by Calculated Risk on 5/30/2024 08:35:00 AM

Thursday, May 30, 2024

Q1 GDP Growth Revised Down to 1.3% Annual Rate

From the BEA: Gross Domestic Product, First Quarter 2024 (Second Estimate) and Corporate Profits (Preliminary)

Real gross domestic product (GDP) increased at an annual rate of 1.3 percent in the first quarter of 2024, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2023, real GDP increased 3.4 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 2.5% to 2.0%. Residential investment was revised up from 13.9% to 15.4%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 1.6 percent. The update primarily reflected a downward revision to consumer spending (refer to "Updates to GDP").

The increase in real GDP primarily reflected increases in consumer spending, residential fixed investment, nonresidential fixed investment, and state and local government spending that were partly offset by a decrease in private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

Weekly Initial Unemployment Claims Increase to 219,000

by Calculated Risk on 5/30/2024 08:30:00 AM

The DOL reported:

In the week ending May 25, the advance figure for seasonally adjusted initial claims was 219,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 215,000 to 216,000. The 4-week moving average was 222,500, an increase of 2,500 from the previous week's revised average. The previous week's average was revised up by 250 from 219,750 to 220,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 222,500.

The previous week was revised up.

Weekly claims were higher close to the consensus forecast.

Wednesday, May 29, 2024

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 5/29/2024 08:02:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, up from 215 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2023 (Second estimate). The consensus is that real GDP increased 1.2% annualized in Q1, down from the advance estimate of 1.6%.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 0.6% decrease in the index.

Las Vegas April 2024: Visitor Traffic Up 3.8% YoY; Convention Traffic Up 36%

by Calculated Risk on 5/29/2024 05:00:00 PM

From the Las Vegas Visitor Authority: April 2024 Las Vegas Visitor Statistics

With strength in both leisure and conventions segments, Las Vegas visitation in April exceeded 3.5M, up +3.8% YoY.

Convention attendance saw a YoY increase of 36% related in part to scheduling differences of some shows such as the ISC West ‐ International Security Conference (20K attendees, in Apr 2024 vs. Mar last year) along with new shows including the Google Cloud Next show (30k attendees), the Craft Brewers Conference (12k attendees) and the PZ3 Live Veterinary & Pet Technology Conference (5k attendees).

Even with a larger room count vs. last April, overall hotel occupancy reached 85.5% (up 1.2 pts), with Weekend occupancy of 93.4% (up 1.0 pts) and Midweek occupancy reaching 82.6% (up 1.7 pts) . ADR exceeded $182 while RevPAR approached $156, showing YoY increases of 6.6% and 8.1%, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (dark blue), 2021 (light blue), 2022 (light orange), 2023 (dark orange) and 2024 (red).

Visitor traffic was up 3.8% compared to last April. Visitor traffic was down 0.8% compared to the same month in 2019.

FDIC: Number of Problem Banks Increased in Q1 2024

by Calculated Risk on 5/29/2024 01:36:00 PM

The FDIC released the Quarterly Banking Profile for Q1 2024:

Reports from 4,568 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) report aggregate net income of $64.2 billion in first quarter 2024, an increase of $28.4 billion (79.5 percent) from the prior quarter. A large decline in noninterest expense because of several substantial, non-recurring items recognized by large banks in the prior quarter, as well as higher noninterest income and lower provision expenses this quarter, contributed to the quarterly increase. These and other financial results for first quarter 2024 are included in the FDIC’s latest Quarterly Banking Profile released today.

...

Asset Quality Metrics Remained Generally Favorable With the Exception of Material Deterioration in Credit Card and Commercial Real Estate (CRE) Portfolios: Loans that were 90 days or more past due or in nonaccrual status increased to 0.91 percent of total loans, up five basis points from the prior quarter and 16 basis points from the year-ago quarter. The quarterly increase was led by commercial and industrial loans and non-owner-occupied CRE loans. The noncurrent rate for non-owner occupied CRE loans of 1.59 percent is now at its highest level since fourth quarter 2013, driven by office portfolios at the largest banks. Despite the recent increases, the industry’s total noncurrent ratio remains 37 basis points below the pre-pandemic average of 1.28 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From the FDIC:

The number of banks on the FDIC’s “Problem Bank List” increased from 52 to 63. Total assets held by problem banks rose $15.8 billion to $82.1 billion. Problem banks represent 1.4 percent of total banks, which is within the normal range for non-crisis periods of 1 to 2 percent of all banks.This graph from the FDIC shows the number of problem banks and assets at problem institutions.

Note: The number of assets for problem banks increased significantly back in 2018 when Deutsche Bank Trust Company Americas was added to the list. An even larger unknown bank was added to the list in Q4 2021, however that bank is now off the problem list.

Inflation Adjusted House Prices 2.2% Below Peak; Price-to-rent index is 7.5% below 2022 peak

by Calculated Risk on 5/29/2024 10:34:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 2.2% Below Peak

Excerpt:

It has been 18 years since the bubble peak. In the March Case-Shiller house price index released on Tuesday, the seasonally adjusted National Index (SA), was reported as being 72% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 10% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $431,000 today adjusted for inflation (44% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 2.2% below the recent peak, and the Composite 20 index is 3.1% below the recent peak in 2022. Both indexes declined slightly in March in real terms.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 5/29/2024 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

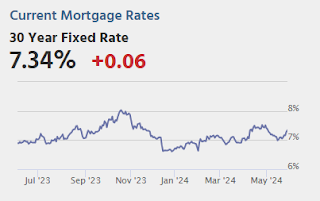

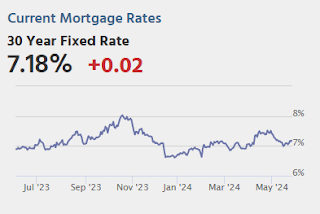

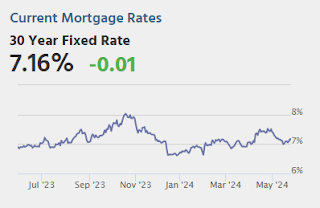

Mortgage applications decreased 5.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 24, 2024.

The Market Composite Index, a measure of mortgage loan application volume, decreased 5.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 6.3 percent compared with the previous week. The Refinance Index decreased 14 percent from the previous week and was 12 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 10 percent lower than the same week one year ago.

“Mortgage rates increased for the first time in four weeks, with the 30-year fixed rate up to 7.05 percent and all other loan types also seeing increases. The uptick in rates led to a decline in mortgage applications heading into Memorial Day weekend,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Both purchase and refinance applications fell, pushing overall activity to the lowest level since early March. Borrowers remain sensitive to small increases in rates, impacting the refinance market and keeping purchase applications below last year’s levels. There continues to be limited levels of existing homes for sale and many buyers are struggling to find listings in their price range that meet their needs.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.05 percent from 7.01 percent, with points increasing to 0.63 from 0.60 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 10% year-over-year unadjusted.

Tuesday, May 28, 2024

Wednesday: Beige Book, Richmond Fed Mfg

by Calculated Risk on 5/28/2024 07:12:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 5/28/2024 01:35:00 PM

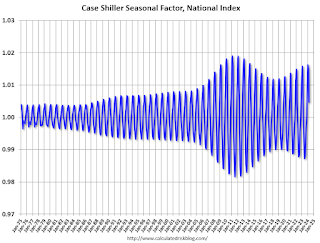

Two key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

Click on graph for larger image.

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through March 2024). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the pandemic price surge changed the month-over-month pattern.

The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

Comments on March House Prices, FHFA: House Prices Increased 0.1% in March

by Calculated Risk on 5/28/2024 09:50:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 6.5% year-over-year in March; FHFA: House Prices Increased 0.1% in March, up 6.6% YoY

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March closing prices). March closing prices include some contracts signed in November, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.30%. This was the fourteenth consecutive MoM increase, but a smaller MoM increase than the previous two months.

On a seasonally adjusted basis, prices increased month-to-month in 15 of the 20 Case-Shiller cities. Seasonally adjusted, San Francisco has fallen 8.2% from the recent peak, Seattle is down 6.0% from the peak, Portland down 4.0%, and Phoenix is down 3.1%.

Case-Shiller: National House Price Index Up 6.5% year-over-year in March

by Calculated Risk on 5/28/2024 09:00:00 AM

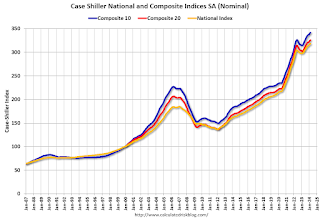

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Hits New All-Time High in March 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.5% annual gain for March, the same increase as the previous month. The 10- City Composite saw an increase of 8.2%, up from a 8.1% increase in the previous month. The 20-City Composite posted a slight year-over-year increase to 7.4%, up from a 7.3% increase in the previous month. San Diego continued to report the highest year-over-year gain among the 20 cities this month with an 11.1% increase in March, followed by New York and Cleveland, with increases of 9.2% and 8.8%, respectively. Portland, which still holds the lowest rank after reporting three consecutive months of the smallest year-over-year growth, posted the same 2.2% annual increase in March as the previous month.

...

The U.S. National Index, the 20-City Composite, and the 10-City Composite all continued their upward trend from last month, showing pre-seasonality adjustment increases of 1.3%, 1.6% and 1.6%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0. 3%, while the 20-City and the 10-City Composite both reported month-over-month increases of 0.3% and 0.5%, respectively.

“This month’s report boasts another all-time high,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “We’ve witnessed records repeatedly break in both stock and housing markets over the past year. Our National Index has reached new highs in six of the last 12 months. During that time, we’ve seen record stock market performance, with the S&P 500 hitting fresh all-time highs for 35 trading days in the past year.

“San Diego stands out with an impressive 11.1% annual gain, followed closely by New York, Cleveland, and Los Angeles, indicating a strong demand for urban markets."

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.5% in March (SA). The Composite 20 index was up 0.3% (SA) in March.

The National index was up 0.3% (SA) in March.

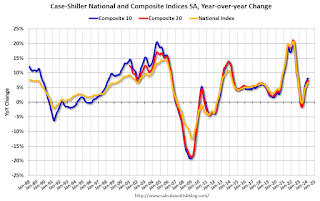

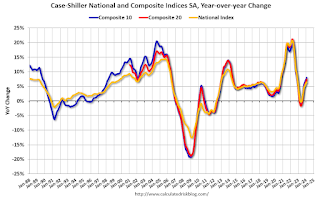

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA was up 8.2% year-over-year. The Composite 20 SA was up 7.4% year-over-year.

The National index SA was up 6.5% year-over-year.

Annual price changes were close to expectations. I'll have more later.

Monday, May 27, 2024

Tuesday: Case-Shiller House Prices

by Calculated Risk on 5/27/2024 06:10:00 PM

Weekend:

• Schedule for Week of May 26, 2024

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.

• Also at 9:00 AM, FHFA House Price Index for March. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Dallas Fed Survey of Manufacturing Activity for May.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 11 and DOW futures are up 51 (fair value).

Oil prices were down over the last week with WTI futures at $78.38 per barrel and Brent at $82.79 per barrel. A year ago, WTI was at $72, and Brent was at $76 - so WTI oil prices are up about 9% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.55 per gallon. A year ago, prices were at $3.55 per gallon, so gasoline prices are unchanged year-over-year.

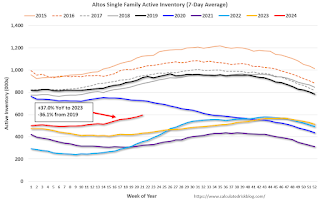

Housing May 27th Weekly Update: Inventory up 2.9% Week-over-week, Up 37.0% Year-over-year

by Calculated Risk on 5/27/2024 09:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, May 26, 2024

TSA: Airline Travel about 12% Above 2019 Levels to New Record High

by Calculated Risk on 5/26/2024 08:21:00 AM

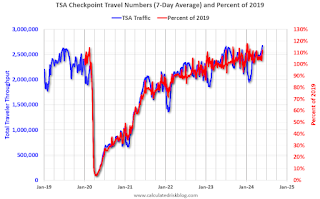

The TSA is providing daily travel numbers.

This data is as of May 24th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA (Blue).

The red line is the percent of 2019 for the seven-day average.

Air travel - as a percent of 2019 - is tracking at about 112% of pre-pandemic levels.

Saturday, May 25, 2024

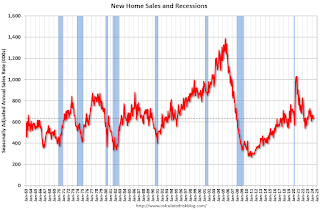

Real Estate Newsletter Articles this Week: New Home Sales Decrease to 634,000 Annual Rate in April

by Calculated Risk on 5/25/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Decrease to 634,000 Annual Rate in April

• NAR: Existing-Home Sales Decreased to 4.14 million SAAR in April

• Watch Months-of-Supply!

• Single Family Built-for-Rent Up 20% Year-over-year in Q1

• 4th Look at Local Housing Markets in April; California Home Sales Up 4.4% YoY in April

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 26, 2024

by Calculated Risk on 5/25/2024 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, March Case-Shiller house prices, and Personal Income and Outlays for April.

For manufacturing, the May Richmond and Dallas Fed manufacturing surveys will be released.

All US markets will be closed in observance of Memorial Day.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for March. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Dallas Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, up from 215 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Second estimate). The consensus is that real GDP increased 1.2% annualized in Q1, down from the advance estimate of 1.6%.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.6% decrease in the index.

8:30 AM ET: Personal Income and Outlays, April 2024. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.7% YoY, and core PCE prices up 2.8% YoY.

9:45 AM: Chicago Purchasing Managers Index for May.

Friday, May 24, 2024

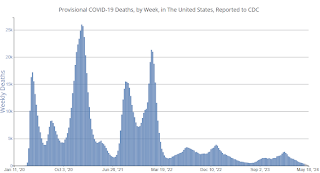

May 24th COVID Update: Weekly Deaths at New Pandemic Low!

by Calculated Risk on 5/24/2024 07:11:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 374 | 471 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

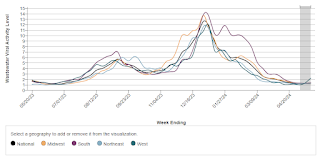

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q2 GDP Tracking: 1.8% to 3.5%

by Calculated Risk on 5/24/2024 02:21:00 PM

From BofA:

2Q GDP tracking is down a tenth to 1.8% q/q saar. Also, we expect the second print of 1Q GDP to be revised down to 1.2% from 1.6%. [May 24th estimate]From Goldman:

emphasis added

We boosted our Q2 GDP tracking estimate by 0.1pp to +3.2% (qoq ar) and our domestic final sales estimate by the same amount to +2.5%. [May 24th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.5 percent on May 24, down from 3.6 percent on May 16. After recent releases from the US Census Bureau and the National Association of Realtors, the nowcast of second-quarter real gross private domestic investment growth decreased from 5.6 percent to 5.1 percent. [May 24th estimate]

Watch Months-of-Supply!

by Calculated Risk on 5/24/2024 11:16:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Watch Months-of-Supply!

A brief excerpt:

Although inventory is well below normal levels, so are sales. I think we need to keep an eye on months-of-supply. Historically nominal prices declined when months-of-supply approached 6 months - and that is unlikely this year - but we could see months-of-supply back to 2019 levels later this year.There is much more in the article.

What would it take to get months-of-supply back to 2019 levels by mid-year? The following table is a simple exercise. If sales stay depressed at 2023 levels, how much would inventory have to increase to put months-of-supply at 2019 levels?

Hotels: Occupancy Rate Increased 0.2% Year-over-year

by Calculated Risk on 5/24/2024 11:01:00 AM

The U.S. hotel industry reported higher performance from the previous week and positive comparisons year over year, according to CoStar’s latest data through 18 May. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

12-18 May 2024 (percentage change from comparable week in 2023):

• Occupancy: 67.4% (+0.2%)

• Average daily rate (ADR): US$163.11 (+2.6%)

• Revenue per available room (RevPAR): US$109.93 (+2.8%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.