by Calculated Risk on 2/02/2012 10:00:00 AM

Thursday, February 02, 2012

Bernanke Testimony: "The Economic Outlook and the Federal Budget Situation"

Fed Chairman Ben Bernanke's testimony, "The Economic Outlook and the Federal Budget Situation", Before the Committee on the Budget, U.S. House of Representatives.

Here is the CSpan feed

Here is the CNBC video feed.

Prepared testimony: The Economic Outlook and the Federal Budget Situation

Weekly Initial Unemployment Claims decline to 367,000

by Calculated Risk on 2/02/2012 08:30:00 AM

The DOL reports:

In the week ending January 28, the advance figure for seasonally adjusted initial claims was 367,000, a decrease of 12,000 from the previous week's revised figure of 379,000. The 4-week moving average was 375,750, a decrease of 2,000 from the previous week's revised average of 377,750.The previous week was revised up to 379,000 from 377,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 375,750.

The 4-week moving average remains below 400,000.

And here is a long term graph of weekly claims:

Weekly claims have been bouncing around lately - January is a period with large seasonal adjustments and that can lead to some large swings. The 4-week average of weekly claims has been moving sideways this year after trending down over the last few months of 2011.

Wednesday, February 01, 2012

Q4 2011 GDP Details: Investment in Office, Mall, and Lodging, Residential Components

by Calculated Risk on 2/01/2012 07:21:00 PM

The BEA released the underlying details this week for the Q4 Advance GDP report. As expected, the recent pickup in non-residential structure investment has been for power and communication.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and then declined sharply. Investment has increased a little recently (probably mostly tenant improvements as opposed to new office buildings).

Click on graph for larger image.

Click on graph for larger image.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 62% from the peak (note that investment includes remodels, so this will not fall to zero).

Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by about 80%.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). This is happening again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

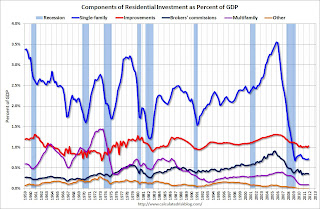

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures has been moving sideways for almost three years, although it might be moving up a little.

Investment in home improvement was at a $158 billion Seasonally Adjusted Annual Rate (SAAR) in Q4 (about 1.0% of GDP), significantly above the level of investment in single family structures of $109 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions declined slightly in Q4, and has been moving sideways as a percent of GDP.

And investment in multifamily structures is still moving sideways as a percent of GDP (increasing slowly in dollars). This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging. It appears that residential investment is starting to pickup, but from a very low level.

Earlier:

• ADP: Private Employment increased 170,000 in January

• Construction Spending increased 1.5% in December

• ISM Manufacturing index indicates faster expansion in January

• U.S. Light Vehicle Sales at 14.18 million annual rate in January

U.S. Light Vehicle Sales at 14.18 million annual rate in January

by Calculated Risk on 2/01/2012 03:50:00 PM

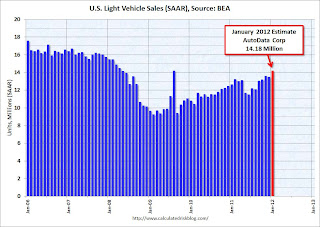

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.18 million SAAR in January. That is up 12.1% from January 2011, and up 5.1% from the sales rate last month (13.5 million SAAR in Dec 2011).

This was well above the consensus forecast of 13.6 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for December (red, light vehicle sales of 14.18 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

The annualized sales rate was up sharply from December, and this was about the same level as August 2009 with the spike in sales from "cash-for-clunkers". Excluding cash-for-clunkers this was the strongest sales month since April 2008.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales will probably make another strong positive contribution GDP in Q1 2012 GDP, although not as strong as in Q4 2011.

Another strong gain for auto sales.

Misc: REO to Rental Program, New Refinance Plan and Auto Sales

by Calculated Risk on 2/01/2012 01:20:00 PM

From the FHFA: FHFA Announces Interested Investors May Pre-Qualify For REO Initiative

The Federal Housing Finance Agency (FHFA) today announced the first step of a Real Estate Owned (REO) Initiative targeted to hardest-hit metropolitan areas announced in August 2011. Investors interested in participating may “pre-qualify” to establish eligibility to bid on transactions in the initial pilot phase as well as subsequent phases.From the WSJ: Obama Announces Refinancing Plan

...

During the pilot phase, Fannie Mae will offer for sale pools of various types of assets including rental properties, vacant properties and non-performing loans with a focus on the hardest-hit areas. The first transaction will be announced in the near-term.

...

FHFA is also looking at ways to improve REO sales to homeowners and small investors, enhancing the existing retail sales strategy at Fannie Mae and Freddie Mac. Both companies sell the majority of their REO properties to owner-occupants at close to market value.

The centerpiece of the announcement was the refinancing push, which complements an existing program that makes it easier for homeowners with mortgages backed by Fannie Mae and Freddie Mac to refinance.This would replace non-GSE loans with FHA insured loans. Since it requires congressional approval, it probably will not happen.

The new initiative would extend that opportunity to roughly one-third of all mortgages that aren't backed by federal entities and instead are owned by banks or were bundled by private firms that sold them off to investors as mortgage-backed securities. The Federal Housing Administration would instead guarantee the new loan.

To qualify, homeowners would have to be current on their last six mortgage payments and have no more than one delinquency in the previous six months.

And from the WSJ: January U.S. Auto Sales Jump

Chrysler Group LLC led the way as its January U.S. sales leapt 44% to 101,149 cars and light trucks while ... GM's January sales fell 6%, reflecting deep discounts and new models that fueled sales gains a year ago. ... Ford Motor Co. also said its U.S. sales rose 7.3% to 136,294 cars and light trucks.I'll post a graph after all the data is released - usually around 4 PM ET - of the seasonally adjusted annual sales rate for January.

Earlier:

• ADP: Private Employment increased 170,000 in January

• Construction Spending increased 1.5% in December

• ISM Manufacturing index indicates faster expansion in January

Construction Spending increased 1.5% in December

by Calculated Risk on 2/01/2012 11:32:00 AM

Catching up ... This morning the Census Bureau reported that overall construction spending increased in December:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during December 2011 was estimated at a seasonally adjusted annual rate of $816.4 billion, 1.5 percent (±1.4%) above the revised November estimate of $804.0 billion. The December figure is 4.3 percent (±1.9%) above the December 2010 estimate of $782.9 billion.Private construction spending increased in December:

The value of construction in 2011 was $787.4 billion, 2.0 percent (±1.1%) below the $803.6 billion spent in 2010.

Spending on private construction was at a seasonally adjusted annual rate of $529.7 billion, 2.1 percent (±1.1%) above the revised November estimate of $518.8 billion. Residential construction was at a seasonally adjusted annual rate of $241.2 billion in December, 0.8 percent (±1.3%)* above the revised November estimate of $239.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $288.5 billion in December, 3.3 percent (±1.1%) above the revised November estimate of $279.4 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 64% below the peak in early 2006, and non-residential spending is 30% below the peak in January 2008.

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is down on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit).

Earlier:

• ISM Manufacturing index indicates faster expansion in January

ISM Manufacturing index indicates faster expansion in January

by Calculated Risk on 2/01/2012 10:00:00 AM

PMI was at 54.1% in January, up from a revised 53.1% in December. The employment index was at 54.3%, down from a revised 54.8%, and new orders index was at 57.6%, up from a revised 54.8%.

From the Institute for Supply Management: January 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in January for the 30th consecutive month, and the overall economy grew for the 32nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 54.1 percent, an increase of 1 percentage point from December's seasonally adjusted reading of 53.1 percent, indicating expansion in the manufacturing sector for the 30th consecutive month. The New Orders Index increased 2.8 percentage points from December's seasonally adjusted reading to 57.6 percent, reflecting the 33rd consecutive month of growth in new orders. Prices of raw materials increased for the first time in the last four months. Manufacturing is starting out the year on a positive note, with new orders, production and employment all growing in January."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.5%, but the consensus was before the revisions. This suggests manufacturing expanded at a faster rate in January than in December. It appears manufacturing employment expanded in January with the employment index at 54.3%.

On revisions: Yesterday the ISM released their annual revisions and addressed the seasonality issue that was raised by analysts at Nomura last year. It appears the ISM index (and other indexes) overstated the strength in December after understating the strength earlier in the year. Nomura analysts noted last night that they believe the ISM revision reduces, but does not eliminate, the seasonal adjustment bias due to the financial crisis.

ADP: Private Employment increased 170,000 in January

by Calculated Risk on 2/01/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 170,000 from December to January on a seasonally adjusted basis. The estimated advance in employment from November to December was revised down to 292,000 from the initially reported 325,000.This was at the consensus forecast of an increase of 172,000 private sector jobs in January. The BLS reports on Friday, and the consensus is for an increase of 135,000 payroll jobs in January, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector rose 152,000 in January, and employment in the private, goods-producing sector increased 18,000 in January, while manufacturing employment increased 10,000.

Government payrolls have been shrinking, so the ADP report suggests around 150,000 private nonfarm payroll jobs added in January. Of course ADP hasn't been very useful in predicting the BLS report.

ISM Seasonality

by Calculated Risk on 2/01/2012 12:09:00 AM

This is technical. Earlier this month there was some discussion about how the ISM manufacturing survey might be overstating the strength of manufacturing in December due to some seasonal adjustment issues. Here was a story from FT Alphaville: ‘Tis (still) the seasonality, ISM edition

Today the ISM addressed this issue and released some revisions: ISM Report On Business® Seasonal Adjustments 2012

Seasonal adjustment factors are used to allow for the effects of repetitive intra-year variations resulting primarily from normal differences in weather conditions, various institutional arrangements, and differences attributable to non-movable holidays. It is standard practice to project the seasonal adjustment factors used to calculate the indexes one year ahead (2012).For December, the ISM PMI was revised down to 53.1 from 53.9.

This year's seasonal factor revisions include greater attention to two areas: series with marginal seasonality and with improved outlier detection. Due to this focus, the Department of Commerce recommended that ISM no longer seasonally adjust the ISM Manufacturing Inventories Index. Additionally, they recommended making revisions to all seasonally adjusted data for a longer time period than what ISM has typically done in the past.

In response to concerns that the unusually large declines in autumn 2008 associated with the recent recession that may not have been adequately handled with default settings, this year the Department of Commerce used lower thresholds (critical values) for detecting outliers. As a result of moving averages, these changes in outlier detection affected seasonal factors both before and after 2008; therefore, ISM is making revisions to seasonally adjusted data for the past seven years rather than the customary four-year period.

For January, the consensus is for a reading of 54.5, and this revision probably means the ISM PMI released Wednesday will be a little lower than consensus.

Tuesday, January 31, 2012

Mortgage Settlement: Ally Takes $270 million charge for "foreclosure related matters"

by Calculated Risk on 1/31/2012 07:07:00 PM

Another sign that the mortgage settlement will be announced soon ... from Ally Financial 8-K filed today:

Ally Financial Inc. (“Ally”) has concluded that it will record a charge of approximately $270 million in the fourth quarter of 2011 for penalties expected to be imposed by certain of our regulators and other governmental agencies in connection with foreclosure related matters, which is anticipated to result in an overall net loss for Ally in the fourth quarter. This charge was recorded effective December 31, 2011, considering developments subsequent to year-end.The mortgage settlement (deadline for states is Friday) is one of several upcoming policy announcements that could impact the economy both in the US and in Europe.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

• Real House Prices and House Price-to-Rent

• All current house price graphs

Fannie Mae Serious Delinquency rate declines, Freddie Mac rate increases

by Calculated Risk on 1/31/2012 04:27:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in December to 3.91%, down from 4.0% in November. This is down from 4.48% in December 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.58% in December, up from 3.57% in November. This is the fourth month in a row with a small increase in the delinquency rate. Freddie's rate is down from 3.84% in December 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The serious delinquency rate has been declining, but declining very slowly (Freddie's decline seems to have stalled). The reason for the slow decline is most likely the backlog of homes in the foreclosure process due to processing issues (aka robo-signing).

I expect a mortgage servicer settlement agreement to be reached very soon, and that will probably lead to more modifications and foreclosures - so the delinquency rate should start to decline faster.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

• Real House Prices and House Price-to-Rent

• All current house price graphs

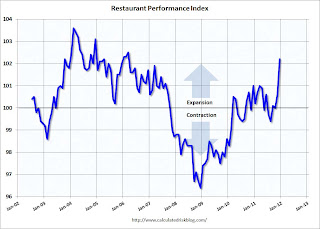

Restaurant Performance Index highest in almost six years in December

by Calculated Risk on 1/31/2012 02:28:00 PM

From the National Restaurant Association: Restaurant Performance Index Rose to Highest Level in Nearly Six Years in December

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.2 in December, up 1.6 percent from November and its highest level in nearly six years. In addition, December represented the third time in the last four months that the RPI stood above 100, which signifies expansion in the index of key industry indicators.Blame in on the lack of snow!

“Aided by favorable weather conditions in many parts of the country, a solid majority of restaurant operators reported higher same-store sales and customer traffic levels in December,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are solidly optimistic about sales growth in the months ahead, and their outlook for the economy is at its strongest point in nearly a year.”

...

Building on a solid November performance that saw the strongest same-store sales results in more than four years, restaurant operators reported even better numbers in December. ... Restaurant operators also reported solid customer traffic results in December. ... In addition to positive sales and traffic levels, capital spending activity among restaurant operators continues to trend upward. Forty-eight percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, the highest level in six months.

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.2 in December (above 100 indicates expansion).

The data for this index only goes back to 2002.

This is "D-list" data (at best), but restaurant spending is discretionary and can tell us a little something about the overall economy. This index showed contraction in July and August, but is now solidly positive.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

• Real House Prices and House Price-to-Rent

• All current house price graphs

Real House Prices and House Price-to-Rent

by Calculated Risk on 1/31/2012 11:47:00 AM

A monthly update: Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to February 2003 levels, and the CoreLogic index is back to April 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 1999 levels, the Composite 20 index is back to April 2000, and the CoreLogic index back to February 2000.

In real terms, all appreciation in the '00s is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to April 2000 levels, and the CoreLogic index is back to February 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to 2000 levels and will probably be back to 1999 levels within the next few months.

Note: In late 2010 I guessed that prices would decline another 5% to 10% on these national indexes (from October 2010 prices). So far prices have fallen another 4% to 5% on these indexes.

Earlier:

• Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

HVS: Q4 Homeownership and Vacancy Rates

by Calculated Risk on 1/31/2012 10:15:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q4 this morning.

As Tom Lawler has been discussing, this is from a fairly small sample, and the homeownership and vacancy rates are higher than estimated in other reports (like Census 2010). This report is commonly used by analysts to estimate the excess vacant supply for housing, but it doesn't appear to be useful for that purpose.

It might show the trend, but I wouldn't rely on the absolute numbers.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate declined to 66.0%, down from to 66.3% in Q3 2011.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The Census researchers are investigating differences in Census 2010, ACS 2010, and HVS 2010 vacant housing unit estimates, but there is no scheduled date for any report.

The Census researchers are investigating differences in Census 2010, ACS 2010, and HVS 2010 vacant housing unit estimates, but there is no scheduled date for any report.

The HVS homeowner vacancy rate declined to 2.3% from 2.4% in Q3. This is the lowest level since early 2006 for this report.

The homeowner vacancy rate has probably peaked and is now declining. However - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate declined to 9.4% from 9.8% in Q3.

The rental vacancy rate declined to 9.4% from 9.8% in Q3.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and Reis reported that the rental vacancy rate has fallen to the lowest level since 2001.

This is the most timely survey on households, but unfortunately the survey has serious issues - and sadly many analysts still use this survey to estimate the excess vacant supply. However this does suggest that the housing vacancy rates are falling.

Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

by Calculated Risk on 1/31/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November (a 3 month average of September, October, and November). This release includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Continued to Decline in November 2011 According to the S&P/Case-Shiller Home Price Indices

Data through November 2011, released today by S&P Indices for its S&P/Case-Shiller1 Home Price Indices ... showed declines of 1.3% for both the 10- and 20-City Composites in November over October. For a second consecutive month, 19 of the 20 cities covered by the indices also saw home prices decrease. The 10- and 20-City composites posted annual returns of -3.6% and -3.7% versus November 2010, respectively. These are worse than the -3.2% and -3.4% respective rates reported for October.

“Despite continued low interest rates and better real GDP growth in the fourth quarter, home prices continue to fall. Weakness was seen as 19 of 20 cities saw average home prices decline in November over October,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “... Nationally, home prices are lower than a year ago. The 10-City Composite was down 3.6% and the 20-City was down 3.7% compared to November 2010. The trend is down and there are few, if any, signs in the numbers that a turning point is close at hand."

“The crisis low for the 10-City Composite was April 2009; for the 20-City Composite the more recent low was March 2011. The 10-City Composite is now about 1.0% above its low, and the 20-City Composite is only 0.6% above its low. From their 2006 peaks, both Composites are down close to 33% through November.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 33.5% from the peak, and down 0.7% in November (SA). The Composite 10 is at a new post bubble low (Seasonally adjusted), but still above the low NSA.

The Composite 20 index is off 33.5% from the peak, and down 0.7% in November (SA). The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.6% compared to November 2010.

The Composite 20 SA is down 3.7% compared to November 2010. This was a slightly larger year-over-year decline for both indexes than in October.

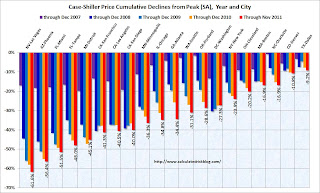

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 3 of the 20 Case-Shiller cities in November seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.2% from the peak.

Prices increased (SA) in 3 of the 20 Case-Shiller cities in November seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.2% from the peak.The NSA indexes are around 1% above the March 2011 lows - and these indexes will hit new lows in the next month or two since prices are falling again. Using the SA data, the Case-Shiller indexes are now at new post-bubble lows.

Monday, January 30, 2012

A few policies I expect soon

by Calculated Risk on 1/30/2012 10:52:00 PM

Housing, payroll tax extension, a Greek deal and more ...

• Mortgage Servicer Settlement. Loren Berlin at the HuffPo writes: As Mortgage Settlement Deal Nears Feb. 3 Deadline, Nevada AG Raises Concerns

As the Obama administration, state attorneys general and the nation's biggest banks close in on a settlement over allegations of widespread mortgage fraud, Nevada's attorney general is pushing back with concerns and questions. Meanwhile a Feb. 3 deadline looms for states to declare whether they are joining the settlement.It sounds like these issues will be clarified, and I expect most states (if not all) to join the settlement. Note that Masto has been working closely with California AG Harris.

In a letter sent Friday, emailed to federal officials and obtained by The Huffington Post, Nevada's attorney general, Catherine Cortez Masto, asked 38 questions relating to a variety of concerns, including fears that states would play second fiddle to the federal government in making decisions. She also questioned if states would lose their ability to pursue certain types of lawsuits against banks and whether states would get their fair share of the housing assistance for their borrowers.

• A surge in refinance activity in March. Not a new policy - this was announced last October when the FHFA made changes to Home Affordable Refinance Program (HARP) to allow more homeowners with GSE loans and with negative or near negative equity - and who are current on their mortgages - to refinance into lower interest rate loans.

The key to this program - for the lenders - was that the lender was not responsible for any of the representations and warranties associated with the original loan (this is huge for the lenders). The elimination of Reps and warrants for the original loans applies to Desktop Underwriter® (DU) and that will not be updated until March.

• REO to Rental Program: This rental program for Fannie and Freddie REO is being pushed by several agencies, and was discussed earlier this month in the Fed white paper "The U.S. Housing Market: Current Conditions and Policy Considerations" and by NY Fed President William Dudley: Housing and the Economic Recovery

This program could include bulk REO sales to investors, but might also include Fannie and Freddie renting out more REOs. There will be a similar effort for non-GSE properties as regulators relax the rules on banks renting out properties. Note: This program isn't needed in many areas because of the strong demand from small investor groups.

• Extension of payroll tax cut and extended unemployment benefits: The two month extension expires Feb 29th, and I expect these two programs will be extended through the end of the year. From Bloomberg: Boehner Says He’s Confident Congress Will Extend Payroll Tax-Cut

House Speaker John Boehner said he’s confident that Republicans and Democrats in Congress will agree to a payroll tax-cut extension supported by President Barack Obama.And on Europe:

“We are in a formal conference with the Senate, and I’m confident that we’ll be able to resolve this fairly quickly,” Boehner, an Ohio Republican, said on ABC’s “This Week” program yesterday.

• Although a default is possible, I expect the Greek debt deal and next bailout agreement to be reached sometime in February. From the Athens News: Troika stick delays PSI carrot

Despite its agreement with bondholders on all the parameters of private-sector involvement (PSI) in the Greek debt writedown, the government will have to wait for another week before winning approval from the EU-IMF-ECB troika for a second bailout package worth 130bn euros.These deals always happen at the last minute, and this will be no exception.

A timely PSI deal for the haircut of 50 percent – or 100bn euros – from the 205bn euro privately held portion of Greek debt was crucial to avert a Greek default before March 20 when a 14.4bn euro bond redemption comes due.

• The second round of the ECB's 3 year Long Term Refinancing Operation (LTRO) will probably be for over €1 trillion (the first 3 year LTRO was for €489 billion). The second auction will be held on February 29th. From the Financial Times: Banks set to double crisis loans from ECB

Several of the eurozone’s biggest banks have told the Financial Times that they could well double or triple their request for funds ... “Banks are not going to be as shy second time round,” said the head of one eurozone bank .. “We should have done more first time.”It may be well over €1 trillion.

excerpt with permission

Research: Weak labor demand explains increase in unemployment duration

by Calculated Risk on 1/30/2012 07:28:00 PM

The average duration of unemployment in the US increased sharply during the recent recession, and was still near the record high in December. One of the reasons the average has stayed high is because of a change in the measurement methodology, but even after accounting for that change, the duration is still near record levels.

Another measure - the median duration of unemployment - has declined slightly from a peak of 25 weeks in June 2010, to 21 weeks in December 2011. In the severe recession of the early '80s, the median duration peaked at 12.3 weeks, even though the unemployment rate was higher in the early '80s than during the recent employment recession.

Researchers Rob Valletta and Katherine Kuang at the San Francisco Fed look at the reasons the duration increased: Why Is Unemployment Duration So Long?

During the recent recession, unemployment duration reached levels well above those of past downturns. Duration has continued to rise during the uneven economic recovery that began in mid-2009. Elevated duration reflects such factors as changes in survey measurement, the demographic characteristics of the unemployed, and the availability of extended unemployment benefits. But the key explanation is the severe and persistent weakness in aggregate demand for labor.This seems obvious, but it is important for policymakers to understand that the primary cause of the increase in duration is not extended unemployment benefits or changes in demographics, but weak aggregate demand.

Mortgage Settlement: States face "end-of-the-week deadline"

by Calculated Risk on 1/30/2012 03:42:00 PM

From Reuters: States to decide this week on mortgage deal

State and federal officials are close to a settlement with the largest U.S. banks over mortgage abuses, with states facing an end-of-the-week deadline to decide whether they will sign on, people close to the talks said.If this settlement goes forward (and I expect it will), then there will be more modification and foreclosure activity in coming months.

... negotiators have overcome a sticking point and agreed on Joseph Smith, North Carolina's banking commissioner, as a monitor to ensure the banks comply with the terms of the settlement ...

In exchange for up to $25 billion, much in the form of cutting mortgage debt for distressed homeowners, the banks will resolve civil state and federal lawsuits about servicing misconduct and faulty foreclosures, and state lawsuits about how they made some of the loans.

This is just one of several policy changes in the works including the automated HARP refinance program (starts in March) and a possible GSE REO to rental program. Plus the Federal Reserve is "contemplating issuing guidance to banking organizations and examiners" to allow banks to also rent more residential REO.

Currently, according to LPS, there are 1.79 million loans 90+ days delinquent and an additional 2.07 million loans in the foreclosure process.

As I noted earlier this year, it appears the overall goal of these policy changes is to reduce the large backlog of seriously delinquent loans while, at the same time, not flood the housing market with distressed homes.

Fed Senior Loan Officer Survey: Lending standards "little changed", "somewhat stronger loan demand"

by Calculated Risk on 1/30/2012 02:00:00 PM

The Federal Reserve released the quarterly January 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices today. The survey had "three sets of special questions: the first set asked banks about lending to firms with European exposures; the second set asked banks about changes in their lending policies on commercial real estate (CRE) loans over the past year; and the third set asked banks about their outlook for credit quality in 2012."

Overall, in the January survey, domestic banks reported that their lending standards had changed little and that they had experienced somewhat stronger loan demand, on net, over the past three months.On Europe:

...

On the household side, lending standards and demand for loans to purchase residential real estate were reportedly little changed over the fourth quarter on net. Standards on home equity lines of credit (HELOCs) were about unchanged, while demand for such loans weakened on balance. Moderate net fractions of banks reported that they had eased standards on all types of consumer loans over the past three months, and some banks also eased terms on auto loans. Demand for credit card and auto loans reportedly had increased somewhat, while demand for other types of consumer loans was about unchanged.

Large fractions of domestic and foreign respondents again reported having tightened standards on loans to European banks or their affiliates and subsidiaries. There was more widespread tightening of standards than in the previous survey on loans to nonfinancial firms that have operations in the United States and significant exposures to European economies. Demand for credit was reportedly little changed, on net, from European banks (or their affiliates and subsidiaries) and from nonfinancial firms with significant European exposures.On CRE:

A new special question asked if domestic respondents had experienced an increase in business over the past six months as a result of decreased competition from European banks (or their affiliates and subsidiaries). About half of the respondents who reported competing with European banks noted such an increase in business.

The January survey also included a question regarding changes in terms on CRE loans over the past year (repeated annually since 2001). During the past 12 months, on net, some domestic banks reportedly eased maximum CRE loan sizes and many domestic banks trimmed loan rate spreads. A few large domestic banks, on balance, reported that they had lengthened maximum loan maturities. Other terms for CRE loans were reportedly little changed. The January results were the first in five years to find a net easing in some of the CRE loan terms covered in the survey.On credit quality in 2012:

The January survey contained a set of special questions that asked banks about their outlook for delinquencies and charge-offs across major loan categories in the current year, assuming that economic activity progresses in line with consensus forecasts. These questions have been asked once each year for the past six years. Overall, between 15 and 60 percent of domestic banks, on net, expected improvements in delinquency and charge-off rates during 2012 in the major loan categories included in the survey.There are several charts here.

So far the European financial crisis hasn't led to tighter lending standards in the U.S., but standards remain pretty tight.

Dallas Fed Manufacturing Survey shows expansion in January

by Calculated Risk on 1/30/2012 10:39:00 AM

This is the last of the regional Fed surveys for January. The regional surveys provide a hint about the ISM manufacturing index - and all of the regional surveys were stronger in January.

From the Dallas Fed: Texas Manufacturing Activity Picks Up

Texas factory activity increased in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 0.2 to 5.8, suggesting growth resumed this month.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing conditions also indicated growth in January. The new orders index jumped to 9.5, its highest reading in six months, after two months in negative territory. ... Perceptions of broader economic conditions were notably more positive in January. The general business activity index shot up to 15.3 after dipping into negative territory in December.

...

Labor market indicators reflected continued labor demand growth. The employment index came in at 12.2, up from 9.9 in December. ... The hours worked index continued to suggest average workweeks lengthened.

...

Expectations regarding future business conditions were markedly more optimistic in January.

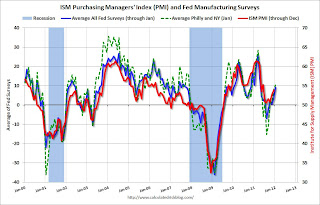

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through January), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

The ISM index for January will be released Wednesday, Feb 1st and the regional surveys suggest another small increase in January. The consensus is for a slight increase to 54.5 from 53.9 in December.