by Calculated Risk on 1/01/2010 01:02:00 PM

Friday, January 01, 2010

Impact of Census on Employment and Unemployment Rate

What will be the impact of the 2010 Census on employment? Click on graph for larger image in new window.

Click on graph for larger image in new window.

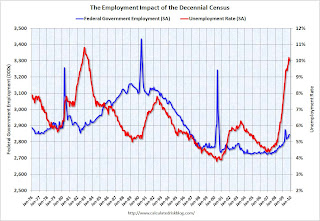

The first graph shows the impact of the decennial Census on Federal Government employment (Seasonally adjusted) and on the unemployment rate.

Note: left on right scales don't start at zero to better show the change.

Every 10 years there is a large spike in Federal Government employment, but the Census has little impact on the unemployment rate. The second graph shows the monthly change in Federal government employment during the last two decennial census periods (1990 and 2000).

The second graph shows the monthly change in Federal government employment during the last two decennial census periods (1990 and 2000).

There was a surge in payroll employment in March, April and especially in May. And then almost all of the jobs were lost in the June through September period. We should expect a similar pattern this year.

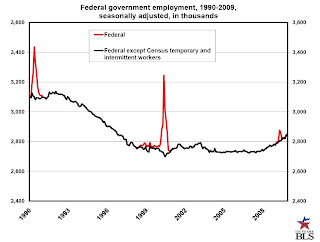

Note: there are reports that the Census Bureau will hire up to 1.4 million people, however that represents some contingency planning, and includes a number of people already hired temporarily in 2009. We can probably expect a couple hundred thousand people added between January through April, and another 500 thousand or so in May. This could push the unemployment rate down slightly, but probably in the 0.1% to 0.2% range. The BLS provides a monthly report of Census hiring. This graph is from the BLS report and shows the historical impact of the Census on Federal Government employment.

The BLS provides a monthly report of Census hiring. This graph is from the BLS report and shows the historical impact of the Census on Federal Government employment.

There was a small spike in employment in April 2009, and currently the decennial census has little impact on employment. This will be something to check every month - especially from March through September.

Chicago PMI revised down, Treasury makes final TARP Bank Investments

by Calculated Risk on 1/01/2010 09:53:00 AM

A couple of stories that I missed yesterday ...

Dow Jones reports that the Chicago Institute for Supply Management revised down the Chicago PMI to 58.7 on Thursday from the announced reading of 60.0 on Wednesday. The most significant change was to the employment index that now shows contraction at 47.6 compared to the announced 51.2.

And the WSJ reports that the Treasury announced they made their final TARP investment in a bank: Treasury Ends TARP Bank Investments (ht jb)

The U.S. Treasury this week officially ended the bank recapitalization portion of its Troubled Asset Relief Program. ... A Treasury spokesman said [10 small banks] would be the last to receive capital under the effort ...

Thursday, December 31, 2009

Happy New Year

by Calculated Risk on 12/31/2009 11:16:00 PM

| Happy New Year! |

The first week of 2010 will be chock-full of data. Should be very interesting. And oh ... good riddance to the aughts!

From Tanta's sister Cathy ... A little "New Years Eve" Rock Blogging

Jim the Realtor: One Million is the new Two Million

by Calculated Risk on 12/31/2009 08:07:00 PM

Prices are still too high in some areas ... yeah, these people put half a million down - and the foreclosure auction is coming up.

Renters Win!

by Calculated Risk on 12/31/2009 05:14:00 PM

From USA Today: Apartment renters win as vacancy rate climbs (ht Brian)

Rents fell a record 3.5% in 2009 after factoring in freebies, according to MPF Research. MPF projects prices will fall an additional 2% next year ...Note: Reis reported the apartment vacancy rate at a 23 year high 7.8% at the end of Q3 2009, and the Census Bureau reported the total rental vacancy rate at a record 11.1%.

"I've been at this 35 years, and it's by far the worst I've seen it," says Jeff Cronrod of the American Apartment Owners Association.

Nationwide, apartment vacancy is 7.8%, up from 4.8% at the end of 2007, says MPF Vice President Greg Willett.

The article notes that the supply of rental units is growing as investors buy homes to rent for cash flow and some "homeowners who want to move but can't sell their houses because they're worth less than their mortgages are renting them out instead."

Hey, who does that remind you of? (hint)

Reader Poll Results: Economic Outlook for 2010

by Calculated Risk on 12/31/2009 03:15:00 PM

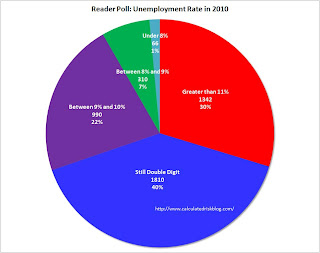

Here are the results of the reader poll. Thanks to the 4,518 people who participated! Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first question was the outlook for GDP growth in 2010. Readers who participated in the poll tend to be pessimistic, with 57% expecting a double dip recession, and another 30% expecting real GDP growth to be below 2% in 2010.

Usually the economy grows very quickly after a severe recession. As an example, following the '48/'49 recession, the economy grew at a double digit growth rate for the first three quarters of the recovery. In the 2nd half of 1959, the economy grew at a 9.7% rate, and in the year following the '73/'75 recession, GDP increased 6.2%.

Since this was the most severe recession since the Great Depression, a normal recovery would probably be 8%+ real GDP growth for a year or so. That isn't going to happen. Even a 4% growth rate would have to be considered sluggish by historical standards.

I'll post more on the reasons for my outlook, but I think the U.S. will avoid a double dip recession, and 2010 GDP growth will be in the 2% to 3% range. The second question concerned the unemployment rate at the end of 2010 (December 2010).

The second question concerned the unemployment rate at the end of 2010 (December 2010).

Most poll participants (70%) are expecting the unemployment rate to be at or above 10% at the end of 2010. I think it might be close, but I agree with the majority on the unemployment rate (still double digits in Dec 2010). There will be a temporary positive impact from the 2010 Census, and I expect another stimulus package (labeled a "jobs package") to be announced in the next few months - and maybe that will push the rate down below double digits.

I'll have more in the next few days. Thanks again for participating! I hope most of us are too pessimistic.

Hotels: Worst Year Since Great Depression

by Calculated Risk on 12/31/2009 12:28:00 PM

In terms of the occupancy rate, 2009 was the worst year since the Great Depression (close to 55%). And last week was no exception with Smith Travel Research reporting the occupancy rate fell to 33.8 percent - the lowest weekly occupancy rate on record.

From HotelNewsNow.com: STR reports US performance for week ending 26 December

In year-over-year measurements, the industry’s occupancy fell 5.4 percent to end the week at 33.8 percent. Average daily rate dropped 8.0 percent to finish the week at US$85.78. Revenue per available room for the week decreased 13.0 percent to finish at US$29.02.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Note: Some of the holidays don't line up - especially at the end of the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com (Note: They have a free daily email too for hotel news)

The end of the year can be a little confusing because of the holidays, and the next key weeks will be mid-to-late January to see if business travel is picking up in 2010.

Restaurant Index Shows Contraction in November

by Calculated Risk on 12/31/2009 10:20:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

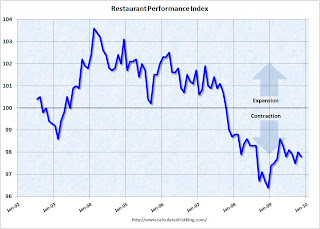

Unfortunately the data for this index only goes back to 2002.

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Uncertain as the Restaurant Performance Index Declined for the Third Time in the Last Four Months

[T]he National Restaurant Association’s ... Restaurant Performance Index (RPI) ... stood at 97.8 in November, down 0.2 percent from its October level. In addition, the RPI remained below 100 for the 25th consecutive month, which signifies contraction in the index of key industry indicators.

“Although the RPI remained below 100 for the 25th consecutive month, which signals contraction, restaurant operators are cautiously optimistic that conditions will improve in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators reported a positive six-month sales outlook for the first time in three months, and remained optimistic that the economy will improve during the next six months.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 96.0 in November – down 0.5 percent from October and tied for its second-lowest level on record. In addition, November represented the 27th consecutive month below 100, which signifies contraction in the current situation indicators.

Restaurant operators reported negative same-store sales for the 18th consecutive month in November, with the overall results similar to the September and October performances. ...

Customer traffic also remained soft in November, as restaurant operators reported net negative traffic for the 27th consecutive month. ...

Along with soft sales and traffic levels, operators reported a dropoff in capital spending activity. Thirty-three percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, down from 40 percent who reported similarly last month.

emphasis added

Weekly Initial Unemployment Claims Decline

by Calculated Risk on 12/31/2009 08:32:00 AM

Note: For fun, see the reader polls on the right sidebar for 2010 economic outlook. Polling ends today at 3 PM ET.

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 26, the advance figure for seasonally adjusted initial claims was 432,000, a decrease of 22,000 from the previous week's revised figure of 454,000. The 4-week moving average was 460,250, a decrease of 5,500 from the previous week's revised average of 465,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 19 was 4,981,000, a decrease of 57,000 from the preceding week's revised level of 5,038,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 5,500 to 460,250. This is the lowest level since September 2008.

The decline in initial claims is good news, although the 4-week average suggests continuing job losses. Also we have also to be careful because data can be volatile during the holidays.

New York General Fund Deficit

by Calculated Risk on 12/31/2009 12:06:00 AM

From the NY Times: New York State Has First Deficit in General Fund

... For the first time in history, [New York]’s main bank account is poised to end the year in the red.No problem - just write IOUs.

... New York had a negative balance of $174 million in its general fund on Wednesday, with nearly $1 billion in bills owed by day’s end. ... To fill the gap, New York will be forced to rely on ... raiding its short-term investment pool ... But that account itself is dangerously low, with only about $800 million on hand, compared with a balance in more flush years of as much as $16 billion.

And the lower the short-term balance falls, the harder it is for the state to cover its day-to-day bills and the closer New York moves toward a previously unimaginable eventuality: A government check that bounces.

Wednesday, December 30, 2009

Jim the Realtor: Squatter Scam

by Calculated Risk on 12/30/2009 08:03:00 PM

This is a pretty bold squatter. According to Jim, the squatter moved in right after the tenant left ... and when the landlord (in foreclosure) showed up, the squatter called the cops and accused him of trying to break in - and apparently was able to obtain a restraining order against the owner ... it is now Jim's problem!

Treasury Commits $3.8 Billion more to GMAC

by Calculated Risk on 12/30/2009 04:55:00 PM

From the Treasury: Treasury Annouces [SIC] Resturcturing of Commitment To GMAC

Treasury will commit $3.8 billion of new capital to GMAC ... Prior to today's actions, Treasury had invested $12.5 billion in preferred stock of GMAC. Treasury owns $13.1 billion in preferred stock in GMAC, through purchases and the exercise of warrants, and 35 percent of the common equity in GMAC.From the WaPo: U.S. taking majority ownership of GMAC

The Treasury Department said it will increase its stake in GMAC to 56 percent from 35 percent. It also will hold about $14 billion in what amount to loans that GMAC may eventually be required to repay.

Reader Poll on Economic Outlook

by Calculated Risk on 12/30/2009 03:12:00 PM

I've added two polls on the right sidebar.

Predict the 2010 GDP growth and the Dec 2010 unemployment rate.

I'll post the poll results here tomorrow and post my own thoughts over the weekend.

Please feel free to post your predictions in the comments too - and I'll link to this post next year.

Best to all

House Prices and the Unemployment Rate

by Calculated Risk on 12/30/2009 12:35:00 PM

Here is a comparison of real house prices and the unemployment rate using the LoanPerformance national house price data (starts in 1976) and Case-Shiller Composite 10 index (starts in 1987). Both indexes are adjusted by CPI less shelter. This is an update to a post earlier this year. Click on image for larger graph in new window.

Click on image for larger graph in new window.

The two previous national declines in real house prices are evident on the graph (early '80s and early '90s). The dashed green lines are drawn at the peak of the unemployment rate following the peak in house prices.

In the early '80s, real house prices declined until the unemployment rate peaked, and then increased sluggishly for a few years. Following the late 1980s housing bubble, real house prices declined for several years after the unemployment rate peaked.

Although there are periods when there is no relationship between the unemployment rate and house prices, this graph suggests that house prices will not bottom (in real terms) until the unemployment rate peaks (or later, especially since the current bubble dwarfs those previous housing bubbles). This also suggests that real house prices are probably 10% or more too high on a national basis.

Chicago Purchasing Managers Increases in December

by Calculated Risk on 12/30/2009 09:51:00 AM

From MarketWatch: Chicago purchasing index reaches 16-month high

More businesses in the Chicago region were expanding in December than at any time in the past 16 months, based on the latest data from the Chicago purchasing managers index. The business activity index rose to 60.0% from 56.1% in November...Readings above 50% indicate expansion, and below 50% indicate contraction, so this suggests business activity is increasing.

This index is for both manufacturing and service activity in the Chicago region. In general the Chicago area is considered representative of the mix of manufacturing and non-manufacturing business activity in the nation.

The national ISM manufacturing index will be released Monday, and the ISM non-manufacturing index next Wednesday.

Japan: Twenty Years Later

by Calculated Risk on 12/30/2009 07:56:00 AM

From The Times: Japan pledges to end economic spiral (ht Jonathan)

Japan’s four-month-old Government ... today vowed to enlarge the economy by 150 trillion yen (£1 trillion) ...Talk about a high level of debt to GDP.

The Democratic Party of Japan said that the scheme would deliver annual real GDP growth of at least 2 per cent between now and 2020 and ... is thought to be an attempt by the Government to quash rising domestic fears over the country’s gargantuan mound of public debt. The debt equates to about 180 per cent of GDP and will probably hit 200 per cent in the wake of the record budget announced last week.

Halfway through the Government’s ten-year plan, Japan's debt relative to GDP may rise to 246 per cent, according to analysts from the International Monetary Fund.

...

Since its property bubble burst 20 years ago, Japan has borrowed heavily to stimulate the economy and recent years have seen the level of debt spiral wildly.

Tuesday, December 29, 2009

Fannie, Freddie Changes

by Calculated Risk on 12/29/2009 11:04:00 PM

There has been much more on the Dec 24th press release from Treasury.

From the WSJ: Questions Surround Fannie, Freddie

From Tim Duy: Why Christmas Eve?

I think Linda Lowell at HousingWire has a good explanation: Treasury Updates Its GSE Support; And the Mainstream Misleads

First on the timing:

It’s in the law: the Treasury’s authorization in [Housing and Economic Recovery Act (HERA) of 2008] to alter the terms, conditions and amounts under any agreements (such as the PSPAs) to purchase Fannie or Freddie obligations expires December 31, 2009. After that date, new authorization would be required from Congress.That explains the timing. My guess is some people at Treasury aren't working this week, so last Thursday was the deadline.

As far as why uncap Fannie and Freddie even though the current caps looked sufficient:

Too much is at stake, for taxpaying homeowners, to leave outstanding even a small “tail risk” that one of the enterprises would penetrate the cap. We’ve all seen how politics - even the agendas of a small minority - can stall lawmaking by the majority. Read the law (HERA): if a deficiency goes unfunded, the deficient enterprise goes into receivership.And receivership (as opposed to the current conservatorship) means the enterprise would be wound down. So Ms. Lowell suggests this was probably to avoid a low probability event that could have triggered a huge political battle - and put the housing market at further risk since the housing market is currently "overwhelmingly supported by FHA/Ginnie Mae, Fannie and Freddie".

Also, on my earlier speculation about whether this was related to HAMP, Nick Timiraos at the WSJ writes:

A Treasury representative said the bailout caps were suspended "specifically to ensure continued confidence in Fannie Mae and Freddie Mac, but were not based on any considerations" related to an expansion of the administration's loan-modification program.I guess this qualifies as a huge nothingburger.

Treasury plans GMAC cash infusion

by Calculated Risk on 12/29/2009 08:06:00 PM

From the Detroit News: Treasury plans to inject around $3.5 billion into GMAC (ht jb)

The Treasury Department plans to announce as early Wednesday afternoon that it will give GMAC Inc. around $3.5 billion in additional capital, sources told The Detroit News.Most of the losses have come from ResCap, GMAC's mortgage unit.

... The Treasury Department said earlier this year it would invest up to $5.6 billion more in GMAC -- on top of $13.4 billion GMAC has received over the last year.

...

GMAC is the primary lender to most GM and Chrysler dealers and customers ...

Just a few billion more. Nothing compared to AIG, Freddie and Fannie.

Are Homes now "Cheap"?

by Calculated Risk on 12/29/2009 06:09:00 PM

First, from Brett Arends in the WSJ on May 6, 2008: Is Housing Slump at a Bottom?

Wellesley College Prof. Karl E. Case, one of the leading experts on the housing market in the country ... suggests we may be at, or near, the bottom of the housing crash.Total starts were at 574 thousand in November after falling to a low of 479 thousand earlier this year - half the number of starts from when Prof. Case called the bottom in 2008.

...

"It is really remarkable how much where we are today looks like the bottom we've had in the last three cycles," Mr. Case says. "Every time we've gone below a million starts, the market has cleared at that moment."

...

"It's bottom-fishing time, I think," says Mr. Case. "There's got to be bargains in Florida, Arizona and Nevada."

And on "bottom-fishing" in Florida, Arizona and Nevada: prices have fallen 23.5%, 31,3% and 36.4% in Miami, Phoenix and Las Vegas respectively since Prof. Case's suggestion in May 2008 using his own Case-Shiller index.

Why bring this up now? Because Brett Arends wrote in the WSJ today: Latest Home Price Data Is Good News for Buyers

Homes are now cheap.Mr. Arends does write that homes are not cheap everywhere, but his main argument is:

If you buy an average home today, and take out a 30-year mortgage at 5%, the annual bill for interest and repayment of principal will come to about 19 times typical weekly earnings ...He then provides a chart that shows this is the lowest level since the early '70s for this metric. Mr. Arends does add many cautions and caveats.

Well, allow me to retort.

House prices are not cheap nationally. This is apparent in the price-to-income, price-to-rent, and also using real prices. Sure, most of the price correction is behind us and it is getting safer to be a bottom caller! But "cheap" means below normal, and I believe that is incorrect.

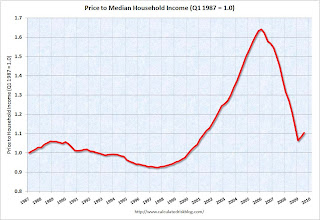

The following graph shows the price-to-income ratio using the Case-Shiller national index as of Q3 2009, and the Census Bureau's median income tables (assuming no increase for 2009).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 10% or so. A further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes.

The second graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices through October. For rents, the national Owners' Equivalent Rent from the BLS is used.

The second graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices through October. For rents, the national Owners' Equivalent Rent from the BLS is used.Although most of the adjustment in the price-to-rent ratio is behind us, it appears this ratio is still a little high.

As Mr. Arends also noted, this is national data, so beware of the local variations.

So why does Mr. Arends think "homes are now cheap"? Because he is using a measure of affordability based on mortgage interest rates. This is a mistake without further anlaysis.

Imagine this simplified example with a buyer willing to pay $1000 per month. With a 5% mortgage rate, the buyer could afford a $186,282 30 year fixed rate mortgage (principal and interest). But the buyer expects to sell the home in seven years, and he expects mortgage rates to be 7% then. That means the new buyer - who will also be willing to pay $1000 per month - can only afford a mortgage of $150,308.

So how does the affordability index account for this expected $36,000 loss? It doesn't.

It ends up in this simplified example, the current buyer would be willing to pay about $161,000 today because of the lower interest rate if he was planning on selling in seven years at $150,000 - excluding all expenses, transaction costs, tax savings, discount rates, etc. The actual calculation would be extremely complicated.

Sometimes it is smart to buy when "affordability" is low like in the early '80s when mortgage rates were very high - but smart buyers were expecting rates to fall. And sometimes it is smart not to buy when "affordability" appears high - like say last year when Mr. Arends wrote in May 2008:

[I]nterest rates are low right now. ... you can get a 30-year fixed-rate mortgage under 6%. If the economy recovers that won't last. If you are shopping for a home, it is probably worth seeing if you can lock in one of these rates cheaply.But the real key is to focus on supply and demand, and on the general fundamentals of price-to-income and price-to-rent (not perfect measures). House prices are not currently "cheap". They just aren't outrageously expensive nationally anymore.

ATA Trucking Tonnage Index Increases in November

by Calculated Risk on 12/29/2009 04:40:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Jumped 2.7 Percent In November Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.7 percent in November, following a 0.2 percent contraction in October. The latest gain boosted the SA index from 103.6 (2000=100) in October to 106.4, its highest level in a year. The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 100.8 in November, down 8.0 percent from October.The economy fell off a cliff in September 2008, so the year-over-year comparisons are getting easier. As ATA Chief Economist Bob Costello noted, trucking benefited from the inventory correct, and he believes that is nearing completion - and trucking will likely "exhibit starts and stops" until there is a pickup in domestic end demand.

Compared with November 2008, SA tonnage fell 3.5 percent, which was the best year-over-year showing in twelve months. In October, the index was down 5.2 percent from a year earlier.

ATA Chief Economist Bob Costello said that tonnage is moving in the right direction. “Slowly, but surely, truck freight has started the recovery process and November’s solid increase is a very positive sign,” Costello noted. He said that November’s tonnage levels were pushed higher by improved economic activity, as well as by an inventory correction that is near completion. “Truck freight had been hurt by both slow economic output and bloated inventories; however, we now have evidence that the inventories are in much better shape, which will not be such a drag on truck freight volumes.” Costello continued to be cautious about the future though. “While the economy and trucking is improving, the industry should not get overly excited about the sizeable increase in November. I continue to believe that both the economy and truck tonnage will exhibit starts and stops in the months ahead, but the general trend should be for moderate growth.”

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

Note: I think this is the highest level since January, unless January was revised down.