by Calculated Risk on 3/17/2010 08:03:00 AM

Wednesday, March 17, 2010

MBA: Mortgage Applications Decrease, Mortgage Rates Fall

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.9 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.7 percent from the previous week and the seasonally adjusted Purchase Index decreased 2.3 percent from one week earlier. ...

The refinance share of mortgage activity increased to 67.3 percent of total applications from 67.2 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.91 percent from 5.01 percent, with points increasing to 1.30 from 0.82 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year fixed-rate observed in the survey since mid-December of 2009, yet the effective rate was unchanged from last week due to the significant increase in points.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with mortgage rates below 5%, the 4 week average of the purchase index is still at the levels of 1997.

Geithner, Orzag, Romer: "We do not expect substantial further declines in unemployment this year"

by Calculated Risk on 3/17/2010 12:43:00 AM

From Treasury Secretary Timothy Geithner, White House budget director Peter Orszag and Christina Romer, chairman of the Council of Economic Advisers: Joint Statement. A few excerpts:

Because of normal growth in the population and the fact that some workers are likely to reenter the labor force as the economy improves, it typically takes employment growth of somewhat over 100,000 per month to bring the unemployment rate down. Because we do not expect job growth substantially over 100,000 per month over the remainder of the year, we do not expect substantial further declines in unemployment this year. Indeed, the rate may rise slightly over the next few months as some workers return to the labor force, before beginning a steady downward trend. ...

As the pace of job creation picks up in 2011 and 2012, there is likely to be greater progress in reducing unemployment. Nonetheless, because of the severe toll the recession has taken on the labor market, the unemployment rate is likely to remain elevated for an extended period. The forecast projects that in the fourth quarter of 2011, the unemployment rate will be 8.9 percent, and that by the fourth quarter of 2012, it will be 7.9 percent.

The unemployment rate at 8.9% in Q4 2011? And 7.9% in Q4 2012? Ouch ...

Tuesday, March 16, 2010

Some previous FOMC forecasts

by Calculated Risk on 3/16/2010 09:32:00 PM

This is just a reminder to take FOMC forecasts with a grain of salt.

First, the NBER determined that the great recession started in December 2007, and the FOMC met that same month - so we can see what they were thinking. The participant were aware that the incoming data was weakening, but their outlook was still for growth in 2008 and beyond ...

From the December 2007 FOMC Minutes:

In their discussion of the economic situation and outlook, participants generally noted that incoming information pointed to a somewhat weaker outlook for spending than at the time of the October meeting. The decline in housing had steepened, and consumer outlays appeared to be softening more than anticipated, perhaps indicating some spillover from the housing correction to other components of spending. These developments, together with renewed strains in financial markets, suggested that growth in late 2007 and during 2008 was likely to be somewhat more sluggish than participants had indicated in their October projections. Still, looking further ahead, participants continued to expect that, aided by an easing in the stance of monetary policy, economic growth would gradually recover as weakness in the housing sector abated and financial conditions improved, allowing the economy to expand at about its trend rate in 2009.And here are the October projections mentioned in the December minutes:

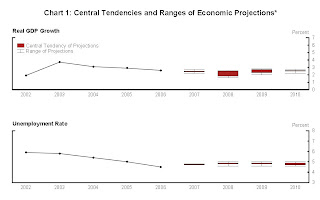

Click on graph for larger image in new window.

Click on graph for larger image in new window.In October 2007, FOMC participants were forecasting GDP in the 2% range in 2008 with a return to trend growth in 2009, and the unemployment rate rising to perhaps 5%. How did that work out?

Of course this is nothing new. Here are a few quotes from Fed Chairman Alan Greenspan back in 1990 (bear in mind that the recession started in July, 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].” Greenspan, July 1990Of course I started marking my graphs with recession blue bars in January 2008 (I had luckily predicted the December start to the recession). Although my current view is for sluggish and choppy growth in 2010, there are still some downside risks - especially in the 2nd half of the year. Right now I think Q1 GDP growth will be sluggish, and the impact from the stimulus will fade over the year.

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.” Greenspan, August 1990

“... the economy has not yet slipped into recession.” Greenspan, October 1990

Distressed Sales: Sacramento as an Example, February Update

by Calculated Risk on 3/16/2010 06:49:00 PM

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area. It will be especially interesting to track this after the Home Affordable Foreclosure Alternatives (HAFA) starts on April 5th. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the February data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. Almost 68% of all resales (single family homes and condos) were distressed sales in February.

Note: This data is not seasonally adjusted, and the decline in sales from the end of last year is about normal. The second graph shows the percent of REO, short sales and conventional sales. The percent of REOs has been increasing again, and the percent of short sales has declined slightly over the last couple of months. The percent of conventional sales peaked last November, and has declined to 32% in February.

The second graph shows the percent of REO, short sales and conventional sales. The percent of REOs has been increasing again, and the percent of short sales has declined slightly over the last couple of months. The percent of conventional sales peaked last November, and has declined to 32% in February.

Now that many HAMP trial modifications have been cancelled, I expect REO sales to increase. Also, I expect the percentage of short sales to be higher in 2010 than in 2009 - but probably not as high as foreclosures (it will be interesting to watch).

Also total sales in February were off 24.3% compared to February 2009; the ninth month in a row with declining YoY sales.

On financing, over 60 percent were either all cash (30.7%) or FHA loans (30.2%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

DataQuick: SoCal Home Sales up slightly in February

by Calculated Risk on 3/16/2010 03:58:00 PM

From DataQuick: Southern California median price and sales volume up

Note: Ignore the median price. The repeat sales indexes from Case-Shiller and LoanPerformance are better measures. The median is impacted by the mix.

Southern California home sales in February were above year-ago levels for the 20th month in a row as buyers continued to snap up bargain properties with government-backed mortgages and tax incentives. ....DataQuick doesn't list the percentage of short sales, but the total distressed sales is probably over 50%. Also the 38.5% of buyers using FHA insured loans is way above normal levels.

A total of 15,359 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was virtually unchanged from 15,361 in January, and up 0.8 percent from 15,231 in February 2009, according to MDA DataQuick of San Diego.

[CR Note: this is the second month in a row the YoY increase was razor thin.]

The February sales average is 17,983 going back to 1988, when DataQuick’s statistics begin. The sales distribution remains tilted toward lower-cost distressed homes, although not as steeply as most of last year.

...

Foreclosure resales accounted for 42.3 percent of the resale market last month, up from 42.1 percent in January, and down from 56.7 percent a year ago, which was the all-time high.

Government-insured FHA loans, a popular choice among first-time buyers, accounted for 38.5 percent of all home purchase loans in February.

Absentee buyers – mostly investors and some second-home purchasers – bought 18.9 percent of the homes sold in February. Buyers who appeared to have paid all cash – meaning there was no indication that a corresponding purchase loan was recorded – accounted for 29.3 percent of February sales. In January it was a revised 29.7 percent – an all-time high. The 22-year monthly average for Southland homes purchased with cash is 13.8 percent.

When the first time homebuyer tax credit ends, I expect the percent of FHA insured loans to decline sharply - and probably for total sales to decline. The tax credit associated buying will end in April, but the sales are counted when escrow closes - and that could be in May or June.

FOMC Statement: Economic Activity "Continued to strengthen"

by Calculated Risk on 3/16/2010 02:15:00 PM

Information received since the Federal Open Market Committee met in January suggests that economic activity has continued to strengthen and that the labor market is stabilizing. Household spending is expanding at a moderate rate but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly. However, investment in nonresidential structures is declining, housing starts have been flat at a depressed level, and employers remain reluctant to add to payrolls. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.The key language about rates stayed the same: "The Committee ... continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period."

With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve has been purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt; those purchases are nearing completion, and the remaining transactions will be executed by the end of this month. The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

In light of improved functioning of financial markets, the Federal Reserve has been closing the special liquidity facilities that it created to support markets during the crisis. The only remaining such program, the Term Asset-Backed Securities Loan Facility, is scheduled to close on June 30 for loans backed by new-issue commercial mortgage-backed securities and on March 31 for loans backed by all other types of collateral.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to the buildup of financial imbalances and increase risks to longer-run macroeconomic and financial stability.

Another key point was that the FOMC reiterated the ending dates for the MBS purchases. The Fed is giving advance warning that these purchases will expire as previously announced.

There is some concern about what will happen when the Fed stops buying agency MBS. The important thing to remember is that there will be buyers; it is just a matter of price. My guess is that mortgage rates will rise about 35 bps relative to the Ten Year treasury over several months after the Fed stops buying MBS. The Fed's Brian Sack and others have argued for 10 bps or less.

Another important point in the Fed statement was the recognition that the housing sector is not as strong as it appeared at the end of last year. Here is the language on housing over the last few statements:

Nov, 2009: "Activity in the housing sector has increased over recent months"

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Jan, 2010: No comment.

March, 2010: housing starts have been flat at a depressed level

This was the first one day Fed meeting since September 16, 2008 - and that probably says something too.

Report: FDIC Seeking Buyers for Puerto Rican Banks

by Calculated Risk on 3/16/2010 11:59:00 AM

From Dow Jones: FDIC Seeks Buyers for Three Puerto Rican Banks

According to two people familiar with the matter, the agency has hired an investment bank to try to find capital or outright purchasers for W Holding Co. Inc., R&G Financial Corp. and Eurobancshares Inc., three banks located in Puerto Rico with almost $21 billion in combined assets.This is a follow up to the report last month from José Carmona and John Marino at caribbeanbusinesspr.com: Feds expected to take action against island banks next month

The three banks hold almost 30% of Puerto Rico's $62 billion of deposits, and their bank subsidiaries are operating under enhanced FDIC scrutiny.

Federal regulators are likely to begin taking action against troubled island banks sometime [in March], government and industry sources told CARIBBEAN BUSINESS.Westernbank is a subsidiary of W Holding Company mentioned in the Dow Jones article.

Since the beginning of the year, the Federal Deposit Insurance Corp. (FDIC) has been beefing up its local ranks, recruiting accountants and auditors, leading to speculation about imminent action during this year’s first quarter.

...

There are three local banks operating under FDIC cease & desist orders—R-G Premier Bank, Eurobank and Westernbank.

HAMP Debt-to-income Ratios of "Permanent" Mods

by Calculated Risk on 3/16/2010 11:10:00 AM

Last night I mentioned the astounding DTI (Debt-to-income) of HAMP modification borrowers who were converted to a permanent modification: 2010: REOs or Short Sales?  Click on chart for larger image in new window.

Click on chart for larger image in new window.

If we look at the HAMP program stats (see page 6), the median front end DTI (debt to income) before modification was 45%, and the back end DTI was an astounding 76.4%!

Just imagine the characteristics of the borrowers who can't be converted!

Here is a table putting the numbers in dollars:

| Median Characteristics of HAMP Permanent Modification | ||

|---|---|---|

| Before Modification | After Modification | |

| Monthly Income | $2,702.77 | $2,702.77 |

| Front End (PITI & HOA) | $1,216.25 | $837.86 |

| Back End (total) | $2,064.92 | $1,616.26 |

| After Debt Income | $637.85 | $1,086.52 |

Front end DTI includes Principal, Interest, Taxes and Insurance (PITI) plus any homeowners association fees.

The back end DTI includes PITI and HOA, plus installment debt, alimony, 2nd liens, and other fixed payments.

That left the median borrower before modification with only $637.85 not including payroll taxes ($206.76), income taxes, utilities, food, and other monthly expenses. No wonder the borrowers were delinquent.

Now these median borrowers have $1,086.52 to pay all those expenses after the to 59.8% DTI bank end ratio. Remember this is gross, and is before the $206,76 in payroll taxes and an income taxes). Although this is an improvement, I expect many of these borrowers to redefault.

Housing Starts decline in February

by Calculated Risk on 3/16/2010 08:30:00 AM

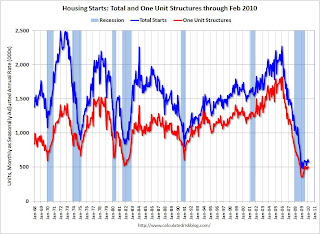

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 575 thousand (SAAR) in February, down 5.9% from the revised January rate, and up 20% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for nine months.

Single-family starts were at 499 thousand (SAAR) in February, down 0.6% from the revised January rate, and 40% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for nine months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This level of starts is both good news and bad news. The good news is the excess housing inventory is being absorbed - a necessary step for housing (and the economy) to recover.

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 575,000. This is 5.9 percent (±10.0%)* below the revised January estimate of 611,000, but is 0.2 percent (±9.8%)* above the February 2009 rate of 574,000.

Single-family housing starts in February were at a rate of 499,000; this is 0.6 percent (±10.6%)* below the revised January figure of 502,000. The February rate for units in buildings with five units or more was 58,000.

Housing Completions:

Privately-owned housing completions in February were at a seasonally adjusted annual rate of 700,000. This is 5.4 percent (±20.2%)* above the revised January estimate of 664,000, but is 15.5 percent (±13.6%) below the February 2009 rate of 828,000.

Single-family housing completions in February were at a rate of 458,000; this is 4.3 percent (±13.7%)* above the revised January rate of 439,000. The February rate for units in buildings with five units or more was 236,000.

The bad news is economic growth will probably be sluggish - and unemployment elevated - until residential investment picks up.

Note: on the February snow storms, starts were up in the West and Midwest, and down in the Northeast and South (includes D.C. and Virginia), so the snow probably did impact starts. Of course some builders started spec homes to beat the tax credit expiration - and that boosted starts temporarily.

Monday, March 15, 2010

2010: REOs or Short Sales?

by Calculated Risk on 3/15/2010 11:20:00 PM

Paul Jackson has a great post at HousingWire: Housing Recovery is Spelled R-E-O

[U]sing LPS data, for all loans more than 90 days in arrears, the average days delinquent is now at 272 days—up from 204 days in early 2008. For loans in foreclosure, the aging numbers are even more staggering: loans in this bucket average 410 days delinquent, up from 260 days delinquent in early 2008.Ahhh ... the "Squatter Stimulus Plan" - live mortgage free (but not worry free).

Ponder those numbers for just a second. On average, severely delinquent borrowers have gone more than 9 months without making a mortgage payment—and yet foreclosure has not yet started for them. For those borrowers who are in the foreclosure process, it’s been an average of 13.6 months—more than one full year—since they last made any payment on their mortgage.

But Paul thinks foreclosures (REOs) will be the answer, not short sales:

For some, short sales will be an important solution—but don’t kid yourself: the hype currently surrounding short sales and the HAFA program will prove to be short-lived ...He gives two main reasons for foreclosures over short sales: 1) 2nd liens, and 2) that HAFA has the same qualifications as HAMP. I agree that 2nd liens pose a serious problem, but on the qualifications, Paul writes:

The HAFA program, going into effect on April 5, is getting plenty of attention—and the program’s heart is in the right place. But most are forgetting that it’s an extension of HAMP, the government’s loan modification program that has seen tepid success at best thus far. A loan must first be HAMP-eligible in order for anyone (borrower, servicer, or investor) to qualify for the program’s various incentive payments for short sale or deed-in-lieu.But lets review the qualifications for HAFA:

Which means any of the guidelines applicable to the HAMP program—loan in default or default imminent, within UPB [CR: unpaid principal balance] guidelines, owner-occupied, and originated prior to 2009—still apply.

If we look at the HAMP program stats (see page 6), the median front end DTI (debt to income) for permanent mods was 45%, and the back end DTI was an astounding 76.4%! And these are the borrowers who made it to permanent status!The property is the borrower’s principal residence; The mortgage loan is a first lien mortgage originated on or before January 1, 2009; The mortgage is delinquent or default is reasonably foreseeable; The current unpaid principal balance is equal to or less than $729,7501; and The borrower’s total monthly mortgage payment (as defined in Supplemental Directive

09-01) exceeds 31 percent of the borrower’s gross income.

Many borrowers who meet the HAMP qualifications never even get a trial program because their DTI ratios are so high there is just no way they will make it to a permanent mod. The servicers turn them down on the spot. These are the borrowers eligible for the HAFA program right away - and looking at the HAMP DTI stats I suspect this is a much larger group of borrowers than will ever get a permanent mod. So, although I think REOs will play a key role, I think short sales will also be very important.

More on Short Sales at HousingWire:

As 2010 gears up to be the ‘Year of the Short Sale,’ Lenders Processing Service (LPS), the integrated technology provider, is jumping on opportunities such a situation offers by launching its own short sale service to clients.

In a report that may be considered numerical ammunition to the argument that short sales are heating up faster than modifications, Equator announced that it ushered along more than 125,000 short sale transactions, from November to February, since launching an automated short sale platform.Note: Yes, I predicted that 2010 would be the year of the short sale, although I think economist Tom Lawler was first.

Financial Regulatory Reform Update

by Calculated Risk on 3/15/2010 08:15:00 PM

For those interested, here is the text of the proposed bill.

It is only 1,336 pages long ...

Some overviews:

From Sewell Chan at the NY Times:

Mr. Dodd said he believed there was substantial bipartisan agreement on 9 of the bill’s 11 provisions, the exceptions being consumer protection and corporate governance.From the WSJ: Finance Overhaul Sets Up Winners, Losers

...

The major flashpoints will include, among other things, the scope of authority for a new Consumer Financial Protection bureau to be established within the Fed; the scope of exemptions under new rules governing the trade of derivatives; and the mechanism by which the government could seize and dismantle a large company on the verge of failure.

The bill includes a provision intended to curb Wall Street’s influence over the Federal Reserve Bank of New York. Its president would be appointed by the president of the United States, not by a board that includes representatives of member banks.

Among the winners, community banks and small credit unions would be financially able to compete, for perhaps the first time, against large competitors reined in by new restrictions on capital, complexity and size. The Federal Reserve and the Federal Deposit Insurance Corp. would see their powers redefined, and in many ways expanded.From Elizabeth Warren, via Firedoglake:

On the other side of the ledger, large financial companies overseen by the Fed would have to pay into a $50 billion fund to pay for the collapse of failed financial firms.

“Since bringing our economy to the brink of collapse, Wall Street has spent more than a year and hundreds of millions of dollars in an all-out effort to block financial reform. Despite the banks’ ferocious lobbying for business as usual, Chairman Dodd took an important step today by advancing new laws to prevent the next crisis. We’re now heading toward a series of votes in which the choice will be clear: families or banks.”

Afternoon Reading: Taxes on Short Sales, More Delinquencies, TARP Fraud

by Calculated Risk on 3/15/2010 05:02:00 PM

California legislators last week passed a bill that ... mirrors a federal law that excludes "forgiven debt" on a principal residence from being considered taxable income. It covers short sales, foreclosures, deeds in lieu of foreclosure and loan modifications that reduce the principal due.It is important to remember the Federal exemption only applies to "money used to purchase, build or fix up a home". That exemption makes sense - and California will probably fix the current tax law.

However, Gov. Arnold Schwarzenegger, who has until March 23 to sign the bill, indicated that he is likely to veto it based on an unrelated provision regarding tax fraud.

...

When the foreclosure crisis started, Congress passed the Mortgage Forgiveness Debt Relief Act of 2007 so foreclosed homeowners would not be liable for their canceled debt. It is in force through 2012. California had a similar law, but it expired at the end of 2008, leaving Californians who lost their homes in 2009 potentially liable for big state tax bills.

...

Tax experts advise people who lost their homes in 2009 to file for an extension in hopes that California will rectify matters.

However the exemption doesn't apply to those who used the Home ATM for toys or trips ... that debt forgiveness is taxable by both the federal government and the state.

Lender Processing Services put out its Mortgage Monitor report today, and the numbers are really staggering.

Loans delinquent/in foreclosure process: 7.5 million

REO/Post-sale foreclosure: 1 million

Loans that were current 1/1/09 and 60+ days delinquent 1/1/10: 2.5 million

That last one is interesting, because it shows how much faster loans are going bad than are being modified.

...

Tomorrow on CNBC we're going to devote a full day to the current state of the housing market, from what has failed to what is promising on the horizon.

The former president of New York's privately held Park Avenue Bank was arrested and charged on Monday ... A 10-count criminal complaint accused Charles Antonucci of devising "an elaborate round-trip loan transaction" that he told others was his own $6.5 million investment in the bank, misleading state bank regulators and the U.S. Federal Deposit Insurance Corporation (FDIC).

...

"Antonucci is the first person ever to be charged with attempting to defraud the TARP and we expect he will not be the last," Manhattan U.S. Attorney Preet Bharara said at a news conference.

Home Builders $2.3 Billion "Gift" from Taxpayers

by Calculated Risk on 3/15/2010 03:16:00 PM

Last year, included in the "Worker, Homeownership and Business Assistance Act of 2009" that extended the popular unemployment benefits were two unpopular and ineffective tax credits: the home buyer tax credit, and a net operating loss carryback extension to allow businesses to write off current losses against profits up to 5 years ago - the profitable years for home builders.

Zach Fox at SNL Financial has an update on the carryback: Builders record $2.30B in tax benefits

In all, homebuilders recorded $2.30 billion in income tax benefits during their most recent quarters, according to SNL Financial. ... The tax benefit was so large that it might have been the only reason two builders did not go under, Vicki Bryan, a senior high-yield analyst at Gimme Credit, told SNL.Zach has much more on the home builders, and here are some comments from Chris Thornberg on the effectiveness of the tax credit:

"This is so important that it might have saved the weakest ones, Hovnanian [Enterprises Inc.], Beazer [Homes USA Inc.] They looked like they were headed to bankruptcy," she said.

excerpts with permission

[Christopher Thornberg] said the net operating loss carryback extension and expansion will do nothing to mend the housing market.As Thornberg notes, the only reason for a tax provision like this is to spur construction - something we don't need right now. It would be better if there was less capacity in the home building sector.

"Of course not. They're not building any homes; there's still too many of them kicking around," Christopher Thornberg, a principal at Beacon Economics in Los Angeles, told SNL. "Permits, starts are still flat; they're still at a bottom. It's a bailout. It's a bailout for builders. It's a bailout for Robert Toll. They're bailing out Robert Toll. Repeat after me, they are bailing out Robert Toll. What's wrong with this picture?"

When asked whether there were any positives to come out of the net operating loss carryback extension and expansion, Thornberg said, "No, no, no, no, no, no, no. No. Nothing. There's nothing to build; there's an oversupply. If anything, they're making it worse because they're encouraging construction when we need to burn off our existing supply first."

One thing is certain, the Return on Lobbying (ROL) for the home builders was awesome, as Gretchen Morgenson noted in the NY Times last year: Home Builders (You Heard That Right) Get a Gift

The Center for Responsive Politics reports that through Oct. 26 of this year, home builders paid $6 million to their lobbyists. ... Much of this year’s lobbying expenditures were focused on arguing for the tax loss carry-forward, documents show.

Among individual companies, Lennar spent $240,000 lobbying while companies affiliated with Hovnanian Enterprises spent $222,000. Pulte Homes spent $210,000 this year.

That’s some return on investment. After spending its $210,000, Pulte will receive $450 million in refunds. And Hovnanian, after spending its $222,000, will get as much as $275 million.

NAHB Builder Confidence declines in March

by Calculated Risk on 3/15/2010 01:00:00 PM

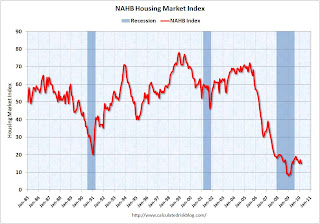

Note: any number under 50 indicates that more builders view sales conditions as poor than good. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 15 in March. This is a decrease from 17 in February.

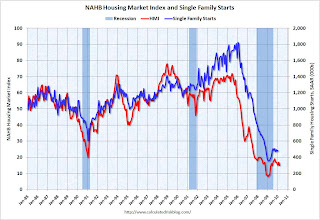

The record low was 8 set in January 2009. This is very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May 2009. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts (February starts will be released tomorrow, Tuesday March 16th).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts (February starts will be released tomorrow, Tuesday March 16th).

This shows that the HMI and single family starts mostly move generally in the same direction - although there is plenty of noise month-to-month.

And right now they are moving sideways - at best.

I was looking back through some old posts - and it seems like yesterday - but it was last summer that I wrote about how starts would probably move sideways for some time because of the large overhang of existing housing units (both owner occupied homes and rental units). I added some emphasis later in the year:

"To be blunt: Those expecting a sharp rebound in starts from the bottom are wrong. And remember - residential investment is usually the best leading indicator for the economy."That still seems correct today.

Press release from the NAHB: (added) Foreclosures Weigh on Builder Confidence in March

Builder confidence in the market for newly built, single-family homes fell back two points to 15 in March as poor weather conditions and distressed property sales posed increasing challenges to both builders and buyers, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.Not much snow in March ...

“Unusually poor weather conditions certainly had a negative effect on builders’ business in February,” said NAHB Chairman Bob Jones, a home builder from Bloomfield Hills, Mich. “At the same time, the continual flow of distressed properties priced below the cost of production is having an adverse effect on new-home appraisals and also making it tough for builders’ customers to sell their existing homes.”

Capital One Credit Card Defaults decline, BofA defaults increase

by Calculated Risk on 3/15/2010 10:56:00 AM

From Reuters: Capital One Credit Card Defaults Fall, but BofA's Rise

Capital One said the annualized net charge-off rate — debts the company believes it will never collect — for U.S. credit cards fell to 10.19 percent in February from 10.41 percent in January. ...

However, Bank of America said its defaults rate rose in February, up from 13.25 percent in January to 13.51 percent.

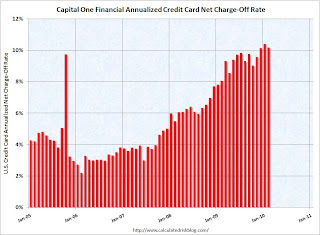

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 - to 9.75% - associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Capital One's credit card annualized net charge-off rate is now at 10.19% - down slightly from January, but still above that spike in 2005!

As Reuters notes, Capital One is usually the first to report monthly credit card charge-offs - so this is the one I track. The other major credit card issuers will report later today.

Industrial Production, Capacity Utilization increase slightly in February

by Calculated Risk on 3/15/2010 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged up 0.1 percent in February following a gain of 0.9 percent in January. Production was likely held down somewhat by winter storms in the Northeast. Manufacturing decreased 0.2 percent in February, with mixed results among its major industries. The output of mines rose 2.0 percent, while the index for utilities rose 0.5 percent. At 101.0 percent of its 2002 average, industrial output in February was 1.7 percent above its year-earlier level. Capacity utilization for total industry moved up 0.2 percentage point to 72.7 percent, a rate 7.9 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 6.5% from the record low set in June (the series starts in 1967).

Capacity utilization at 72.7% is still far below normal - and far below the the pre-recession levels of 80.5% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

Also - this is the highest level for industrial production since Dec 2008, but production is still 10.1% below the pre-recession levels at the end of 2007. Snow is being blamed for industrial production and capacity utilization only increasing slightly.

Krugman: "Time to take a stand" on China Currency Manipulation

by Calculated Risk on 3/15/2010 12:32:00 AM

From Paul Krugman in the NY Times: Taking On China

Tensions are rising over Chinese economic policy, and rightly so: China’s policy of keeping its currency, the renminbi, undervalued has become a significant drag on global economic recovery. Something must be done.This is one of the key imbalances that needs to be resolved.

...

Twice a year, by law, Treasury must issue a report identifying nations that “manipulate the rate of exchange between their currency and the United States dollar for purposes of preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade.” The law’s intent is clear ... In practice, however, Treasury has been both unwilling to take action on the renminbi and unwilling to do what the law requires, namely explain to Congress why it isn’t taking action. Instead, it has spent the past six or seven years pretending not to see the obvious.

Will the next report, due April 15, continue this tradition? Stay tuned.

... Chinese currency policy is adding materially to the world’s economic problems at a time when those problems are already very severe. It’s time to take a stand.

Sunday, March 14, 2010

Housing Market Index, Housing Starts, Snow and Spec Homes

by Calculated Risk on 3/14/2010 09:33:00 PM

As mentioned in the Weekly Summary and a Look Ahead post, the NAHB Housing Market Index for March, and Housing Starts for February, will both be released early this week.

Here is a graph showing the relationship between the two series: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the January data for single family starts.

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. Since the NAHB index increased slightly in February (it is released a month ahead of starts), we might expect some increase in February single family housing starts. Of course the snow might be a factor, although few new homes are built in the northeast compared to the rest of the country. Of course D.C. is in the South region (as is Virginia), so it might be hard to tell. Here is a map of states in each region for the Census Bureau report.

Of course the snow might be a factor, although few new homes are built in the northeast compared to the rest of the country. Of course D.C. is in the South region (as is Virginia), so it might be hard to tell. Here is a map of states in each region for the Census Bureau report.

There might also be an increase in speculative starts in some regions (single family) in February since many builders started a few extra homes in anticipation of the expiration of the first time home buyer tax credit. February was probably the last chance to start a spec home to take advantage of the expected buying rush in April - since the builders have to close by the end of June. It usually takes about 6 months to build a home, but 5 months is doable for smaller homes and with so many sub contractors hungry for work.

We will need to look at the details by region this time, but the general trend is sideways ...

Economic Outlook: Review of Possible Upside Surprises to Forecast

by Calculated Risk on 3/14/2010 05:09:00 PM

My general outlook for 2010 is for sluggish and choppy growth. Usually the deeper the recession, the steeper the recovery - however recoveries following economic crisis tend to be sluggish (see: "The Aftermath of Financial Crises", Reinhart and Rogoff, 2009):

An examination of the aftermath of severe financial crises shows deep and lasting effects on asset prices, output and employment. ... Even recessions sparked by financial crises do eventually end, albeit almost invariably accompanied by massive increases in government debt.Also the two usual engines of recovery, consumer spending and residential investment, both remain constrained as households rebuild their balance sheets (constraining consumption), and serious problems remain in the housing market including significant excess inventory and high levels of distressed properties.

Last November I listed a few possible upside surprises and downside risks to the above forecast. Here is an update on the possible upside surprises:

On consumer spending, I wrote:

My expectation has been that the saving rate would rise to around 8% over the next couple of years. The saving rate rose sharply in 2009, however the most recent report from the BEA: Personal Income and Outlays, January 2010 showed the saving rate fell to 3.3% in January.Consumer spending. One of the key reasons I think growth will be sluggish in 2010 is because I expect the personal saving rate to increase as households rebuild their balance sheets and reduce their debt burden. But you never know. As San Francisco Fed President Dr. Yellen said yesterday: "Consumers have surprised us in the past with their free-spending ways and it’s not out of the question that they will do so again." Still, it is hard to imagine much of a spending boom with high unemployment (putting pressure on wages), and limited credit (so some people can spend beyond their income).

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report.

Although I still expect the saving rate to rise, it is possible that it will not rise as far - or as fast - as I expected. That would mean consumption could grow closer to income growth in 2010.

My comments last year on exports:

Based on the comments of Chinese Premier Wen last night, "don't hold your breath" was probably good advice (although I do expect China to revalue this year). U.S. exports have increased over the last year, but it appears the growth of exports has slowed.Exports. Perhaps we are seeing a shift from a U.S. consumption driven world economy, to a more balanced global economy. An increase in consumption in other countries, combined with the weaker dollar should lead to more U.S. exports. And if China revalued that might lead to a boom in U.S. exports. ... Please don't hold your breath waiting for China!

On Residential Investment:

This has been as weak as expected ...Residential Investment. Those expecting a "V-shaped" or immaculate recovery - with unemployment falling sharply in 2010 - are expecting single family housing starts to rebound quickly to a rate significantly above 1 million units per year. That won't happen. But it is possible for single family starts to rebound to 700 thousand SAAR, even with the large overhang of existing housing inventory.

And on another stimulus:

With unemployment above 10%, there will be significant political pressure for another stimulus package - especially if the economy starts to slow in the first half of 2010. This next package could be several hundred billion (maybe $500 billion) and could increase GDP growth in 2010 above my forecast.It now appears the additional stimulus will be in the $100 billion range, mostly for additional unemployment benefits.

The most likely upside surprise appears to be coming from consumer spending and the lack of an increase in the saving rate. I still think the saving rate will continue to rise - although maybe not as fast as I originally expected.

Also - I still think the recovery will be choppy and sluggish. I'll review the downside risks soon ...

Weekly Summary and a Look Ahead

by Calculated Risk on 3/14/2010 12:03:00 PM

This will be a busy week with two key housing reports released on Monday and Tuesday: Builder confidence and Housing starts.

On Monday, the Fed will release the February Industrial Production and Capacity Utilization report at 9:15 AM ET. Expectations are for no increase in industrial production, and a slight decrease in capacity utilization (snow related).

Also on Monday, the NAHB will release the Housing Market Index of builder confidence for March at 1:00 PM ET (little change expected - still depressed), and the Empire Manufacturing Survey will be released at 8:30 AM.

On Tuesday, the Census Bureau will release Housing Starts for February at 8:30 AM ET. There will probably be a small decline in February starts because of the snow, however housing starts have already been moving sideways since last June as the excess inventory of housing units has slowly been absorbed.

Also on Tuesday, the FOMC statement will be released at 2:15 PM ET. Obviously there will be no change to the federal funds rate, but the statement might be a little more positive on the economy. The key wording -"exceptionally low levels of the federal funds rate for an extended period" - will almost certainly remain the same. The Fed will probably discuss planning for an "exit strategy" and the end of the MBS purchase program at the end of March.

On Wednesday, the MBA Mortgage Applications Index, and the Producer Price index for February will both be released.

On Thursday, the closely watched initial weekly unemployment claims, and the February Consumer Price Index (consensus is for a 0.1% increase - subdued inflation) will be released. Of special interest will be the Owners' Equivalent Rent index that has been declining for several months.

Also on Thursday, the March Philly Fed survey will be released.

On Friday the FDIC will probably close several more banks. I'm still expecting some activity in Puerto Rico soon, and the Chicago Tribune reported this week that bids are being taken on several banks in the Chicago area:

The Federal Deposit Insurance Corp. is putting at least a half-dozen struggling Chicago-area banks out for bid to healthy institutions that might want to buy their deposits and asset.On Saturday, Fed Chairman Ben Bernanke will be speaking at the Community Bankers convention in Florida.

...

People familiar with the FDIC process say that, among the undercapitalized banks, those that the regulator is trying to line up buyers for include Amcore Bank, Broadway Bank, Lincoln Park Savings Bank, Wheatland Bank, Citizens Bank & Trust Co. of Chicago and New Century Bank.

And a summary of last week ...

On a monthly basis, retail sales increased 0.3% from January to February (seasonally adjusted, after revisions), and sales were up 4.5% from February 2009 (easy comparison). However January was revised down sharply from a 0.5% increase to 0.1%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The red line shows retail sales ex-gasoline and shows the increase in final demand ex-gasoline has been sluggish.

Retail sales are up 6.0% from the bottom, but still off 6.4% from the peak. Retail ex-gasoline are up 3.6% from the bottom and still off 5.4% from the peak.

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The Census Bureau reports:

The Census Bureau reports: [T]otal January exports of $142.7 billion and imports of $180.0 billion resulted in a goods and services deficit of $37.3 billion, down from $39.9 billion in December, revised.The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

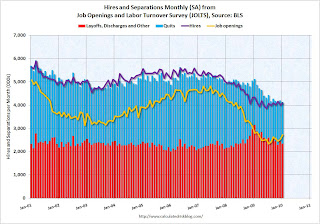

The following graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the BLS JOLTS report. Red and light blue added together equals total separations.

According to the JOLTS report, there were 4.08 million hires in January (SA), and 4.122 million total separations, or 42 thousand net jobs lost. The comparable CES report showed a loss of 26 thousand jobs in January (after revision).

According to the JOLTS report, there were 4.08 million hires in January (SA), and 4.122 million total separations, or 42 thousand net jobs lost. The comparable CES report showed a loss of 26 thousand jobs in January (after revision).Separations have declined sharply from early 2009, but hiring has barely picked up. Quits (light blue on graph) are at near the low too. Usually "quits" are employees who have already found a new job (as opposed to layoffs and other discharges).

The low turnover rate is another indicator of a weak labor market.

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).Fifteen states and D.C. now have double digit unemployment rates. New Jersey and Indiana are close.

Five states and D.C. set new series record highs: California, South Carolina, Florida, Georgia and North Carolina. Two other states tied series highs: Nevada and Rhode Island.

Best wishes to all.