by Calculated Risk on 1/18/2013 06:49:00 PM

Friday, January 18, 2013

Lawler: Early Look At Existing Home Sales in December

From economist Tom Lawler:

Based on reports from various realtor associations/MLS across the country, I expect that existing home sales in December as measured by the National Association of Realtors will come in at a seasonally adjusted annual rate of 4.97 million in December, down 1.4% from November’s pace (which I think should be revised upward a bit), but up 13.5% from last December’s seasonally adjusted pace. Folks who track unadjusted data from local realtor reports but don’t take into account “calendar” effects would probably expect a lower number; after all, most (though not all) local realtor reports showed substantially lower YOY growth in December compared to November, and the number of local areas showing YOY sales declines was up in December compared to November. Indeed, national existing homes sales on an unadjusted basis, which showed YOY growth of 15.5% in November, are likely to show a YOY growth rate of less than half that amount in December. However, not only was there one fewer “business” day this December compared to last December, but both Christmas and New Years (this year) came on a Tuesday --- reducing the “effective” number of business days even further. As a result, this December’s seasonal factor will “gross up” the unadjusted sales figures by more than last Decembers.

On the inventory front, both local realtor reports and entities that track local real estate listings showed that in most (though not all) areas of the country the number of homes listed for sale at the end of December was down sharply from the end of the November – which is typical for most (though not quite all) parts of the country. Based on looking at various sources of data, my “best guess” is that the NAR’s estimate of the inventory of existing homes for sale at the end of December will be 1.87 million, down 7.9% from November and down 19.4% from last December.

Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price in December will show another double-digit YOY increase, probably of around 11.0%. This gain does not, of course, reflect the increase in “typical” home prices, but does reflect in part the sharply lower foreclosure sales share of home resales this December compared to last December.

CR Note: The NAR will report December existing home sales on Tuesday, Jan 22nd. The consensus is the NAR will report sales of 5.10 million.

Based on Lawler's estimates, the NAR will report inventory around 1.87 million units for December, and months-of-supply around 4.5 months (down from 4.8 months in November). This would be the lowest level of inventory in over 10 years, and the lowest months-of-supply since early 2005.

The Future's so Bright ...

by Calculated Risk on 1/18/2013 03:19:00 PM

It looks like economic growth will pickup over the next few years. I've written about this before - a combination of growth in the key housing sector, a significant amount of household deleveraging behind us, the end of the drag from state and local government layoffs (four years of austerity nearing the end), some loosening of household credit, and the Fed staying accommodative (with a 7.8% unemployment rate and inflation below the Fed's target, the Fed will remain accommodative).

The key short term risk is too much additional deficit reduction too quickly. There is a strong argument that the "fiscal agreement" might be a little too much with the current unemployment rate - my initial estimate was that Federal government austerity would subtract about 1.5 percentage points from growth in 2013 (Merrill Lynch estimate up to 2.0 percentage points including an estimate for the coming sequester agreement). This means another year of sluggish growth, even with an improved private sector (retail will be impacted by the payroll tax increase). But ex-austerity, we'd probably be looking at a decent year.

Here are a few graphs:

Click on graph for larger image.

Click on graph for larger image.

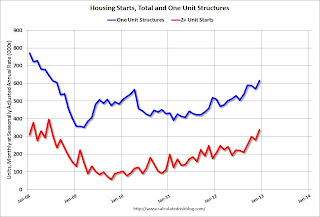

This graph shows total and single family housing starts. Even after the 28.1% in 2012, the 780 thousand housing starts in 2012 were the fourth lowest on an annual basis since the Census Bureau started tracking starts in 1959. Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 level.

Residential investment and housing starts are usually the best leading indicator for economy, so this suggests the economy will continue to grow over the next couple of years.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.

Note: The dashed line shows an estimate including the benchmark revision.

It appears most of the state and local government layoffs are over. Some states like California are close to running a surplus, and, as the BLS reported this morning, even Nevada is seeing a sharp improvement in the unemployment rate.

And another key graph on the US deficit. As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably decline to around 3% in fiscal 2015.

And another key graph on the US deficit. As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably decline to around 3% in fiscal 2015.

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next three years based on current policy (Jan Hatzius at Goldman Sachs estimates the deficit will 3% of GDP in 2015). Note: With 7.8% unemployment, there is a strong argument for less deficit reduction in the short term, but that doesn't seem to be getting any traction.

This graph from the the NY Fed shows aggregate consumer debt decreased in Q3. This was mostly due to a decline in mortgage debt.

Household debt peaked in Q2 2008 and has been declining for over four years. There is probably more deleveraging ahead (mostly from foreclosures and distressed sales), but this suggests some improvement in household balance sheets.

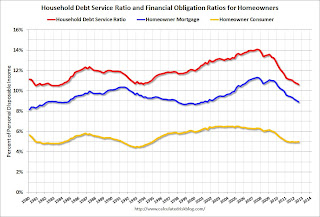

The second graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The second graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The graph shows the DSR for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages and consumer debt. The overall Debt Service Ratio has declined back to early 1980s levels, and is near the record low - thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt is at 1994 levels.

The blue line is the homeowner's financial obligation ratio for mortgages (blue). This ratio increased rapidly during the housing bubble, and continued to increase until 2008. Now, with falling interest rates, and less mortgage debt (mostly due to foreclosures), the ratio is back to 2001 levels. This will probably decline further, but for many homeowners, the obligation ratio is low.

There are several tailwinds for the economy, and the headwinds (like household deleveraging) are mostly subsiding. Deficit reduction is on a reasonable path - we don't want to reduce the deficit much faster than this projection for the next few years, because that will be too much of a drag on the economy.

Overall it appears the economy is poised for more growth over the next few years.

What about the longer term?

There are a number of longer term challenges from rising health care expenditures, climate change, income and wealth inequality and more, but I remain very optimistic about the longer term too. There is a constant focus on the aging population, but by 2020, eight of the top ten largest cohorts (five year age groups) will be under 40, and by 2030 the top 11 cohorts are the youngest 11 cohorts. The renewing of America! And these young people are smart (less exposure to lead is a significant story), and well educated too. I'll write more on the long term soon.

Last year, I said that looking forward I was the most optimistic since the '90s. And things are only getting better. The future's so bright, I gotta wear shades.

Yes, the song was about nuclear holocaust ... but it was originally intended the way I'm using it.

2007 Fed Transcripts

by Calculated Risk on 1/18/2013 01:48:00 PM

Here are the Fed transcripts for 2007.

From the WSJ: Fed's 2007 Transcripts Show Shift to Alarm

The Fed entered 2007 with interest-rate policies on hold and many officials comfortable about the economic outlook. By year-end, the U.S. was in recession ...One of my ongoing criticisms of Bernanke was that he was "behind the curve".

Fed Chairman Ben Bernanke ... was often behind the curve in his economic outlook. In January, for example, he projected that the "worst outcomes" for housing had become less likely. In May, he said he saw "good fundamental reasons to think that growth will be moderate."

He began to see after midyear that strains in financial markets threatened to move beyond housing to the broader economy and financial system. Mr. Bernanke himself slowly took on a more interventionist stance, but appears to have embraced that position reluctantly.

...

Meanwhile, Janet Yellen, then president of the Federal Reserve Bank of San Francisco and now the central bank's vice chairman, became increasingly alarmed about the growing risks to the economy as the year progressed.

"I still feel the presence of a 600-pound gorilla in the room, and that is the housing sector," she said in June 2007. "The risk for further significant deterioration in the housing market, with house prices falling and mortgage delinquencies rising further, causes me appreciable angst."

By December, she was pushing the Fed for aggressive responses to the crisis. "At the time of our last meeting, I held out hope that the financial turmoil would gradually ebb and the economy might escape without serious damage. Subsequent developments have severely shaken that belief," she said in December.

And some excerpts from FT Alphaville: From subprime to crisis: the Fed’s 2007 transcripts and 2007 FOMC transcripts: a few more excerpts. Janet Yellen in September 2007:

"We see a large drop in house prices as quite likely to adversely affect consumption spending over time through a number of different channels, including wealth effects, collateral effects, and negative effects on spending through the interest rate resets. A big worry is that a significant drop in house prices might occur in the context of job losses, and this could lead to a vicious spiral of foreclosures, further weakness in housing markets, and further reductions in consumer spending. ... at this point I am concerned that the potential effects of the developing credit crunch could be substantial. I recognize that there’s a tremendous amount of uncertainty around any estimate. But I see the skew in the distribution to be primarily to the downside, reflecting possible adverse spillovers from housing to consumption and business investment."And from the WaPo Wonkblog: The Fed’s 2007 crisis response: Twinkies, pessimism pills, and missed warnings.

State Unemployment Rates "little changed" in December

by Calculated Risk on 1/18/2013 10:59:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in December. Twenty-two states recorded unemployment rate decreases, 16 states and the District of Columbia posted increases, and 12 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-two states and the District of Columbia registered unemployment rate decreases from a year earlier, six states experienced increases, and two states had no change.

...

Nevada and Rhode Island recorded the highest unemployment rates among the states in December, 10.2 percent each. North Dakota again registered the lowest jobless rate, 3.2 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan, Ohio and Nevada have seen the largest declines - New Jersey is the laggard.

The states are ranked by the highest current unemployment rate. Only two states still have double digit unemployment rates: Nevada and Rhode Island. In early 2010, 18 states and D.C. had double digit unemployment rates.

I expect the unemployment rate in Nevada to fall below 10% very soon.

Even though Nevada still has the highest unemployment rate (tied with Rhode Island), the rate has declined in recent months, falling from 12.1% in August to 10.2% in December.

Preliminary January Consumer Sentiment declines to 71.3

by Calculated Risk on 1/18/2013 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for January declined to 71.3 from the December reading of 72.9.

This was below the consensus forecast of 75.0. There are a number of factors that can impact sentiment including unemployment, gasoline prices and other concerns - and, for January, the payroll tax increase and Congress' threat to not pay the bills.

Back in August 2011, sentiment declined sharply due to the threat of default and the debt ceiling debate. Unfortunately it appears Congress is negatively impacting sentiment once again.

Thursday, January 17, 2013

Friday: Consumer Sentiment, State Employment

by Calculated Risk on 1/17/2013 09:18:00 PM

First from Merrill Lynch on more mortgage credit: "Housing heats up"

[W]e believe recent developments on mortgage policy and mortgage servicing could lead to loosening of credit, providing further upside momentum for prices. We highlight three important steps forward the mortgage market has made.More credit availability is one reason Merrill Lynch increased their house price forecast for 2013 to 4.7% (up from 3.0%).

One major development was the announcement of the final definition of a Qualified Mortgage (QM) by the Consumer Finance Protection Bureau (CFPB). The rule focuses on a borrower’s ability to repay, setting a 43% back-end debt-toincome ratio (DTI) as a clear upper boundary. By adhering to this guideline and avoiding risky loan features (such as IO, neg am, balloons, etc.) for prime quality borrowers, lenders can claim a “safe harbor” from future litigation from borrowers. ...

...

[R]elease of the QM definition is an important step forward that should enable lenders to increase their willingness to make residential mortgage loans.

Additionally, ten mortgage servicing companies ... reached an agreement in principle with regulators ... As a result of this agreement, the participating servicers would cease the Independent Foreclosure Review, which involved case-by-case reviews, and replace it with a broader framework allowing eligible borrowers to receive compensation significantly more quickly. We believe the end of this Review process should free up and create aggregate servicing capacity that could be used for other activities such as moving distressed loans through the pipeline more quickly and processing refinancing applications, suggesting higher voluntary and possibly involuntary prepayments in the future.

Furthermore, Fannie Mae announced a comprehensive resolution with Bank of America ... The resolution included Fannie Mae’s approval of Bank of America’s request to transfer the servicing rights of approximately 941,000 loans to specialty servicers. Bank of America also announced that it signed definitive agreements with two different counterparties to sell the servicing rights on certain residential mortgage loans serviced for Fannie Mae, Freddie Mac, Ginnie Mae, and private label securitizations, with an aggregate unpaid principal balance of approximately $306 billion. Our view is that these transfers effectively act as an injection of servicing capacity into the industry, which should allow for more refinancing activity, more loss mitigation activity and, ultimately, loosening of mortgage credit.

Friday economic releases:

• At 9:55 AM ET, Reuter's/University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 75.0, up from 72.9.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for November 2012

Lawler: 2012 "Surprises" in Housing and 2013 Forecast

by Calculated Risk on 1/17/2013 05:20:00 PM

CR note: Economist Tom Lawler's forecasts for 2012 were very close (see: Lawler: Housing Forecast for 2012). Here is what Tom wrote on January 16, 2012:

“(T)here are pretty decent reasons to believe that 2012 will be a turnaround year for the housing sector, with (1) construction activity increasing; (2) overall vacancy rates falling, with especially low rental vacancy rates; (3) rents continuing to increase, and outpacing overall inflation; and (4) home prices hitting a bottom early in the year that is not much lower than the end of last year (2011).”The following is from Tom Lawler: 2012 "Surprises" in Housing and 2013 Forecast

Here are a few observations on last year’s housing market, including some of the bigger “surprises.”

1. Home Prices: While it seemed reasonably to expect a modest YOY gain in home prices (as measured by repeat-transactions HPIs), it appears as if the “actual” gain will come in well above the most optimistic of forecasters. “Reasons” included but are not limited to (1) much larger than expected declines in inventories, (2) substantial increases in investor purchases of SF homes, and (3) continued actions by monetary policymakers to engage in fiscal policy by buying MBS to push mortgage rates lower and thus encourage credit flows into a specific sector of the economy (housing).

2. Inventories: While a continued reduction in homes listed for sale seemed exceedingly likely in 2012, the magnitude of the drop clearly exceeded “consensus.” “Reasons” included but were not limited to (1) strong investor buying of SF homes and turning them into rental properties; and 2) a slower than consensus pace of completed foreclosures which, combined with strong demand for REO properties, resulted in a sharp drop in the inventory of REO for sale;

3. Investor Buying of SF Homes as Rental Properties: While investor buying of SF homes as rental properties began increasing significantly several years ago, the entrance of and/or increased activity by “big-money” institutional investors resulted in a substantial increase in such investor buying. Such activity was barely contemplated by “consensus” forecasters.

3. Completed Foreclosures: In 2011 the “robo-signing” scandal led to a significant slowdown in completed foreclosures in the latter part of that year. Many analysts had expected that once the infamous mortgage “settlement” was signed (in March 2012) that banks/servicers would shortly thereafter accelerate completed foreclosures. That didn’t happen; instead servicers spent much of 2012 focusing on compliance (including ending dual tracking); there was a resurgence in modification activity; and foreclosure timelines continued to increase (and in several states legislation was passed that effectively lengthened timelines in those states). As a result, 2012 was another low “foreclosure resolution” year.

4: Rental Vacancy Rates and Rents: While the decline in rental vacancy rates and increase in rents last year was not as much of a surprise as the drop in homes listed for sale and the increase in home prices, the RVR fell by more, and rents increased by more, than “consensus.”

5. Homeownership Rates: While there are no good, timely data on the US homeownership rate (the widely tracked HVS overstates the homeownership rate), available data combined with analysis of the systematic undercount of renters in CPS-based surveys, suggests that the US homeownership rate declined again in 2012 – probably to around 63.7%, compared to the 65.2% on April 1, 2010 suggested by the decennial Census results. (HVS showed a first-half 2010 homeownership rate of 67.0%). Reasons included a shift by householders on the benefits vs. costs of homeownership; what appears to have been a rebound in household growth of “younger” adults; tight mortgage underwriting; and an increase in householders with “troubled” credit.

Looking into 2013, reduced inventory levels, firmer home prices and rental rates, and a likely acceleration in household growth suggest that housing production should increase again in 2013. Moreover, unlike in 2010 and 2011 (when inventories remained elevated), such an increase would be a welcome result.

My “best guess” for housing production this year is as follows:

| US Housing Starts (000's) | Mfg. Housing | |||

|---|---|---|---|---|

| Total | Single Family | Multifamily (2+) | Shipments | |

| 2012 | 780 | 535.5 | 244.5 | 55 |

| 2013(F) | 965 | 675 | 290 | 60 |

| US Housing Completions (000's) | Placements | |||

| 2012 | 651.4 | 484.6 | 166.8 | 50 |

| 2013(F) | 840 | 605 | 235 | 57 |

On the home-price front, I’m still trying to get a “handle” on 2012’s gain. In the December 2011 Zillow survey my Q4/Q4 forecast for the % increase in the SPCS “national” HPI was 2.5% for 2012 and 6.0% for 2013. But the “actual” for 2012 is likely to exceed 6%. – though the Q4/11 SPCS HPI appears to have been “hit” with some depressed “distressed” sales prices. Right now my best guess is for a Q4/Q4 YOY increase of about 3.0%.

I’ll have more details, and some thoughts on the risks to the forecast (NOT focusing on “macro” risks), either tomorrow or next week.

CR Note: This was from housing economist Tom Lawler. Here is a link to several other 2013 housing forecasts.

Some Comments on Housing Starts

by Calculated Risk on 1/17/2013 03:31:00 PM

A few key points:

• Housing starts increased 28.1% in 2012 (initial estimate). This is a solid year-over-year increase, and residential investment is now making a positive contribution to GDP growth.

• Even after increasing 28% in 2012, the 780 thousand housing starts this year were the fourth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2009 through 2011). This was also the fourth lowest year for single family starts since 1959.

• Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 level.

• Residential investment and housing starts are usually the best leading indicator for economy. Note: Housing is usually a better leading indicator for the US economy than manufacturing, see: Josh Lehner's The Handoff – Manufacuturing to Housing. Nothing is foolproof as a leading indicator, but this suggests the economy will continue to grow over the next couple of years.

The following table shows annual starts (total and single family) since 2005:

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.0 | 28.1% | 535.5 | 24.4% |

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year, but still well below the 1997 through 2007 level of multi-family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Starts are moving up, but the increase in completions has just started. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Philly Fed Manufacturing Survey Shows Contraction in January

by Calculated Risk on 1/17/2013 01:44:00 PM

Catching up ... earlier from the Philly Fed: January Manufacturing Survey

Manufacturing activity declined moderately this month, according to firms responding to the January Business Outlook Survey. ... The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from a revised reading of 4.6 in December to ‐5.8 this month.Earlier this week, the Empire State manufacturing survey also indicated contraction in January.

Labor market conditions at reporting firms deteriorated this month. The employment index, at ‐5.2, fell from ‐0.2 in December. ...

The survey’s future indicators suggest that firms expect recent declines to be temporary. The future general activity index increased from a revised reading of 23.7 to 29.2, its second consecutive monthly increase.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

The average of the Empire State and Philly Fed surveys decreased in January, and is back below zero. This suggests another weak reading for the ISM manufacturing index.

CoreLogic: Negative Equity Decreases in Q3 2012

by Calculated Risk on 1/17/2013 11:01:00 AM

From CoreLogic: CORELOGIC® Reports 1.4 Million Borrowers Returned to "Positive Equity" Year to Date through the end of the Third Quarter 2012

CoreLogic ... today released new analysis showing approximately 100,000 more borrowers reached a state of positive equity during the third quarter of 2012, adding to the more than 1.3 million borrowers that moved into positive equity through the second quarter of 2012. This brings the total number of borrowers who moved from negative equity to positive equity September YTD to 1.4 million. 10.7 million, or 22 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2012. This is down from 10.8 million properties, or 22.3 percent, at the end of the second quarter of 2012. An additional 2.3 million borrowers had less than 5 percent equity in their home, referred to as near-negative equity, at the end of the third quarter.

Together, negative equity and near-negative equity mortgages accounted for 26.8 percent of all residential properties with a mortgage nationwide in the third quarter of 2012, down from 27 percent at the end of the second quarter in 2012. Nationally, negative equity decreased from $689 billion at the end of the second quarter in 2012 to $658 billion at the end of the third quarter, a decrease of $31 billion. This decrease was driven in large part by an improvement in house price levels.This dollar amount represents the total value of all homes currently underwater nationally.

“Through the third quarter, the number of underwater borrowers declined significantly,” said Mark Fleming, chief economist for CoreLogic. “The substantive gain in house prices made in 2012, partly due to tight inventory caused by negative equity’s lock-out effect, has paradoxically alleviated some of the pain.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 56.9 percent, followed by Florida (42.1 percent), Arizona (38.6 percent), Georgia (35.6 percent) and Michigan (32 percent). These top five states combined account for 34 percent of the total amount of negative equity in the U.S."

The second graph shows the distribution of home equity. Close to 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But some borrowers are close.

The second graph shows the distribution of home equity. Close to 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But some borrowers are close.More from CoreLogic: "As of Q3 2012, there were 1.8 million borrowers who were only 5 percent underwater, who if home prices continue increasing over the next year, could return to a positive equity position."

This is more improvement, but there are still 10.7 million residential properties with negative equity.

Weekly Initial Unemployment Claims decline to 335,000

by Calculated Risk on 1/17/2013 09:25:00 AM

The DOL reports:

In the week ending January 12, the advance figure for seasonally adjusted initial claims was 335,000, a decrease of 37,000 from the previous week's revised figure of 372,000. The 4-week moving average was 359,250, a decrease of 6,750 from the previous week's revised average of 366,000.

The previous week was revised up from 371,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 359,250.

This was the lowest level for weekly claims since January 2008, and the 4-week average is near the low since early 2008. Note: Data for January has large seasonal adjustments - and can be very volatile, but this is still good news.

Weekly claims were below the 368,000 consensus forecast.

Earlier:

• Housing Starts increase sharply to 954 thousand SAAR in December

Housing Starts increase sharply to 954 thousand SAAR in December

by Calculated Risk on 1/17/2013 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 954,000. This is 12.1 percent above the revised November estimate of 851,000 and is 36.9 percent above the December 2011 rate of 697,000.

Single-family housing starts in December were at a rate of 616,000; this is 8.1 percent above the revised November figure of 570,000. The December rate for units in buildings with five units or more was 330,000.

An estimated 780,000 housing units were started in 2012. This is 28.1 percent above the 2011 figure of 608,800.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 903,000. This is 0.3 percent above the revised November rate of 900,000 and is 28.8 percent above the December 2011 estimate of 701,000.

Single-family authorizations in December were at a rate of 578,000; this is 1.8 percent above the revised November figure of 568,000. Authorizations of units in buildings with five units or more were at a rate of 301,000 in December.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased sharply from November.

Single-family starts (blue) increased to 616,000 thousand in December.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total housing starts were at 954 thousand (SAAR) in December, up 12.1% from the revised November rate of 851 thousand (SAAR).

Total starts has doubled from the bottom start rate, and single family starts are up about 75 percent from the low

This was well above expectations of 887 thousand starts in December. Starts in December were up 36.9% from December 2011, and starts are up 28.1% from the 2011 level. I'll have more soon ...

Wednesday, January 16, 2013

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 1/16/2013 08:37:00 PM

James Hamilton quotes several economists (Republican and Democrat): Debt-ceiling economics and politics. Hamilton concludes:

The real purpose of the debt ceiling is political-- it gives the minority party an opportunity to grandstand as if they're somehow holding the line on the deficits that are the necessary mathematical result of previous spending and tax legislation. The political game is to force the majority party to push through the debt-ceiling increase and then try to embarrass them for their votes, relying on the stupidity of voters not to see the posturing for what it really is. But when different parties control the two houses of Congress, the only chumps in this game are the legislators who still try to play the same hand.Thursday would be a good day to vote to pay the bills! Sooner is better than later ...

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 368 thousand from 371 thousand last week.

• Also at 8:30 AM, Housing Starts for December will be released. The consensus is for total housing starts to increase to 887 thousand (SAAR) in December, up from 861 thousand in November.

• At 10:00 AM, the Philly Fed Manufacturing Survey for January. The consensus is for a reading of 6.0, down from 8.1 last month (above zero indicates expansion).

Report: Housing Inventory declines 17% year-over-year in December

by Calculated Risk on 1/16/2013 04:01:00 PM

From Realtor.com: December 2012 Real Estate Trend Data

The total U.S. for-sale inventory of single family homes, condos, townhomes and co-ops (SFH/CTHCOPS) in December dropped to its lowest point since Realtor.com has been collecting these data, with 1,565,425 units for sale, down 17.32% compared to a year ago and roughly half its peak of 3.1 million units in September 2007. The median age of the inventory also decreased 9.01% on a year-over-year basis.Note: Realtor.com only started tracking inventory in September 2007, but this is probably the lowest level in a decade. On a month-over-month basis, inventory declined 6.5%. Some of the decline in December is seasonal because some sellers take their homes off the market for the holidays.

...

On a year-over-year basis, the for-sale inventory declined in all but one of the 146 markets tracked by Realtor.com, while list prices increased in 66 markets, held steady in 31 markets and declined in 49 markets.

Going forward, I expect to see smaller year-over-year declines simply because inventory is already very low.

Tom Lawler sent me this note today:

"Realtor.com’s monthly numbers reflect the daily average number of listings in a month, as opposed to most local realtor reports and the NAR’s existing home inventory number, which are end-of-month estimates."

Click on graph for larger image.

Click on graph for larger image."Here is a comparison of Realtor.com’s for-sale inventory numbers and the NAR’s existing home inventory estimate.

As noted above, the Realtor.com data reflect monthly average listings, while the NAR estimates are end-of-month listings. Given the “normal” tendency for listings at the end of December to be well below the monthly average, the NAR December inventory number is likely to show a significantly larger monthly decline that the Realtor.com number."

The NAR is scheduled to report December existing home sales and inventory on Tuesday, January 22nd.

Fed's Beige Book: Economic activity expanded at "modest or moderate" pace

by Calculated Risk on 1/16/2013 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicated that economic activity has expanded since the previous Beige Book report, with all twelve Districts characterizing the pace of growth as either modest or moderate. ... Overall, holiday sales were reported as being modestly higher than in 2011, though sales were below expectations for contacts in many of the Districts.And on real estate:

Since the previous Beige Book, consumer spending increased to some degree in all twelve Districts. Across the nation, holiday sales grew modestly compared with last year but came in below expectations in the New York, Cleveland, Atlanta, Chicago, and San Francisco Districts. ... Citing concerns that consumers will spend cautiously due to ongoing fiscal uncertainty, retail contacts and auto dealers reported a slightly dimmer, though positive, outlook for future sales.

Existing residential real estate activity expanded in all Districts that reported; growth rates were described as moderate or strong in nine Districts. Contacts in the Boston District attributed their strong sales growth to low interest rates, affordable prices, and rising rents. All Districts reporting on price levels saw increases; New York and Chicago reported only very minor increases. The five Districts that reported on housing inventories all reported falling levels. New residential construction (including repairs) expanded in all but one District of those Districts that reported. Contacts in the Kansas City District reported that increased lumber and drywall costs limited construction, causing a slight decline this period. Hurricane Sandy disrupted construction activity initially in New York, but this has since led to increased work for subcontractors on repairs and reconstruction.This suggests sluggish growth overall, with "moderate or strong" growth for real estate.

Though a little weaker than residential real estate, reports on sales and leasing of nonresidential real estate are still mostly positive--described as modest on average. The Boston District reported a drop in leasing beyond normal seasonal trends; contacts cited fiscal cliff uncertainty as a factor. Minneapolis and Kansas City reported increased demand and tightening commercial real estate markets. Philadelphia, St. Louis, and Dallas all reported more modest increases in nonresidential real estate activity. Nonresidential construction is weaker than residential, with only slight to modest growth.

Key Measures show low inflation in December

by Calculated Risk on 1/16/2013 11:59:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (1.9% annualized rate) in December. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.1% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for December here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was virtually flat 0.0% (-0.2% annualized rate) in December. The CPI less food and energy increased 0.1% (1.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for November and increased 1.5% year-over-year.

On a monthly basis, median CPI was at 1.9% annualized, trimmed-mean CPI was at 1.1% annualized, and core CPI increased 1.2% annualized. Also core PCE for November increased 1.6% annualized. These measures suggest inflation is below the Fed's target of 2% on a year-over-year basis.

With this low level of inflation and the current high level of unemployment, the Fed will keep the "pedal to the metal".

Builder Confidence unchanged in January

by Calculated Risk on 1/16/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged in January at 47. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Holds Steady in January

Builder confidence in the market for newly built, single-family homes was unchanged in January, remaining at a level of 47 on the National Association of Home Builders/Wells Fargo Housing Market Index, released today. This means that following eight consecutive monthly gains, the index continues to hold at its highest level since April of 2006.

...

“Builders’ sentiment remains very close to the index’s tipping point of 50, where an equal number of builders view conditions as good and poor, and fundamentals indicate continued momentum in housing this year,” said NAHB Chief Economist David Crowe. “However, persistently tight mortgage credit conditions, difficulties in obtaining accurate appraisals and the ongoing stalemate in Washington over critical economic concerns continue to impede the housing recovery.”

...

The index’s components were mixed in January. The component gauging current sales conditions remained unchanged at 51. Meanwhile, the component gauging sales expectations in the next six months fell one point to 49 and the component gauging traffic of prospective buyers gained one point to 37.

The HMI three-month moving average was up across all regions, with the Northeast and Midwest posting a two-point gain to 36 and 50, respectively. The South registered a three-point gain to 49 and the West posted a four-point increase to 51.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts (December housing starts will be released tomorrow). This was slightly below the consensus estimate of a reading of 48.

Fed: Industrial Production increased 0.3% in December

by Calculated Risk on 1/16/2013 09:28:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.3 percent in December after having risen 1.0 percent in November when production rebounded in the industries that had been negatively affected by Hurricane Sandy in late October. For the fourth quarter as a whole, total industrial production moved up at an annual rate of 1.0 percent. Manufacturing output advanced 0.8 percent in December following a gain of 1.3 percent in November; production edged up at an annual rate of 0.2 percent in the fourth quarter. The output at mines rose 0.6 percent in December, and the output of utilities fell 4.8 percent as unseasonably warm weather held down the demand for heating. At 98.1 percent of its 2007 average, total industrial production in December was 2.2 percent above its year-earlier level. Capacity utilization for total industry moved up 0.1 percentage point to 78.8 percent, a rate 1.5 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.8% is still 1.5 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December to 98.1. This is 17.5% above the recession low, but still 2.6% below the pre-recession peak.

Both Industrial Production and Capacity Utilization were slightly above expectations.

BLS: CPI unchanged in December, Core CPI increases 0.1%

by Calculated Risk on 1/16/2013 08:39:00 AM

From the Bureau of Labor Statistics (BLS): Consumer Price Index - December 2012

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in December on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment. The gasoline index declined again in December, but other indexes, notably food and shelter, increased, resulting in the seasonally adjusted all items index being unchanged.On a year-over-year basis, CPI is up 1.7 percent, and core CPI is up 1.9 percent. Both below the Fed's target. This was at the consensus forecast of no change for CPI, and a 0.1% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in December, the same increase as in November. ... The index for all items less food and energy rose 1.9 percent over the last 12 months, the same figure as last month.

I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Tuesday, January 15, 2013

Wednesday: CPI, Industrial Production, Homebuilder Confidence, Beige Book

by Calculated Risk on 1/15/2013 08:30:00 PM

Former Republican Senator Alan Simpson was on CNBC today. Here was the Q&A on the debt ceiling:

Maria Bartiromo: "Do you believe the GOP should be using the debt ceiling as leverage point to get the President to agree to the cuts?"

Alan Simpson: "I think that would be a grave mistake. I don’t think that would solve anything. I know they are going to try it, and how far you go with a game of chicken, I have no idea. But I can tell you … you can’t, you really can’t … This is stuff we’ve already indebted ourselves. If you’re a real conservative – a really honest conservative, without hypocrisy – you’d want to pay your debt. And that’s what this is, they are not running up anything new."

I disagree with Simpson on many issues, but I agree with this point. No honest conservative would vote against paying the bills. So lets have a vote tomorrow. Wednesday would be a good day to authorize paying the bills (aka raising the "debt ceiling") and put this nonsense behind us.

The real budget issues are the "sequester" and the "continuing resolution". See my earlier post: After the Debt Ceiling is increased ... Make sure to check the graph of the deficit as a percent of GDP; it might surprise some people.

Wednesday economic releases:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Consumer Price Index for December. The consensus is for no change in CPI in December and for core CPI to increase 0.1%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.2% increase in Industrial Production in December, and for Capacity Utilization to increase to 78.5%.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in December. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts.