by Calculated Risk on 11/17/2009 02:11:00 PM

Tuesday, November 17, 2009

DataQuick: SoCal Home Sales Increase

From DataQuick: Southland home sales up again, drop in median price smallest in 2 years

Southern California home sales rose in October as prices showed more signs of firming. The median sale price fell by the smallest amount in two years, the result of a shrinking inventory of homes for sale and government and industry efforts to stoke demand and curtail foreclosures ...DataQuick does a good job of describing the uncertainties concerning the housing market.

...

Last month 22,132 new and resale houses and condos closed escrow in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was up 2.8 percent from 21,539 in September and also up 2.8 percent from 21,532 a year earlier, according to MDA DataQuick of San Diego.

October marked the 16th month in a row with a year-over-year sales gain, although last month’s was the smallest of those increases. ...

Sales increases over the last two months can be partially attributed to the recent increase in short sales, which take longer to close escrow. The result is that some summer deals that might normally have closed earlier instead closed in September and October. ...

[also] A rush by some to take advantage of the federal tax credit for first-time buyers ...

FHA mortgages accounted for 38.3 percent of all Southland purchase loans last month, compared with 32.5 percent a year ago and just 2 percent two years ago. ...

“The government is playing a huge role in stabilizing and, to some extent, reinvigorating the housing market,” said John Walsh, MDA DataQuick president. “Its actions have triggered ultra-low mortgage rates, plentiful low-down-payment (FHA) financing, an extended and expanded tax credit for home buyers, and programs and political pressure aimed at reducing foreclosures.”

“The real question now is how well can the market perform next year as some of the government stimulus disappears,” he continued. “The more upbeat outlooks suggest a strengthening economy and job market will help pick up the slack, and that demand for lower-cost foreclosures will remain robust. The more negative forecasts assume, among other things, a much slower economic recovery, more foreclosures than the market can readily digest, and more turbulence in the credit markets.”

The latter outlook suggests today’s market stability is contrived and will prove short-lived – nothing more than a temporary price plateau – while the former suggests home prices are currently at or near bottom.

...

Recent month-to-month and year-over-year gains in the median sale price reflect, in large part, a shift of late toward foreclosures representing a lower percentage of sales. It’s mainly the result of lenders and loan servicers increasingly steering distressed borrowers into either an attempted short sale or loan modification. This reduction in foreclosures is key because over the past two years foreclosed properties were often the most aggressively priced on the market.

Last month, foreclosure resales – houses and condos sold in October that had been foreclosed on in the prior 12 months – made up 40.6 percent of all Southland resales. That was up insignificantly from 40.4 percent in September and down from a high of 56.7 percent in February this year.

As sales of lower-cost foreclosures began to wane earlier this year, sales in higher-cost neighborhoods picked up. High-end homes began to account for a greater share of all sales and helped reverse the steep slide in the median price. Over the past few months, however, the high-end’s share of total sales has flattened out.

...

Foreclosure activity remains high by historical standards, although mortgage default notices have flattened out or trended lower in many areas lately.

emphasis added

The increase in FHA insured loans is amazing: from 2% in 2007 to 39.3% last month.

NAHB: Builder Confidence Flat in November

by Calculated Risk on 11/17/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

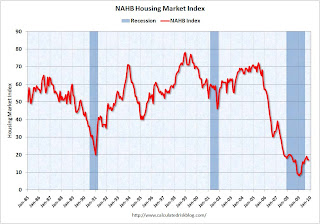

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 17 in November. October was revised down from 18 to 17. The record low was 8 set in January.

This is very low - and this is what I've expected - a long period of builder depression.

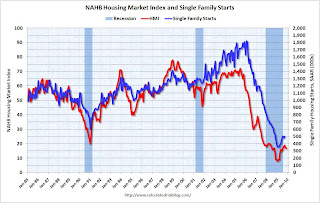

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October starts will be released Wednesday Nov 18th).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October starts will be released Wednesday Nov 18th).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. But it appears that those expecting a sharp rebound in starts are probably wrong.

Press release from the NAHB (added): Builder Confidence Unchanged in November

Fed's Lacker: Fed Can't be "paralyzed by patches of lingering weakness"

by Calculated Risk on 11/17/2009 10:46:00 AM

From Richmond Fed President Jeffrey Lacker The Economic Outlook:

Earlier this year some economists were highlighting the risk that the low level of economic activity could push the rate of inflation down, perhaps even below zero. I think the risk of a substantial further reduction in inflation has diminished substantially since then. The historical record suggests that the early years of a recovery is when the risk is greatest that confidence in the stability of inflation erodes and we see an upward drift in inflation and inflation expectations. This risk could be particularly pertinent to the current recovery, given the massive and unprecedented expansion in bank reserves that has occurred, and the widespread market commentary expressing uncertainty over whether the Federal Reserve is willing and able to promptly reverse that expansion.Lacker is one of the inflation hawks on the FOMC.

As a technical matter, I do not see any problem – we do have the tools to remove as much monetary stimulus as necessary to keep inflation low and stable. The harder problem is the same one that we face after every recession, which is choosing when and how rapidly to remove monetary stimulus. There is no doubt that we must be aware of the danger of aborting a weak, uneven recovery if we tighten too soon. But if we hope to keep inflation in check, we cannot be paralyzed by patches of lingering weakness, which could persist well into the recovery. In assessing when we will need to begin taking monetary stimulus out, I will be looking for the time at which economic growth is strong enough and well-enough established, even if it is not yet especially vigorous.

First, I think we could see further declines in inflation in 2010; even the possibility of core PCI deflation. I don't think the risk of further declines has "diminished substantially".

Second, I think Q3 GDP will be revised down based on subsequent data (like the trade report), and GDP growth will be lower than Lacker expects in early 2010. I think Lacker is overly optimistic on the economy.

Also - historically the Fed hasn't raised rates until well after unemployment peaks, and I doubt they will raise rates until late in 2010 at the earliest (and probably later). Here is a graph from a previous post in September (the unemployment rate is now 10.2%):

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Industrial Production, Capacity Utilization Increase Slightly in October

by Calculated Risk on 11/17/2009 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.1 percent in October ... Manufacturing production moved down 0.1 percent and the output of mines decreased 0.2 percent, but the index for utilities rose 1.6 percent. At 98.6 percent of its 2002 average, total industrial production was 7.1 percent below its level of a year earlier. Capacity utilization for total industry moved up 0.2 percentage point to 70.7 percent, a rate 10.2 percentage points below its average for 1972 through 2008, and capacity utilization for manufacturing was unchanged at 67.6 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series has increased for four straight months, and is up from the record low set in June (the series starts in 1967).

Note: y-axis doesn't start at zero to better show the change.

This is just one month, but the recovery in industrial production slowed in October.

Report: Record Mortgage Loan Delinquency Rates in Q3

by Calculated Risk on 11/17/2009 08:29:00 AM

TransUnion reports that the 60 day mortgage delinquency rate increased to a record 6.25% in Q3, from 5.81% in Q2.

From TransUnion: Mortgage Loan Delinquency Rates on Course to Hit Record in 2009

Mortgage loan delinquency (the ratio of borrowers 60 or more days past due) increased for the 11th straight quarter, hitting an all-time national average high of 6.25 percent for the third quarter of 2009. This statistic is traditionally seen as a precursor to foreclosure and increased 7.57 percent from the previous quarter's 5.81 percent average. While still increasing, this quarter marks the third consecutive period the delinquency rate increase has decelerated. For comparison purposes, the delinquency rate from the fourth quarter 2008 to first quarter 2009 saw an increase of almost 14 percent, and the percent change from first quarter to second quarter 2009 increased by 11.3 percent. Year-over-year, mortgage borrower delinquency is up approximately 58 percent (from 3.96 percent).The MBA will release delinquency data on Thursday.

Mortgage borrower delinquency rates in the third quarter of 2009 continued to be highest in Nevada (14.5 percent) and Florida (13.3 percent), while the lowest mortgage delinquency rates were found in North Dakota (1.7 percent), South Dakota (2.3 percent) and Vermont (2.6 percent). Areas showing the greatest percentage growth in delinquency from the previous quarter were Wyoming (+17.9 percent), Kansas (+17.4 percent) and North Dakota (+16 percent). Bright spots for the quarter included the District of Columbia, showing a decline in mortgage delinquency rates, down 0.19 percent from the previous quarter.

Monday, November 16, 2009

Merle Hazard: Give me that Old Time Recession

by Calculated Risk on 11/16/2009 11:55:00 PM

Some late night entertainment from Merle Hazard (other hits include Inflation or Deflation?, Mark to Market and H-E-D-G-E)

Note: Merle will be performing live at the annual convention of the American Economic Association, Sunday, January 3, 2010, 8 p.m. in Atlanta.

Update on Las Vegas Cosmopolitan Resort & Casino

by Calculated Risk on 11/16/2009 10:54:00 PM

In June 2008, reader Brian sent me an email that started:

"When the bankers are selecting color schemes, you know a project isn't going well"He was referring to Deutsche Bank foreclosing on the $3.5 billion Cosmopolitan Resort & Casino in Las Vegas.

Bloomberg has an update: Deutsche Bank Drowning in Vegas on Costliest Bank-Owned Casino

Deutsche Bank AG’s Cosmopolitan Resort & Casino complex in Las Vegas, already the most expensive debacle in the city for a single lender, is now two years behind schedule, $2 billion over budget and under water -- literally.From bad to worse ...

...

So far, Deutsche Bank has had to write down 500 million euros ($748 million) on Cosmopolitan. ... Further north on the Las Vegas Strip, work halted on the Fontainebleau in June with a bankruptcy filing after its lenders, including Deutsche Bank, refused further funding. The 63-story casino resort is about 70 percent complete.

TARP Watchdog: AIG Bailout Transferred Billions from Government to Counterparties

by Calculated Risk on 11/16/2009 09:47:00 PM

In a report (pdf) titled "Factors Affecting Efforts to Limit Payments to AIG Counterparties", Neil Barofsky, special inspector for TARP, wrote that the "negotiating strategy to pursue concessions from [AIG] counterparties offered little opportunity for success, even in the light of the willingness of one of the counterparty to agree to concessions".

He also concluded that the "structure and effect of the FRBNY's assistance to AIG ... effectively transferred tens of billions of dollars of cash from the government to AIG's counterparties".

Here is a story from Bloomberg: Fed’s Strategy ‘Severely Limited’ AIG Bailout, Watchdog Says

Meredith Whitney Expects Double-Dip Recession, FDIC dumps "Cease & Desist"

by Calculated Risk on 11/16/2009 03:51:00 PM

From CNBC (added): Stocks Overvalued, Recession Will Return: Meredith Whitney

From American Banker: FDIC Speaks More Softly, Retains Stick

The FDIC changed the name of its cease-and-desist order to the less ominous-sounding "consent order" (a term already used by other regulators) ... David Barr, an FDIC spokesman, said that the traditional cease-and-desist order will be issued to any banks that refuse to stipulate and instead seek an administrative hearing.A kinder softer name ...

...

The FDIC has not made any of the new orders public so far.

LA Area Port Traffic in October

by Calculated Risk on 11/16/2009 02:24:00 PM

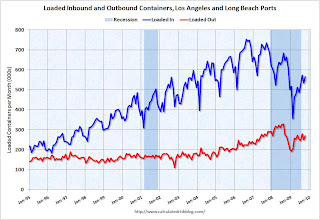

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was 14.7% below October 2008.

Loaded outbound traffic was 1.0% above October 2008.

There was a clear recovery in U.S. exports earlier this year; however exports have been mostly flat since May. This year will be the 3rd best year for export traffic at LA area ports, behind 2007 and 2008.

For imports, traffic is below the October 2003 level, and 2009 will be the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline in November.

The lack of further export growth to Asia is discouraging ...

On imports - last year retailers were stuck with too much inventory (the supply chain is long and imports didn't adjust as quickly as exports). It appears retailers will have much less inventory this year for the holidays.

Fed Chairman Ben Bernanke at Economic Club of NY

by Calculated Risk on 11/16/2009 12:15:00 PM

Here is a live video of Bernanke at the Economic Club of NY

Here is the CNBC feed.

Prepared Speech: On the Outlook for the Economy and Policy

How the economy will evolve in 2010 and beyond is less certain. On the one hand, those who see further weakness or even a relapse into recession next year point out that some of the sources of the recent pickup--including a reduced pace of inventory liquidation and limited-time policies such as the "cash for clunkers" program--are likely to provide only temporary support to the economy. On the other hand, those who are more optimistic point to indications of more fundamental improvements, including strengthening consumer spending outside of autos, a nascent recovery in home construction, continued stabilization in financial conditions, and stronger growth abroad.On CRE (added):

My own view is that the recent pickup reflects more than purely temporary factors and that continued growth next year is likely. However, some important headwinds--in particular, constrained bank lending and a weak job market--likely will prevent the expansion from being as robust as we would hope.

Demand for commercial property has dropped as the economy has weakened, leading to significant declines in property values, increased vacancy rates, and falling rents. These poor fundamentals have caused a sharp deterioration in the credit quality of CRE loans on banks' books and of the loans that back commercial mortgage-backed securities (CMBS). Pressures may be particularly acute at smaller regional and community banks that entered the crisis with high concentrations of CRE loans. In response, banks have been reducing their exposure to these loans quite rapidly in recent months. Meanwhile, the market for securitizations backed by these loans remains all but closed. With nearly $500 billion of CRE loans scheduled to mature annually over the next few years, the performance of this sector depends critically on the ability of borrowers to refinance many of those loans. Especially if CMBS financing remains unavailable, banks will face the tough decision of whether to roll over maturing debt or to foreclose.More:

I expect moderate economic growth to continue next year. Final demand shows signs of strengthening, supported by the broad improvement in financial conditions. Additionally, the beneficial influence of the inventory cycle on production should continue for somewhat longer. Housing faces important problems, including continuing high foreclosure rates, but residential investment should become a small positive for growth next year rather than a significant drag, as has been the case for the past several years. Prospects for nonresidential construction are poor, however, given weak fundamentals and tight financing conditions.

...

Jobs are likely to remain scarce for some time, keeping households cautious about spending. As the recovery becomes established, however, payrolls should begin to grow again, at a pace that increases over time. Nevertheless, as net gains of roughly 100,000 jobs per month are needed just to absorb new entrants to the labor force, the unemployment rate likely will decline only slowly if economic growth remains moderate, as I expect.

Business Inventories Decline in September

by Calculated Risk on 11/16/2009 10:00:00 AM

The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed inventories are still declining. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Census Bureau reported:

Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,303.4 billion, down 0.4 percent (±0.1%) from August 2009 and down 13.4 percent (±0.3%) from September 2008.Inventory levels are still a little high compared to lower sales levels, and further inventory reductions are probably coming. Although changes in private inventories made a positive contribution to Q3 GDP in the preliminary report, the usual inventory restocking cycle at the beginning of a recovery will probably be muted without a pickup in final demand.

The total business inventories/sales ratio based on seasonally adjusted data at the end of September was 1.32. The September 2008 ratio was 1.32.

Retail Sales Increase in October

by Calculated Risk on 11/16/2009 08:30:00 AM

On a monthly basis, retail sales increased 1.4% from September to October (seasonally adjusted), and sales are off 1.7% from October 2008. Excluding auto sales and parts, retail sales rose 0.2% in October.

The increase in October was mostly a rebound from the decline in September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

The red line shows retail sales ex-gasoline and shows there has been little increase in final demand. The second graph shows the year-over-year change in retail sales since 1993.

The second graph shows the year-over-year change in retail sales since 1993.

Real retail sales declined by 1.7% on a YoY basis. The year-over-year comparisons are much easier now since retail sales collapsed in October 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $347.5 billion, an increase of 1.4 percent (±0.5%) from the previous month, but 1.7 percent (±0.5%) below October 2008. Total sales for the August through October 2009 period were up 1.5 percent (±0.3%) from the same period a year ago. The August to September 2009 percent change was revised from -1.5 percent (±0.5%) to -2.3 percent (±0.3%).It appears retail sales have bottomed, but there has been little pickup in final demand.

IMF: China Needs Stronger Currency

by Calculated Risk on 11/16/2009 12:13:00 AM

From Reuters: Stronger Yuan Needed for Global Rebalancing: IMF Chief

IMF Managing Director Dominique Strauss-Kahn said ... [China needs to increase emphasis on domestic demand], especially private consumption ...And from Paul Krugman: World Out of Balance

"A stronger currency is part of the package of necessary reforms," he said. "Allowing the renminbi (yuan) and other Asian currencies to rise would help increase the purchasing power of households, raise the labour share of income, and provide the right incentives to reorient investment."

... Looking forward, we can expect to see both China’s trade surplus and America’s trade deficit surge.This is something I need to think about. The U.S. trade deficit has been closely correlated to Mortgage Equity Withdrawal (MEW, aka "Home ATM"), and I doubt MEW is coming back soon, so I'm not sure we will see a huge increase in the deficit this time (excluding China and oil exporting companies). So this might impact other countries (like Europe) more than the U.S.

That, at any rate, is the argument made in a new paper by Richard Baldwin and Daria Taglioni of the Graduate Institute, Geneva. As they note, trade imbalances, both China’s surplus and America’s deficit, have recently been much smaller than they were a few years ago. But, they argue, “these global imbalance improvements are mostly illusory — the transitory side effect of the greatest trade collapse the world has ever seen.”

...

But with the financial crisis abating, this process is going into reverse. Last week’s U.S. trade report showed a sharp increase in the trade deficit between August and September. And there will be many more reports along those lines.

So picture this: month after month of headlines juxtaposing soaring U.S. trade deficits and Chinese trade surpluses with the suffering of unemployed American workers. If I were the Chinese government, I’d be really worried about that prospect.

Sunday, November 15, 2009

Housing Starts and Vacant Units: No "V" Shaped Recovery

by Calculated Risk on 11/15/2009 07:31:00 PM

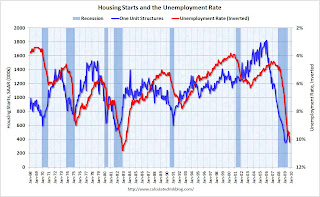

On Friday I posted a graph showing the historical relationship between housing starts and the unemployment rate (repeated as the 2nd graph below). The graph shows that housing leads the economy both into and out of recessions, and the unemployment rate lags housing by about 12 to 18 months.

It appears that housing starts bottomed earlier this year, however I don't think we will see a sharp recovery in housing this time - and I also think unemployment will remain high throughout 2010. As I noted in the earlier post, there is still a large overhang of vacant housing in the United States, and a sharp bounce back in housing starts is unlikely.

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing. Click on graph for larger image in new window.

Click on graph for larger image in new window.

It is very unlikely that there will be a strong rebound in housing starts with a record number of vacant housing units.

The vacancy rate has continued to climb even after housing starts fell off a cliff. Initially this was because of a significant number of completions. Also some hidden inventory (like some 2nd homes) have become available for sale or for rent, and lately some households have probably doubled up because of tough economic times.

Note: the increase in the vacancy rate in the '80s was due to several factors including demographics (baby boomers moving from renting to owning), and overbuilding of apartment units (part of S&L crisis).

Here is a repeat of the earlier graph: This graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

This graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Spring or Summer 2010. However, since I expect the housing recovery to be sluggish, I also expect unemployment to remain high throughout 2010.

Krugman Suggests $300 Billion Jobs Program

by Calculated Risk on 11/15/2009 03:32:00 PM

"There’s no hard and fast number, but ... I have in mind something like $300 Billion, you could do quite a lot that’s actually targeted on jobs."In the following interview, with Alison van Diggelen of Fresh Dialogues, Paul Krugman offers some suggestions for addressing the high unemployment rate (transcript here):

Professor Paul Krugman, Nov 12, 2009

And two pieces - the first from the NY Times, and the second from Krugman's blog.

From Krugman in the NY Times: Free to Lose

[T]hese aren’t normal times. Right now, workers who lose their jobs aren’t moving to the jobs of the future; they’re entering the ranks of the unemployed and staying there. Long-term unemployment is already at its highest levels since the 1930s, and it’s still on the rise.And from his blog: It’s the stupidity economy

And long-term unemployment inflicts long-term damage. Workers who have been out of a job for too long often find it hard to get back into the labor market even when conditions improve. And there are hidden costs, too — not least for children, who suffer physically and emotionally when their parents spend months or years unemployed.

So it’s time to try something different.

Just to be clear, I believe that a large enough conventional stimulus would do the trick. But since that doesn’t seem to be in the cards, we need to talk about cheaper alternatives that address the job problem directly. Should we introduce an employment tax credit, like the one proposed by the Economic Policy Institute? Should we introduce the German-style job-sharing subsidy proposed by the Center for Economic Policy Research? Both are worthy of consideration.

The point is that we need to start doing something more than, and different from, what we’re already doing.

[S]ome readers have asked why I’m not making the same arguments for America now that I was making for Japan a decade ago. The answer is that I don’t think I’ll get anywhere, at least not until or unless the slump goes on for a long time.

OK, so what’s next? The second-best answer would be a really big fiscal expansion, sufficient to mostly close the output gap. The economic case for doing that is really clear. But Washington is caught up in deficit phobia, and there doesn’t seem to be any chance of getting a big enough push.

That’s why, at this point, I’m turning to what I understand perfectly well to be a third-best solution: subsidizing jobs and promoting work-sharing.

Summary and a Look Ahead

by Calculated Risk on 11/15/2009 11:29:00 AM

This will be a busy week for key economic news starting with October Retail sales on Monday, Industrial Production and Capacity Utilization on Tuesday, and Housing Starts and CPI on Wednesday.

Also on Monday, at noon ET, Fed Chairman Ben Bernanke will speak at the Economic Club of New York.

Last week started with several key Fed speeches:

I am concerned about the potential impact of CRE on the broader economy. ... there could be an impact resulting from small banks' impaired ability to support the small business sector—a sector I expect will be critically important to job creation.

... A lot of the CRE exposure is concentrated at smaller institutions (banks with total assets under $10 billion). These smaller banks account for only 20 percent of total commercial banking assets in the United States but carry almost half of total CRE loans (based on Bank Call Report data).

Many small businesses rely on these smaller banks for credit. ... Moreover, small firms' reliance on banks with heavy CRE exposure is substantial. Banks with the highest CRE exposure (CRE loan books that are more than three times their tier 1 capital) account for almost 40 percent of all small business loans.

Today, the number one challenge for small businesses remains poor sales rather than access to credit. But tomorrow, it will be important that small businesses also have access to funding if they are going to play their traditional role as an engine of growth.

When the weakness of the commercial property market is combined with the muted outlook for housing and consumer spending, you can see why I believe that the overall economic recovery is likely to be gradual and remain vulnerable to shocks. ... it would look something like an “L” with a gradual upward tilt of the base. With such a slow rebound, unemployment could well stay high for several years to come.

[L]ooking into 2010 and perhaps to 2011, the most likely outcome is for growth to be suboptimal, unemployment to remain a vexing problem and inflation to remain subdued.And economic data:

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly U.S. exports and imports in dollars through September 2009.

Imports and exports increased in September. On a year-over-year basis, exports are off 13% and imports are off 21%.

The major contributors to the increase in the trade deficit were the increase in oil prices, and more imports from China. Also - the deficit is higher than expected, suggesting a downward revision to Q3 GDP.

And there were three more bank failures on Friday taking the total to 123 in 2009:

And some other stories of interest:

And a couple of comments from your humble blogger:

Best wishes to all.

China Banking Regulator: U.S. Policy Fueling Asset Speculation

by Calculated Risk on 11/15/2009 09:20:00 AM

From Bloomberg: China’s Liu Says U.S. Rates Cause Dollar Speculation

“The continuous depreciation in the dollar, and the U.S. government’s indication, that in order to resume growth and maintain public confidence, it basically won’t raise interest rates for the coming 12 to 18 months, has led to massive dollar arbitrage speculation,” [Liu Mingkang, chairman of the China Banking Regulatory Commission said] ...President Obama will be in China today, and there will probably be some dicussion of China's exchange rate policy.

Liu said this has “seriously affected global asset prices, fuelled speculation in stock and property markets, and created new, real and insurmountable risks to the recovery of the global economy, especially emerging-market economies.”

Saturday, November 14, 2009

Orion Bank CEO Had a Plan ...

by Calculated Risk on 11/14/2009 10:55:00 PM

In his comments with the Unofficial Problem Bank list, surferdude808 noted that the Federal Reserve issued a Prompt Corrective Action order against Orion Bank on Thursday. Orion was seized the following day by the FDIC.

The PCA order makes for interesting reading (Note: Stephen at FUMU Finance wrote to me about this - here is Stephen's post with some background details: Orion Bank - Management's master plan!). From the PCA:

In order to improve its management, the Bank must dismiss Jerry Williams (“Williams”), its current chief executive officer, president, and chairman of its board of directors, from office and as a member of the board of directors, based on the following:Pretty amazing.

(a) Prior to June 2009, the Bank reached its legal lending limit under Florida law with respect to the aggregate loans outstanding to a borrower and his related interests. In June 2009, Williams permitted the Bank to make loans of an additional approximately $60 million to straw borrowers who were related interests of the borrower referred to above in continuing violation of the Florida legal lending limit statute (the “June 2009 loans”);

(b) the June 2009 loans referred to above, which were made to enable the borrowers to purchase certain low quality assets from the Bank, were underwritten in an unsafe and unsound manner. The loans were made without adequate analysis of the borrowers’ creditworthiness, capacity for repayment, and valuation of collateral offered in support of the loans. Further, the loans were structured in a manner to make it appear that the Bank was reducing its level of classified assets;

(c) the Bank needed additional capital as of June 30, 2009, to avoid being less than well-capitalized. Williams had knowledge that $15 million of loan proceeds from the June 2009 loans referred to above were to be used to purchase common and preferred stock issued by Orion Bancorp, Inc., Naples, Florida (“Bancorp”), the parent holding company for the Bank, and Williams took steps to ensure that the $15 million was promptly used to purchase the holding company stock;

(d) in early July 2009, in response to inquiries from the Federal Reserve Bank of Atlanta (the “Reserve Bank”), Williams stated orally and in writing that the $15 million in capital referred to above was raised “without any financing” provided by the Bank. This statement was false because Williams had information available to him to demonstrate that the Bank intended that the loan proceeds be used as the source of the stock purchase;

(e) as a result of the actions set forth in (a) through (d), above, the Bank, with Williams’ active participation, filed materially inaccurate regulatory reports, made false statements to the Federal Reserve, has suffered additional loan losses, and has failed to comply with provisions of an outstanding Written Agreement designed to require that the Bank properly address its asset quality problems. These actions show that the management of the Bank would be improved without Williams’ service as a senior executive officer or director of the Bank.

emphasis added

Home Builder's Return on Lobbying

by Calculated Risk on 11/14/2009 07:18:00 PM

Gretchen Morgenson at the NY Times writes about the tax loss carry-back1 "gift" for home builders in the recently signed "Worker, Homeownership and Business Assistance Act of 2009": Home Builders (You Heard That Right) Get a Gift

The Center for Responsive Politics reports that through Oct. 26 of this year, home builders paid $6 million to their lobbyists. ... Much of this year’s lobbying expenditures were focused on arguing for the tax loss carry-forward, documents show.That is quite a Return on Lobbying (ROL), although some of the money went to lobbying for the inefficient homebuyer tax credit.

Among individual companies, Lennar spent $240,000 lobbying while companies affiliated with Hovnanian Enterprises spent $222,000. Pulte Homes spent $210,000 this year.

That’s some return on investment. After spending its $210,000, Pulte will receive $450 million in refunds. And Hovnanian, after spending its $222,000, will get as much as $275 million.

And, oh, this "gift" will create few if any jobs.

1 UPDATE: This is really a tax loss carry back to the profitable years.