by Calculated Risk on 11/17/2010 08:30:00 AM

Wednesday, November 17, 2010

Housing Starts decline in October

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 519 thousand (SAAR) in October, down 11.7% from the revised September rate of 588 thousand, and just up 9% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Most of the decline this month was due to multi-family starts (after two strong months).

Single-family starts decreased 1.1% to 436 thousand in October. This is 21% above the record low in January 2009 (360 thousand).

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was below expectations of 590 thousand starts, mostly because of the volatile multi-family starts. Starts will stay low until the excess inventory of existing homes is absorbed.

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 519,000. This is 11.7 percent (±8.6%) below the revised September estimate of 588,000 and is 1.9 percent (±9.6%)* below the October 2009 rate of 529,000.

Single-family housing starts in October were at a rate of 436,000; this is 1.1 percent (±8.6%)* below the revised September figure of 441,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 550,000. This is 0.5 percent (±3.0%)* above the revised September rate of 547,000, but is 4.5 percent (±3.1%) below the October 2009 estimate of 576,000.

Single-family authorizations in October were at a rate of 406,000; this is 1.0 percent (±1.3%)* above the revised September figure of 402,000.

MBA: Mortgage Purchase Activity decreases as mortgage rates increase

by Calculated Risk on 11/17/2010 07:30:00 AM

The MBA reports: Mortgage Applications Decline as Mortgage Rates Jump in Latest MBA Weekly Survey

The Refinance Index decreased 16.5 percent from the previous week and is at the lowest level observed since July of this year. The seasonally adjusted Purchase Index decreased 5.0 percent from one week earlier, the first decrease after three consecutive weekly increases.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.46 percent from 4.28 percent, with points increasing to 1.13 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year fixed-rate observed in the survey since the week ending September 10, 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is about 30% below the levels of April 2010. This suggests existing home sales will remain weak through at least the end of the year.

Tuesday, November 16, 2010

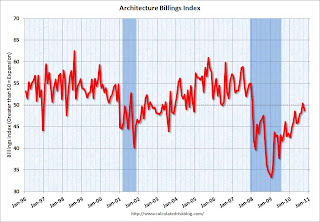

AIA: Architecture Billings Index shows contraction in October

by Calculated Risk on 11/16/2010 11:59:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index decreased to 48.7 in October from 50.4 in September. Any reading below 50 indicates contraction.

The ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Architecture Billings Index since 1996. The index showed expansion in September (above 50) for the first time since Jan 2008, however the index is indicating contraction again in October.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So there will probably be further declines in CRE investment for the next 9 to 12 months.

Report: European Crisis team heads to Ireland

by Calculated Risk on 11/16/2010 07:45:00 PM

The Financial Times is reporting that a Debt crisis team heads for Dublin. This team includes IMF, European Central Bank, and European Commission officials - personnel from the same agencies who visited Greece right before that bailout. Although this is just a "discussion", the Financial Times suggests this is sign "a bailout for the country’s ailing banks is imminent".

And from the WSJ: Banks' Exposure Stirs EU Contagion Worries

All told, European banks were sitting on more than $650 billion of exposure to Ireland as of March 31, according to the Bank for International Settlements.A bailout of the Irish banks is a bailout of European banks (especially UK and German banks).

By request, here are links to the sovereign debt series from "Some investor guy" posted earlier this year:

DataQuick: SoCal Home Sales off 24.3% from October 2009

by Calculated Risk on 11/16/2010 04:11:00 PM

From DataQuick: Southland Home Sales Fall, Prices Flat

Southern California home sales dropped in October to their lowest level in three years amid doubts about the drawn-out market recovery, tight mortgage lending policies and expired government incentives.In October 2009, existing home sales were boosted by the home buyer tax credit, and the NAR reported sales of 5.98 million on a Seasonally adjusted annual rate (SAAR) basis.

...

A total of 16,744 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 7.4 percent from 18,091 in September, and down 24.3 percent from 22,132 for October 2009, according to MDA DataQuick of San Diego.

...

Foreclosure resales accounted for 34.7 percent of the resale market last month, up from a revised 33.6 percent in September and down from 40.4 percent a year ago.

Sales are down close to 25% year-over-year just about everywhere, and the initial estimate for national sales in October is about 4.5 million SAAR with about 10.4 months-of-supply.

Update on Ireland Bailout Talks

by Calculated Risk on 11/16/2010 12:51:00 PM

Update: The Guardian is providing updates: Ireland's debt crisis - live coverage (ht Tommy)

From the Financial Times: Dublin in talks to resolve crisis

“We are discussing with both the ECB and the IMF and of course the Irish,” Mr [Rehn, the EU’s economic and monetary affairs commissioner] told reporters in Brussels on Tuesday. “The real problems are in the banking sector,” not with the government, “but these are connected”.The WSJ has details of the proposed bailout: U.K. Support Sought for Ireland Bailout

excerpt with permission

A package of aid for Irish banks could be worth €45 billion to €50 billion, while a broader package designed to restore confidence in Ireland's public finances as well could range from €80 billion to €100 billion ... In any deal, the IMF would likely contribute half as much aid as the EU and U.K. combined.And Irish leaders are still saying they have not asked for help, but they are now acknowledging the talks:

“Given the current market conditions, there have been on-going contacts at official level with our international partners,” [Taoiseach Brian Cowen] said.Some reports suggest a tentative deal could be reached very soon (perhaps as early as tomorrow).

...

“This is not an insurmountable challenge and, through working together with our partners in a calm and rational manner, we can resolve these issues and underpin financial stability in the medium and longer term," he said. “It is in all of our interests that we find a credible, efficient and above all workable solution that will provide assurance to the markets and thereby restore confidence and stability."

NAHB Builder Confidence up slightly in November

by Calculated Risk on 11/16/2010 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was at 16 in November. This is a 1 point increase from the revised 15 in October (revised down from 16). This is the highest level since June. The record low was 8 set in January 2009, and 16 is still very low ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October housing starts will be released tomorrow).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

Press release from the NAHB: Builder Confidence Improves Slightly in November

Builder confidence in the market for newly built, single-family homes improved slightly in November, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI rose one notch to 16 from a downwardly revised level of 15 in the previous month.This was slightly below expectations of an increase to 17.

...

Two out of three of the HMI's component indexes registered improvement in November, while the third component held steady. The component gauging sales expectations in the next six months rose two points to 25, the component gauging traffic of prospective buyers rose one point to 12, and the component gauging current sales conditions held unchanged at 16.

Industrial Production, Capacity Utilization Flat in October

by Calculated Risk on 11/16/2010 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in October after having fallen 0.2 percent in September. ... The capacity utilization rate for total industry was flat at 74.8 percent, a rate 6.6 percentage points above the low in June 2009 and 5.8 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 9.7% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 74.8% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in October, and production is still 7.3% below the pre-recession levels at the end of 2007.

This was below consensus expectations of a 0.3% increase in Industrial Production, and an increase to 74.9% for Capacity Utilization.

Monday, November 15, 2010

NY Times on European Debt Crisis

by Calculated Risk on 11/15/2010 11:35:00 PM

An overview from the NY Times: Europe Fears That Debt Crisis Is Ready to Spread

European officials, increasingly concerned that the Continent’s debt crisis will spread, are warning that any new rescue plans may need to cover Portugal as well as Ireland to contain the problem they tried to resolve six months ago.Officials of both Ireland and Portugal are saying they are not asking for help - Ireland is funded until mid-2011. So this crisis might simmer for some time ...

...

Of paramount concern to policy makers in Europe is Spain, which is struggling to close its own deficit of 9 percent of G.D.P. at a time when unemployment is more than 20 percent and the economy is failing to grow.

LA Port Traffic in October: Exports increase

by Calculated Risk on 11/15/2010 07:40:00 PM

Notes: this data is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was up 15% compared to October 2009.

Loaded outbound traffic was up 12% from October 2009.

For imports, there is a clear seasonal pattern and frequently a double peak - first in late summer, and then in October as retailers build inventory for the holiday season - so this was an unusual decrease in October compared to September.

For exports there is no clear seasonal pattern, and exports increased to just above the level in May. This suggests that the trade deficit with China (and other Asian countries) might have declined slightly in October (seasonally adjusted).

S&P predicts house prices to fall another 7% to 10% through 2011

by Calculated Risk on 11/15/2010 05:05:00 PM

From Jon Prior at HousingWire: S&P predicts more home price declines through 2011

Standard & Poor's analysts believe home prices will drop between 7% and 10% through 2011 ...This gives me an excuse to update the graph on house prices and months-of-supply. The following graph shows existing home months-of-supply (left axis), and Case-Shiller composite 20 house prices (right axis, inverted).

"Low mortgage rates ...influence on home buying activities has been limited due to the weak housing market and a lack of demand," S&P credit analyst Erkan Erturk said. ...

Prices will continue to be pressed down as long as the market works through a backlog of distressed properties that remains elevated.

Click on graph for larger image in new window.

Click on graph for larger image in new window.House prices are through August using the composite 20 index (a three month average of June, July and August). Months-of-supply is through September. The preliminary data indicates that months-of-supply was still in double digits in October.

This is one of the reasons I expect house prices to fall another 5% to 10% - and it looks like S&P is now forecasting about the same price declines.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

Philly Fed: Forecasters still catching up

by Calculated Risk on 11/15/2010 02:35:00 PM

This is interesting because these forecasters are still catching up with the slowdown.

From the Philly Fed: Forecasters Predict Further Slowdown in Economic Recovery

The pace of recovery in output and employment in the U.S. economy looks a little slower now than it did three months ago, according to 43 forecasters surveyed by the Federal Reserve Bank of Philadelphia. The panel expects real GDP to grow at an annual rate of 2.2 percent this quarter, down from the previous estimate of 2.8 percent. [CR Note: I'll take the under for Q4]The real GDP projections and the unemployment rate forecasts are a little inconsistent. If GDP grows at these rates, the unemployment rate will probably be higher than these projections through 2013.

...

The forecasters predict real GDP will grow 2.5 percent in 2011, 2.9 percent in 2012, and 3.0 percent in 2013.

...

The forecasters also predict weaker recovery in the labor market. Unemployment is projected to be an annual average of 9.7 percent in 2010, before falling to 9.3 percent in 2011, 8.7 percent in 2012, and 7.9 percent in 2013. These estimates are higher than the projections in the last survey. On the employment front, the forecasters have revised downward the growth in jobs over the next four quarters. The forecasters see nonfarm payroll employment growing at a rate of 86,600 jobs per month this quarter and 104,200 jobs per month next quarter.

...

The current outlook for the headline and core measures of CPI and PCE inflation in 2011 and 2012 is lower than it was in the last survey.

Misc: NY Manufacturing conditions "deteriorate", Business Inventories Increase

by Calculated Risk on 11/15/2010 10:14:00 AM

From the NY Fed:

The Empire State Manufacturing Survey indicates that conditions deteriorated in November for New York State manufacturers. For the first time since mid-2009, the general business conditions index fell below zero, declining 27 points to -11.1. The new orders index plummeted 37 points to -24.4, and the shipments index also fell below zero. The indexes for both prices paid and prices received declined, with the latter falling into negative territory. The index for number of employees remained above zero but was well below its October level, and the average workweek index dropped to -13.0.I'll have more when the Philly Fed index is released on Thursday, but this was far below the expectations of a reading of 15.

And from the Census Bureau: September 2010 Manufacturing and Trade Inventories and Sales report

Inventories. Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,402.9 billion, up 0.9 percent (±0.1%) from August 2010 and up 6.3 percent (±0.4%) from September 2009.Expectations were for a 0.8% increase in inventories.

Inventories/Sales Ratio. The total business inventories/sales ratio based on seasonally adjusted data at the end of September was 1.27.

Retail Sales increase 1.2% in October

by Calculated Risk on 11/15/2010 08:30:00 AM

On a monthly basis, retail sales increased 1.2% from September to October (seasonally adjusted, after revisions), and sales were up 7.3% from October 2009.

Retail sales increased 0.4% ex-autos - about at expectations.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 11.2% from the bottom, and only off 1.8% from the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.6% on a YoY basis (7.3% for all retail sales).

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $373.1 billion, an increase of 1.2 percent (±0.5%) from the previous month, and 7.3 percent (±0.7%) above October 2009.

Sunday, November 14, 2010

Ireland Minister: Reports of Bailout Talks are "Fiction"

by Calculated Risk on 11/14/2010 09:41:00 PM

Earlier posts:

From the Irish Times: Ministers claim fiscal plan and budget negate need for bailout

Minister for Justice Dermot Ahern also said there was no foundation to media reports that the country is close to availing of the bailout. “It is fiction ..."A number of media outlets have reported that bailout talks were ongoing ... the European bond markets might be interesting later tonight.

...

"We have not applied. There are no negotiations going on. If there were, Government would be aware of it, and we are not aware of it,” said Mr Ahern

Ireland: Talks Continue

by Calculated Risk on 11/14/2010 06:17:00 PM

Earlier posts:

Not much new. Ireland officials are insisting they don't need help, and other European governments apparently pushing for Ireland to ask for a bail-out.

From the Telegraph: Ireland fights to stave off £77 billion bail-out

Talks went on into the night as Irish ministers insisted that they could manage their stricken finances but other Governments expressed concerns that an emergency bail-out may be required as early as today.Here are the Bloomberg links to check later for the Ireland, Portugal and Spain 10-year bonds. And Greece too.

...

The key period, said officials, would be the reaction of the international market today to Irish and other eurozone bonds, especially Portuguese and Spanish government debt. Any sign of panic will lead to fears of so-called market contagion spreading from Ireland to Portugal, Spain and the wider eurozone.

Schedule for Week of November 14th

by Calculated Risk on 11/14/2010 01:24:00 PM

The previous post is the Summary for Week ending November 14th

Two key housing reports will be released this week: October housing starts (Wednesday) and November homebuilder confidence (Tuesday). Also October retail sales will be released on Monday, and the Fed will release the October industrial production and capacity utilization report (Tuesday).

7:40 PM ET: Richmond Fed President Jeffrey Lacker speaks on "Unemployment and Monetary Policy: Lessons from Half a Century Ago" before the 2010 International Conference for Advanced Placement Economics teachers

8:30 AM ET: Retail Sales for October. The consensus is for a 0.7% increase from September. (0.4% increases ex-auto).

8:30 AM: Empire Manufacturing Survey for November. The consensus is for a reading of 15.0, about the same level as in October (15.7). These regional surveys have shown a slight pickup following the slowdown in Q3.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.8% increase in inventories.

8:30 AM: Producer Price Index for October. The consensus is for a 0.8% increase in producer prices.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.3% increase in Industrial Production, and an increase to 74.9% (from 74.7%) for Capacity Utilization. Both Industrial Production and Capacity Utilization surprised to the downside in September.

10 AM: The November NAHB homebuilder survey. This index collapsed following the expiration of the home buyer tax credit. The consensus is for a slight increase to 17 from 16 in October (still very depressed).

Early: The AIA's Architecture Billings Index for October will be released (a leading indicator for commercial real estate). This showed slight expansion in September (50.4) for the first time since January 2008. This index usually this leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last few months - suggesting reported home sales will be very weak through the end of the year.

8:30 AM: Housing Starts for October. Housing starts also collapsed following the expiration of the home buyer tax credit. The consensus is for a decrease to 590,000 (SAAR) in October from 610,000 in September.

8:30 AM: Consumer Price Index for September. The consensus is for a 0.4% increase in prices. The consensus for core CPI is an increase of 0.1%.

9:15 AM: St. Louis Fed President James Bullard speaks on the "Past, Present, and Future of the Government Sponsored Enterprises (GSE's)"

8:30 AM: The initial weekly unemployment claims report will be released. Initial claims declined to 435,000 last week, and initial claims are expected to increase to 445,000 this week.

10:00 AM: Philly Fed Survey for November. This survey showed slight expansion last month after showing contraction for the previous two months. The consensus is for an increase to 5.6 from 1.0 in October.

10:00 AM: Conference Board's index of leading indicators for October. The consensus is for a 0.5% increase in this index.

5:15 AM: Fed Chairman Ben S. Bernanke speaks on Global Rebalancing at the Sixth European Central Bank Central Banking Conference, Frankfurt am Main, Germany

After 4:00 PM: Perhaps the FDIC will have another busy Friday afternoon ...

CoreLogic House Price Index for September. This release will probably show further declines in house prices. The index is a weighted 3 month average for July, August and September.

Making Home Affordable Program (HAMP) for October and the “Housing Scorecard”

Summary for Week ending November 14th

by Calculated Risk on 11/14/2010 08:55:00 AM

A summary of last week - mostly in graphs. Note: A key story all week concerned the possible bailout of Ireland.

The Census Bureau reported:

[T]otal September exports of $154.1 billion and imports of $198.1 billion resulted in a goods and services deficit of $44.0 billion, down from $46.5 billion in August, revised.

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly U.S. exports and imports in dollars through September 2010.

After trade bottomed in the first half of 2009, imports increased much faster than exports. Over the last five months, both exports and imports have been relatively flat.

The trade deficit will probably increase in October since oil prices increased, and China reported a higher trade surplus for October.

This graph shows the index since January 1999.

This graph shows the index since January 1999.Press Release: Over the Road Trucked Shipping Decline Signals Weaker Holiday Season, Reports Latest Ceridian-UCLA Pulse of Commerce Index™

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, fell 0.6 percent in October following a decline of 0.5 percent in September and a decline of 1.0 percent in August. ... “We have had a recovery ‘time out,’” summarized [Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast].

From National Federation of Independent Business (NFIB): Small Business Optimism improves slightly

From National Federation of Independent Business (NFIB): Small Business Optimism improves slightly Optimism rose again in October, but the index remains stuck in the recession zone established over the past two years, not a good reading even with a 2.7 point improvement over September. This is still a recession level reading based on Index values since 1973. However, job creation plans did turn positive and job reductions ceased.The above graph shows the small business optimism index since 1986. Although the index increased to 91.7 in October (highest since May), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

The next graph shows the net hiring plans over the next three months.

The next graph shows the net hiring plans over the next three months.Hiring plans have turned slightly positive again. According to NFIB: "Average employment growth per firm was 0 in October, one of the best performances in years. ... Over the next three months, eight percent plan to increase employment (unchanged), and 13 percent plan to reduce their workforce (down three points), yielding a seasonally adjusted net one percent of owners planning to create new jobs, a four point gain from September."

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.Usually small business owners complain about taxes and regulations (that usually means business is good!), but now their self reported biggest problem is lack of demand.

The preliminary Reuters / University of Michigan consumer sentiment index increased slightly in November to 69.3 from 67.7 in October.

The preliminary Reuters / University of Michigan consumer sentiment index increased slightly in November to 69.3 from 67.7 in October.This was a big story in when consumer sentiment collapsed again in July. Since then this measure of consumer sentiment has mostly moved sideways at a fairly low level.

In general consumer sentiment is a coincident indicator.

Best wishes to all.

Saturday, November 13, 2010

Labor Force Participation Trends, Over 55 Age Groups

by Calculated Risk on 11/13/2010 09:59:00 PM

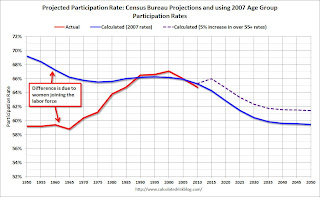

On Thursday I asked: What will happen to the Labor Force Participation Rate?

I posted a series of graphs trying to show the trends in participation - and one of the graphs I posted showed two projections for the labor force participation rate through 2050 (using population projections from the Census Bureau). Here is that graph again:

Click on graph for larger image.

Click on graph for larger image.

This graph shows the calculated participation rate (blue) through 2050, and the actual participation rate since 1950 (red). The calculated participation rate, using 2007 data, is far too high for the earlier periods. This is mostly because of women joining the labor force (see the previous post for more on women joining the labor force).

The blue line would indicate the participation rate over the next 40 years if the participation rate per age group stayed static at 2007 levels. The participation rate would be expected to decline as the population ages. This simple analysis suggests the participation rate would be at about the same level in 2015 as today.

I added the dashed purple line to show the impact of a 5 percentage point increase in the 'over 55' labor force participation rate. I pointed out that the participation rate for the 'over 55' age group has been trending up. If the trend continues for the 'over 55' group - perhaps because of necessity, perhaps because of fewer "back breaking" jobs - then the overall participation rate will not fall as quickly as the blue line indicates. With just a 5 percentage point increase in participation for the 'over 55', the participation rate will be back to 66% in 2015.

A couple of readers asked if this was possible? The answer is yes.

The second graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The second graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The participation rate is trending up for all age groups. And another five percentage point increase is very possible over the next 5 to 10 years. After that the 'over 55' participation rate might start to decline as the oldest baby boomers move into the 'over 75' age group.

All of this suggests to me that the participation rate will probably move back towards 66% over the next few years, even with an aging population.

Reports: Ireland bailout talks continue

by Calculated Risk on 11/13/2010 05:30:00 PM

The Financial Times "Eurozone in talks on Ireland bail out" reports that European ministers are currently deliberating whether Ireland needs a bailout before the markets open on Monday. The FT notes that the "the discussions ... are expected to intensify on Sunday".

And from Bloomberg: Ireland Urged to Take Aid by Officials Amid Debt Crisis

Irish Prime Minister Brian Cowen said he is working with fellow European leaders as his nation’s sovereign debt crisis threatens the stability of European markets.Leaders in Ireland want to avoid asking for aid from the IMF or using the EFSF, however other European leaders are apparently pushing Ireland to accept aid to contain the financial turbulence.

While reiterating that his debt-strapped country has not sought to tap an EU rescue fund, Cowen told reporters today that “there are issues affecting the wider euro area of which we are a member” and that he and his counterparts were working to “ensure that the bond markets respond positively to the euro.”

My guess is if Ireland accepts aid, then Ireland's bonds will rally (and the yield will fall sharply) - however this will probably lead to a "buyers strike" for Portugal's bonds. And then Portugal will have to ask for aid. Then Spain and / or Italy would be next in line ... and I think that is the real concern.