by Calculated Risk on 11/24/2009 10:42:00 AM

Tuesday, November 24, 2009

FDIC Q3 Banking Profile: 552 Problem Banks

The FDIC released the Q3 Quarterly Banking Profile today. The FDIC listed 552 banks with $345.9 billion in assets as “problem” banks in Q3, up from 416 banks with $299.8 billion in assets in Q2, and 252 and $159.4 billion in assets in Q4 2008.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 513 problem banks - and will probably increase this week. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

The 552 problem banks reported at the end of Q3 is the highest since 1993.

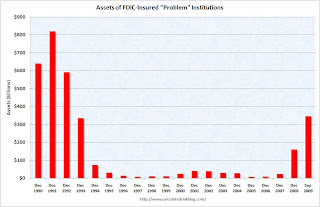

The second graph shows the assets of "problem" banks since 1990. The assets of problem banks are the highest since 1992.

The assets of problem banks are the highest since 1992.

On the Deposit Insurance Fund:

The Deposit Insurance Fund (DIF) decreased by $18.6 billion during the third quarter to a negative $8.2 billion (unaudited) primarily because of $21.7 billion in additional provisions for bank failures. Also, unrealized losses on available-for-sale securities, combined with operating expenses, reduced the fund by $1.1 billion. Accrued assessment income added $3.0 billion to the fund during the quarter, and interest earned, combined with realized gains from sale of securities and surcharges from the Temporary Liquidity Guarantee Program, added $1.2 billion.The number of failures is now up to 124.

Fifty insured institutions with combined assets of $68.8 billion failed during the third quarter of 2009, the largest number since the second quarter of 1990 when 65 insured institutions failed. Ninety-five insured institutions with combined assets of $104.7 billion failed during the first three quarters of 2009, at a currently estimated cost to the DIF of $25.0 billion. The DIF’s reserve ratio was negative 0.16 percent on September 30, 2009, down from 0.22 percent on June 30, 2009, and 0.76 percent one year ago. The September 30, 2009, reserve ratio is the lowest reserve ratio for a combined bank and thrift insurance fund since June 30, 1992, when the ratio was negative 0.20 percent.