by Calculated Risk on 4/21/2010 08:35:00 PM

Wednesday, April 21, 2010

On Existing Home Sales

Existing home sales for March will be released tomorrow and the consensus is for the NAR to report 5.25 million sales on a seasonally adjusted annual rate (SAAR) basis. That is probably close (I'll take the under). The NAR reported a 5.02 million sales rate in February.

1) The Federal tax credit expires at the end of April for buyers to sign a contract. Since existing home sales are reported when the transaction is closed (by the end of June to qualify for the tax credit), the tax credit probably had little impact on March sales. The boost to reported existing home sales from the tax credit will probably come mostly in May and June.

2) New home sales are counted when the contract is signed, so the boost should come earlier (March and April). The Census Bureau will report March new home sales on Friday.

3) The MBA mortgage purchase index is showing only a small pickup in purchase applications - so it appears the boost to sales from the tax credit will be much smaller than last year.

4) The level of existing home inventory is probably the most interesting detail in the NAR report tomorrow. Unfortunately there appears to be some discrepancy between local inventory levels and the number the NAR reports. However, on a year-over-year basis, inventories have been declining for the last 19 months. It is possible that the inventory level in March will be above March 2009 (3.65 million in March 2009). So that is something to watch for ...

Greece, Portugal Spread to Bunds Widen

by Calculated Risk on 4/21/2010 03:58:00 PM

Just an update ...

From Bloomberg: Portugal Spread to Bunds Widest in 13 Months on Greek Contagion

The yield on Portugal’s 10-year bond jumped 11 basis points to 4.80 percent ... That left the difference in yield, or spread, with bunds 11 basis points wider at 166 basis points, after earlier reaching 172 basis points, the most since March 10, 2009.

Greek 10-year bonds dropped ... sending the yield up 20 basis points to 8.17 percent. The yield premium over bunds jumped 25 basis points to 503 basis points after climbing to more than 522 basis points, the most since at least March 1998, when Bloomberg began compiling the generic prices.

Distressed Sales: Sacramento as an Example, March Update

by Calculated Risk on 4/21/2010 12:13:00 PM

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.

Starting last month First American Corelogic has started releasing a distressed sales report - and that shows the trend in short sales and REOs nationally. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the March data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. Almost 65% of all resales (single family homes and condos) were distressed sales in March.

Note: This data is not seasonally adjusted, although the increase in sales in March is slightly above normal because of the tax credit. The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December. This will probably continue to increase this year (2010 is the year of the short sale!).

The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December. This will probably continue to increase this year (2010 is the year of the short sale!).

Also total sales in March were off 3.4% compared to March 2009; the tenth month in a row with declining YoY sales - even with a surge from tax credit buying this year!

On financing, nearly 60 percent were either all cash (27.1%) or FHA loans (31.5%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

Architecture Billings Index shows contraction in March

by Calculated Risk on 4/21/2010 08:57:00 AM

Note: This index is a leading indicator for Commercial Real Estate (CRE) investment.

The WSJ reports that the American Institute of Architects’ Architecture Billings Index increased to 46.1 in March from 44.8 in February. Any reading below 50 indicates contraction.

"This is certainly an encouraging sign that we could be moving closer to a recovery phase, even though we continue to hear about mixed conditions across the country," said Kermit Baker, chief economist at the American Institute of ArchitectsThe ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

The second graph compares the Architecture Billings Index with the year-over-year change in non-residential structure investment.

Historically, according to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through all of 2010, and probably longer.

Historically, according to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through all of 2010, and probably longer.Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

And more on CRE: Fitch: U.S. CMBS Loan Defaults to Exceed 11% by End of 2010

Loan defaults will continue to escalate for U.S. CMBS, with an additional 4.4% likely in 2010 and the overall rate to exceed 11% among Fitch-rated deals by the end of the year, according to Fitch Ratings.

... For the first time in five years, multifamily was not the property type with the most new defaults, with that distinction going to retail (32.3%) last year. Following retail was multifamily (22.1%), office (20.2%) and hotel (17.8%). Fitch projects sizeable default increases for each property type, with rates likely to increase at accelerated rates for office and hotel loans.

'Office defaults spiked in the fourth quarter last year, with further rental and net operating income declines likely through next year before a rebound takes place,' said Senior Director Richard Carlson.

MBA: Mortgage Purchase Applications Increase "Modestly"

by Calculated Risk on 4/21/2010 08:07:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 13.6 percent on a seasonally adjusted basis from one week earlier. ...

“Treasury rates fell last week causing a decline in mortgage rates. As a result, refinance applications picked up over the week, as some borrowers took advantage of this recent rate volatility to lock in a low fixed-rate loan,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Purchase applications continued to increase coming out of the Easter holiday, as we approach the end of the homebuyer tax credit, and are up modestly over last month.”

The Refinance Index increased 15.8 percent from the previous week and the seasonally adjusted Purchase Index increased 10.1 percent from one week earlier. ...

The refinance share of mortgage activity increased to 60.0 percent of total applications from 58.9 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.04 percent from 5.17 percent, with points increasing to 0.98 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

So far the increase in activity because of the expiration of the tax credit has been "modest". I expect any increase this year to be less than the increase last year ...

Tuesday, April 20, 2010

Shiller: "Mini-bubble" in Stock and Housing Markets

by Calculated Risk on 4/20/2010 10:18:00 PM

Jennifer Schonberger at Motley Fool interviews Professor Robert Shiller: Shiller: The Housing Recovery Could Be on Shaky Ground.

A couple of comments from Shiller, first on house prices:

Robert Shiller: Home prices have been going up for nearly a year now, according to our data, the S&P/Case-Shiller indices ... Normally we could extrapolate that kind of upward trend because historically home prices have shown a lot of momentum. But I think we're in a very unusual circumstance because of the massive bailouts, the homebuyer tax credits, the Fed's purchase of mortgage-backed securities -- and these things are coming to an end. So it's an unusual period. So I don't trust the trend that we have. I'm worried that it might get reversed.And on asset prices:

Shiller: We have had kind of a mini-bubble in the stock market and the housing market. It wasn't just because of rate cuts. It was also because of government stimulus and bailouts. So the question is: Are we at risk for even more price increases, and another bubble? I think we are at risk, but I'm not predicting it. I think it's more likely we don't do so well from here.

NY Times: Up to 300,000 public school jobs could be cut

by Calculated Risk on 4/20/2010 06:48:00 PM

From Tamar Lewin and Sam Dillon at the NY Times: School Districts Warn of Even Deeper Teacher Cuts (ht Ann)

School districts around the country ... are warning hundreds of thousands of teachers that their jobs may be eliminated in June.These cuts will make the employment situation worse. This is also a reminder that the Federal stimulus spending peaks in Q2, and then starts to decline in Q3.

... their usual sources of revenue — state money and local property taxes — have been hit hard by the recession. In addition, federal stimulus money earmarked for education has been mostly used up this year.

...

Districts in California have pink-slipped 22,000 teachers. Illinois authorities are predicting 17,000 public school job cuts. And New York has warned nearly 15,000 teachers that their jobs could disappear in June.

Secretary of Education Arne Duncan estimated that state budget cuts imperiled 100,000 to 300,000 public school jobs. In an interview on Monday, he said the nation was flirting with “education catastrophe.”

DataQuick: Foreclosures moving to mid-to-high end

by Calculated Risk on 4/20/2010 04:00:00 PM

As a followup to the previous post, here is some more data from DataQuick:

"We are seeing signs that the worst may be over in the hard-hit entry-level markets, while problems are slowly spreading to more expensive neighborhoods. We're also seeing some lenders become more accommodating to work-outs or short sales, while others appear to be getting stricter about delinquencies. It's very noisy out there," [John Walsh, DataQuick president] said.The foreclosure rates in the mid-to-high end areas will never be as high as in the low end areas, but the percentage of total foreclosures will probably continue to increase. I also expect the average time in the foreclosure process to start to decrease this year as the lenders start clearing out the backlog.

The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for 47.5 percent of all default activity a year ago. In first-quarter 2010 that fell to 40.9 percent.

California's mid- to high-end housing markets were more likely to have seen a rise in mortgage defaults last quarter, though the concentration of default activity - measured by defaults per 1,000 homes - remained relatively low in those areas.

For example, zip codes statewide with median home sale prices of $500,000-plus saw mortgage defaults buck the overall trend and rise 1.5 percent last quarter compared with the prior quarter, while year-over-year the decline was 19 percent (versus a 40.2 percent marketwide annual decrease). Collectively, these zips saw 4.5 default notices filed for every 1,000 homes in the community, compared with the overall market's rate of 9.3 NODs for every 1,000 homes statewide.

In zip codes with medians below $500,000, mortgage default filings fell 5.8 percent from the prior quarter and declined nearly 43 percent from a year earlier. However, collectively these zips saw 10.5 NODs filed for every 1,000 homes - more than double the default rate for the zips with $500,000-plus medians.

On average, homes foreclosed on last quarter spent 7.5 months winding their way through the formal foreclosure process, beginning with an NOD. A year ago it was 6.8 months. The increase could reflect, among other things, lender backlogs and extra time needed to pursue possible loan modifications and short sales.

Foreclosure resales accounted for 42.6 percent of all California resale activity last quarter. It was up from a revised 40.6 percent the prior quarter, and down from 57.8 percent a year ago, the peak.

DataQuick: California Notice of Default Filings Decline in Q1

by Calculated Risk on 4/20/2010 02:06:00 PM

Click on graph for larger image in new window.

This graph shows the Notices of Default (NOD) by year through 2009, and for Q1 2010, in California from DataQuick.

Although the pace of filings has slowed, it is still very high by historical standards.

From Alejandro Lazo at the LA Times: California foreclosures drop 4.2% as lenders work with troubled borrowers

Across California, a total of 81,054 homes received a notice of default in the first quarter compared with 84,568 in the fourth quarter of 2009 and a record 135,431 in the first quarter of 2009.In terms of new NOD filings, the peak was probably in 2009. A few key points:

Philly Fed State Coincident Indicators

by Calculated Risk on 4/20/2010 11:05:00 AM

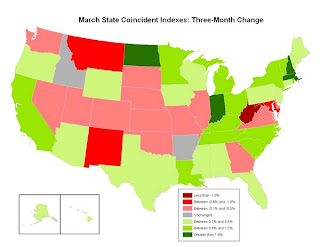

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Seventeen states are showing declining three month activity. The index increased in 31 states, and was unchanged in 2.

Here is the Philadelphia Fed state coincident index release for March.

In the past month, the indexes increased in 35 states, decreased in 10, and remained unchanged in five (Georgia, Illinois, South Dakota, Utah, and Vermont) for a one-month diffusion index of 50. Over the past three months, the indexes increased in 31 states, decreased in 17, and remained unchanged in two (Arkansas and Idaho) for a three-month diffusion index of 28.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Based on this indicator, most of the U.S. was in recession in early 2008.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Based on this indicator, most of the U.S. was in recession in early 2008.The last time the index was higher was in December 2007.

Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

DOT: Vehicle Miles Driven Decline in February

by Calculated Risk on 4/20/2010 08:52:00 AM

The Department of Transportation (DOT) reported today that vehicle miles driven in February were down from February 2009:

Travel on all roads and streets changed by -2.9%(-6.3 billion vehicle miles) for February 2010 as compared with February 2009. Travel for the month is estimated to be 212.9 billion vehicle miles.

Cumulative Travel for 2010 changed by -2.3% (-10.1 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent change from the same month of the previous year as reported by the DOT.

As the DOT noted, miles driven in February 2010 were down -2.9% compared to February 2009.

The second graph shows the moving 12 month total of miles driven (to remove seasonality).

The second graph shows the moving 12 month total of miles driven (to remove seasonality).The moving 12 month total peaked in November 2007. The impact on vehicle miles of the gasoline shortages in the '70s are clear - in the late '70s and early '80s, it took 40 months before vehicle miles returned to the peak of April 1979.

Blame it on the snow - except this is the 2nd month in a row with a year-over-year decline in miles driven. If vehicle miles continues to decline on a year-over-year basis, it might suggest high gasoline prices are starting to impact the economy.

Monday, April 19, 2010

Greece: Bond spreads widen as Bundesbank President says Greece may need more aid

by Calculated Risk on 4/19/2010 07:21:00 PM

An update on Greece: The IMF team was delayed arriving in Greece because of the ash from the Iceland volcano, meanwhile the Bundesbank president was quoted as saying Greece may need more aid.

Also the German Finance Minister was quoted in Der Spiegel: "We cannot allow the bankruptcy of a euro member state like Greece to turn into a second Lehman Brothers."

From the NY Times: Greek Debt Unsettles Bond Market

Yields on Greek bonds pushed to fresh highs on Monday ... as investors continued to worry about the country’s near-term ability to finance its debt. ... The yield on benchmark 10-year Greek government bonds closed in Europe at 7.63 percent — the highest since Greece joined the euro. That widened the spread, or difference, with equivalent German bonds to 4.55 percentage points.From Bloomberg: Weber Said to Tell German Lawmakers Greece May Need More Aid

Bundesbank President Axel Weber told German lawmakers that Greece may need more aid than the 30 billion euros ($40 billion) promised by the European Union as the government in Athens struggles to push through planned spending cuts, two people present at the briefing said.An interview with German Finance Minister Wolfgang Schäuble in Der Speigel: 'We Cannot Allow Greece to Turn into a Second Lehman Brothers'

Schäuble: [W]e have experienced a financial crisis from which we in Europe must draw a clear lesson: We cannot allow the bankruptcy of a euro member state like Greece to turn into a second Lehman Brothers.

SPIEGEL: You are exaggerating. In past years, it's happened again and again that a country couldn't pay its debts, and yet that hasn't led to a collapse of the global financial system. Why should this be different in Greece's case?

Schäuble: Because Greece is a member of the European monetary union. Greece's debts are all denominated in euros, but it isn't clear who holds how much of those debts. For that reason, the consequences of a national bankruptcy would be incalculable. Greece is just as systemically important as a major bank.

Fannie Mae updates "Waiting Period" following Pre-Foreclosure Events

by Calculated Risk on 4/19/2010 03:27:00 PM

From Austin Kilgore at HousingWire: Fannie Shortens Wait for Some Distressed Borrowers to Get New Loans

Fannie Mae announced it is reducing the wait time for some borrowers between when they complete a short sale or deed-in-lieu of foreclosure transaction and when they can obtain a new mortgage.Here is the update from Fannie Mae. For other loans (mostly higher risk loans), the period has been increased to seven years (per the eligibility matrix).

Previously, a borrower was required to wait four years before getting a new mortgage, or two years if their home sold in a short sale. Under the new guidelines, a borrower that previously completed a deed-in-lieu of foreclosure transaction can get a new mortgage in two years, provided the borrower has a 20% down payment.

If the borrower has a 10% down payment, the wait period is still four years.

A couple notes: Several reports are mentioning the shorter waiting period (2 years instead of 4 years), but that is just for borrowers who put 20% down. This update also makes the policy consistent for short sales and deed-in-lieu of foreclosure transactions - and for the first time explicitly mentions short sales (since these are becoming much more common).

Moody's: CRE Prices Decline 2.6% in February

by Calculated Risk on 4/19/2010 11:43:00 AM

Moody's reported this morning that the Moody’s/REAL All Property Type Aggregate Index declined 2.6% in February. This is a repeat sales measure of commercial real estate prices.

Moody's noted that the share of distressed sales has increased sharply. In 2008 distressed sales were only 4% of all sales, in 2009 nearly 20% of all the repeat sales transaction were classified as distressed. In February 2010, the percent of distressed sales jumped to a record 32%.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

Commercial real estate values are now down 25.8% over the last year, and down 41.8% from the peak in August 2007.

More Housing Bust and Construction Employment

by Calculated Risk on 4/19/2010 10:58:00 AM

Back in 2006, we discussed that the hardest hit areas, in the then coming housing bust, would be the communities most dependent on residential construction employment. Last week, I posted a follow up focused on California: The Housing Bust and Construction Employment

Zach Fox at SNL Interactive writes about the impact on Cape Coral, a construction dependent community in Florida: A generation of wealth lost

With so little commercial space in Cape Coral, the metro area became especially reliant on construction for employment. By June 2006, 16.8% of all jobs in the metro area came from the mining, logging and construction sector (the Bureau of Labor Statistics does not break out construction jobs for the Cape Coral-Fort Myers, MSA). By contrast, the national average reliance on the sector that month was 6.3%. Even the notoriously growth-dependant Phoenix-Mesa-Glendale, Ariz., MSA (the U.S. Office of Management and Budget changed the name of the MSA from Phoenix-Mesa-Scottsdale, Ariz., in December 2009), was far less reliant on development, with 10.1% of its jobs coming from mining, logging and construction in June 2006.

"I can remember driving up the west [Florida] coast and saying, 'Where are all these people going to work?'" [Andrea Heuson, a professor of finance at the University of Miami] said.

Unsurprisingly, with construction jobs falling off a cliff, Cape Coral-Fort Myers has posted a towering unemployment rate, hitting 13.9% in February, according to a preliminary report; the national average was 10.4% in February, non-seasonally adjusted. Whatever housing market metric one picks, Cape Coral-Fort Myers is near the top — in a bad way. The metro area has seen prices fall 49.5% from the 2006 first quarter through the 2009 fourth quarter, larger than the 42.0% drop posted by California's infamous Inland Empire and the 49.3% decline seen in Nevada's eviscerated Las Vegas-Paradise MSA, according to the FHFA's all-transactions index. With unemployment shooting up and prices tumbling, it comes as little surprise that Cape Coral-Fort Myers is also one of the nation's most foreclosure-prone neighborhoods. The metro posted the second-highest foreclosure rate of any metro area in the nation during 2009, according to RealtyTrac.This was so easy to predict ...

The SEC and other Banks

by Calculated Risk on 4/19/2010 08:42:00 AM

To follow up on the stories from last night, the Financial Times reported in January: SEC subpoenas big banks over CDOs

The Securities and Exchange Commission sent subpoenas [in December 2009] to banks including Goldman Sachs, Credit Suisse, Citigroup, Bank of America/Merrill Lynch, Deutsche Bank, UBS, Morgan Stanley and Barclays Capital, these people said. Requests for information were also made by the Financial Industry Regulatory Authority, which oversees broker-dealers.So that is a starting list.

The regulators are seeking information about the sale and marketing of so-called synthetic collateralised debt obligations during the financial crisis.

except with permission

And a key story from Jesse Eisinger and Jake Bernstein at ProPublica: The Magnetar Trade: How One Hedge Fund Helped Keep the Bubble Going

Sunday, April 18, 2010

Goldman Sachs, the SEC and Countrywide

by Calculated Risk on 4/18/2010 10:03:00 PM

Several articles tonight ...

From Gretchen Morgenson and Landon Thomas Jr. at the NY Timmes: A Glare on Goldman, From U.S. and Beyond

“We request that S.E.C., with all due haste, pursue investigations into the remaining 24 Abacus transactions for securities fraud, evaluate the extent of any receipt, by Goldman Sachs, of fraudulently generated A.I.G.-issued credit default swap payments, and vigorously pursue the recovery of such payments on behalf of the U.S. taxpayer,” the [Representatives Elijah E. Cummings and Peter DeFazio] wrote to Mary L. Schapiro, the head of the [S.E.C.], in a letter dated April 19. Mr. Cummings and Mr. DeFazio are still gathering signatures from other members of Congress to add to their letter, so it has not yet been sent.From Trish Regan at CNBC: Pursuing Banking Fraud is 'Top Priority': SEC'S Khuzami

In the Securities and Exchange Commission's first public statement since its press conference announcing charges against Goldman Sachs on Friday, S.E.C. Enforcement Director Robert Khuzami told CNBC, "We have brought and will continue to pursue cases involving the products and practices related to the financial crisis." ... a wide range of cases are currently being investigated.From Carrick Mollenkamp, Serena Ng, Scott Patterson, and Gergory Zuckerman the WSJ: SEC Investigating Other Soured Deals

The Securities and Exchange Commission ... is investigating whether other mortgage deals arranged by some of Wall Street's biggest firms may have crossed the line into misleading investors.From Edward Wyatt at the NY Times: S.E.C. Puts Wall St. on Notice

In the last few years, the Securities and Exchange Commission seemed like the cop in the doughnut shop, sitting idly by while the likes of Lehman Brothers and Bernard L. Madoff ran amok.And from John Emshwiller at the WSJ: Countrywide Probe Shows Signs of Life

...

In interviews this weekend, Mary L. Schapiro, the commission’s chairwoman, and Robert Khuzami, its new director of enforcement, said the agency was stepping up both its rule-making and its investigations in the wake of the financial crisis.

Federal criminal investigators looking into the collapse of Countrywide Financial Corp. have been calling witnesses before a grand jury, say people familiar with the matter. Such a step suggests that the investigation of the one-time mortgage giant, which has been continuing for about two years, could be moving closer to a resolution.

Ryan Avent on the Minsky Conference and Financial Reform

by Calculated Risk on 4/18/2010 07:00:00 PM

Ryan Avent discusses the Minsky Conference in The Economist: First, define the problem

I HAVE been meaning to summarise my thoughts on financial regulatory reform in the wake of the Hyman Minsky conference on same. I have to say, it has left me with a sense of resigned cycnicism.I think we need an explanation of how the financial reform would have caught the bubble earlier.

...

On to more specific thoughts. The Federal Reserve is very unhappy with the prospect of losing its regulatory authority over all but the largest financial institutions. ... I found this all to be exasperating. None of the attending presidents adequately explained how a Fed that completely failed to prevent dangerous consolidation before the crisis should now be viewed as a credible enemy of too-big-to-fail after the crisis. None of the attending presidents provided tangible evidence of internal changes designed to make the Fed a more credible regulator. Each was asked about the odd disconnect between the Fed's pre-crisis actions and its post-crisis rhetoric, and each responded by saying little more than "we've learned our lesson, now trust us".... If it believes it can regulate most effectively, [the Fed] should be explicit about how it might do that. ... If the incentives were in place to turn a blind eye before, and little has changed, then "we've learned our lesson" will not make for a sustainable model of competent regulation.

... several of the conference's speakers made the point that regulators had about 90% of the tools they needed to prevent a serious crisis before the crisis hit. They just didn't use them. A lack of needed tools is a convenient excuse for everyone who failed to do their job before the crash, which is everyone, and so you see the reform debate focusing on which new rules or institutions or regulators or authorities are needed that weren't previously around. In some cases, the new tools argument makes sense, but most of the time the real problem was that the people in charge were unwilling to do their jobs.

Weekly Summary and a Look Ahead

by Calculated Risk on 4/18/2010 11:50:00 AM

There will be two key housing reports released at the end of this week: Existing Home sales on Thursday and New Home sales on Friday.

Early in the week, the LoanPerformance house price index (for February) will be released. This will probably show further price declines in February (not seasonally adjusted). Other reports that will be released this week include the Moodys/REAL Commercial Property Price Index (for February), DOTs Vehicle Miles Driven for February, and the DataQuick's Q1 Notice of Defaults (NODs) report for California.

On Monday, the Conference Board's index of leading indicators for March will be released at 10 AM.

On Wednesday, the AIA's Architecture Billings Index for March will be released (a leading indicator for commercial real estate). Also the weekly MBA Mortgage Purchase Applications index will be released.

On Thursday the closely watched initial weekly unemployment claims will be released at 8:30 AM. The consensus is for a decline to 460K this week from 484K last week. The NAR will release Existing Home sales for March at 10 AM. The consensus is for an increase in sales to 5.25 million (SAAR) from 5.02 million (SAAR) in February. The FHFA house price index will be released on Thursday (although Case-Shiller and LoanPerformance are probably the most followed).

On Friday, March Durable Goods Orders will be released at 8:30 AM. The consensus is for a 0.4% increase. New Home sales for March will be released at 10 AM, and consensus is for an increase to 330 thousand (SAAR) from the record low 308 thousand SAAR in February.

Also on Friday the FDIC might close several more banks ...

And a summary of last week:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 626 thousand (SAAR) in March, up 1.6% from the revised February rate, and up 30% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 531 thousand (SAAR) in March, down 0.9% from the revised February rate, and 49% above the record low in January and February 2009 (357 thousand).

Here is the Census Bureau report on housing Permits, Starts and Completions

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 19 in April. This is an increase from 15 in March. The increase this month was driven by traffic of prospective buyers and current sales - and this was the last month that buyers can take advantage of the housing tax credit - so this increase was no surprise.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

From the Fed: Industrial production and Capacity Utilization

This graph shows Capacity Utilization. This series is up 7.2% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 7.2% from the record low set in June 2009 (the series starts in 1967). Capacity utilization at 73.2% is still far below normal - and 9.1% below the the pre-recession levels of 80.5% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

Also - this is the highest level for industrial production since Dec 2008, but production is still 9.6% below the pre-recession levels at the end of 2007.

On a monthly basis, retail sales increased 1.6% from February to March (seasonally adjusted, after revisions), and sales were up 7.6% from March 2009 (easy comparison).

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).The red line shows retail sales ex-gasoline and shows the increase in final demand ex-gasoline has been sluggish.

Retail sales are up 8.3% from the bottom, but still off 4.4% from the peak.

The Census Bureau reports:

[T]otal February exports of $143.2 billion and imports of $182.9 billion resulted in a goods and services deficit of $39.7 billion, up from $37.0 billion in January, revised.The graph shows the monthly U.S. exports and imports in dollars through February 2010.

On a year-over-year basis, exports are up 14% and imports are up 20%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009. This is the first time since late 2008 that imports are up a greater percentage than exports on a YoY basis as export growth appears to have slowed.

From the BLS: Regional and State Employment and Unemployment Summary

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).Fifteen states and D.C. now have double digit unemployment rates. New Jersey and Indiana are close.

Four states and set new series record highs: California, Florida, Nevada and Georgia.

Best wishes to all.

U.K., Germany Consider Action Against Goldman Sachs

by Calculated Risk on 4/18/2010 09:28:00 AM

From Reuters: UK's Brown wants investigation into Goldman Sachs (ht jb)

Prime Minister Gordon Brown said on Sunday he wanted Britain's financial watchdog to investigate U.S. bank Goldman Sachs ...From Bloomberg: Germany to Review Possible Legal Steps Against Goldman: Wilhelm

"I want a special investigation done into the entanglement of Goldman Sachs and the companies there with other banks and what happened," Brown told BBC television.

"There are hundreds of millions of pounds have been traded here and it looks as if people were misled about what happened. I want the Financial Services Authority (FSA) to investigate it immediately," he said.

"I know that the banks themselves will be considering legal action," Brown said, apparently referring to European banks that lost money ...

Germany may take legal action against Goldman Sachs Group Inc., German government spokesman Ulrich Wilhelm said today by phone.Piling on begins ...