by Calculated Risk on 11/20/2010 06:16:00 PM

Saturday, November 20, 2010

Schedule for Week of November 21st

This is a holiday week (Happy Thanksgiving!), but there will be plenty of data released early in the week. The key releases are existing home sales (on Tuesday) and New home sales (on Wednesday).

8:30 AM ET: Chicago Fed National Activity Index (October). This is a composite index of other data.

9:00 AM: CoreLogic Shadow Inventory Data for August 2010. This report provides an estimate of the number of properties not currently listed for sale that are either seriously delinquent (90 days or more), in foreclosure, or real estate owned (REO) by lenders.

Morning: Moody's/REAL Commercial Property Price Index (CPPI) for September.

1:30 PM: Minneapolis Fed President Kocherlakota speaks on "Monetary Policy, Labor Markets, and Uncertainty" before the Sioux Falls Rotary Club.

8:30 AM: Q3 GDP (second estimate). This is the second estimate for Q3 from the BEA, and the consensus is for real GDP growth to be revised to an increase of 2.4% annualized from the advance estimate of 2.0%.

8:30 AM: Corporate Profits, 3rd quarter 2010 (preliminary estimate)

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 4.5 million at a Seasonally Adjusted Annual Rate (SAAR) in October, about the same as the 4.53 million SAAR in September. Housing economist Tom Lawler is projecting a slight decline from last month (SAAR). In addition to sales, the level of inventory and months-of-supply will be very important (since months-of-supply impacts prices). Months-of-supply was probably still in double digits in October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October. The consensus is for a reading of 5 (slight expansion), the same as last month.

10:00 AM: the BLS will release the Regional and State Employment and Unemployment report for October.

2:00 PM: FOMC Minutes, Meeting of November 2-3, 2010. There might be some interesting points on QE2.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last few months - suggesting home sales will be very weak through the end of the year.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income and a 0.5% increase in personal spending, and for the Core PCE price index to increase 0.1%.

8:30 AM: The initial weekly unemployment claims report will be released a day early because of the Thanksgiving holiday. Initial claims increased slightly to 439,000 last week, and initial claims are expected to decline to 435,000 this week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.1% increase in durable goods orders after increasing 3.3% in September.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for November).

10:00 AM: New Home Sales for October from the Census Bureau. The consensus is for a slight increase in sales to 314K (SAAR) in October from 307K in September. New home sales collapsed in May and have averaged only 294K (SAAR) over the last five months. Prior to the last five months, the previous record low was 338K in Sept 1981.

10:00 AM: FHFA House Price Index for September. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

11:00 AM: Kansas City Fed regional Manufacturing Survey for November. The index was at 10 in October.

Thanksgiving Holiday. Markets Closed.

Markets will close at 1:00 p.m. on the day after Thanksgiving.

After 4:00 PM: The FDIC will probably take Friday afternoon off ...

New Fannie Mae Lending Guidelines

by Calculated Risk on 11/20/2010 02:14:00 PM

UPDATE: Good news. These are not seller-funded Down payment Assistance Programs (DAPs). From Fannie Mae:

Interested Party Contributions (IPCs) [include] ... funds that flow from an interested party through a third-party organization, including nonprofit entities, to the borrower ... Fannie Mae does not permit IPCs to be used to make the borrower’s down payment, meet financial reserve requirements, or meet minimum borrower contribution requirements.Lynnley Browning at the NY Times mentions some of the changes: New Lending Guidelines From Fannie Mae

The rules, effective on Dec. 13, will allow buyers to use gifts and grants from nonprofit groups for their minimum 5 percent down payment, which is the threshold set by Fannie Mae, the government-owned company that sets lending standards and buys mortgages from lenders.The lower back end debt-to-income (DTI) ratio makes sense. I'd prefer 31% for the front end DTI1 (the HAMP goal), and 40% for the back end DTI.

...

Fannie Mae is getting tougher on debt-to-income ratios, or the amount of a borrower’s gross monthly income that goes toward paying off all debts. The maximum ratio for those seeking a conventional mortgage will drop to 45 percent from 55 percent under the new guidelines.

...

But perhaps the toughest news from Fannie Mae concerns borrowers who have gone through foreclosure. They will be excluded from obtaining a Fannie-backed loan for seven years, up from four.

1 Front end DTI includes Principal, Interest, Taxes and Insurance (PITI) plus any homeowners association fees. The back end DTI includes PITI and HOA, plus installment debt, alimony, 2nd liens, and other fixed payments.

Ireland Update: Bank Run and Bailout

by Calculated Risk on 11/20/2010 08:55:00 AM

First an update on the bank run from the Irish Times: AIB loses €13bn in deposits due to Irish debt fears

ALLIED IRISH Banks has lost about €13 billion in deposits since the start of the year due to concerns about the financial difficulties of the Government and the banking system, the bank said in a trading statement yesterday.This is about 17% of deposits.

Some €12 billion of the lost deposits were withdrawn, mostly by institutional and corporate depositors, since the end of June.

And on the bailout from Bloomberg: Irish Talks on Aid Plan Intensify as Banks Lose Deposits, Cowen Campaigns

Irish officials and experts from the European Union and International Monetary Fund are working through the weekend in Dublin, racing to finish an aid agreement amid pressure to act before markets tumble.The Irish government is planning on releasing a four-year economic plan this coming Tuesday, and the government is expected to formally request aid after releasing the plan. A key question is if the European Commission and IMF will accept the plan or require additional action - such as raising the 12.5 per cent corporation tax.

... IMF Managing Director Dominique Strauss-Kahn said Europe is moving “too slowly” to resolve the sovereign debt crisis that began in Greece.

After Ireland, the bond yields to watch are Portugal and Spain. Many analysts expect Portugal to be next in line for a bailout, and the big question is Spain.

Here are some comments from Nouriel Roubini on CNBC: Roubini Maps Out Nightmare Scenario of Domino Debt Collapse in Europe

"The next one in line is going to be Portugal.' [Roubini said] "Due to the severity of Portuguese debt problems, Portugal is going to lose market access—and that means they are going to require IMF support as well.

But the real nightmare domino is Spain. Roubini refers to the Spanish debt problems as "the elephant in the room".

"You can try to ring fence Spain. And you can essentially try to provide financing officially to Ireland, Portugal, and Greece for three years. Leave them out of the market. Maybe restructure their debt down the line."

"But if Spain falls off the cliff, there is not enough official money in this envelope of European resources to bail out Spain. Spain is too big to fail on one side—and also too big to be bailed out."

Friday, November 19, 2010

Unofficial Problem Bank list increases to 903 Institutions

by Calculated Risk on 11/19/2010 10:58:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 19, 2010.

Changes and comments from surferdude808:

As anticipated, the Unofficial Problem Bank List rose above 900 as the OCC released its actions through the middle of October 2010 today. Net additions were 5 institutions, which pushed the list total to 903. Assets increased this week by $1.13 billion pushing the aggregate total to $419.6 billion.The Q3 FDIC Quarterly banking profile will be released soon and will probably show around 900 problem banks at the end of September.

There were four removals this week including the three failures -- First Banking Center, Burlington, WI ($822 million); Gulf State Community Bank, Carrabelle, FL ($117 million); and Allegiance Bank of North America, Bala Cynwyd, PA ($116 million). First Banking Center opened in 1920, survived the Great Depression, but did not make it through the Great Recession.

The other removal was the termination of a Supervisory Agreement against The First National Bank of Trenton, Trenton, TX ($147 million) by the OCC. We would not be surprised if the termination is because the Supervisory Agreement is being replaced by a Consent Order.

The nine additions this week include Mid-Wisconsin Bank, Medford, WI ($498 million Ticker: MWFS); First National Bank South, Alma, GA ($335 million); Farmers State Bank, Victor, MT ($323 million); Madison National Bank, Merrick, NY ($305 million); United Americas Bank, National Association, Atlanta, GA ($263 million); San Antonio National Bank, Refugio, TX ($249 million); First Federal Bank, A FSB, Tuscaloosa, AL ($180 million); Santa Clara Valley Bank, National Association, Santa Paula, CA ($140 million); and Sonoran Bank, N.A., Phoenix, AZ ($36 million).

Other changes this week include the Federal Reserve issuing a Prompt Corrective Action Order against Legacy Bank, Milwaukee, WI ($216 million); and the OCC converting a Formal Agreement to a Consent Order against Fidelity Bank of Florida, National Association, Merritt Island, FL ($419 million). We anticipate the FDIC will release its actions for October next week.

Bank Failure #149: First Banking Center, Burlington, Wisconsin

by Calculated Risk on 11/19/2010 07:10:00 PM

Escape velocity near

Warp trajectory

by Soylent Green is People

From the FDIC: First Michigan Bank, Troy, Michigan, Assumes All of the Deposits of First Banking Center, Burlington, Wisconsin

As of September 30, 2010, First Banking Center had approximately $750.7 million in total assets and $664.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $142.6 million. Compared to other alternatives, First Michigan Bank's acquisition was the least costly resolution for the FDIC's DIF. First Banking Center is the 149th FDIC-insured institution to fail in the nation this year, and the second in Wisconsin.Three down today with close to $1 billion in assets. A billion here, a billion there ...

Bank Failure #148: Allegiance Bank of North America, Bala Cynwyd, Pennsylvania

by Calculated Risk on 11/19/2010 06:12:00 PM

To perpetual bailout

And justice for none

by Soylent Green is People

From the FDIC: VIST Bank, Wyomissing, Pennsylvania, Assumes All of the Deposits of Allegiance Bank of North America, Bala Cynwyd, Pennsylvania

As of September 30, 2010, Allegiance Bank of North America had approximately $106.6 million in total assets and $92.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $14.2 million. .... Allegiance bank of North America is the 148th FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania.Two down today ...

Bank Failure #147: Gulf State Community Bank, Carrabelle, Florida

by Calculated Risk on 11/19/2010 05:14:00 PM

Note: I started posting bank failures a few years when I was predicting 100s of banks would fail. Since then it has become sort of a Friday afternoon ritual.

Rare Florida solvent bank

So few may exist

by Soylent Green is People

From the FDIC: Centennial Bank, Conway, Arkansas, Assumes All of the Deposits of Gulf State Community Bank, Carrabelle, Florida

As of September 30, 2010, Gulf State Community Bank had approximately $112.1 million in total assets and $112.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $42.7 million. ... Gulf State Community Bank is the 147th FDIC-insured institution to fail in the nation this year, and the 28th in Florida.Another 40% or so loss on assets. Ouch.

Disposition of Canceled HAMP Trial Modifications

by Calculated Risk on 11/19/2010 03:47:00 PM

Treasury released the October HAMP statistics last night.

There is some interesting data on the disposition of canceled HAMP trial modifications. The general view was that a majority of these borrowers would lose their homes in foreclosure or through a short sale. That hasn't happened yet.

The statistics, from the 8 largest servicers (about 80% of HAMP), show that most of these borrowers are in alternative modification programs or have cured the default (current of loan paid off).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the disposition of canceled HAMP trial modifications (in percentages). This represents 552 thousand canceled trial modifications as of September.

Only 3.9% of borrowers have lost their homes in foreclosure, and another 8.5% have lost their homes through a short sale or deed-in-lieu of foreclosure.

About 13% of borrowers are in the foreclosure process, and another 1.9% in bankruptcy.

So what has happened to the borrowers in all of those canceled trials? The largest percentage of borrowers are in alternative modification programs (lender programs). The next largest group is in "action pending". Some have paid off their loans (probably sold their homes), and another 7.7% have managed to become current.

So the number of foreclosures was lower than many expected, although many of the borrowers in the alternative modification programs will probably redefault (and the action pending group might also results in a number of foreclosures). Hopefully HAMP will keep updating this table.

Fed Manufacturing Surveys and ISM Manufacturing Index

by Calculated Risk on 11/19/2010 12:04:00 PM

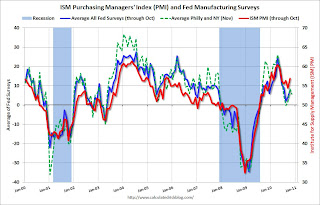

Earlier this week, the NY Fed and the Philly Fed manufacturing surveys were released. The readings couldn't have been more different, with the NY Fed survey showing "conditions deteriorated", and the Philly Fed showing activity improved sharply:

The Empire State Manufacturing Survey indicates that conditions deteriorated in November for New York State manufacturers. For the first time since mid-2009, the general business conditions index fell below zero, declining 27 points to -11.1. The new orders index plummeted 37 points to -24.4, and the shipments index also fell below zero.And the Philly Fed:

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of 1.0 in October to 22.5 in November. This is the highest reading in the index since last December. Indexes for new orders and shipments also improved this month, and each index increased 15 points.Usually these two surveys are fairly consistent, and this is reminder not to make too much of any one data point! Is manufacturing slowing or is activity picking up again? These two surveys provide opposite answers.

The other regional Fed surveys and the ISM manufacturing index will be released over the next two weeks, and hopefully they will provide some clarity.

The following graph compares the regional Fed surveys with the ISM manufacturing index, including the NY Fed and Philly Fed surveys for November. Averaging the NY Fed and Philly Fed survey suggests manufacturing is still expanding, but at a sluggish pace:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The New York and Philly Fed surveys are averaged together (dashed green, through November), and averaged five Fed surveys (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City.

The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM manufacturing index will released on Dec 1st. The Richmond Fed survey will be released on Tuesday Nov 23rd, the Kansas City Fed survey on Wednesday Nov 24th, and the Dallas Fed survey on Monday Nov 29th.

A slowdown in manufacturing has been one of the reasons I thought GDP growth would slow in the 2nd half of 2010 and into 2011 (this is part of the general sluggish and choppy recovery). My view was based on the end of the inventory adjustment, a slowdown in export growth, and sluggish growth for consumer spending. So the Philly Fed reading was surprising to me.

"Some thoughts on the muni market"

by Calculated Risk on 11/19/2010 09:30:00 AM

From Bond Girl: Some thoughts on the muni market

I have been somewhat hesitant to write about the recent sharp correction in the muni market, mainly because I do not like wasting my time.I think it is important to understand that these supply issues are what is driving the muni market - not an imminent default.

...

My opinion, for whatever it is worth to you, is that there are a handful of factors – mostly unrelated to the relative creditworthiness of muni issuers – that have provoked this correction. These factors are related, and they will likely contribute to volatility going into next year. The first, obviously, is a supply glut. The pending expiration of the Build America Bond (BAB) program has pulled supply forward, and this is going to seesaw over the next several weeks. Since the BAB program was initiated, most issuers have structured their new issues with the sense that they will go to either the tax-exempt or taxable market, whichever is more advantageous at the time. It has been almost completely a supply management game since the market for these bonds was established and munis became truly bifurcated.

...

By allowing muni issuers to sell taxable bonds, the BAB program opened the market up to investors like pensions and foreign investors, who otherwise would not benefit from a tax exemption on the interest income on the bonds and would find tax-exempt yields unappetizing. This program has relieved the supply pressure on the market for essentially two years now, keeping interest rates low.

What is going on now is that muni issuers are scrambling to get deals done to take advantage of the program before it expires, and this is pulling the number of new issues that would ordinarily be coming to market forward. So the looming expiration of the BAB program is creating the very conditions it was created to alleviate. Issuers are very conscious of this fact, and that is why a large number of deals are getting pulled. As more issues get pulled and supply is reduced, there will be some relief on rates, which I think is what happened today. But you can expect that muni issuers will be dancing around this until the program expires at the end of the year, so there will likely be significant volatility. There is also considerable uncertainty as to how supply issues will play out in the first quarter of 2011.

Thursday, November 18, 2010

Bernanke criticizes China, Supports additional fiscal stimulus

by Calculated Risk on 11/18/2010 10:25:00 PM

Here are two speeches from Fed Chairman Ben Bernanke:

Rebalancing the Global Recovery

[O]n its current economic trajectory the United States runs the risk of seeing millions of workers unemployed or underemployed for many years. As a society, we should find that outcome unacceptable. Monetary policy is working in support of both economic recovery and price stability, but there are limits to what can be achieved by the central bank alone. The Federal Reserve is nonpartisan and does not make recommendations regarding specific tax and spending programs. However, in general terms, a fiscal program that combines near-term measures to enhance growth with strong, confidence-inducing steps to reduce longer-term structural deficits would be an important complement to the policies of the Federal Reserve.And on China:

The exchange rate adjustment is incomplete, in part, because the authorities in some emerging market economies have intervened in foreign exchange markets to prevent or slow the appreciation of their currencies. ... why have officials in many emerging markets leaned against appreciation of their currencies toward levels more consistent with market fundamentals? The principal answer is that currency undervaluation on the part of some countries has been part of a long-term export-led strategy for growth and development. This strategy, which allows a country's producers to operate at a greater scale and to produce a more diverse set of products than domestic demand alone might sustain, has been viewed as promoting economic growth and, more broadly, as making an important contribution to the development of a number of countries. However, increasingly over time, the strategy of currency undervaluation has demonstrated important drawbacks, both for the world system and for the countries using that strategy.And from Bernanke: Emerging from the Crisis: Where Do We Stand?

In the United States, we have seen a slowing of the pace of expansion since earlier this year. The unemployment rate has remained close to 10 percent since mid-2009, with a substantial fraction of the unemployed out of work for six months or longer. Moreover, inflation has been declining and is currently quite low, with measures of underlying inflation running close to 1 percent. Although we project that economic growth will pick up and unemployment decline somewhat in the coming year, progress thus far has been disappointingly slow.Reports on the speeches:

From the NY Times: Bernanke Speech Offers Support for Obama Policy

From Bloomberg: Bernanke Steps Up Stimulus Defense, Turns Tables on China

From the WSJ: Bernanke Takes Aim at China

Q3: Quarterly Housing Starts and Unemployment

by Calculated Risk on 11/18/2010 06:33:00 PM

This week the Census Bureau released the "Quarterly Starts and Completions by Purpose and Design" report for Q3 2010. Although this data is Not Seasonally Adjusted (NSA), it shows the trends for several key housing categories.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The number of units built for rent increased sharply in Q3. Although still fairly low, there were 40 thousand rental units started in Q3 2010, almost double the 22 thousand started in Q3 2009. With the rental vacancy rate starting to fall - and no more ill-conceived homebuyer tax credits on the horizon - rental unit construction has probably bottomed. This increase in construction will help a little with employment.

The number of condo units started doubled from last year too - but from close to zero (from 5 thousand in Q3 2009 to 6 thousand last quarter).

The largest category - starts of single family units, built for sale - decreased to 75,000 in Q3 from 92,000 in Q2. Some of this was seasonal, and some was related to end of the tax credit. Starts of owner built units declined in Q3 too.

And an update by request ...

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) rebounded a little last year,and then moved sideways for some time, before declining again in May.

This is what I expected when I first posted the above graph in August 2009. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.Until the excess housing inventory is reduced, housing starts will stay depressed, and the unemployment rate will probably stay elevated. It does appear progress is being made reducing the excess inventory, but it will take some time. To reduce the excess inventory requires new household formation to be higher than housing starts - and even though housing starts are near record lows, new household formation has also been sluggish - partially because there are few construction jobs!

Hotels: RevPAR up 14.1% compared to same week in 2009

by Calculated Risk on 11/18/2010 02:51:00 PM

From HotelNewsNow.com: STR: Chain scales report strong weekly results

Overall, the industry’s occupancy increased 11.1% to 58.4%, ADR was up 2.7% to US$98.77, and RevPAR ended the week up 14.1% to US$57.65.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 9.2% compared to last year and 6.1% below the median for 2000 through 2007.

Note: Even though the occupancy rate is above the level of the same week in 2008, and RevPAR (revenue per available room) is up 14.1% compared to the same week in 2009 - RevPAR is still down 3.7% compared to the same week in 2008 - and the 2nd half of 2008 was a very difficult period for the hotel industry.

This suggests some increase in business travel - and probably a little more business confidence (the spring and fall are mostly business travel).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

MBA National Delinquency Survey: Delinquency rate declines in Q3

by Calculated Risk on 11/18/2010 11:29:00 AM

The MBA reports that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This is down from 14.42 percent in Q2 2010.

Note: the MBA's National Delinquency Survey (NDS) covered "about 44 million first-lien mortgages on one- to four-unit residential properties" and the "NDS is estimated to cover approximately 88 percent of the outstanding first lien mortgages in the market." This gives about 50 million total first lien mortgages or about 6.75 million delinquent or in foreclosure.

From the MBA: Delinquencies and Loans in Foreclosure Decrease, but Foreclosure Starts Rise in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 9.13 percent of all loans outstanding as of the end of the third quarter of 2010, a decrease of 72 basis points from the second quarter of 2010, and a decrease of 51 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 9.13% (SA) and 4.39% equals 13.52%.

...

The percentage of loans in the foreclosure process at the end of the third quarter was 4.39 percent, down 18 basis points from the second quarter of 2010 and down eight basis points from one year ago.

Most of the decline in the overall delinquency rate was in the seriously delinquent categories (90+ days or in foreclosure process). Part of the reason is lenders were being more aggressive in foreclosing in Q3 (before the foreclosure pause), and there was a surge in REO inventory (real estate owned). Some of the decline was probably related to modifications too.

The following graph shows the percent of loans delinquent by days past due.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Loans 30 days delinquent decreased to 3.36%. This is slightly below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.44% - the lowest since Q2 2008.

With the foreclosure pause, the 90+ day and in foreclosure rates will probably increase in Q4. The 30 day and 60 day buckets are dependent on jobs and house prices.

More from the press release:

“Mortgage delinquency rates declined over the quarter and over the past year, due primarily to a large decline in the 90+ day delinquency rate. The number of loans in foreclosure also dropped, bringing the serious delinquency rate to its lowest level since the second quarter of 2009. However, the foreclosure starts rate increased for all loan types and the foreclosure starts rate for prime fixed loans set a new record high in the survey, as more loans entered the foreclosure process,” said Michael Fratantoni, MBA’s Vice President of Research and Economics.The MBA also noted that a majority of delinquent loans (and loans in foreclosure) are prime loans. We are all subprime now!

“Most often, homeowners fall behind on their mortgages because their income has dropped due to unemployment or other causes. Although the employment report for October was relatively positive, the job market had improved only marginally through the third quarter, so while there was a small improvement in the delinquency rate, the level of that rate remains quite high. As we anticipate that the unemployment rate will be little changed over the next year, we also expect only modest improvements in the delinquency rate.”

...

“The foreclosure paperwork issues announced by several large servicers in late September and early October are unlikely to have had a large impact on the third quarter numbers, but may well increase the foreclosure inventory numbers in the fourth quarter of 2010 and in early 2011. ... The servicers that halted foreclosure sales temporarily may show higher foreclosure inventory numbers in the fourth quarter of 2010 and in early next year than would otherwise have been the case. ... However, these foreclosed homes are likely to come on the market in the medium term, so it is only a delay rather than a change in the underlying economics.”

Philly Fed Index shows pickup in manufacturing activity

by Calculated Risk on 11/18/2010 10:00:00 AM

Here is the Philadelphia Fed Index: Business Outlook Survey

Results from the Business Outlook Survey suggest that regional manufacturing activity showed improvement in November. All of the survey's broad indicators of economic performance showed improvement from their reading in October, and firms reported an increase in employment and work hours.This is well above the consensus expectations of a reading of 5.6 - and shows the opposite of the NY Fed manufacturing survey.

...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of 1.0 in October to 22.5 in November. This is the highest reading in the index since last December. Indexes for new orders and shipments also improved this month, and each index increased 15 points.

...

Labor market conditions also showed some improvement this month, paralleling the improvement in other broad indicators. This month, firms also reported some growth in employment and a longer workweek.

emphasis added

Weekly Initial Unemployment Claims increase slightly

by Calculated Risk on 11/18/2010 08:39:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 13, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 2,000 from the previous week's revised figure of 437,000. The 4-week moving average was 443,000, a decrease of 4,000 from the previous week's revised average of 447,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 4,000 to 443,000.

This is the lowest level for the 4-week moving average since September 2008 - a clear improvement over recent months, but still elevated - and still a sign of weakness in the job market.

Wednesday, November 17, 2010

Fed's Duke on Foreclosure documentation issues

by Calculated Risk on 11/17/2010 09:11:00 PM

From Fed Governor Elizabeth Duke: Foreclosure documentation issues. She didn't provide any specifics although she noted that the report will be published early next year. She also mentioned some foreclosure data:

The Office of the Comptroller of the Currency (OCC), the Office of Thrift Supervision (OTS), the Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve are conducting an in-depth review of practices at the largest mortgage servicing operations. ... The regulators expect the initial on-site portion of our work to be completed this year and currently plan to publish a summary overview of industry-wide practices in early 2011.Duke discusses some of the potential risks from foreclosure issues, and she noted the Fed expects the number of foreclosures will stay elevated for several years:

The number of foreclosures initiated on residential properties has soared from about 1 million in 2006, the year that house prices peaked, to 2.8 million last year. Over the first half of this year, we have seen a further 1.2 million foreclosure filings, and an additional 2.4 million homes were somewhere in the foreclosure pipeline at the end of June. All told, we expect about 2.25 million foreclosure filings this year and again next year, and about 2 million more in 2012. While our outlook is for filings to decline in coming years, they will remain extremely high by historical standards. Currently, almost 5 million mortgage loans are 90 days or more past due or in foreclosure.Note: We will have some updated delinquency data tomorrow. For Q2, the Mortgage Bankers Association (MBA) reported that 9.11% of first-liens were 90 or more days delinquent or in the foreclosure process. That was about 4.8 million loans.

Tomorrow morning the MBA will release the Q3 National Delinquency Survey at 10 AM ET - and I'll be on the conference call at 10:30 AM.

Ireland: Debt Crisis team arrives Thursday

by Calculated Risk on 11/17/2010 04:50:00 PM

A few details from the Financial Times: Dublin feels pressure on rescue package

Also from the WSJ: Ireland Braces for Bank Exam

Inflation: Core CPI, Median CPI, 16% trimmed-mean CPI all below 1% YoY

by Calculated Risk on 11/17/2010 02:34:00 PM

In addition to the CPI release this morning from the BLS, the Cleveland Fed released the median CPI and the trimmed-mean CPI:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.1% annualized rate) in October. The 16% trimmed-mean Consumer Price Index was virtually unchanged at 0.0% (0.6% annualized rate) during the month.So these three measures: core CPI, median CPI and trimmed-mean CPI, all increased less than 1% over the last 12 months. The indexes for rent and owners' equivalent rent both increased in October (some analysts blamed the disinflation trend on these measures of rent, but that wasn't true in October).

...

Over the last 12 months, the median CPI rose 0.5%, the trimmed-mean CPI rose 0.8%, the CPI rose 1.2%, and the CPI less food and energy rose 0.6%

For the core CPI, the BLS noted:

Over the last 12 months, the index for all items less food and energy has risen 0.6 percent, the smallest 12-month increase in the history of the index, which dates to 1957

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows these three measure of inflation on a year-over-year basis.

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

As far as disinflation, the U.S. is still tracking Japan in the '90s ...

CoreLogic: House Prices declined 1.8% in September

by Calculated Risk on 11/17/2010 11:41:00 AM

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from August 2010 to September 2010. The CoreLogic HPI is a three month weighted average of July, August, and September and is not seasonally adjusted (NSA).

From CoreLogic: September Home Prices Declined 2.79 Percent Year Over Year

CoreLogic ... today released today released its September Home Price Index (HPI) that shows that home prices in the U.S. declined for the second month in a row after rising slightly for the first seven months of the year. According to the CoreLogic HPI, national home prices, including distressed sales, declined 2.79 percent in September 2010 compared to September 2009 and declined by 1.08 percent [revised] in August 2010 compared to August 2009. Excluding distressed sales, year-over-year prices declined .73 percent in September 2010.. ...

“We’re continuing to see price declines across the board with all but seven states seeing a decrease in home prices,” said Mark Fleming, chief economist for CoreLogic. “This continued and widespread decline will put further pressure on negative equity and stall the housing recovery.”

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 2.8% over the last year, and off 29.2% from the peak.

The index is 3.9% above the low set in March 2009, and I expect to see a new post-bubble low for this index later this year or early in 2011. As Fleming noted, prices are falling in most areas now.