by Calculated Risk on 1/19/2012 08:30:00 AM

Thursday, January 19, 2012

Weekly Initial Unemployment Claims decline to 352,000

The DOL reports:

In the week ending January 14, the advance figure for seasonally adjusted initial claims was 352,000, a decrease of 50,000 from the previous week's revised figure of 402,000. The 4-week moving average was 379,000, a decrease of 3,500 from the previous week's revised average of 382,500.The previous week was revised up to 402,000 from 399,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 379,000.

The 4-week moving average is well below 400,000.

And here is a long term graph of weekly claims:

This is the lowest level for weekly claims since April 2008.

Summary of Busy Day

by Calculated Risk on 1/19/2012 12:01:00 AM

• From the LA Times: SOPA blackout: Bills lose three co-sponsors amid protests

Three co-sponsors of the SOPA and PIPA antipiracy bills have publicly withdrawn their support as Wikipedia [,hoocoodanode.org] and thousands of other websites blacked out their pages Wednesday to protest the legislation.• NAHB Builder Confidence index increases in January

Sen. Marco Rubio (R-Fla.) withdrew as a co-sponsor of the Protect IP Act in the Senate, while Reps. Lee Terry (R-Neb.) and Ben Quayle (R-Ariz.) said they were pulling their names from the companion House bill, the Stop Online Piracy Act.

• Industrial Production increased 0.4% in December, Capacity Utilization increased

• AIA: Architecture Billings Index indicated expansion in December

• MBA: Mortgage Refinance Applications increase sharply

• Residential Remodeling Index declines seasonally in November

Wednesday, January 18, 2012

FNC and Zillow House Price Indexes for November

by Calculated Risk on 1/18/2012 06:15:00 PM

Note: The Case-Shiller House Price index for November will be released Tuesday, Jan 31st. CoreLogic has already reported that prices declined 1.4% in November (NSA, including foreclosures).

• Today from FNC: November Home Prices Decline 0.4%

Based on the latest data on non-distressed home sales (existing and new homes) through November, FNC’s national RPI shows that single-family home prices fell in November to a seasonally unadjusted rate of 0.4%. As a gauge of underlying home value, the RPI excludes sales of foreclosed homes, which are frequently sold with large price discounts reflecting poor property conditions.The FNC index tables for three composite indexes and 30 cities are here.

All three RPI composites (the National, 30-MSA, and 10-MSA indices) show month-to-month declines in November, ranging from -0.4% at the national level to -0.9% across the nation’s top 10 housing markets. ... The two broader indices indicate a nearly 5.0% decline in the 12-month period between November 2010 and November 2011, or -0.4% per month on an annualized basis. The 10-MSA composite index lost about 4.0% during the period, or -0.3% per month annualized.

• Last week From Zillow: U.S. Home Values Unchanged in November

TThe Zillow Real Estate Market Reports, released today, show home values remained essentially flat from October to November falling only 0.1 percent to $147,800, representing a 4.6 percent decline on a year-over-year basis. ... Home values are back to late 2003 levels and mortgage rates are still below 4 percent for a 30-year fixed rate mortgage.In nominal terms, Case-Shiller and CoreLogic show prices are back to 2003 levels too. In real terms (and as a price-to-rent ratio), prices are back to 2000 levels.

Even though there are some differences between the indexes, on a year-over-year basis they are fairly close with CoreLogic down 4.3%, FNC down 4.9%, and Zillow down 4.6%.

HUD Secretary Donovan : Mortgage Settlement "Very Close"

by Calculated Risk on 1/18/2012 03:21:00 PM

From the WSJ: U.S., Banks Near 'Robo-Signing' Settlement

Administration officials and attorneys general are "very close" to a settlement with major banks of the so-called robo-signing issues after about a year of negotiations, [Housing and Urban Development Secretary Shaun Donovan] said at a conference of U.S. mayors meeting in Washington.The settlement was "close" last year, and now it is "very close". The story mentions some regional banks taking charges that appear related to the settlement - and that suggests "very close" is probably means the next month or two.

The reductions in borrowers' principal balances contained in the settlement, Mr. Donovan said, will be "far and away the largest principal reduction of the [housing] crisis" ...

For months, officials have said that a settlement is close, only to be frustrated by new hurdles. ... Meanwhile, regional banks are also preparing for an agreement. U.S. Bancorp Inc. said Wednesday that it took a $130 million fourth-quarter charge tied to matters that involve collecting mortgage payments and foreclosing on delinquent home owners.

AIA: Architecture Billings Index indicated expansion in December

by Calculated Risk on 1/18/2012 12:11:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Positive for Second Straight Month

After showing struggling business conditions for most of 2011, the Architecture Billings Index (ABI) has now reached positive terrain in consecutive months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the December ABI score was 52.0, following the exact same mark in November. This score reflects an overall increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.0, down just a point from a reading of 65.0 the previous month.

“We saw nearly identical conditions in November and December of 2010 only to see momentum sputter and billings fall into negative territory as we moved through 2011, so it’s too early to be sure that we are in a full recovery mode,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Nevertheless, this is very good news for the design and construction industry and it’s entirely possible conditions will slowly continue to improve as the year progresses.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was unchanged at 52.0 in December. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.

NAHB Builder Confidence index increases in January

by Calculated Risk on 1/18/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in January to 25 from 21 in December. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Fourth Consecutive Time in January

Builder confidence in the market for newly built, single-family homes continued to climb for a fourth consecutive month in January, rising four points to 25 on the NAHB/Wells Fargo Housing Market Index (HMI), released today. This is the highest level the index has attained since June of 2007.

...

“Builders are seeing greater interest among potential buyers as employment and consumer confidence slowly improve in a growing number of markets, and this has helped to move the confidence gauge up from near-historic lows in the first half of 2011,” noted NAHB Chief Economist David Crowe. “That said, caution remains the word of the day as many builders continue to voice concerns about potential clients being unable to qualify for an affordable mortgage, appraisals coming through below construction cost, and the continuing flow of foreclosed properties hitting the market.”

...

Each of the HMI’s three component indexes registered a fourth consecutive month of improvement in January. The component gauging current sales conditions rose three points to 25, which was its highest point since June of 2007. The component gauging sales expectations in the next six months also rose three points, to 29 -- its highest point since September 2009. And the component gauging traffic of prospective buyers rose three points to 21, its highest point since June of 2007.

The HMI also posted gains in all four regions in January, including a nine-point gain to 23 in the Northeast, a one-point gain to 24 in the Midwest, a two-point gain to 27 in the South and a five-point gain to 21 in the West.

Click on graph for larger image.

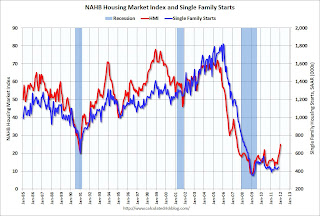

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts (December housing starts will be released tomorrow).

Both confidence and housing starts had been moving sideways at a very depressed level for several years - but confidence has been moving up.

This is still very low, but this is the highest level since June 2007.

Industrial Production increased 0.4% in December, Capacity Utilization increased

by Calculated Risk on 1/18/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.4 percent in December after having fallen 0.3 percent in November. For the fourth quarter as a whole, industrial production rose at an annual rate of 3.1 percent, its 10th consecutive quarterly gain. In the manufacturing sector, output advanced 0.9 percent in December with similarly sized gains for both durables and nondurables. The output of utilities fell 2.7 percent, as unseasonably warm weather reduced the demand for heating; the output of mines moved up 0.3 percent. At 95.3 percent of its 2007 average, total industrial production in December was 2.9 percent above its level of a year earlier. The capacity utilization rate for total industry rose to 78.1 percent, a rate 2.3 percentage points below its long-run (1972--2010) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is still 2.3 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December to 95.3, and previous months were revised up slightly.

The consensus was for a 0.5% increase in Industrial Production in December, and for an increase to 78.1% for Capacity Utilization. This was close to consensus.

MBA: Mortgage Refinance Applications increase sharply

by Calculated Risk on 1/18/2012 08:33:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 26.4 percent from the previous week to its highest level since August 8, 2011. The seasonally adjusted Purchase Index increased 10.3 percent from one week earlier to its highest level since December 12, 2011.The following graph shows the MBA Purchase Index and four week moving average since 1990.

"Interest rates dropped last week due to continuing anxieties regarding the fragile economic situation in Europe," said Michael Fratantoni, MBA's Vice President of Research and Economics. Fratantoni continued, "With mortgage rates reaching new lows, refinance volume jumped and MBA's refinance index reached its highest level in the last six months. Purchase activity also increased as buyers returned to the market after the holiday season."

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.06 percent from 4.11 percent ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 4.40 percent from 4.34 percent

...

Click on graph for larger image.

Click on graph for larger image.The purchase index increased last week, and the 4-week average also increased. This index has mostly been sideways for the last 2 years - and even with the recent increase, this is at about the same level as in 1997.

Residential Remodeling Index declines seasonally in November

by Calculated Risk on 1/18/2012 12:23:00 AM

The BuildFax Residential Remodeling Index was at 137.9 in November, down from 147.6 in October, but up 33.5% from November 2010. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax Remodeling Index

The Residential BuildFax Remodeling Index rose 33.5% year-over-year in November--for the twenty-fifth straight month of growth--to 137.9. However, this also marked the first month-over-month drop since February, likely due to seasonal factors. Residential remodels in November were down month-over-month 9.7 points (6.6%) from the October value of 147.6, and up year-over-year 34.6 points from the November 2010 value of 103.3.

...

"Residential remodeling in 2011 grew substantially above 2010 rates and remained strong through the end of the year," said Joe Emison, Vice President of Research and Development at BuildFax. "However, we do expect to see the number of remodeling permits decrease on a month-over-month basis for the duration of the winter."

Click on graph for larger image.

Click on graph for larger image.Although the index declined in November, this is the highest level for a November since the index started in 2004, even above the levels from 2004 through 2006 during the home equity ("home ATM") withdrawal boom.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 33.5% from November 2010. This is the 25th consecutive month with a year-over-year increase.

Even though new home construction is still moving sideways, two other components of residential investment probably increased in 2011: multi-family construction and home improvement.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Tuesday, January 17, 2012

QOTD: Housing "markets get healthy from the bottom up"

by Calculated Risk on 1/17/2012 07:43:00 PM

From the WSJ: From Bottom Up, Signs of Housing Recovery (ht Brian)

Across Westchester, the number of buyers in contract to buy homes priced less than $500,000 at the end of 2011 rose by nearly 40% compared to a year earlier, according to a market report issued by the broker Houlihan Lawrence. Sales weakened at higher price points.The article doesn't discuss the role of investors buying, and investor buying is at record levels in California and other bubble states.

Analysts have noted a similar pattern in New Jersey. Sales have picked up due to buyers of properties priced less than $400,000, according to data compiled by the Otteau Valuation Group. The number of such contracts signed during the fourth quarter rose by 11.3% compared to the same period a year earlier.

Analysts said housing-market recoveries often begin at the bottom.

"It is nice when you get the high end of the market doing well," said Chris Meyers, chief operating officer of Houlihan Lawrence, the largest residential brokerage in Westchester, "but in our experience the strong markets get healthy from the bottom up."

Also the article doesn't mention the higher conforming loan limits from Fannie and Freddie in Westchester. But there is some truth to the quote "markets get healthy from the bottom up".

LA area Port Traffic increases slightly year-over-year in December

by Calculated Risk on 1/17/2012 03:21:00 PM

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for November. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is up 0.2% from November, and outbound traffic is up 0.1%.

On a rolling 12 month basis, outbound traffic is moving "sideways" for the last couple of months, and it appears inbound traffic has halted the recent decline.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of December, loaded inbound traffic was up 2% compared to December 2010, and loaded outbound traffic was up 1% compared to December 2010.

For the month of December, loaded inbound traffic was up 2% compared to December 2010, and loaded outbound traffic was up 1% compared to December 2010.

Exports have been increasing, although the rate of increase has slowed.

Imports have been somewhat soft - this is the first month with a year-over-year increase since May 2011.

DataQuick: SoCal Home Sales decline year-over-year, Record investor buying

by Calculated Risk on 1/17/2012 01:35:00 PM

This report is only for Southern California, but it contains useful information for analyzing the housing market. Over half the sales in SoCal were distressed in December (foreclosures and short sales), over one quarter of the sales were to absentee owners (usually investors), and new home sales were at a record low in December. Note: DataQuick reports new home sales at closing and the Census Bureau reports when contracts are signed - so this is for contracts signed last six months ago.

From DataQuick: Southland December Home Sales, Prices Fall Short of a Year Earlier

Southern California home sales surged last month from November – as they normally do – amid relatively strong activity under $300,000 and a record share of sales to “absentee” buyers, mainly investors. ... A total of 19,247 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in December. That was up 14.0 percent from 16,884 in November but down 1.4 percent from 19,528 in December 2010, according to San Diego-based DataQuick.The National Association of Realtors (NAR) will report December existing home sales on Friday. The consensus is for sales of 4.6 million on seasonally adjusted annual rate basis.

...

While December sales of existing (not new) houses and condos combined fell 0.5 percent from a year earlier, sales of newly built homes fell 12.0 percent year-over-year, to the lowest level on record for a December.

“Last year ended much the way it began, with pitifully low new-home sales, record investor activity, drum-tight credit, and lots of potential buyers and sellers just sitting tight,” said John Walsh, DataQuick president.

...

Distressed property sales accounted for 52.5 percent of the Southland resale market last month, up from 51.2 percent in November but down from 53.8 percent a year earlier. Nearly one out of three homes resold last month was a foreclosure, while about one in five was a “short sale.”

...

Absentee buyers, mainly investors and vacation-home buyers, purchased a record 26.4 percent of the Southland homes sold in December, paying a median $200,000. ... The December absentee figure was up from 25.1 percent in November and up from 23.4 percent a year earlier.

Economist Tom Lawler estimates the NAR will report sales of 4.64 million, up about 5% from November’s pace. He also expects the NAR to report inventory declined to around 2.44 million, down 5.4% from November and down 19.2% from last December. This would put months-of-supply at around 6.3 months (lowest since early 2006), and would put listed inventory at the lowest level since early-2005.

Credit Stress Indicators: Little Spillover to US from Europe

by Calculated Risk on 1/17/2012 12:05:00 PM

As we've discussed, there are several possible channels of contagion from the European financial crisis. The most obvious is the trade channel. The recession in Europe appears to already be negatively impacting U.S. exports. The most recent trade report showed exports to eurozone countries declined 6.9% in November. Although Europe is a major U.S. trading partner, exports only make up a small portion of U.S. GDP, and the drag from lower exports will be minimal.

A more significant channel would be tightening of U.S. credit conditions in response to the European crisis. I will look closely at the Fed’s January Senior Loan Officer Opinion Survey on Bank Lending Practices that will be released at the end of the month. The October survey showed “considerable” tightening on lending to European banks, and some tightening to European firms, but the survey showed no significant additional tightening in the U.S.

Since the most significant channel will probably be credit stress, here are a few indicators of credit stress:

• The three month LIBOR has decreased:

Data from the British Bankers' Association showed the three-month dollar London Interbank Offered Rate, or Libor, was fixed at 0.56230%, down from 0.56490% Monday. ... The spread between the three-month dollar Libor and overnight index swaps, a barometer of market stress, was unchanged at 48 basis points.The three-month LIBOR rate peaked during the crisis at 4.81875% on Oct 10, 2008. This increased last year, but has mostly been sideways since then.

• The TED spread is at 0.537. The TED spread is the difference between the three month T-bill and the LIBOR interest rate. This peaked in December at 0.581 and has declined slightly since then. The 5 year graph shows that recent increase in comparison to the U.S. financial crisis in 2008.

Here is a screen shot of the TED spread from Bloomberg.

Here is a screen shot of the TED spread from Bloomberg. Click on graph for larger image.

The peak was 4.63 on Oct 10, 2008. A normal spread is around 0.5.

• The A2P2 spread as at 0.39. This spread is mostly moving sideways, and is far below the peak of the financial crisis of 5.86.

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now high quality 30 day nonfinancial paper is yielding close to zero.

•

The two year swap spread screen shot from Bloomberg. This spread has declined to 34.3.

The two year swap spread screen shot from Bloomberg. This spread has declined to 34.3. This spread peaked at near 165 in early October 2008.

So far there hasn't been much spillover to the U.S.

NY Fed Survey: Manufacturing activity expanded at a faster pace in January

by Calculated Risk on 1/17/2012 08:39:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that manufacturing activity expanded in New York State in January. The general business conditions index climbed five points to 13.5. The new orders index rose eight points to 13.7 and the shipments index inched up to 21.7. ... Future indexes conveyed a high degree of optimism about the six-month outlook, with the future general business conditions index rising nine points to 54.9, its highest level since January 2011.On employment:

Employment indexes were positive and higher, pointing to higher employment levels [12.1 up from 2.3] and a longer average workweek [6.6 up from -2.3]. ... On a series of supplementary survey questions, 51 percent of respondents indicated that they expect their workforces to increase over the next six to twelve months, while just 9 percent predicted declines in the total number of workers—results noticeably more positive than in the June 2011 survey.This was slightly above the consensus forecast of a reading of 10.5 (above 0 is expansion). The future indexes and employment readings were especially encouraging.

Weekend:

• Summary for Week Ending January 13th

• Schedule for Week of Jan 15th

Monday, January 16, 2012

Monday Night Futures: China GDP increases 8.9% year-over-year

by Calculated Risk on 1/16/2012 10:03:00 PM

From the MarketWatch: China fourth-quarter GDP up 8.9%

The country's GDP in the October to December period rose 8.9% from the year-ago quarter, weaker than the 9.1% expansion recorded in the three months to Sept. 30, but faster than the 8.6% growth tipped in a Dow Jones Newswires poll of economists. Other monthly economic indicators also beat expectations, with December retail sales climbing 18.1% from a year-earlier, while industrial output during the month rose 12.8%.The Asian markets are green tonight. The Nikkei is up about 0.6%, and the Hang Seng is up 1.5%. The Seoul Composite is up 1.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up about 4 and Dow futures are up 40.

Oil: WTI futures are up to $99.90 and Brent is up to $111.80 per barrel.

Yesterday:

• Summary for Week Ending January 13th

• Schedule for Week of Jan 15th

Comparing New Home Sales and Housing Starts

by Calculated Risk on 1/16/2012 05:05:00 PM

Earlier I posted some housing forecasts for 2012. A frequently asked question is how do new home sales compare to single family housing starts (both series are from the Census Bureau). This graph below shows the two series - although they track each other, the two series cannot be directly compared.

For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. From the Census Bureau: Comparing New Home Sales and New Residential Construction

Click on graph for larger image.

Click on graph for larger image.

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series. We categorize new residential construction into four intents, or purposes:However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The Q3 2011 quarterly report showed that there were 79,000 single family starts, built for sale, in Q3 2011, and that was about the same as the 77,000 new homes sold for the same quarter. This data is Not Seasonally Adjusted (NSA).

Built for sale (or speculatively built): the builder is offering the house and the developed lot for sale as one transaction this includes houses where ownership of the entire property including the land is acquired ("fee simple") as well as houses sold for cooperative or condominium ownership. These are the units measured in the New Residential Sales series.

Contractor-built (or custom-built): the house is built for the landowner by a general contractor, or the land and the house are purchased in separate transactions.

Owner-built: the house is built entirely by the landowner or by the landowner acting as his/her own general contractor.

Built for rent: the house is built with the intent that it be placed on the rental market when it is completed.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts (blue) were higher than sales (red), and inventories of new homes increased.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts (blue) were higher than sales (red), and inventories of new homes increased. Sales and starts have been running at about the same level for the last 2 years. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory they built up in 2005 and 2006.

Some Bullish Housing Forecasts for 2012

by Calculated Risk on 1/16/2012 01:14:00 PM

Earlier I posted some housing forecasts from analysts at Wells Fargo, Goldman Sachs, and added two more forecasts from Merrill Lynch and John Burns.

David Crowe, chief economist at the National Association of Home Builders has put out his forecasts (excel) calling for new home sales to increase to 360 thousand in 2012 (from 304 thousand in 2011), and for housing starts to increase 17% to 709 thousand. He forecasts single family starts will also increase 17% to 501 thousand. Crowe expects a significant increase in new home sales in 2013.

But here is the most optimistic forecast I've seen from Moody's via Julie Schmit at USA Today: Housing outlook is more upbeat

Existing home sales will rise 12% this year after a 2% increase last year, and new home sales, coming off a horrid year, will jump 74% this year, Moody's Analytics predicts.That would put single family starts (not total starts) at 687 thousand in 2012, and new home sales at 530 thousand.

Single-family housing starts will rise 37% this year, Moody's predicts, after falling 9% last year.

Here is a table of some recent forecasts. I expect some increase in 2012 for both starts and new home sales, but I think the Wells Fargo / John Burns / NAHB forecasts are probably the upper range for 2012.

| Some Housing Forecasts for 2012 (000s) | |||

|---|---|---|---|

| New Home Sales | Single Family Starts | Total Starts | |

| Merrill Lynch1 | 304 | 427 | |

| Fannie Mae | 336 | 473 | 704 |

| Wells Fargo | 350 | 457 | 690 |

| John Burns | 359 | 717 | |

| NAHB | 360 | 501 | 709 |

| Moody's | 530 | 687 | |

| 1 Merrill forecast is "sideways" in 2012 | |||

Herman Van Rompuy: Europe urgently needs an "anti-recession strategy"

by Calculated Risk on 1/16/2012 09:24:00 AM

Press remarks by President of the European Council Herman Van Rompuy

For the short term, we discussed the fiscal compact treaty and the crisis mechanisms. There is a number of things I can assert today:And on Greece from CNBC: Greek PM: Two Deals But No Drachma Ahead

- we will agree on the new fiscal compact treaty at the end of this month and we will sign it early March;

- our crisis mechanisms are being strengthened. The European Stability Mechanism (ESM) will enter into force in July 2012, earlier than planned. We will also assess the adequacy of the EFSF/ESM’s size without delay. ...

In the meantime, we should re-focus on growth and job creation. Growth friendly consolidation and job friendly growth are what we need! Growth should be enhanced by strengthening supply and by stimulating demand. We must urgently put in place an anti-recession strategy, mobilizing means and efforts at the Union level and - most importantly - at Member States level.

... our foremost concern should be stimulating employment. We need more, better and new jobs. Today, over 23 million people are unemployed in Europe. The economic slowdown risks increasing this number. Many of them are young. Women are particularly affected. The young are Europe's future and we need to give them hope and a decent perspective of joining the labour market.

In his first and only interview since taking office, Greek Prime Minister Lucas Papademos ... expressed complete confidence in his country’s ability to get through what is likely to be a harrowing two months as it approaches a 14.5 billion euro debt repayment in March.The Greek deal with creditors must be worked out over the next week or so. The second deal must be completed in February.

Two different financial deals must be negotiated before then. ... The first of the two deals is with the country’s private sector lenders—banks, pension funds, and hedge funds around the world that own 206 billion euros worth of Greek government debt. ... Greece must then come up with a 4-year economic plan that is acceptable to the IMF and the EU, in order to secure the 130 billion euros and fund its operations. That deal with the IMF and the EU must also get done before the March repayment deadline.

The EU summit meeting is on January 30th and will focus on growth.

Sunday, January 15, 2012

Growing Doubts about Greece

by Calculated Risk on 1/15/2012 09:26:00 PM

From the NY Times: As Reforms Flag in Greece, Europe Aims to Limit Damage

As Greece and its lenders prepare for another week of tense negotiations, European officials now say that the task is less to help the country through its troubles than to avoid the sort of uncontrolled default that many experts fear could threaten the global financial system.And more from Tim Duy at FedWatch: How's That Austerity Working?

Officials from the so-called troika of foreign lenders to Greece — the European Central Bank, European Union and International Monetary Fund — have come to believe that the country has neither the ability nor the will to carry out the broad economic reforms it has promised in exchange for aid, people familiar with the talks say, and they say they are even prepared to withhold the next installment of aid in March.

...

As recently as November, Greece and its lenders were optimistic that the country’s newly installed prime minister, Lucas Papademos ... would stabilize Greece’s soaring debt and help nurse the country back to health.

But since then, his interim government ... has been paralyzed.

Bottom Line: The actions of the European Central Bank greatly eased the immediate financial pressures in the Eurozone. But the underlying problem of internal imbalances remain, and the European response is still not addressing those imbalances. Instead, the commitment to the fixed exchange rate combined with Germany's failure to recognize that their current account surplus must turn to deficit if they ever hope to be repaid promises to lock the Eurozone on the path of ongoing recession.We should know about the Greek debt deal over the next week or two. I suspect a deal will be reached, and that Greece will receive the March aid. But at some point the "pretending" will have to stop.

Yesterday:

• Summary for Week Ending January 13th

• Schedule for Week of Jan 15th

Oil Prices and Economic Growth

by Calculated Risk on 1/15/2012 06:32:00 PM

A followup to the previous post on the possible impact on oil prices of an Iranian oil embargo, from Brad Plumer at the WaPo: How high oil prices could squelch the recovery

According to a U.S. Energy Information Administration analysis, a $20 increase in the cost of a barrel of oil — roughly what we saw last year — is estimated to shave roughly 0.4 points off GDP growth in the first year alone and boost unemployment by 0.1 percentage points. So if Iran threatens to close the Strait of Hormuz (through which about 20 percent of the world’s oil flows) and prices start screaming upward from $107 per barrel to $120 or beyond, that would put a very noticeable dent in growth.The recession in Europe, and slower growth in China (as Plumer notes), might offset some of the upward price pressure from a disruption of supply from Iran.

What’s more, oil shocks tend to have long-lingering effects. The EIA estimates that a $20 price increase continues biting into the economy for at last another year thereafter. James Hamilton, an economist at the University of California, San Diego, has suggested that the consequences of a price spike can persist for several quarters, as the resulting slowdown in consumer spending takes some time to ripple through the economy. That’s true even if the spike is only temporary and recedes quickly.

And below is a graph of gasoline prices. Gasoline prices had been slowly moving down since peaking in early May, but have started moving up again. Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |