by Calculated Risk on 12/05/2009 09:09:00 PM

Saturday, December 05, 2009

Fannie and Freddie Put Back More Loans to Lenders

From the WSJ: Soured Loans Put Lenders on the Hook

As home loans sour at a rapid clip, mortgage finance giants Fannie Mae and Freddie Mac are aggressively bouncing back defectively underwritten loans to lenders. The result: higher loan-loss reserves for the lenders and new headwind for banks trying to escape the housing downturn.It is a small number, but it is a start. These are mostly prime loans too - most of the subprime and Alt-A loans were securitized by Wall Street, not the GSEs.

For lenders such as Wells Fargo & Co., Bank of America Corp., J.P. Morgan Chase & Co. and Citigroup Inc., which are among the largest sellers of mortgages to Fannie and Freddie, this could mean buying back souring loans at a loss.

...

Through Sept. 30, Freddie Mac put back about $2.7 billion of single-family mortgages to lenders, more than double the $1.2 billion of a year earlier.

...

In 2008, Fannie Mae bounced back roughly a quarter of the loans on 94,652 real-estate owned properties, or REOs, properties that have been reclaimed by Fannie after foreclosure. Through Sept. 30, Fannie Mae REO properties totaled 98,428. Many of these loans are plain-vanilla prime 30-year fixed-rate mortgages ...

Autos: Google Domestic Trends

by Calculated Risk on 12/05/2009 06:29:00 PM

We've looked at this resource from Google before: Domestic Trends. Google is tracking search trends for several specific sectors of the economy.

As an example, below is a screen capture of the Auto Buyers Index.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows the seasonality of car buying, plus the Cash-for-clunkers surge in searches. Click on link for interactive graph - you can also plot the data YoY.

The YoY data for autos has recently turned slightly negative.

I also recommend real estate, rental and unemployment.

The YoY rental index has just turned positive, and the unemployment index has turned up again.

Jim the Realtor Shows some New Construction

by Calculated Risk on 12/05/2009 03:06:00 PM

Jim asks: "Wouldn't it be something if the builders end up beating the banks to the buyers? The banks are satisfied to drip them out - so the builders end up flooding the market and soak up all the buyers."

Moody's: Option ARMs Show "Dismal Performance"

by Calculated Risk on 12/05/2009 10:28:00 AM

From HousingWire: Moody’s Links Option ARM, Subprime Performance Click on graph for larger image in new window.

Via: Housing Wire

"The total count of Option ARMs outstanding are highly concentrated among a few states. (source: Moody's)"

From the article:

[The Option ARM] sector shows “dismal” performance, with more than 40% of borrowers 60 or more days past due on payments. And many of these loans have yet to experience a recast event, when initial minimum monthly payments jump as much as 60%, according to sources interviewed by HousingWire for an upcoming issue.For their borrowers, modifications that lower the interest or extend the term, just delay the inevitable - and really makes the borrowers into renters.

“Even though borrowers with Option ARM loans have the option to make monthly payments typically lower than the accruing interest on the loan, many borrowers are choosing a different option–not making any payment at all.”

...

Negative equity is a key driver of weak performance — as well as a more predictive measure of default than unemployment — particularly among Option ARMs.

...

“There is little hope that most of these [delinquent] borrowers will start making payments again if no principal is forgiven,” Moody’s said. “Forbearance does not eliminate the obligation to repay the loan principal, it only delays it. And many delinquent borrowers are potentially so far underwater that it would take close to a decade for them to attain any positive equity in their home.”

FDIC Bank Failure Update

by Calculated Risk on 12/05/2009 08:39:00 AM

The FDIC closed six more banks on Friday, with the largest - AmTrust Bank - estimated to cost the Deposit Insurance Fund $2 billion. That brings the total FDIC bank failures to 130 in 2009.

From the Plain Dealer on AmTrust: AmTrust Bank fails, bought by New York bank

While the closure is not surprising -- given the parent company's bankruptcy filing this week -- it is still stunning to the bank's 280,000 local customers, 1,400 local employees and a community that had watched the sleepy thrift become a national powerhouse and an important philanthropic force across Northeast Ohio.The following graph shows bank failures by week in 2009.

...

While depositors aren't losing anything, the FDIC fund is taking an estimated $2 billion hit, [FDIC spokesman David Barr] said. The FDIC entered into an agreement to cap New York Community Bank's potential losses on the loans it's buying. NYCB agreed to buy about $9 billion in AmTrust assets. The FDIC will keep the remaining $3 billion in loans to sell later.

Among the nation's 8,100 banks, AmTrust was the 92nd largest as of June 30. At its height, it was the 68th largest in 2006 and 2007. In the last two years it's lost nearly 40 percent of its assets and deposits as its loans lost value, CDs matured and customers left. AmTrust was simply into mortgage lending too deep, much of it risky or in markets that were about to implode.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: Week 1 on graph ends Jan 9th.

The bank failures seem to come in bunches, and with 3 weeks to go it seems 140+ bank failures is likely this year.

The second graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.

The second graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.The cumulative estimated losses for the DIF, since early 2007, is now over $52.4 billion.

Friday, December 04, 2009

Slow Start for Modifications

by Calculated Risk on 12/04/2009 11:55:00 PM

The Treasury is expected to announce the number of permanent modifications and other metrics for the Making Home Affordable program next week, but clearly the program is off to a slow start ...

From Renae Merle at the WaPo: Quarter of borrowers in anti-foreclosure plan are behind

About 25 percent of borrowers helped under the administration's massive foreclosure prevention plan have already fallen behind on their new mortgage payments, according to government data that raise new questions about the program's effectiveness.Floyd Norris at the NY Times has more: Why Many Home Loan Modifications Fail

...

For example, at a conference last month, J.P. Morgan Chase, which signed up more than 178,000 homeowners, noted that 22 percent of borrowers helped didn't make their first payment.

...

More than half of the borrowers eligible for a permanent modification by the end of the year have not submitted all of the required documents, from pay stubs to tax returns, including some who have provided nothing, government officials have said.

Next week will be interesting ...

Unofficial Problem Bank List, Dec 4, 2009

by Calculated Risk on 12/04/2009 09:30:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

NOTE: This was compiled prior to the six bank failures today (all six are listed).

Changes and comments from surferdude808:

The Unofficial Problem Bank List had a slight decline in the number of institutions from 543 to 542 as three institutions were added while four were dropped. Aggregate assets declined from $312.3 billion to $310.0 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Additions included WaterStone Bank, SSB, Wauwatosa, WI ($1.9 billion); First National Bank of Crossett, Crossett, AR ($160 million); and Signature Bank, Windsor, CO ($91 million). Deletions are four national bank were the OCC terminated a formal agreement. However, the OCC sometimes will replace a formal agreement with a cease & desist order; hence, we will have to wait to see if any of the deletions reappear later in the month when the OCC releases its actions for November.

The deletions include Riverside National Bank of Florida, Fort Pierce, FL ($3.5 billion); First National Bank of the Rockies, Grand Junction, CO ($393 million); First National Bank of Griffin, Griffin, GA ($306 million); and Liberty National Bank, Lawton, OK ($181 million).

The other change of note is a Prompt Corrective Action Order issued by the Federal Reserve against the Bank of Illinois, Normal, IL ($247 million). Bank of Illinois has been operating under a Written Agreement as of November 14, 2009.

Note: The FDIC announced there were 552 bank on the official Problem Bank list at the end of Q3. The difference is a mostly a matter of timing - some enforcement actions haven't been announced yet, and others may be pending.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #130: Greater Atlantic Bank, Reston, Virginia

by Calculated Risk on 12/04/2009 07:13:00 PM

Demoted, downsized, shrunken

Sold to Sonabank

by Soylent Green is People

From the FDIC: Sonabank, McLean Virginia, Assumes All of the Deposits of Greater Atlantic Bank, Reston, Virginia

Greater Atlantic Bank, Reston, Virginia, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes six today.

As of October 20, 2009, Greater Atlantic Bank had total assets of approximately $203.0 million and total deposits of approximately $179.0 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $35 million. ... Greater Atlantic Bank is the 130th FDIC-insured institution to fail in the nation this year, and the first in Virginia. The last FDIC-insured institution closed in the state was New Atlantic Bank, National Association, Norfolk, on August 12, 1993.

Bank Failure #129: Benchmark Bank, Aurora, Illinois

by Calculated Risk on 12/04/2009 06:48:00 PM

(Is "down" the new "up" today?)

Not a wanted prize

by Soylent Green is People

From the FDIC: MB Financial Bank, National Association, Chicago, Illinois, Assumes All of the Deposits of Benchmark Bank, Aurora, Illinois

Benchmark Bank, Aurora, Illinois, was closed today by the Illinois Department of Financial and Professional Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes five today ...

As of November 16, 2009, Benchmark Bank had total assets of approximately $170.0 million and total deposits of approximately $181.0 million....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $64 million. ... Benchmark Bank is the 129th FDIC-insured institution to fail in the nation this year, and the twentieth in Illinois. The last FDIC-insured institution closed in the state was Park National Bank, Chicago, on October 30, 2009.

Bank Failures #127 & 128: Down Goes AmTrust

by Calculated Risk on 12/04/2009 06:12:00 PM

Giant "Amtrust-Rex" looks up.

Annihilation

Cold Winter bears down

Many banks fall like snowflakes

No two are alike

by Soylent Green is People

From the FDIC: HeritageBank of the South, Albany, Georgia, Assumes All of the Deposits of the Tattnall Bank, Reidsville, Georgia

The Tattnall Bank, Reidsville, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...And from the FDIC: New York Community Bank, Westbury, New York, Assumes All of the Deposits of AmTrust Bank, Cleveland, Ohio

As of September 30, 2009, The Tattnall Bank had total assets of $49.6 million and total deposits of approximately $47.3 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $13.9 million. .... The Tattnall Bank is the 127th FDIC-insured institution to fail in the nation this year, and the 24th in Georgia. The last FDIC-insured institution closed in the state was First Security National Bank, Norcross, earlier today.

AmTrust Bank, Cleveland, Ohio, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of October 27, 2009, AmTrust Bank had total assets of approximately $12.0 billion and total deposits of approximately $8.0 billion. ...

As part of this transaction, the FDIC will acquire a cash participant instrument. This will serve as additional consideration for the transaction. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $2.0 billion.

Furthermore, the FDIC transferred to New York Community Bank all qualified financial contracts to which AmTrust was a party.

... AmTrust Bank is the 128th FDIC-insured institution to fail in the nation this year, and the second in Ohio. The last FDIC-insured institution closed in the state was Peoples Community Bank, West Chester, which closed on July 31, 2009.

Bank Failures #125 & 126: Two more in Georgia

by Calculated Risk on 12/04/2009 05:11:00 PM

Gifts to US from Sheila Bair

No return receipt.

by Soylent Green is People

From the FDIC: State Bank and Trust Company, Macon, Georgia, Assumes All of the Deposits of the Buckhead Community Bank, Atlanta, Georgia

The Buckhead Community Bank, Atlanta, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: State Bank and Trust Company, Macon, Georgia, Assumes All of the Deposits of First Security National Bank, Norcross, Georgia

As of November 6, 2009, The Buckhead Community Bank had total assets of approximately $874.0 million and total deposits of approximately $838.0 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $241.4 million. ... The Buckhead Community Bank is the 125th FDIC-insured institution to fail in the nation this year, and the 22nd in Georgia. The last FDIC-insured institution closed in the state was United Security Bank, Sparta, on November 6, 2009.

First Security National Bank, Norcross, Georgia, was closed today by the Office of the Comptroller of the Currency (OCC), which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....

As of September 30, 2009, First Security National Bank had total assets of approximately $128.0 million and total deposits of approximately $123.0 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $30.1 million. ... First Security National Bank is the 126th FDIC-insured institution to fail in the nation this year, and the 23rd in Georgia. The last FDIC-insured institution closed in the state was The Buckhead Community Bank, Atlanta, earlier today.

Market Update

by Calculated Risk on 12/04/2009 04:00:00 PM

While we wait for the FDIC ... a couple of market graphs: Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today. The S&P 500 was first at this level in April 1998; about 11 1/2 years ago.

The S&P 500 is up 63% from the bottom (429 points), and still off 29% from the peak (459 points below the max).

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

If the Economy lost Jobs, why did the Unemployment Rate decline?

by Calculated Risk on 12/04/2009 12:02:00 PM

In August, when it was reported that the July unemployment rate dipped slightly to 9.4% from 9.5% in June, I pointed out that the dip in unemployment was just monthly noise: Jobs and the Unemployment Rate

FAQ: How can the unemployment rate fall if the economy is losing net jobs, especially since the population is growing?Here are a couple of scatter graphs to illustrate this point ...

This data comes from two separate surveys. The unemployment Rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 400,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

...

[T]he jobs and unemployment rate come from two different surveys and are different measurements (one for positions, the other for people). Some months the numbers may not seem to make sense (lost jobs and falling unemployment rate), but over time the numbers will work out.

The first graph shows the monthly change in net jobs (on the x-axis) as a percentage of the payroll employment, and the change in the unemployment rate on the y-axis.

The data is for the last 40 years: 1969 through July 2009.

Click on graph for large image.

Click on graph for large image.Although these surveys are different measures of employment - there is still a correlation - in general, the more payroll jobs added (further right on the x-axis), the more the unemployment rate declines (y-axis). And generally the more jobs lost, the more the unemployment rate increases.

But the graph sure is noisy on a monthly basis.

Look at the two red triangles - those are the data points for the last two months.

Notice that the increase in the October unemployment rate was much higher than expected based on the number of payroll jobs lost. And the opposite was true for November (the unemployment rate fell even though payroll employment declined slightly).

The second graph covers the same period but uses a two month rolling average:

Now we see a much sharper correlation.

Now we see a much sharper correlation.The red triangles are the for the last two data points, and the Sept-Oct point is above the curve, whereas the Oct-Nov point is on the curve. All this means is the jump in the unemployment rate in October was higher than expected, and the decline in November balanced it out.

This also suggests the economy needs to be adding about 0.13 percent of payroll employment per month to keep the unemployment rate from rising. That is about 170 thousand net jobs per month - this accounts for both population growth and an expected increase in the employment-population ratio.

Note that the trend line is a 3rd order polynomial (equation on graph). When the economy starts to add jobs, more people start looking for work - and the relationship between net jobs and the unemployment rate is not linear. (see next graph).

If we use a six month rolling average for the above graphs, R-squared rises to 0.8.

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.Note: the graph doesn't start at zero to better show the change.

This measure was flat in November at 58.5%, the lowest level since the early '80s. However once the economy starts adding jobs, more people will be looking for work, and the employment-population ratio will start to increase. This means the stronger the economy, the more net jobs required each quarter to lower the unemployment rate by the same amount.

The bottom line is the decline in the unemployment rate this month was noise, and the unemployment rate will probably increase further. If the economy adds about 2 million payroll jobs next year, we'd expect the unemployment rate to still be at about 10% at the end of the year.

Unemployment: Record number Unemployed over 26 Weeks, Diffusion Index

by Calculated Risk on 12/04/2009 11:09:00 AM

Two more graphs ...

Unemployed over 26 Weeks

Back in September, David Leonhardt wrote on the job churn rate in the NY Times:

Try thinking of it this way: All of the unemployed people in the country are gathered in a huge gymnasium that’s been turned into a job search center. The fact that this recession is the worst in a generation means that there are many, many people in the gym. The fact that the economy is churning so slowly means that there is not much traffic into and out of the gym.Millions of workers are still stuck in that gymnasium, and a record number of workers have been unemployed for more than 26 weeks.

If you’re inside, you will have a hard time getting out. Yet if you’re lucky enough to be outside the gym, you will probably be able to stay there.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 5.887 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 3.8% of the civilian workforce. (note: records started in 1948)

Diffusion Index

The second graph shows the BLS diffusion indexes for total private employment and manufacturing employment.

The second graph shows the BLS diffusion indexes for total private employment and manufacturing employment.Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Both the "all industries" and "manufacturing" employment diffusion indices had been trending up - meaning job losses are becoming less widespread.

Back in March, I pointed out the increase in the diffusion index was "a sliver of good news" in a very grim employment report. The diffusion index in March suggested that the situation was no longer getting worse.

Now the index shows job losses are less widespread. However this still shows a minority of industries are hiring, and the index will probably be above 50 when the employment recovery begins. (For more on how this is constructed, see the BLS Handbook)

Earlier employment posts today:

Seasonal Retail Hiring, Employment-Population Ratio, Part Time Workers

by Calculated Risk on 12/04/2009 09:24:00 AM

Here are a few more graphs based on the employment report ...

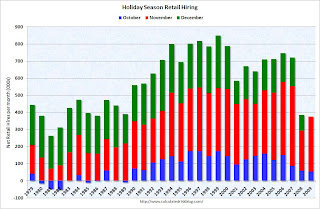

Seasonal Retail Hiring

Retailers are hiring seasonal workers at slightly above the pace of last year ... Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This really shows the collapse in retail hiring in 2008.

Retailers only hired 54.2 thousand workers (NSA) net in October. This is essentially the same as in 2008 (59.1 thousand NSA). However retailers hired 321.3 thousand workers in November (NSA), an increase from the 233.7 thousand last year. This suggests retailers are a little more optimistic than last year.

Employment-Population Ratio Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

This measure was flat at 58.5% in November; this is the lowest level since the early '80s.

The Labor Force Participation Rate fell to 65.0% (the percentage of the working age population in the labor force). This is the lowest since the mid-80s.

When the job market starts to recover, many of these people will reenter the workforce and look for employment - and that will keep the unemployment rate elevated for some time.

Part Time for Economic Reasons

From the BLS report:

The number of people working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in November at 9.2 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined slightly to 9.246 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined slightly to 9.246 million. The all time record was set last month.

Earlier employment post today:

Employment Report: 11K Jobs Lost, 10% Unemployment Rate

by Calculated Risk on 12/04/2009 08:30:00 AM

From the BLS:

The unemployment rate edged down to 10.0 percent in November, and nonfarm payroll employment was essentially unchanged (-11,000), the U.S. Bureau of Labor Statistics reported today.

Click on graph for larger image.

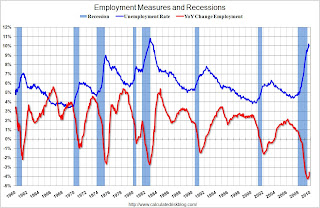

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 11,000 in November. The economy has lost almost 4.8 million jobs over the last year, and 7.2 million jobs1 during the 23 consecutive months of job losses.

The unemployment rate decreased to 10.0 percent. Year over year employment is strongly negative.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

The 11,000 jobs lost was surprising and was much better than other indicators (like ADP, weekly initial claims, ISM reports) would have indicated. The decrease in the unemployment rate was expected because of the large increase last month (and the unemployment rate is noisy). More to come ...

1Note: The total jobs lost does not include the preliminary benchmark payroll revision of minus 824,000 jobs. (This is the preliminary estimate of the annual revision that will be announced early in 2010).

Employment Report Forecasts

by Calculated Risk on 12/04/2009 12:16:00 AM

Just a few forecasts ...

From CNBC: Look Ahead: Jobs Report Has Markets on Edge

Economists expect November's decline in non farm payrolls to come in at about 125,000, and unemployment is expected to hold steady at 10.2 percent. ... Bill Stone, chief investment strategist at PNC Wealth Management ... said PNC expects job losses of 150,000 for November.From MarketWatch: Another 100,000 jobs lost, economists predict

Another 100,000 jobs were destroyed during November, according to the median forecast of economists surveyed by MarketWatch. It would be the 23rd consecutive month of job losses, the longest losing streak since the 1930s.Goldman is forecasting the report will show 100,000 net jobs lost in November.

The official unemployment rate is expected to remain at 10.2%, the highest since 1983.

Best to all

Thursday, December 03, 2009

BofA Raises $19.3 Billion

by Calculated Risk on 12/03/2009 08:30:00 PM

From Bloomberg: Bank of America Raises $19.3 Billion in Share Sale at $15 Each

Bank of America Corp., which plans to repay $45 billion of U.S. government bailout money, raised $19.3 billion in a sale of securities at $15 apiece, a 4.8 percent discount to its common stock.This means BofA should repay the $45 Billion in TARP money tomorrow or early next week.

I expect other banks - possibly Wells Fargo and Citigroup - to raise capital too. (ht jb)

Fed Chairmen Never Learn

by Calculated Risk on 12/03/2009 04:55:00 PM

In his 2001 testimony, Fed Chairman Alan Greenspan testified before the House Committee on the Budget, and while offering his usual cautions and caveats, Greenspan talked of surpluses for the foreseeable future.

Greenspan spoke of "an on-budget surplus of almost $500 billion ... in fiscal year 2010". The National Debt would soon be retired and the Boomer's retirements secure. Greenspan offered a projection of "an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs."

How did that work out?

The key point is that for the Fed to remain independent, the Fed Chairman - as a rule - should avoid all discussions of fiscal policy.

Now comes Fed Chairman Bernanke today on the deficit. From Ryan Grim at Huffington Post:

"Well, Senator, I was about to address entitlements," Bernanke replied [to Senator Bennett]. "I think you can't tackle the problem in the medium term without doing something about getting entitlements under control and reducing the costs, particularly of health care."No matter if people agree or disagree with Bernanke, to maintain independence the Fed Chairman should not be commenting on the deficit and entitlements.

Bernanke reminded Congress that it has the power to repeal Social Security and Medicare.

"It's only mandatory until Congress says it's not mandatory. And we have no option but to address those costs at some point or else we will have an unsustainable situation," said Bernanke.

...

"Willie Sutton robbed banks because that's where the money is, as he put it," Bernanke said. "The money in this case is in entitlements."

And from Silla Brush at The Hill: Bernanke: 'Little bit early' to make case for second stimulus

Federal Reserve Chairman Ben Bernanke ... Bernanke emphasized that the government has spent less than half of the money in the $787-billion package passed earlier this year and that analysts are still determining its impact.Once again - it doesn't matter whether you agree or disagree with Bernanke - he should not be talking about these issues.

"Only about 30 percent of the funds have been disbursed," Bernanke said. "It's a little bit early to make a strong judgment, a little bit early to decide whether or not to do additional fiscal actions."

A very poor performance today from the Fed Chairman.

AmTrust Lawyers Discuss Bank Seizure

by Calculated Risk on 12/03/2009 02:44:00 PM

From the Plain Dealer: AmTrust sale appears inevitable, according to attorneys

Peter Goldberg doesn't expect to be the CEO of AmTrust Bank much longer, but his expertise will be needed to help the AmTrust and its employees once the bank is taken over by regulators and sold to another bank.This is probably forcing the FDIC's hand to take action soon (like tomorrow).

That revelation was among many made Thursday during the initial hearing of AmTrust Bank's parent company, AmTrust Financial Corp., in U.S. Bankruptcy Court in Cleveland.

... attorneys for AmTrust Financial and its major creditors ... talked candidly about AmTrust's dismal condition and made it clear they've already started planning for what happens after AmTrust is sold.

Here is another article from the Plain Dealer on the bankruptcy filing of the bank hold company: AmTrust's bankruptcy filing may be a lesson learned from WaMu