by Calculated Risk on 4/08/2010 02:33:00 PM

Thursday, April 08, 2010

Report: Distressed Home Sales Increasing

First American Corelogic released their first distressed sales report this morning: Distressed Sales Again on the Rise, Reaching 29% in January

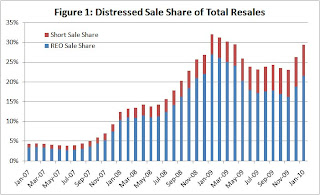

First American CoreLogic today released its first monthly report on distressed sales activity. The report below indicates that distressed home sales – such as short sales and real estate owned (REO) sales – accounted for 29 percent of all sales in the U.S. in January: the highest level since April 2009. The peak occurred in January 2009 when distressed sales accounted for 32 percent of all sales transactions (Figure 1). After the peak in early 2009, the distressed sale share fell to 23 percent in July, before rising again in late 2009 and continuing into 2010.Here are a couple of graphs from the report:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Credit: First American Corelogic.

This graph shows the total percent of distressed sales broken down by REO and Short Sales. Notice that the percent short sales has increased significantly over the last year - that trend will probably continue.

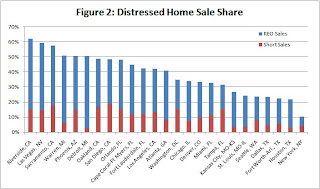

The second graph shows the breakdown by certain metropolitan areas.

The second graph shows the breakdown by certain metropolitan areas. Among the largest 25 markets, Riverside, CA, had the largest percentage of distressed sales in January (62 percent), followed closely by Las Vegas (59 percent) and Sacramento (58 percent) (Figure 2). The top REO market was Detroit where the REO share was 48 percent, followed closely by Riverside (47 percent) and Las Vegas (45 percent). San Diego’s short sale share was 19 percent in January, making it the highest ranked short sale market, followed by Sacramento (18 percent) and Oakland (16 percent). Although the top 10 markets for foreclosures are all located in Florida, only two Florida markets, Orlando and Cape Coral, made the top 10 distressed sale list. The most likely reason: Florida is a judicial state where foreclosures process through the courts and take quite a bit longer than in California, Arizona or Nevada, where non‐judicial foreclosures are the norm.I've been following the Sacramento market as an example of a distressed market - and the Sacramento Association of REALTORS® reported that almost 69% of sales were distressed in January, with 24% short sales, and 45% REOs. The FACL data shows about 58% as distressed. The difference is probably in the methodology.

The exact numbers probably aren't as important as the trend - and this will be an interesting trend to follow in 2010.