by Calculated Risk on 6/14/2009 08:06:00 PM

Sunday, June 14, 2009

Office Building Sells at 40% Below Construction Costs

From the WSJ: Maguire Sells Office Site at 40% Off (ht Ron)

Maguire Properties Inc ... sold a newly developed office building in Irvine, Calif., for about $160 million, a price representing an estimated 40% discount to its construction cost.Quite a haircut. New Century still causing damage ...

...

Emmes Group of Cos. ... purchased the 19-story building, which was completed in 2007 and is about 60% leased. ...

The building ... was originally slated to be anchored by [subprime lender] New Century Financial Corp. ... The building is roughly estimated to have cost about $500 a square foot, according to Michael Knott, a senior adviser with Green Street Advisors in Newport Beach, Calif. Emmes's price was about $300 a square foot.

Mall Space

by Calculated Risk on 6/14/2009 03:40:00 PM

Here is an interesting short discussion on reusing mall space from Rob Walker in the NY Times Magazine: Repurpose-Driven Life

Talk of American infrastructure tends to focus on inadequacies: roads that need to be repaired or widened, bridges fortified, electrical grids updated. All the more striking, then, that America’s retail infrastructure — its malls, supercenters, big boxes and other styles of store-clumping — has come to be characterized by rampant abundance. This has been a decades-long trend. But it has taken the economic downturn, with chain stores liquidating, mall tenancy slipping and car dealerships scheduled for closure, to focus popular attention on the problem with our retail infrastructure: there is too much of it.And that was in 2003 - before the most recent mall building boom began (see graph at bottom).

A recent book, “Retrofitting Suburbia,” by Ellen Dunham-Jones and June Williamson, notes that in 1986, the United States had about 15 square feet of retail space per person in shopping centers. That was already a world-leading figure, but by 2003 it had increased by a third, to 20 square feet. The next countries on the list are Canada (13 square feet per person) and Australia (6.5 square feet); the highest figure in Europe is in Sweden, with 3 square feet per person.

| From Italian cartoonist Giovanni Fontana (used with permission). Here is his website, the vignettist's corner Click on cartoon for larger image in new window. |

Of course the housing bubble in the U.S. was much large than the mall bubble.

In 2005, investment in single-family structures hit a peak of $481 billion (all residential investment including multi-family and home improvement was $761 billion in 2005.)

Investment in malls peaked at $32.5 billion in 2007. So the mall bubble isn't anywhere near as big as the housing bubble in absolute numbers or potential negative impact on the overall economy.

Here is a graph of mall investment through Q1 2009 as a percent of GDP based on data from the BEA ...

Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline.

Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline. Note that the article above stated there were 20 square feet of retail space per person in shopping centers in 2003 - and that was before the more recent building boom. There is just too much retail space in the U.S.

Construction Employment in the Inland Empire

by Calculated Risk on 6/14/2009 02:17:00 PM

Way back in 2005 I stated the obvious:

"Of all the areas experiencing a housing boom, the areas most at risk have had the greatest increase in real estate related jobs. These jobs include home construction, real estate agents, mortgage brokers, inspectors and more.To update the graphs:

...

Not surprisingly, California has become more dependent on construction than the rest of the country, and construction has really boomed in San Diego. But San Diego has nothing on the Inland Empire.

I believe that areas like the Inland Empire will suffer the most when housing activity slows."

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph (using Not Seasonally Adjusted data) shows construction as a percent of total employment for the Inland Empire, California and the U.S.

Although there was a surge in construction employment in the U.S., and about a 50% increase in California (as a percent of total employment), construction employment doubled (as a percent of total employment) in the Inland Empire.

Now construction employment in the Inland Empire - as a percent of total employment - is getting close to the lows of the early '90s.

The second graph shows the percent of construction employment and the unemployment rate for the Inland Empire.

The second graph shows the percent of construction employment and the unemployment rate for the Inland Empire.With the housing bust, the percent construction employment has declined sharply and the unemployment rate has risen to around 13% (about the same as Detroit).

Krugman: "Risk for long stagnation is really high"

by Calculated Risk on 6/14/2009 09:37:00 AM

From The Observer: Paul Krugman's fear for lost decade (ht Jonathan)

A few excerpts:

Krugman: The risk of a full, all-out Great Depression - utter collapse of everything - has receded a lot in the past few months. But this first year of crisis has been far worse than anything that happened in Japan during the last decade, so in some sense we already have much worse than anything the Japanese went through. The risk for long stagnation is really high.And on the stimulus:

Will Hutton: [I]s Obama doing enough on fiscal policy?

PK: Well we have a stimulus which is a little over 5% of one year's GDP but some of it is not real - something that was going to happen anyway and not very stimulative. So it's really about 4% of GDP of genuine stimulus, but spread over two and a half years. So, it's actually quite a lot less than what I was arguing for.

WH: So, will it be sufficient?

PK: Well, sufficient to actually restore full employment would probably have to be 5% or more. More than we have would certainly be a good thing. It actually might happen. You know, the buzz I'm getting is that a second-round stimulus might well come on the agenda.

Saturday, June 13, 2009

Cartoon: Another 30 Percent

by Calculated Risk on 6/13/2009 08:31:00 PM

Earlier I posted that Fitch expects "home prices will fall an additional 12.5% nationally and 36% in California" from Q1 2009.

Here is Eric's take ...

| From cartoonist Eric G. Lewis. Click on cartoon for larger image in new window. |

Geithner: "Economic storm receding"

by Calculated Risk on 6/13/2009 06:03:00 PM

From Reuters: Geithner: It's Too Soon To Withdraw Economic Stimulus

US Treasury Secretary Timothy Geithner said on Saturday it was too early to start withdrawing stimulus for the world's top economies, but governments should pledge a return to more sustainable fiscal policies in the future.From NY Times: At Talks, Geithner Defends Stimulus

"Growth should remain the principal focus of policy among the G8 and broader G20 economies," Geithner told a news conference ... He said recovery has not yet arrived, and governments need to keep reinforcing recent improvements in global demand.

"It is too early to shift toward policy restraint," Geithner said

...

Geithner said the "force of the economic storm is receding" he told the BBC in Lecce that he wanted recovery firmly in place before withdrawing stimulus.

"We don't have a world economy that's growing anywhere close to potential yet. We want to see recovery firmly established before we start to get on to the next challenge," he said in the interview.

“Where we have seen improvements, they are the result of the unprecedented scope and intensity of policy actions to support demand and financial repair,” Mr. Geithner said in a statement. “These early signs of improvement are encouraging, but the global economy is still operating well below potential, and we still face acute challenges.”Despite the "unprecedented scope and intensity of policy actions", the global economy (and U.S. economy) are still in recession, and the so-called "improvements" are that the pace of contraction has slowed. We still have a ways to go.

emphasis added

Cities Downsize to Survive

by Calculated Risk on 6/13/2009 01:25:00 PM

From The Telegraph: US cities may have to be bulldozed in order to survive (ht Chad, Brian)

The government looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature.

Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

The radical experiment is the brainchild of Dan Kildee, treasurer of Genesee County, which includes Flint.

Having outlined his strategy to Barack Obama during the election campaign, Mr Kildee has now been approached by the US government and a group of charities who want him to apply what he has learnt to the rest of the country.

Mr Kildee said he will concentrate on 50 cities, identified in a recent study by the Brookings Institution, an influential Washington think-tank, as potentially needing to shrink substantially to cope with their declining fortunes.

Most are former industrial cities in the "rust belt" of America's Mid-West and North East. They include Detroit, Philadelphia, Pittsburgh, Baltimore and Memphis.

In Detroit ... there are already plans to split it into a collection of small urban centres separated from each other by countryside.

"The real question is not whether these cities shrink – we're all shrinking – but whether we let it happen in a destructive or sustainable way," said Mr Kildee. "Decline is a fact of life in Flint. Resisting it is like resisting gravity."

Fitch Expects Home Prices to Fall through 2nd Half of 2010

by Calculated Risk on 6/13/2009 08:44:00 AM

Fitch expects "home prices will fall an additional 12.5% nationally and 36% in California" from Q1 2009.

And, oh, you remember subprime?

From HousingWire: Subprime Bloodletting Continues at Fitch

Fitch Ratings today made massive downgrades on various vintage ‘05 through ‘08 subprime residential mortgage-backed securities (RMBS), indicating the extent of the fallout related to subprime defaults has yet to subside.Here is the Fitch statement: Fitch Takes Various Actions on 543 2005-2008 U.S. Subprime RMBS Deals

The rating agency slashed hundreds of RMBS ratings further into junk territory.

On home prices:

The projected losses also reflect an assumption that from the first quarter of 2009, home prices will fall an additional 12.5% nationally and 36% in California, with home prices not exhibiting stability until the second half of 2010. To date, national home prices have declined by 27%. Fitch Rating's revised peak-to-trough expectation is for prices to decline by 36% from the peak price achieved in mid-2006. The additional 9% decline represents a 12.5% decline from today's levels.In explaining the downgrades, Fitch said the actions reflect updated loss expectations and further economic deterioration:

“The home price declines to date have resulted in negative equity for approximately 50% of the remaining performing borrowers in the 2005-2007 vintages. In addition to continued home price deterioration, unemployment has risen significantly since the third quarter of last year, particularly in California where the unemployment rate has jumped from 7.8% to 11%.”

Friday, June 12, 2009

Study: Home Equity Borrowers in Danger

by Calculated Risk on 6/12/2009 10:54:00 PM

"The conventional view is that housing appreciation is good because it reduces (default) risk. Not according to my theory, which is housing appreciation is bad. It encourages junior-lien borrowing. When appreciation stops, somebody is going to be left in a bad position."From Matt Padilla at the O.C. Register: Second mortgages: Lines of danger?

Michael LaCour-Little, finance professor at Cal State Fullerton (emphasis added)

Record foreclosures hitting Orange County involve more than just newbie buyers who got in over their heads.And look at these numbers:

Some housing watchers say evidence is mounting that even veteran homeowners got caught up in housing euphoria and now are paying for it.

The latest argument comes from Michael LaCour-Little, a finance professor at Cal State Fullerton. He is lead author of a new study, which found that during the housing boom some long-time owners borrowed against all their property's equity gain, or paper profits. They treated their houses like cash machines.

...

It's long been assumed that homebuyers who purchased at housing's peak with little money down are among the most likely to face foreclosure. They owed more than their property was worth once prices tanked.

But the study concludes 'cashing-out' is about as predictive of foreclosure for the same reason: negative equity.

Professor LaCour-Little tracked all houses and condos set for foreclosure auctions, known as trustee's sales, in the first two weeks of November 2006, 2007 and 2008 in Orange, Los Angeles, Riverside, San Bernardino and San Diego counties. ...There will be many foreclosures of homes bought before the bubble (or in the early stages of the bubble), because the homeowners extracted too much equity from the home. This is not surprising, but probably means more foreclosures than policymakers expect.

For the early November 2008 data sample, he tracked 2,358 properties and found 79 percent of borrowers had at least a second mortgage. Some also had third and fourth liens. ...

The 2008 foreclosures were purchased in "median" year 2004, meaning half the purchases were before and half after. That suggests more than half the purchases were before housing's peak in 2005 and 2006.

Senatorial Splendor

by Calculated Risk on 6/12/2009 09:36:00 PM

Since the FDIC cancelled Friday ... here is Senator Voinovich showing us his charting skills.

FDIC's Bair: Banking Crisis Not Over

by Calculated Risk on 6/12/2009 06:27:00 PM

From Forbes: Bair Cautions Banking Crisis Is Not Over (ht jb)

Sheila Bair ... said Friday that while the crisis that swept through the financial world last year has subsided somewhat, it was far from over and there would be "many more bank failures" ahead.

"I think there's still some challenges, I think we need to be realistic. There are still some troubled assets on the books and we still have an economy that's under significant stress," said Bair in a 90-minute interview with Forbes reporters and editors on Friday.

We still don't know how deep the recession is going to be," she said, adding, "we'll still be well below what we were in the S&L days."

...

"Hopefully there are no more events that create liquidity stresses on the banks," Bair said, knocking on a wooden conference room table, "and now we're having more good old-fashioned capital insolvencies."

... she worried aloud about the current trend toward making the Federal Reserve banking's regulator-in-chief. ... "No other developed country gives their central bank the kind of power we give our central bank," Bair said.

"[The Fed] had authority to prescribe across-the-board lending standards for mortgages, and a lot of people said they should do that and they just didn't," Bair says as an example of where too many roles led to lapses. "Where does the consumer role go on your priority list? At some point it just doesn't get done. It just doesn't get the focus it should."

BFF and Market

by Calculated Risk on 6/12/2009 04:00:00 PM

Some stats: There have been 37 FDIC bank failures in 2009 (about 1.6 per week). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the bank failures per week through the first 23 weeks of 2009.

There have been six weeks with no failures, and two weeks with four failures.

Note: Corus Bankshares Inc. faces a June 18th deadline imposed by bank regulators to raise capital or find a buyer. I wouldn't be surprised if Corus is seized next week. The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Setser: Who bought all the recently issued Treasuries?

by Calculated Risk on 6/12/2009 03:03:00 PM

From Brad Setser at Follow the Money: Just who bought all the Treasuries the issued in late 2008 and early 2009?

... the Fed’s flow of funds data leaves little doubt that — at least during the first quarter — the rise in public borrowing was fully offset by a fall in private borrowing.

Who bought all the Treasuries the US government has issued in the last four quarters of data (q2 2008 to q1 2009)? Foreign demand for Treasuries — as we have discussed extensively — hasn’t disappeared, unlike foreign demand for other kinds of US debt. But foreign demand hasn’t increased at the same pace as the Treasury’s need to place debt. The gap was filled largely by a rise in demand for Treasuries from US households.

Before the crisis, foreign purchases formerly accounted for almost all new Treasury issuance. Over the last 12 months, foreign demand accounted for more like half of total issuance even as foreigners bought a record sum of Treasuries. And from what we know about the second quarter, I don’t think the basic story has changed.And for a great series of charts comparing the current recession to prior recessions (from Paul Swartz): The Recession in Historical Context

Credit Indicators

by Calculated Risk on 6/12/2009 12:28:00 PM

Here is another look at a few credit indicators:

From Dow Jones: Key US Dollar Libor Rate Falls To Record Low

The cost of borrowing longer-term U.S. dollars in the London interbank market fell Friday, with the three-month rate reaching its lowest level since the advent of British Bankers Association Libor fixings back in 1986 as funding pressures continued to ease.

Data from the BBA showed three-month dollar Libor, seen as a key gauge of the effectiveness of the Federal Reserve's monetary policy, dropped to 0.62438% from Thursday's 0.62938%.

The three-month rate peaked at 4.81875% on Oct. 10.

Click on graph for larger image in new window.

Click on graph for larger image in new window.There has been improvement in the A2P2 spread. This has declined to 0.55. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread is now down to the normal range of 46.21. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

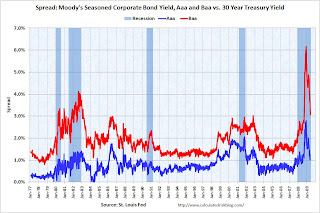

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.The spread has decreased sharply, but the spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.Back in early March, Warren Buffett mentioned that credit conditions were tightening again - and this was probably one of the indexes he was looking at. Since March, the index has declined steadily.

University of Michigan Consumer Sentiment

by Calculated Risk on 6/12/2009 10:10:00 AM

From MarketWatch: Consumer sentiment rises to 69 in June

U.S. consumer sentiment rose in June, but remained at relatively low levels, according to media reports of a survey released Friday by the University of Michigan and Reuters. The consumer sentiment index rose to 69 in mid-June from 68.7 in May.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - it tells you what you pretty much already know.

But it does give me an excuse for a graph ...

Right now consumer sentiment is still very weak.

UK: One in Ten Homeowners with Negative Equity

by Calculated Risk on 6/12/2009 08:49:00 AM

From The Times: One in ten homeowners fall into negative equity

One in ten homeowners fell into negative equity during the first three months of the year, the highest proportion for 15 years, the Bank of England said today.The UK has about 10 million homeowners with mortgages; the U.S. has about 51.6 million.

The Bank estimated that between 7 and 11 per cent of homeowners with a mortgage owed more to their lender than their property was worth, the equivalent of 700,000 to 1.1 million householders.

...

Around 200,000 buy-to-let investors were also estimated to owe more on their mortgage than their property was worth ...

The research said that the overall number of those in negative equity during the first quarter of 2009 was comparable with those who suffered the problem in the mid-1990s, during the last housing market correction.

The Bank said house prices had fallen by around 20 per cent between the autumn of 2007 and the spring of 2009, the largest nominal fall in property values on record. In contrast, it took six years for house prices to fall by 15 per cent between 1989 and 1995.

Moody's has estimated there 14.8 million homeowners with negative equity in the U.S. (just under 30% of homeowners with mortgages) so the problem seems more severe in the U.S.

NY Times: U.S. Better Off than Europe

by Calculated Risk on 6/12/2009 12:34:00 AM

Update: This is ugly from the Irish Times: Annual deflation rate hits 4.7% (ht Brian)

Prices fell 4.7 per cent in the year to May, the steepest rate since 1933, according to new data from the Central Statistics Office (CSO).From Nelson Schwartz at the NY Times: U.S. Recovery Could Outstrip Europe’s Pace

The Consumer Price Index (CPI) fell 4.7 per cent on an annual basis and by 0.5 per cent in the month. This compares to an increase of 0.8 per cent recorded in May 2008.

Some private economists are even predicting that the American economy will resume growth in the fourth quarter, while Europe’s economy is expected to remain in recession well into 2010, after contracting an estimated 4.2 percent this year compared with an expected 2.8 percent decline in the United States.Not much to say - misery loves company.

“The shock originated in the U.S., but Europe is paying a higher price,” said Jean Pisani-Ferry, a former top financial adviser to the French government who is now director of Bruegel, a research center in Brussels.

...

“I think America is further ahead in terms of fixing problems with the banks,” said Mr. Pisani-Ferry, “and countries like Germany have been hurt tremendously by the decline in world trade.”

Figures released this week showed that German exports plunged 28.7 percent in April from a year earlier, the steepest drop since the government began keeping records in 1950.

...

Underscoring the risk that hopes for a quick turnaround anywhere may be premature, the World Bank said Thursday that it expected the global economy to shrink by nearly 3 percent in 2009, far deeper than the 1.7 percent contraction it predicted just over two months ago.

And both Europe and the United States face the specter of rapidly rising unemployment, even if a rebound is beginning.

Thursday, June 11, 2009

Hamilton on CDS Trade: "A fool and his money ..."

by Calculated Risk on 6/11/2009 08:20:00 PM

I was going to post something on this CDS trade, but Professor Hamilton did a much better job than I could: How to lose on a sure-fire bet

Read Hamilton's take ...

Here are the details of the trade from the WSJ: A Daring Trade Has Wall Street Seething

The trade involved credit-default swaps and securities backed by subprime mortgages. The original securities ... were backed by $335 million of subprime mortgages mostly on homes in California made at the housing bubble's peak in 2005 ...

Following a wave of refinancing and defaults, only $29 million of the loans were left outstanding by March 2009, half of which were delinquent or in default...

Believing the securities would become worthless, traders at J.P. Morgan bought credit-default swaps over the past year from Amherst ... Other banks including RBS Securities ... and BofA also bought swaps on the securities from different trading partners.

The banks ... paid as much as 80 to 90 cents for every dollar of insurance, the going rate last fall according to dealer quotes, expecting to receive a dollar back when the securities became worthless ...

At one point, at least $130 million of bets had been made on the performance of around $27 million in securities ...

In late April, traders at some banks were shocked to find out from monthly remittance reports that the bonds they had bet against had been paid off in full. Normally an investor can't pay off loans like that but if the amount of outstanding loans falls to less than 10% of the original pool, the servicer ... can buy them and make bondholders whole.

That's what happened in this case. In April, a servicer called Aurora Loan Services at the behest of Amherst purchased the remaining loans and paid off the bonds.

Households with Mortgages: Approximately 20 Percent Equity

by Calculated Risk on 6/11/2009 05:11:00 PM

One of the headlines from the Fed's Flow of Funds report this morning was that household percent equity had fallen to a record low 41.4%.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows homeowner percent equity since 1952.

This is a simple calculation: divide home mortgages ($10,464 billion) by household real estate assets ($17,870 billion) gives us the percent mortgage debt (58.6%). Subtract from one gives us the percent homeowner equity (41.4%).

But what does this tell us?

What we really want to know is the percent equity for homeowners with mortgages. According to the Census Bureau, 31.6% of all U.S. owner occupied homes had no mortgage in 2007 (most recent data). These homeowners tend to be older, or more risk adverse, and few of them will probably borrow from their home equity.

You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 68.4%. But we can construct a model based on data from the 2007 American Community Survey.

Note: See data at bottom of this post. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the distribution of U.S. households by the value of their home, with and without a mortgage. This data is for 2007.

By using the mid-points of each range, and solving for the price of the highest range to match the then Fed's estimate of household real estate assets at the end of 2007: $20.5 Trillion, we can estimate the total dollar value of houses with and without mortgages.

Using this method, the total value of U.S. houses, at the end of 2007, with mortgages was $15.1 Trillion or 73.6% of the total. The value of houses without mortgages was $5.4 Trillion or 26.4% of the total U.S. household real estate.

Assuming 73.6% of current total assets is for households with mortgages (so $13.2 trillion of $17.87 trillion total), and since all of the mortgage debt ($10.464 trillion) is from the households with mortgages, these homes have an average of 20.4% equity. It's important to remember this includes some homes with 90% equity, and millions of homes with zero or negative equity.

Data from 2007 American Community Survey:

United States | ||

Estimate | Margin of Error | |

|---|---|---|

Total: | 75,515,104 | +/-227,236 |

With a mortgage: | 51,615,003 | +/-152,731 |

Less than $50,000 | 2,037,849 | +/-21,748 |

$50,000 to $99,999 | 6,443,236 | +/-45,023 |

$100,000 to $149,999 | 8,023,775 | +/-48,465 |

$150,000 to $199,999 | 7,318,809 | +/-43,489 |

$200,000 to $299,999 | 9,538,216 | +/-46,625 |

$300,000 to $499,999 | 10,196,919 | +/-44,000 |

$500,000 or more | 8,056,199 | +/-35,865 |

Not mortgaged: | 23,900,101 | +/-91,776 |

Less than $50,000 | 3,577,700 | +/-30,890 |

$50,000 to $99,999 | 4,665,031 | +/-35,455 |

$100,000 to $149,999 | 3,765,972 | +/-28,355 |

$150,000 to $199,999 | 2,968,680 | +/-24,691 |

$200,000 to $299,999 | 3,227,661 | +/-23,430 |

$300,000 to $499,999 | 3,080,889 | +/-21,963 |

$500,000 or more | 2,614,168 | +/-17,619 |

Hotel RevPAR off 22.9 Percent

by Calculated Risk on 6/11/2009 03:40:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 6 June 2009

In year-over-year measurements, the industry’s occupancy fell 13.9 percent to end the week at 56.6 percent. Average daily rate dropped 10.5 percent to finish the week at US$95.90. Revenue per available room [RevPAR] for the week decreased 22.9 percent to finish at US$54.24.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.8% from the same period in 2008.

The average daily rate is down 10.5%, so RevPAR is off 22.9% from the same week last year.