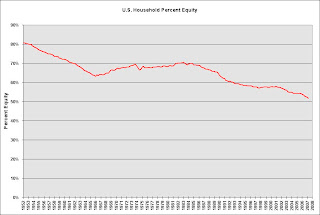

Household percent equity was at an all time low of 51.7%. Click on graph for larger image.

Click on graph for larger image.

This graph shows homeowner percent equity since 1954. Even though prices have risen dramatically in recent years, the percent homeowner equity has fallen significantly (because of mortgage equity extraction 'MEW'). With prices now falling - and expected to continue to fall - the percent homeowner equity will probably decline rapidly in the coming quarters.

For more, see Rex Nutting's article at MarketWatch: Homeowners' equity falls for 1st time in 13 years