by Calculated Risk on 11/24/2010 07:34:00 AM

Wednesday, November 24, 2010

MBA: Mortgage Purchase Applications Increase, highest level since May

The MBA reports: Mortgage Purchase Applications Increase in Latest MBA Weekly Survey

The Refinance Index decreased 1.0 percent from the previous week and is the lowest Refinance Index observed since the end of June. The seasonally adjusted Purchase Index increased 14.4 percent from one week earlier, which included Veterans Day. No adjustment was made for the holiday.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.50 percent from 4.46 percent, with points decreasing to 0.88 from 1.12 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year fixed rate observed in the survey since the week ending September 3, 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with the increase in applications (seasonally adjusted), the four-week moving average of the purchase index is about 22% below the levels of April 2010.

Tuesday, November 23, 2010

Rewind: Irish Banks pass Stress Tests in July 2010

by Calculated Risk on 11/23/2010 11:56:00 PM

Earlier on existing home sales:

The Irish bank stress tests ...

The Central Bank and Financial Regulator CEBS July 2010 Stress Test Results

Allied Irish Banks plc

The exercise was conducted using the scenarios, methodology and key assumptions provided by CEBS. As a result of the assumed shock under the adverse scenario, the estimated consolidated Tier 1 capital ratio would change to 7.2% in 2011 compared to 7.0% as of end of 2009. An additional sovereign risk scenario would have a further impact of 0.70 of a percentage point on the estimated Tier 1 capital ratio, bringing it to 6.5% at the end of 2011, compared with the CRD regulatory minimum of 4%.And The Central Bank and Financial Regulator CEBS July 2010 Stress Test Results

The Governor and Company of the Bank of Ireland

As a result of the assumed shock under the adverse scenario, the estimated consolidated Tier 1 capital ratio would change to 7.6% in 2011 compared to 9.2% as of end of 2009. An additional sovereign risk scenario would have a further impact of 0.50 of a percentage point on the estimated Tier 1 capital ratio, bringing it to 7.1% at the end of 2011, compared with the CRD regulatory minimum of 4%.And today from the Irish Times: Dramatic fall in value of Irish bank stocks

Ooops ...

State Unemployment Rates in October: "Little changed" from September

by Calculated Risk on 11/23/2010 08:06:00 PM

Earlier on existing home sales:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Eight states now have double digit unemployment rates. A number of other states are close.

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in October. Nineteen states and the District of Columbia recorded unemployment rate decreases, 14 states registered rate increases, and 17 states had no rate change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to register the highest unemployment rate among the states, 14.2 percent in October. The states with the next highest rates were Michigan, 12.8 percent, and California, 12.4 percent. North Dakota reported the lowest jobless rate, 3.8 percent, followed by South Dakota and Nebraska, at 4.5 and 4.7 percent, respectively.

...

In October, two states experienced statistically significant unemployment rate changes from September: Maine and Massachusetts (-0.3 percentage point each).

LPS: Over 4.3 million loans 90+ days or in foreclosure

by Calculated Risk on 11/23/2010 04:10:00 PM

LPS Applied Analytics released their October Mortgage Performance data today. According to LPS:

• The average number of days delinquent for loans in foreclosure is a record 492 days

• Over 4.3 million loans are 90 days or more delinquent or in foreclosure

• Foreclosure sales plummeted by 35% in October (as a result of the widespread moratoria)

• Nearly 20% of loans that have been delinquent more than two years are still not in foreclosure

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 9.29 percent of mortgages are delinquent, and another 3.92 are in the foreclosure process for a total of 13.20 percent. It breaks down as:

• 2.72 million loans less than 90 days delinquent.

• 2.24 million loans 90+ days delinquent.

• 2.09 million loans in foreclosure process.

For a total of 7.04 million loans delinquent or in foreclosure.

This is similar to the quarterly data from the Mortgage Bankers Association.

Note: I've seen some people include these 7+ million delinquent loans as "shadow inventory". This is not correct because 1) some of these loans will cure, and 2) some of these homes are already listed for sale (so they are included in the visible inventory).

FOMC Minutes: Forecasts revised down again, Disagreement on outlook

by Calculated Risk on 11/23/2010 02:00:00 PM

From the November 2-3, 2010 (and conference call held on October 15, 2010) FOMC meeting.

The Fed revised down their forecasts again:

| Economic projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| 2010 | 2011 | 2012 | |

| Change in Real GDP | 2.4 to 2.5% | 3.0 to 3.6% | 3.6 to 4.5% |

| June projections | 3.0% to 3.5% | 3.5% to 4.2% | 3.5% to 4.5% |

| April projections | 3.2% to 3.7% | 3.4% to 4.5% | 3.5% to 4.5% |

| Unemployment Rate | 9.5 to 9.7% | 8.9 to 9.1% | 7.7 to 8.2% |

| June projections | 9.2% to 9.5% | 8.3% to 8.7% | 7.1% to 7.5% |

| April projections | 9.1% to 9.5% | 8.1% to 8.5% | 6.6% to 7.5% |

| PCE Inflation | 1.2 to 1.4% | 1.1 to 1.7% | 1.1 to 1.8% |

| June projections | 1.0% to 1.1% | 1.1% to 1.6% | 1.0% to 1.7% |

| April projection | 1.2% to 1.5% | 1.1% to 1.9% | 1.2% to 2.0% |

There was apparently some significant disagreement:

Participants generally agreed that the most likely economic outcome would be a gradual pickup in growth with slow progress toward maximum employment. They also generally expected that inflation would remain, for some time, below levels the Committee considers most consistent, over the longer run, with maximum employment and price stability. However, participants held a range of views about the risks to that outlook. Most saw the risks to growth as broadly balanced, but many saw the risks as tilted to the downside. Similarly, a majority saw the risks to inflation as balanced; some, however, saw downside risks predominating while a couple saw inflation risks as tilted to the upside. Participants also differed in their assessments of the likely benefits and costs associated with a program of purchasing additional longer-term securities in an effort to provide additional monetary stimulus, though most saw the benefits as exceeding the costs in current circumstances.

Misc: Europe, FDIC Quarterly Report, Richmond Manufacturing Survey and more

by Calculated Risk on 11/23/2010 12:44:00 PM

Plenty of data today ...

“I don’t want to paint a dramatic picture, but I just want to say that a year ago we couldn’t imagine the debate we had in the spring and the measures we had to take” over Greece, Merkel said ... “We are facing an exceptionally serious situation as far as the euro’s situation is concerned.”Bond spreads for Spain hit a record today and the 10-year yield moved about 4.9%. The 10-year yields for Ireland and Portugal moved higher today too.

Net income for the 7,760 insured commercial banks and savings institutions reporting quarterly financial results totaled $14.5 billion, a considerable improvement over the $2 billion reported a year ago. Third quarter net income was below the $17.7 billion and $21.4 billion reported in the first and second quarters of this year, respectively, but the shortfall was attributable to a $10.1 billion quarterly net loss at one large institution that had a $10.4 billion charge for goodwill impairment. Absent this loss, third quarter earnings would have represented a three-year high. Almost two out of every three institutions (63.3 percent) reported higher net income than a year earlier, and fewer than one in five (18.9 percent) was unprofitable. This is the lowest percentage of unprofitable institutions since second quarter 2008. A year ago, more than 27 percent of all institutions reported negative net income.The number of problem institutions increased to 860 (about 11% of all institutions) with $379.2 billion in assets (about 2.8% of all assets are at official problem institutions).

In November, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — rose four points to 9 from October's reading of 5. Among the index's components, shipments rose four points to 7, new orders edged up two points to finish at 10, and the jobs index increased six points to 10.This is slightly better than expected. I'll post a graph when after all the regional surveys have been released.

And earlier on existing home sales:

Existing Home Inventory increases 8.4% Year-over-Year

by Calculated Risk on 11/23/2010 11:13:00 AM

Earlier the NAR released the existing home sales data for October; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although inventory decreased from September 2010 to October 2010, inventory increased 8.4% YoY in October. This is the largest YoY increase in inventory since early 2008.

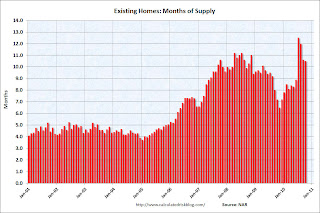

The year-over-year increase in inventory is especially bad news because the reported inventory very high (3.864 million), and the 10.5 months of supply in October is far above normal.

By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2010. Sales for the last four months are significantly below the previous years, and sales will probably be well weak for the remainder of 2010.

The bottom line: Sales were weak in October - almost exactly at the levels I expected - and will continue to be weak for some time. Inventory is very high - and the significant year-over-year increase in inventory is very concerning. The high level of inventory and months-of-supply will put downward pressure on house prices.

October Existing Home Sales: 4.43 million SAAR, 10.5 months of supply

by Calculated Risk on 11/23/2010 10:00:00 AM

The NAR reports: Existing-Home Sales Decline in October Following Two Monthly Gains

Existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, declined 2.2 percent to a seasonally adjusted annual rate of 4.43 million in October from 4.53 million in September, and are 25.9 percent below the 5.98 million-unit level in October 2009 when sales were surging prior to the initial deadline for the first-time buyer tax credit.

...

Total housing inventory at the end of October fell 3.4 percent to 3.86 million existing homes available for sale, which represents a 10.5-month supply4 at the current sales pace, down from a 10.6-month supply in September.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2010 (4.43 million SAAR) were 2.2% lower than last month, and were 25.9% lower than October 2009.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.86 million in October from 4.00 million in September. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall. I'll have more on inventory later ...

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 10.5 months in October from 10.6 months in September. This is extremely high and suggests prices, as measured by the repeat sales indexes like Case-Shiller and CoreLogic, will continue to decline.

These weak numbers are exactly what I expected. The ongoing high level of supply - and double digit months-of-supply are the key stories. I'll have more ...

Q3 real GDP growth revised up to 2.5% annualized rate

by Calculated Risk on 11/23/2010 08:30:00 AM

From the BEA: Gross Domestic Product, 2nd quarter 2010 (second estimate)

The upward revision came from PCE (revised up from 2.6% to 2.8%), from net exports (added 0.25 percentage points to growth), and state and local government expenditures (revised up from -0.2% to 0.8%).

As expected, non-residential structure investment was revised down from 3.9% to -5.7%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The current quarter is in blue.

The dashed line is the median growth rate of 3.05%. The current recovery is still below trend growth.

Monday, November 22, 2010

NY Times: Odd corollary to the Volcker Fed?

by Calculated Risk on 11/22/2010 09:38:00 PM

From Sewell Chan at the NY Times: Fed Adopts Washington Tactics to Combat Critics

Faced with unusually sharp ideological attacks after its latest bid to stimulate the economy, the Federal Reserve now faces a challenge far removed from the conduct of monetary policy: how to defend itself in a hyperpartisan environment without becoming overtly political.

...

The situation forms an odd corollary to the early 1980s, when ... Paul A. Volcker, sharply raised interest rates, setting off back-to-back recessions in a painful but effective war on inflation.

Liberals attacked Mr. Volcker, a Democrat, as an inflation-fighting zealot who disregarded the plight of the unemployed. Now conservatives are portraying Mr. Bernanke, a Republican, as trying too hard to stimulate growth and underestimating the risk of inflation.

Click on graph for larger image in new window.

Click on graph for larger image in new window.When Paul Volcker became Fed Chairman in August 1979, inflation was close to 10% (year-over-year change in core CPI). The unemployment rate was close to 6%. As the Fed tightened (taking the Fed funds rate to around 20%), the unemployment rate started to rise sharply.

So there were two problems in the early '80s: very high inflation, and a rising unemployment rate. It is understandable there was friction between the dual mandates of the Fed - especially when inflation started to fall and the unemployment rate was in double digits.

Now the unemployment rate is at 9.6% - a real and painful problem. And inflation is low and falling. So what is the source of the friction today? The risk of future inflation? This "odd corollary" doesn't work.

Existing Home Sales Forecast, and Ireland Update

by Calculated Risk on 11/22/2010 04:00:00 PM

From housing economist Tom Lawler (existing home sales will be released tomorrow):

Based on the data I have seen so far, I estimate that existing home sales ran at a seasonally adjusted annual rate of around 4.46 million homes, down 1.5% from September’s pace, and down 25.4% from last October’s “tax-credit-goosed” pace. The YOY decline in unadjusted sales will be larger than that for seasonally adjusted sales for “calendar” reasons (including the fact that this October had one fewer business day than last October).A 3.7% decline in inventory (from September) would put inventory at 3.89 million. Based on this estimate, the months-of-supply in October was around 10.4 months.

The local realtor/MLS inventory numbers I’ve seen have on aggregate been broadly consistent with the 3.2% national drop in active listings from September to October on realtor.com, though the local realtor numbers suggest that the NAR’s estimate may show a somewhat greater decline – perhaps closer to -3.7%(The NAR does not use national listings, but instead uses listings from its sample of local MLS/associations/boards).

And on Ireland:

Irish borrowing costs, which fell under 8 per cent earlier today on news that EU had approved a Government request for a multi-billion euro package, rose shortly after the Greens’ announcement and closed at 8.1 per cent.An excellent European source told me today that his attention is now on Spain - and that there are some early troubling signs of rising credit costs (not just the ten year yield). Something to keep an eye on ...

Discussions resumed today between delegations from the IMF, the EU and the Commission and a team of Irish officials to discuss the terms of the bailout.

Monetary Policy Confusion

by Calculated Risk on 11/22/2010 03:17:00 PM

An editorial in the WaPo yesterday - and some recent emails I've received - indicate there is some confusion on the difference between monetary and fiscal policy.

From the WaPo yesterday: Kicking the Fed

[B]uying hundreds of billions of dollars worth of federal debt in a deliberate effort to lower long-term interest rates and boost employment looks to many economists, market participants and politicians like fiscal policy by another name.Well, these "economists, market participants and politicians" are confused.

The NY Fed's Terrence Checki provided a succinct description of monetary policy in a speech last Friday: Challenges Facing the U.S. Economy and Financial System

Monetary policy works by influencing the level and shape of the domestic yield curve. In normal times, the Fed does this by buying and selling Treasury securities at the short end of the curve, thereby influencing short-term rates. The Fed's purchase of Treasury bonds (under quantitative easing "QE" or LSAP) simply extends classic open market operations to longer duration securities, to produce similar results: a shift in the yield curve consistent with desired financial conditions.That is monetary policy, not fiscal policy which is related to government revenue collection and expenditures.

While I have some sympathy for those who question the degree to which this will ultimately be successful in producing the desired real economy effects, I am not sure what to make of the fact that a change in operating procedure per se could have generated such an uproar ..

Regarding the external implications of the policy, several points are worth keeping in mind. One is that the goal of policy is to stimulate demand in the United States by encouraging lower real yields. To be sure, the dollar has weakened of late, but as a side effect of policy, not as a goal, and not by more than might be expected in light of our recent slowing and recent changes in interest rates and inflation expectations. And as growth strengthens, the value of the dollar should adjust accordingly.

It seems valid to question the effectiveness of QE2 (aka LSAP), but confusing monetary and fiscal policy is not helpful.

The Milwuakee Journal Sentinel provides an example of a confused politician: Ryan leads opposition to Fed's economic efforts

"There is nothing more insidious that a government can do to its people than to debase its currency," [U.S. Rep. Paul] Ryan said.Ryan is correct about the dangers of inflation, but that isn't a concern right now. And if Ryan means what he says about the debasing the currency, he should be opposing the proposed extension of the tax cut for higher income earners. That is fiscal policy. What will debase the currency is long term government spending far in excess of revenue.

Just as harmful, Ryan warns, is that the proliferation of newly printed dollars inevitably unleashes inflation and throws the economy out of kilter in other ways.

"Inflation is a killer of wealth. It wipes out the middle class. It eviscerates the standard of living for people who have retired or are living on fixed incomes," he said.

Ryan then argues for eliminating the Fed's dual mandate of price stability and maximum sustainable employment. There are times when the two mandates are in conflict - like during periods of stagflation - but not right now.

Currently inflation is below the Fed's target of around 2%, and the unemployment rate is unacceptably high at 9.6%. So both "mandates" argue for further FOMC action.

I would support further fiscal policy aimed directly at the unemployed (an extension of benefits - or even directly hiring some of the unemployed). I think that would be more effective than monetary policy right now.

Moody's: Commercial Real Estate Prices increase in September

by Calculated Risk on 11/22/2010 11:52:00 AM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index increased 4.3% in September. This reverses the sharp decline in August. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

From Bloomberg: Commercial Property Prices in U.S. Increase the Most on Record, Moody Says

U.S. commercial property prices rose 4.3 percent in September from the previous month ... “Each of the summer months this year recorded declines in the 3 percent to 4 percent range, followed by this month’s sizeable uptick,” Nick Levidy, a Moody’s managing director in New York, said in the statement. “The relatively large swings seen in the index recently are due in part to the uncertain macroeconomic environment and the effects of a thin market with low transaction volumes.”The headline for the Bloomberg article is a little misleading - there was a large reported increase in September, but that was pretty minor compared to the price declines over the summer.

CoreLogic: Shadow Housing Inventory pushes total unsold inventory to 6.3 million units

by Calculated Risk on 11/22/2010 09:21:00 AM

From CoreLogic: Shadow Inventory Jumps More Than 10 Percent in One Year, Pushing Total Unsold Inventory to 6.3 Million Units

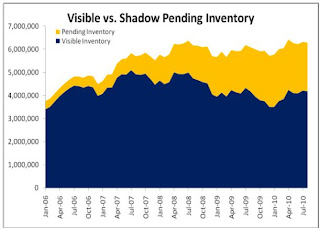

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

CoreLogic estimates the "shadown inventory" (by this method) at about 2.1 million units.

CoreLogic estimates shadow inventory, sometimes called pending supply, by calculating the number of properties that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders and that are not currently listed on multiple listing services (MLSs). Shadow inventory is typically not included in the official metrics of unsold inventory.

According to CoreLogic, the visible supply of unsold inventory was 4.2 million units in August 2010, the same as the previous year. The visible inventory measures the unsold inventory of new and existing homes that were on the market. The visible months’ supply increased to 15 months in August, up from 11 months a year earlier due to the decline in sales during the last few months.

The total visible and shadow inventory was 6.3 million units in August, up from 6.1 million a year ago. The total months’ supply of unsold homes was 23 months in August, up from 17 months a year ago. Although it can vary and it depends on the market and real estate cycle, typically a reading of six to seven months is considered normal so the current total months’ supply is roughly three times the normal rate.

...

Mark Fleming, chief economist for CoreLogic commented, “The weak demand for housing is significantly increasing the risk of further price declines in the housing market. This is being exacerbated by a significant and growing shadow inventory that is likely to persist for some time due to the highly extended time-to-liquidation that servicers are currently experiencing.”

The second graph from CoreLogic shows the total visible and pending inventory. Even though the visible inventory has declined slightly from the peak in 2007, the total inventory is at close to an all time high of 6.3 million units.

The second graph from CoreLogic shows the total visible and pending inventory. Even though the visible inventory has declined slightly from the peak in 2007, the total inventory is at close to an all time high of 6.3 million units.Note: The term "shadow inventory" is used in many different ways. My definition is: housing units that are not currently listed on the market, but will probably be listed soon. This includes:

Although the CoreLogic report is useful in estimating future supply, I think it is the visible supply that impacts prices.

Chicago Fed: Economic Activity picked up slightly in October

by Calculated Risk on 11/22/2010 08:30:00 AM

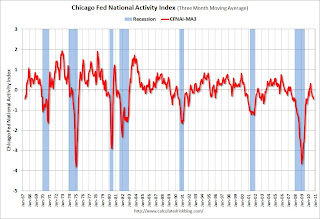

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity picked up in October

Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index increased to –0.28 in October from –0.52 in September.

...

The index’s three-month moving average, CFNAI-MA3, decreased to –0.46 in October from –0.33 in September, reaching its lowest level since November 2009. October’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend for the fifth consecutive month. With regard to inflation, the amount of economic slack reflected in the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was sluggish in October.

Sunday, November 21, 2010

Shadow Inventory

by Calculated Risk on 11/21/2010 10:10:00 PM

Tomorrow morning CoreLogic will release their Shadow Inventory report as of August 2010. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

CoreLogic then adds this shadow or "pending inventory" to the "visible supply" for August as reported by the NAR: 4.1 million units and 12.0 months-of-supply.

The term "shadow inventory" is used in many different ways. My definition is: housing units that are not currently listed on the market, but will probably be listed soon. This includes:

I expect CoreLogic to report 1.5 to 2.0 million units of pending supply, and that will put their combined months-of-supply metric in the stratosphere. Although the CoreLogic report is useful in estimating future supply, I think it is the visible supply that impacts prices.

Earlier: Here is the economic schedule for the coming holiday week. There will be plenty of data released early in the week, including existing home sales on Tuesday, new home sales on Wednesday, the 2nd estimate of Q3 GDP on Tuesday, and Personal income and spending for October on Wednesday - and much more.

And a summary of last week.

Irish Bailout approved by EU and IMF

by Calculated Risk on 11/21/2010 04:09:00 PM

From the Irish Times: Irish application for IMF/EU rescue package approved

Taoiseach Brian Cowen tonight confirmed the European Union has agreed to Government request for financial aid package from the European Union and the International Monetary Fund.The amount of the aid still hasn't been determined. Apparently the loans will be from the IMF, the European Financial Stability Facility (EFSF), and possibly from the UK and Sweden directly.

European finance ministers held an emergency conference call tonight to consider a Cabinet request for aid, during which the application was approved.

More from the Financial Times: Eurozone agrees €80bn-€90bn Irish aid

Earlier: Here is the economic schedule for the coming holiday week. There will be plenty of data released early in the week, including existing home sales on Tuesday, new home sales on Wednesday, the 2nd estimate of Q3 GDP on Tuesday, and Personal income and spending for October on Wednesday - and much more.

And a summary of last week.

A Summary for the Week ending November 20th

by Calculated Risk on 11/21/2010 11:30:00 AM

Below is a summary of last week mostly in graphs. Note: A key story again last week was the imminent bailout of Ireland. There will probably be more on the bailout details later today.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 519 thousand (SAAR) in October, down 11.7% from the revised September rate of 588 thousand, and just up 9% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

This was below expectations of 590 thousand starts, mostly because of the volatile multi-family starts. Single-family starts decreased 1.1% to 436 thousand in October. This is 21% above the record low in January 2009 (360 thousand).

The graph shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit. Starts will stay low until the excess inventory of existing homes is absorbed.

The MBA reported that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This is down from 14.42 percent in Q2 2010.

Note: the MBA's National Delinquency Survey (NDS) covered "about 44 million first-lien mortgages on one- to four-unit residential properties" and the "NDS is estimated to cover approximately 88 percent of the outstanding first lien mortgages in the market." This gives about 50 million total first lien mortgages or about 6.75 million delinquent or in foreclosure.

This graph shows the percent of loans delinquent by days past due.

This graph shows the percent of loans delinquent by days past due.Most of the decline in the overall delinquency rate was in the seriously delinquent categories (90+ days or in foreclosure process). Part of the reason is lenders were being more aggressive in foreclosing in Q3 (before the foreclosure pause), and there was a surge in REO inventory (real estate owned). Some of the decline was probably related to modifications too.

Loans 30 days delinquent decreased to 3.36%. This is slightly below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.44% - the lowest since Q2 2008.

With the foreclosure pause, the 90+ day and in foreclosure rates will probably increase in Q4.

The CoreLogic HPI is a three month weighted average of July, August, and September and is not seasonally adjusted (NSA).

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index is down 2.8% over the last year, and off 29.2% from the peak.

The index is 3.9% above the low set in March 2009, and I expect to see a new post-bubble low for this index later this year or early in 2011.

“We’re continuing to see price declines across the board with all but seven states seeing a decrease in home prices,” said Mark Fleming, chief economist for CoreLogic. “This continued and widespread decline will put further pressure on negative equity and stall the housing recovery.”

On a monthly basis, retail sales increased 1.2% from September to October (seasonally adjusted, after revisions), and sales were up 7.3% from October 2009.

On a monthly basis, retail sales increased 1.2% from September to October (seasonally adjusted, after revisions), and sales were up 7.3% from October 2009. Retail sales increased 0.4% ex-autos - about at expectations.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 11.2% from the bottom, and only off 1.8% from the pre-recession peak.

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in October after having fallen 0.2 percent in September. ... The capacity utilization rate for total industry was flat at 74.8 percent, a rate 6.6 percentage points above the low in June 2009 and 5.8 percentage points below its average from 1972 to 2009.

This graph shows Capacity Utilization. This series is up 9.7% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 9.7% from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 74.8% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The next graph shows industrial production since 1967.

The next graph shows industrial production since 1967.Industrial production was unchanged in October, and production is still 7.3% below the pre-recession levels at the end of 2007.

This was below consensus expectations of a 0.3% increase in Industrial Production, and an increase to 74.9% for Capacity Utilization.

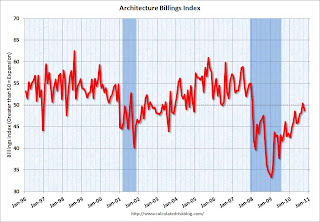

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

Reuters reported that the American Institute of Architects’ Architecture Billings Index decreased to 48.7 in October from 50.4 in September. Any reading below 50 indicates contraction.

Reuters reported that the American Institute of Architects’ Architecture Billings Index decreased to 48.7 in October from 50.4 in September. Any reading below 50 indicates contraction. This graph shows the Architecture Billings Index since 1996. The index showed expansion in September (above 50) for the first time since Jan 2008, however the index is indicating contraction again in October.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So there will probably be further declines in CRE investment for the next 9 to 12 months.

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 16 in November. This is a 1 point increase from the revised 15 in October (revised down from 16). This is the highest level since June, but slightly below expectations of an increase to 17. The record low was 8 set in January 2009, and 16 is still very low ...

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 16 in November. This is a 1 point increase from the revised 15 in October (revised down from 16). This is the highest level since June, but slightly below expectations of an increase to 17. The record low was 8 set in January 2009, and 16 is still very low ...Note: any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts.

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

Over the last 12 months, the median CPI rose 0.5%, the trimmed-mean CPI rose 0.8%, and the CPI less food and energy rose 0.6%. The indexes for rent and owners' equivalent rent both increased in October (some analysts blamed the disinflation trend on these measures of rent, but that wasn't true in October).

This graph shows these three measure of inflation on a year-over-year basis.

This graph shows these three measure of inflation on a year-over-year basis. They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year.

As far as disinflation, the U.S. is still tracking Japan in the '90s ...

Best wishes and Happy Thanksgiving to all!

Irish finance minister will recommend IMF and EU Bailout

by Calculated Risk on 11/21/2010 08:54:00 AM

Some breaking news from the Irish Times: Lenihan to seek Cabinet approval for financial bailout

Minister for Finance Brian Lenihan said he would seek Cabinet approval later today for a financial bailout from the International Monetary Fund (IMF) and the European Union.In addition to Ireland, the bond yields to watch are for Portugal and Spain to see if the problem spreads.

...

"I will be recommending to the Government that we should apply for a program and start formal applications," he said.

Saturday, November 20, 2010

Ireland’s children "brought up for export" again

by Calculated Risk on 11/20/2010 09:31:00 PM

The previous post is the Schedule for Week of November 21st

From Suzanne Daley at the NY Times: The Hunt for Jobs Sends the Irish Abroad, Again

Ireland seems set to watch yet another generation scatter across the globe to escape desperate times. ... Experts say about 65,000 people left Ireland last year, and some estimate that the number may be more like 120,000 this year. At first, most of those leaving were immigrants returning home to Central Europe. But increasingly, the experts say, it is the Irish themselves who are heading out ...Ireland already has a huge excess of housing units - and losing another generation will not help. The younger generation is leaving Greece too. A shrinking population - especially losing the young and well educated - doesn't help the economy recover.