by Calculated Risk on 5/07/2010 09:59:00 AM

Friday, May 07, 2010

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

Here are a few more graphs based on the employment report ...

Employment-Population Ratio

The Employment-Population ratio increased to 58.8% in April (from 58.6% in March), after plunging since the start of the recession. This is about the same level as in December 1983. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

The Labor Force Participation Rate increased to 65.2% from 64.9% in March. This is the percentage of the working age population in the labor force. This is still well below the 66% to 67% rate that was normal over the last 20 years. As people return to the labor force, as the employment picture improves, this will put upward pressure on the unemployment rate - even with job growth.

Part Time for Economic Reasons  From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged at 9.2 million in April. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 9.152 million in April.

The all time record of 9.24 million was set in October.

These workers are included in the alternate measure of labor underutilization (U-6) that was at 17.1% in April.

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 6.72 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.34% of the civilian workforce. (note: records started in 1948)

Although the headline number of 290,000 payroll jobs was a positive (this is 224,000 after adjusting for the 66,000 Census 2010 temporary hires), the underlying details were mixed. The positives: the employment-population ratio increased (after plunging sharply), and average hours increased.

Negatives include the unemployment rate increasing to 9.9%, a near record number of part time workers (for economic reasons) pushing U-6 to 17.1%, and a record number of workers unemployed for more than 26 weeks.

The number of long term unemployed is one of the key stories of this recession, especially since many of them are now losing their unemployment benefits. Note: In Q1, all of the increase in income - and much of the increase in consumption - came from government transfer payments for unemployment benefits.

I'll have even more later ...

Earlier employment post today:

April Employment Report: 290K Jobs Added, 9.9% Unemployment Rate

by Calculated Risk on 5/07/2010 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 290,000 in April, the unemployment rate edged up to 9.9 percent, and the labor force increased sharply, the U.S. Bureau of Labor Statistics reported today.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls increased by 290,000 in April. The economy has lost 1.4 million jobs over the last year, and 7.8 million jobs since the recession started in December 2007.

The unemployment rate increased to 9.9 percent as people returned to the workforce.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Census 2010 hiring was 66,000 (NSA) in April.

This was well above expectations, especially given the level of Census 2010 hiring. The increase in the unemployment rate was because of people returning to the work force - the decline in the participation rate during the recession was stunning, and it is no surprise that people are once again looking for work. I'll have much more soon ...

Thursday, May 06, 2010

Employment Report Preview

by Calculated Risk on 5/06/2010 11:59:00 PM

The BLS will release the April Employment situation report tomorrow (Friday) morning at 8:30 AM ET. The consensus is around 200K payroll jobs and the unemployment rate declining slightly to 9.6%.

The estimates for temporary Census 2010 hiring are around 100K, so the market expectation is for about 100K payroll jobs ex-Census. That is the key number (the underlying job creation). Note: the largest increase in Census 2010 hiring will happen in May - perhaps 500K payroll jobs - and then all of those jobs will be unwound over the next 6 months.

The earlier data this week has been somewhat mixed. ADP reported 32K private sector jobs in April, the largest monthly increase since January 2008.

The ISM manufacturing report suggested fairly robust hiring in the manufacturing sector:

ISM's Employment Index registered 58.5 percent in April, which is 3.4 percentage points higher than the 55.1 percent reported in March. This is the fifth consecutive month of growth in manufacturing employment.Of course the manufacturing sector is relatively small.

And the ISM non-manufacturing report suggested job losses in the much larger service sector:

Employment activity in the non-manufacturing sector contracted in April for the 28th consecutive month. ISM's Non-Manufacturing Employment Index for April registered 49.5 percent. This reflects a decrease of 0.3 percentage point when compared to the 49.8 percent registered in March.The weekly initial unemployment claims was elevated throughout April suggesting continuing weakness in employment, but the Monster employment index was strong.

The Monster Employment Index rose eight points in April as a number of industries initiated springtime recruitment efforts. The annual growth rate further accelerated, rising by 11 percent, the highest rate of increase since July 2007.Anything above 100K ex-Census will be viewed as a solid report. As far as the unemployment rate, it usually drops 0.1% to 0.2% during the peak of the Census hiring (April and May) - however the participation rate fell so far during the recession, it is possible that the unemployment rate will tick up as more people reenter the workforce. We will know in a few hours ...

Market Selloff: Looking for clues

by Calculated Risk on 5/06/2010 09:20:00 PM

From Graham Bowley at the NY Times: Markets Plunge, Then Stage a Rebound

[I]n Washington a team of Treasury officials began combing through market tapes trying to figure out what was going on. By the evening they still had not gotten to the bottom of it, but they discovered some aberrations — market blips — in trading coming out of Chicago.And from Scott Patterson at the WSJ: Did Shutdowns Make Plunge Worse?

...

As of about 6 p.m., all the officials knew was that there had been what one official called “a huge, anomalous, unexplained surge in selling, it looks like in Chicago, at about 2:45.” The source remained unknown, but it had apparently set off algorithmic trading strategies, which in turn rippled across everything, pushing trading out of whack and feeding on itself — until it started to reverse.

Federal officials fielded rumors ... But they did not know the truth.

What happens to the day’s market losers will depend on what the cause was and whether it can be identified. That is a question for the S.E.C.

A number of high-frequency firms stopped trading Thursday in the midst of the market plunge, possibly adding to the market's unprecedented selloff.No answers yet - just rumors.

Tradebot Systems Inc., a large high-frequency firm based in Kansas City, Mo., closed down its computer trading systems when the Dow Jones Industrial Average had dropped about 500 points ... Tradeworx Inc., a N.J. firm that operates a high-frequency fund, also stopped trading during the market turmoil ...

NASDAQ to Cancel Certain Trades

by Calculated Risk on 5/06/2010 06:53:00 PM

Usually I focus more on economics, but ...

Via Reuters:

Nasdaq Operations said it will cancel all trades executed between 2:40 p.m. to 3 p.m. showing a rise or fall of more than 60 percent from the last trade in that security at 2:40 p.m or immediately prior.This needs an explanation ...

Market Update

by Calculated Risk on 5/06/2010 04:00:00 PM

There are two rumors: The first is that there was a trading error (fat finger of a E-mini SP future order), the second is that Euro banks are having a liquidity problem of some sort. Neither is confirmed. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in April 1998; over 12 years ago.

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Q1 PCE Growth came from Transfer Payments and Reductions in Personal Saving

by Calculated Risk on 5/06/2010 01:02:00 PM

This is a theme I've probably already pounded into the ground ... but here is some more from the Atlanta Fed's Economic Highlights:

This graph is from the Altanta Fed and shows the month-to-month increase in government transfer payments (green) and the change in real personal income less transfer payments (flat red line).

From the Atlanta Fed:

The major contributor to income growth during the past several months has been transfer payments.We could take this a step further ... the following table shows month-to-month increase in transfer payments and the month-to-month reduction in personal saving - and then compares to the month-to-month increase in Personal Consumption Expenditures (PCE). Note: all numbers are annual rates.

| Monthly Increase, Billions (SAAR) | Jan-10 | Feb-10 | Mar-10 |

|---|---|---|---|

| Government Transfer Payments | |||

| Old-age, survivors, disability, and health insurance benefits | -1.5 | 3.1 | 5.1 |

| Government unemployment insurance benefits | -6.6 | -2.2 | 11.8 |

| Other | 33.7 | 6.4 | 7.8 |

| Reduction in Personal saving | 55.1 | 54 | 28.2 |

| Total Saving Reduction and Transfer Payments | 80.7 | 61.3 | 52.9 |

| Increase in Personal outlays | 34.4 | 58.3 | 60.6 |

This shows that the entire increase in consumption in Q1 was due to transfer payments and reductions in the saving rate (now down to 2.7% in March). I suppose the saving rate could go to zero - although I expect it to increase, maybe incorrectly! - but at some point increases in consumption are going to have to come from jobs and income growth, not government transfer payments and reductions in the saving rate.

Bernanke on Stress Tests

by Calculated Risk on 5/06/2010 09:58:00 AM

From Fed Chairman Ben Bernanke: The Supervisory Capital Assessment Program--One Year Later

Importantly, the concerns about banking institutions arose not only because market participants expected steep losses on banking assets, but also because the range of uncertainty surrounding estimated loss rates, and thus future earnings, was exceptionally wide. The stress assessment was designed both to ensure that banks would have enough capital in the face of potentially large losses and to reduce the uncertainty about potential losses and earnings prospects. To achieve these objectives, for each banking organization included in the SCAP, supervisors estimated potential losses for each major category of assets, as well as revenue expectations, under a worse-than-expected macroeconomic scenario for 2009 and 2010. Importantly, the SCAP was not a solvency test; rather, the exercise was intended to determine whether the tested firms would have sufficient capital remaining to continue lending if their losses were larger than expected. The assessment included all domestic bank holding companies with at least $100 billion in assets at the end of 2008--19 firms collectively representing about two-thirds of U.S. banking assets.The good news is the economy has performed better than the "more adverse" scenario, especially house prices and GDP - although unemployment is still much worse than the "baseline" projections.

...

The assessment found that if the economy were to track the specified "more adverse" scenario, losses at the 19 firms during 2009 and 2010 could total about $600 billion. After taking account of potential resources to absorb those losses and capital that had already been raised or was contractually committed, and after establishing the size of capital buffers for the end of the two-year horizon that we believed would support stability and continued lending, we determined that 10 of the 19 institutions would collectively need to raise an additional $75 billion in common equity. Firms were asked to raise the capital within six months, by November 2009. Importantly, we publicly released our comprehensive assessments of each of the firms' estimated losses and capital needs under the more-adverse scenario. Our objective in releasing the information was to encourage private investment in these institutions, and thus bolster their lending capacity. If private sources of capital turned out not to be forthcoming, however, U.S. government capital would be available.

The bad news is one of the key goals has not been met: to "bolster lending". From Bernanke:

Our goal ... was to accomplish more than stability; for example, in the SCAP, by setting reasonably ambitious capital targets, we hoped also to hasten the return to a better lending environment.Several analysts (like Meredith Whitney yesterday) are questioning the health of the banks. Perhaps it is time to repeat the stress tests (make them an annual exercise like the FSA in the UK), publish the scenarios for five years (baseline and more adverse), and also make the results public.

Clearly that objective has not yet been realized, as bank lending continues to contract and terms and conditions remain tight.

Weekly Initial Unemployment Claims decline slightly

by Calculated Risk on 5/06/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 1, the advance figure for seasonally adjusted initial claims was 444,000, a decrease of 7,000 from the previous week's revised figure of 451,000. The 4-week moving average was 458,500, a decrease of 4,750 from the previous week's revised average of 463,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 24 was 4,594,000, a decrease of 59,000 from the preceding week's revised level of 4,653,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,750 to 458,500.

The dashed line on the graph is the current 4-week average. The current level of 444,000 (and 4-week average of 458,500) is still high, and suggests continuing weakness in the labor market.

Although declining over the last few weeks, the 4-week average first declined to this level in December 2009, and has been at this level for about five months.

Wednesday, May 05, 2010

Evening Euro

by Calculated Risk on 5/05/2010 10:13:00 PM

Just a bit of an overview ... the European Central Bank (ECB) is meeting in Lisbon, Portugal, and will announce their interest rate decision at 4:45 AM ET. You can watch the news conference here live at 5:30 AM ET.

Great timing to meet in Lisbon since earlier today Moody's warned that Portugal may face a downgrade.

Ratings agency Moody's Investors Service on Wednesday placed Portugal's government bond ratings on review for possible downgrade, citing the recent deterioration of the country's public finances and "long-term growth challenges" to the economy.Three months?

In the event of a downgrade, the country's Aa2 ratings would fall by one or, at most, two notches, the agency said. Moody's said it expects to complete the review within three months.

At the meeting, it is expected that the ECB will leave rates unchanged at 1%.

Professor Krugman argues Greece may end up leaving the euro: Greek End Game

Many commentators now believe that Greece will end up restructuring its debt — a euphemism for partial repudiation. I agree. But the reasoning seems to stop there, which is wrong. In effect, the consensus that Greece will end up defaulting is probably too optimistic. I’m growing increasingly convinced that Greece will end up leaving the euro, too.And there was sad news from Greece, from Reuters: Europe leaders warn of contagion, 3 die in Greece

Freddie Mac: Q1 Net Loss $6.7 billion, Asks for $10.6 billion

by Calculated Risk on 5/05/2010 05:40:00 PM

"[A]s we have noted for many months now, housing in America remains fragile with historically high delinquency and foreclosure levels, and high unemployment among the key risks."

Freddie Mac Chief Executive Officer Charles E. Haldeman, Jr.

Press Release: Freddie Mac Reports First Quarter 2010 Financial Results

First quarter 2010 net loss was $6.7 billion. ...The first quarter loss in 2009 was $9.97 billion and the Q4 2009 loss was $6.5 billion. The losses keep coming, but last quarter Haldeman warned about "a potential large wave of foreclosures", so it appears he is a little more optimistic.

Net worth deficit was $10.5 billion at March 31, 2010, driven primarily by a significant adverse impact due to the change in accounting principles. ...

The Federal Housing Finance Agency (FHFA), as Conservator, will submit a request on the company’s behalf to Treasury for a draw of $10.6 billion under the Senior Preferred Stock Purchase Agreement (Purchase Agreement).

emphasis added

Whitney: Banks Under-reserved for 'Double-dip' in House Prices

by Calculated Risk on 5/05/2010 02:25:00 PM

From Nikolaj Gammeltoft and Peter Eichenbaum at Bloomberg: Whitney Says Banks Face ‘Tough’ Quarter, Housing Dip (ht jb)

Banks continue to suffer from losses on non-performing loans, and U.S. home prices will fall again amid increasing supply and sluggish demand, according to [banking analyst Meredith Whitney].I also think the repeat national house price indexes (Case-Shiller, LoanPerformance) will show further price declines later this year. But, we have to recognize that a majority of the national price declines are behind us, and any 'double-dip' in prices will be much smaller than the previous declines.

“I’m steadfast in my belief there’s going to be a double- dip in housing,” she said. “You will see clearly that the banks are under-reserved when housing dips again.”

My guess is some mid-to-high end bubble areas will see the largest future price declines - so the impact on the banks will depend on their exposure to the those areas.

I think BofA with the Countrywide loans, Wells Fargo with Wachovia / Golden West, and JPMorgan with WaMu are all exposed to the mid-to-high end bubble areas. But all the acquiring banks took large write-downs for these loans earlier, so I'm not sure Whitney is correct about them being under-reserved (it is hard to tell). Of course there are the 2nd lien issues too.

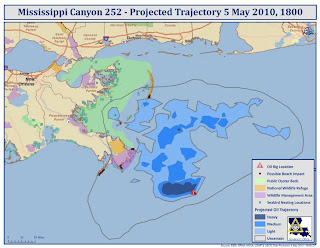

Web Resources for tracking the Oil Spill

by Calculated Risk on 5/05/2010 12:19:00 PM

From NOAA: Deepwater Horizon Incident, Gulf of Mexico

From the Office of the Governor, Louisiana: Gulf Oil Spill 2010 Trajectory

Click on map for larger image in new window.

Update: from Google: Gulf of Mexico Oil Spill (ht Jan)

ISM Non-Manufacturing Index Shows Expansion

by Calculated Risk on 5/05/2010 10:02:00 AM

April ISM Non-Manufacturing index 55.4%, unchanged from March.

This shows further growth in the service sector, although employment contracted for the 28th consecutive month.

From the Institute for Supply Management: April 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the fourth consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 55.4 percent in April, the same percentage as registered in March, and indicating growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased 0.3 percentage point to 60.3 percent, reflecting growth for the fifth consecutive month. The New Orders Index decreased 4.1 percentage points to 58.2 percent, and the Employment Index decreased 0.3 percentage point to 49.5 percent."

...

Employment activity in the non-manufacturing sector contracted in April for the 28th consecutive month. ISM's Non-Manufacturing Employment Index for April registered 49.5 percent. This reflects a decrease of 0.3 percentage point when compared to the 49.8 percent registered in March.

emphasis added

ADP: Private Employment increased in April

by Calculated Risk on 5/05/2010 08:15:00 AM

ADP reports:

Nonfarm private employment increased 32,000 from March to April 2010 on a seasonally adjusted basis, according to the ADP National Employment Report. The estimated change in employment from February to March 2010 was revised up, from a decline of 23,000 to an increase of 19,000.Note: ADP is private nonfarm employment only (no government jobs).

In addition, the revised estimate of the monthly change in employment from January to February 2010 shows a modest increase of 3,000. Thus, employment has increased for three straight months, albeit only modestly. The slow pace of improvement from February through April is consistent with the pause in the decline of initial unemployment claims that occurred during the winter months.

...

April’s ADP Report estimates nonfarm private employment in the service-providing sector rose by 50,000, the third consecutive monthly increase. Employment in the goods-producing sector declined 18,000 during April. However, while construction employment dropped 49,000, manufacturing employment, in an encouraging sign, rose 29,000, the third consecutive monthly increase.

This is close to the consensus forecast of an increase of 28,000 private sector jobs in April.

The BLS reports on Friday, and the consensus is for an increase of 200,000 payroll jobs in April, on a seasonally adjusted (SA) basis, with about 100,000 temporary Census 2010 jobs.

MBA: Mortgage Purchase Applications Highest Since October

by Calculated Risk on 5/05/2010 07:00:00 AM

The MBA reports: Purchase Applications Continue to Increase, Refinance Activity Declines in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 4.0 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 2.1 percent from the previous week and the seasonally adjusted Purchase Index increased 13.0 percent from one week earlier. This is the third consecutive weekly increase in purchase applications and the highest Purchase Index recorded in the survey since the week ending October 2, 2009. ...

"Purchase application activity continued to increase in the last week of the homebuyer tax credit program," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Purchase applications were up 13 percent over the previous week and almost 24 percent over the last month, driven by significant increases in both conventional and government purchase applications. We also saw the Government share of applications for purchasing a home increase to over 50 percent of all purchase applications last week, which is the highest in two decades."

... The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.02 percent from 5.08 percent, with points increasing to 0.92 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

This is the highest level for the purchase index since last October. The index will probably turn down in the next week or two since the tax credit expired last Friday (buyers need to close by June 30th).

Tuesday, May 04, 2010

Martin Wolf: A bail-out for Greece is just the beginning

by Calculated Risk on 5/04/2010 07:47:00 PM

Martin Wolf writes in the Financial Times: A bail-out for Greece is just the beginning

Wolf reviews the bailout of Greece, and points out that Greece will probably be in prolonged slump. He wonders if the Greeks will "bear that burden year after weary year?"

And on the other members of the eurozone:

[T]he programme prevents an immediate shock to fragile financial systems: it is overtly a rescue of Greece, but covertly a bail-out of banks. But it is far from clear that it will help other members now in the firing line. ... Other eurozone members might well end up on their own. None is in as bad a condition as Greece ... But several have unsustainable fiscal deficits and rapidly rising debt ratios.Wolf is not optimistic and has "huge doubts".

excerpts with permission

The 2nd Half Slowdown

by Calculated Risk on 5/04/2010 04:50:00 PM

There are several analysts forecasting GDP growth to pick up in the 2nd half of this year, with annual GDP growth of over 4% for 2010 (the advance Q1 GDP estimate was 3.2%, so over 4% for 2010 would require a nice pick up in the 2nd half). This is not a "v-shaped" recovery - that didn't happen - but these forecasts are still above trend growth.

Unfortunately I think we will see a slowdown in the 2nd half of the year, but still positive growth. Last year I argued for a 2nd half recovery ... and that was more fun!

Here are a few reasons I think the U.S. economy will slow:

1) The stimulus spending peaks in Q2, and then declines in the 2nd half of 2010. This will be a drag on GDP growth in the 2nd half of this year.

2) The inventory correction that added 3.8% to GDP in Q4, and 1.6% to GDP in Q1, has mostly run its course.

3) The growth in Personal Consumption Expenditures (PCE) in Q1 came mostly from less saving and transfer payments, as opposed to income growth. That is not sustainable, and future growth in PCE requires jobs and income growth. Although I expect employment to increase, I think the job market will recover slowly (excluding temporary Census hiring) because the key engine for job growth in a recovery is residential investment (RI) - and RI has stalled (until the excess housing inventory is reduced).

4) There is a slowdown in China and Europe has some problems (if no one noticed) ... and that will probably impact export growth, and also negatively impact one of the strongest U.S. sectors - manufacturing (when was the last time manufacturing was one of the strongest sectors?)

Of course monetary policy is still supportive and it is unlikely the Fed will sell assets or raise the Fed Funds rate this year. Maybe some commodities like oil will be cheaper and give a boost to the U.S. economy ... maybe the saving rate will fall further and consumption will continue to grow faster than income ... maybe residential investment will pick up sooner than I expect ... maybe. But this suggests a 2nd half slowdown to me.

Residential Investment Components Q1 2010

by Calculated Risk on 5/04/2010 02:57:00 PM

More from the Q1 2010 GDP underlying detail tables ...

Note: Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q1 2010. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $152.9 billion Seasonally Adjusted Annual Rate (SAAR) in Q1, significantly above the level of investment in single family structures of $115.2 billion (SAAR).

Home improvement spending, as a percent of GDP, is close to the long term median - although still declining. Brokers' commissions declined after the initial expiration of the tax credit - but will probably be boosted in Q2 by the extension of the homebuyer tax credit - and then will decline again in Q3.

Investment in single family structures is above the record low set in Q2 2009, and far below the normal level. And investment in multifamily structures is still collapsing. These two categories will not increase significantly until the number of excess housing units is reduced.