by Calculated Risk on 5/21/2009 08:34:00 AM

Thursday, May 21, 2009

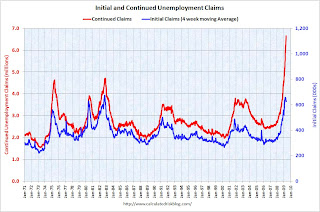

Unemployment Claims: Continued Claims at Record 6.66 Million

The DOL reports on weekly unemployment insurance claims:

In the week ending May 16, the advance figure for seasonally adjusted initial claims was 631,000, a decrease of 12,000 from the previous week's revised figure of 643,000. The 4-week moving average was 628,500, a decrease of 3,500 from the previous week's revised average of 632,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 9 was 6,662,000, an increase of 75,000 from the preceding week's revised level of 6,587,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four-week moving average is at 628,500, off 30,250 from the peak 6 weeks ago.

Continued claims are now at 6.66 million - an all time record.

Typically the four-week average peaks near the end of a recession. There is a reasonable chance that claims have peaked for this cycle, but it is still too early to be sure, and if so, continued claims should peak soon.

The level of initial claims (631 thousand) is still very high, indicating significant weakness in the job market.

Wednesday, May 20, 2009

Report: BofA Wants to Repay TARP in 2009

by Calculated Risk on 5/20/2009 11:46:00 PM

From the Financial Times: BofA seeks to repay $45bn by end of year

Bank of America wants to pay back $45bn in bail-out funds by the end of the year, in a faster-than-expected move made possible by an accelerated programme to raise capital.Stop laughing!

BofA is on track to raise more than $35bn in capital by the end of September...

People familiar with the bank’s plans say negotiations to sell some of BofA’s non-core assets are under way and, if the asset sales occur in the next few months, the bank will be able to fulfil its stress-test obligations and pay back Tarp funds from its $173bn cash reserves.

Plenty of info today:

best to all.

Residential Rental Market and Inflation

by Calculated Risk on 5/20/2009 08:15:00 PM

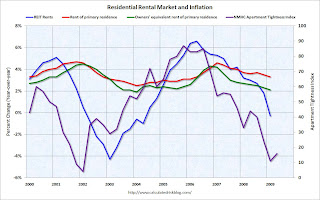

Goldman Sachs tracks the rents at a large number of apartment REITs - and rents are now falling (excerpted from research report with permission):

REITs tend to adjust more rapidly to changing market conditions than the typical landlord, so changes in their behavior are useful signals of turns in the market ... Public REITs typically report the rent increases they have achieved on a year-over-year, comparable-unit basis with each quarterly filing. ... [the tracked] REITS managed 300,000 units that were comparable to the year-before period in the first quarter of 2009 ... In the first quarter of 2009, the major REITs collectively reported an outright decline in rents for the first time since 2004.Goldman notes that declining rents for REITS typically lead declines in the CPI measures of rent: Owners' equivalent rent of primary residence (OER) and Rent of primary residence.

The following graph shows the year-over-year (YoY) in the REIT rents (from Goldman), Owners' equivalent rent of primary residence and Rent of primary residence (both from the BLS). The Apartment Tightness Index from the National Multi Housing Council is on the right Y-axis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows that the Apartment Tightness Index leads REIT rents, and that the BLS measures of rent follow.

This suggests further declines in the YoY REIT rents, and future disinflation for the BLS measures of rent.

This is important for house prices too. With falling rents, house prices need to fall further to bring the house price-to-rent ratio back to historical levels.

Pension Benefit Guaranty Corporation Deficit Increases

by Calculated Risk on 5/20/2009 06:28:00 PM

From Eric Lipton at the NY Times: Bankruptcies Swell Deficit at Pension Agency to $33.5 Billion

The deficit at the federal agency that guarantees pensions for 44 million Americans more than doubled in the last six months to a record high, reaching $33.5 billion ...Here is the PBGC statement: PBGC Deficit Climbs to $33.5 Billion at Mid-Year, Snowbarger to Tell Senate Panel

The Pension Benefit Guaranty Corporation, as of October, had faced a shortfall of $11 billion. But the combined effect of lower interest rates, losses on its investment portfolio and the increase in the number of companies filing for bankruptcy protection resulted in a deepening of its estimated deficit, officials said Wednesday.

...

With the bankruptcy of Chrysler and a possible similar move by General Motors, the agency is facing a record surge in demand. The new deficit estimate takes into account both pensions it has taken over in the last six months, and others it believes it will have to assume control of soon.

The $22.5 billion deficit increase was due primarily to about $11 billion in completed and probable pension plan terminations; about $7 billion resulting from a decrease in the interest factor used to value liabilities; about $3 billion in investment losses; and about $2 billion in actuarial charges.Last year the PBGC voted to allow equity investments, but luckily the entire portfolio wasn't moved into equities - and they only lost $3 billion on their $56 billion asset portfolio.

Snowbarger notes that as of April 30, the PBGC’s investment portfolio consisted of 30 percent equities, 68 percent bonds, and less than 2 percent alternatives, such as private equity and real estate. All the agency’s alternative investments have been inherited from failed pension plans.

Unfortunately there is much more to come:

The PBGC is closely monitoring companies in the auto manufacturing and auto supply industries. According to PBGC estimates, auto sector pensions are underfunded by about $77 billion, of which $42 billion would be guaranteed in the event of plan termination. The pension insurer also faces increased exposure from weak companies across all sectors of the economy, including retail, financial services and health care.With companies moving away from defined benefit plans, there will be fewer companies paying for insurance in the future - so the PBGC will probably have to be bailed out.

Market Précis

by Calculated Risk on 5/20/2009 04:00:00 PM

By popular demand ...

| Click on graph for larger image in new window. The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

| The second graph compares four significant bear markets: the Dow during the Great Depression, the NASDAQ, the Nikkei, and the current S&P 500. See Doug's: "The Mega-Bear Quartet and L-Shaped Recoveries". |

| The third graph shows the S&P 500 since 1990. The dashed line is the closing price today. The market is only off 42% from the peak. |  |

FOMC Minutes for April

by Calculated Risk on 5/20/2009 02:01:00 PM

From the Fed: Minutes of the Federal Open Market Committee April 28-29, 2009

Some FOMC members suggested buying more Treasury securities:

Members also agreed that it would be appropriate to continue making purchases in accordance with the amounts that had previously been announced—that is, up to $1.25 trillion of agency MBS and up to $200 billion of agency debt by the end of this year, and up to $300 billion of Treasury securities by autumn. Some members noted that a further increase in the total amount of purchases might well be warranted at some point to spur a more rapid pace of recovery; all members concurred with waiting to see how the economy and financial conditions respond to the policy actions already in train before deciding whether to adjust the size or timing of asset purchases. The Committee reaffirmed the need to monitor carefully the size and composition of the Federal Reserve’s balance sheet in light of economic and financial developments.The economic projections are near the end. Although the Fed lowered their economic outlook (compared to January), they are still fairly optimistic. As an example, the central tendency for GDP growth in 2010 is 2% to 3%, not far below trend growth, and above trend growth in 2011 (3.5% to 4.8% central tendency of projections). The Fed is also optimistic about the unemployment rate peaking below 10% later this year or in early 2010. In January, the members saw unemployment peaking in 2009, and the central tendency for unemployment was 8.5% to 8.8% in 2009 - we are already at 8.9% in April!

emphasis added

D.O.T.: U.S. Vehicle Miles off 1.2% YoY in March

by Calculated Risk on 5/20/2009 01:32:00 PM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by -1.2% (-3.1 billion vehicle miles) for March 2009 as compared with March 2008. Travel for the month is estimated to be 245.1 billion vehicle miles.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.3% Year-over-year (YoY); the decline in miles driven was worse than during the early '70s and 1979-1980 oil crisis. However miles driven - compared to the same month of 2008 - has only been off about 1% for the last couple months.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in March 2009 were 1.2% less than in March 2008.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. Although this data isn't seasonally adjusted, it appears that miles driven has stabilized.

Geithner: PPIP to Start by Early July

by Calculated Risk on 5/20/2009 11:42:00 AM

From Bloomberg: Geithner Says Toxic-Asset Plan to Start in Six Weeks

Treasury Secretary Timothy Geithner said he expects a pair of government programs to help banks remove their distressed assets will start by early July ...Here is Geithner's prepared statement.

The Treasury’s Public-Private Investment Program will use $75 billion to $100 billion of government funds to finance sales of as much as $1 trillion in distressed mortgage-backed securities and other assets.

New Mortgage Loan Reset / Recast Chart

by Calculated Risk on 5/20/2009 09:44:00 AM

Matt Padilla at the O.C. Register presents a new reset / recast chart from Credit Suisse: Loan reset threat looms till 2012 Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans.

Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans.

As Tanta noted: "Reset" refers to a rate change. "Recast" refers to a payment change.

Resets are not a huge problem as long as interest rates stay low, but recasts could be significant.

Note that Wells Fargo expects only a small percentage of their $115 billion "pick-a-pay" Option ARM portfolio they acquired via Wachovia (originally from World Savings / Golden West) to recast by 2012 (because Golden West had very generous NegAM terms). I'm not sure how that fits with this chart.

Architecture Billings Index Steady in April

by Calculated Risk on 5/20/2009 09:00:00 AM

From the AIA: Architecture Billings Index Points to Possible Economic Improvement

After an eight-point jump in March, the Architecture Billings Index (ABI) fell less than a full point in April. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI rating was 42.8, down from the 43.7 mark in March. This was the first time since August and September 2008 that the index was above 40 for consecutive months, but the score still indicates an overall decline in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry score was 56.8.

“The most encouraging part of this news is that this is the second month with very strong inquiries for new projects. A growing number of architecture firms report potential projects arising from federal stimulus funds,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Still, too many architects are continuing to report difficult conditions to feel confident that the economic landscape for the construction industry will improve very quickly. What these figures mean is that we could be seeing things turn around over a period of several months.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index is still below 50 indicating falling demand.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). So there will probably be further dramatic declines in CRE investment later this year.

Back in 2005, Kermit Baker and Diego Saltes of the American Institute of

Architects wrote a white paper: Architecture Billings as a Leading Indicator of Construction

The following graph is an update from their paper.

This graph suggests the non-residential construction collapse will be very sharp, and although there isn't enough data to know if this is predictive of the percentage decline in spending, it does suggest a possible year-over-year decline of perhaps 20% to 30% in non-residential construction spending.

GMAC to Receive $7.5 Billion from Treasury

by Calculated Risk on 5/20/2009 08:32:00 AM

From the Detroit News: Feds to inject $7.5B more into GMAC (ht jb)

The Treasury Department is preparing to announce as early as today that it will invest an additional $7.5 billion in GMAC LLC in a deal that could allow the U.S. government to hold a majority stake in the Detroit-based auto finance company.The Stress Test results showed GMAC needs another $11.5 billion in capital, so there is probably more coming.

Tuesday, May 19, 2009

Japan’s GDP Declines at 15.2% Annual Rate

by Calculated Risk on 5/19/2009 11:11:00 PM

From Bloomberg: Japan’s Economy Shrank Record 15.2% Last Quarter (ht creditcriminalslovetarp, Angry Saver, and others)

Japan’s economy shrank at a record 15.2 percent annual pace last quarter as exports collapsed and consumers and businesses cut spending.

The contraction followed a revised fourth-quarter drop of 14.4 percent ...

Exports plunged an unprecedented 26 percent last quarter ...

Home Depot on Housing Market

by Calculated Risk on 5/19/2009 07:51:00 PM

From the Financial Times: Home Depot chief warns on US housing

Growing optimism over the US housing market may be premature, a leading retailer warned on Tuesday.Now that the foreclosure moratorium is over, the pace of foreclosures is picking up again. And, according to Mr. Blake, this will probably impact the home improvement companies.

...

"We are concerned about the accelerating rates of foreclosures, particularly in the western part of the country,” [Frank Blake, chief executive of Home Depot] said, noting that one out of every 54 homes in California was in foreclosure.

Mr Blake said that a slowing foreclosure rate in California during the fourth quarter had led to an improvement in regional store sales but the trend had then reversed as foreclosure rates rose again in the first quarter.

The shift “provides a cautionary note on signalling a recovery prematurely”, he said. “Before we see real improvement we believe we need to see sustainable deceleration in foreclosures.”

Median Price Mix Example

by Calculated Risk on 5/19/2009 05:35:00 PM

The following table shows how the mix of units can skew the median price. This is just an example (not based on actual data).

In this example, from 2002 to 2005 low priced homes doubled in price, and high priced homes increased by two-thirds. The mix remained the same (50 units of each), and the median price increased 75%.

| Item | 2002 | 2005 | 2007 | 2009 | 2010 |

|---|---|---|---|---|---|

| Low Price | $100 | $200 | $200 | $100 | $100 |

| High Price | $300 | $500 | $500 | $400 | $300 |

| Low End Units Sold | 50 | 50 | 40 | 40 | 20 |

| High End Units Sold | 50 | 50 | 50 | 10 | 30 |

| Median Price | $200 | $350 | $500 | $100 | $300 |

| Change in Low Price | -- | 100% | none | -50% | none |

| Change in High Price | -- | 67% | none | -20% | -25% |

| Change in Median Price | -- | 75% | 43% | -80% | 200% |

Now look at what happened in 2007. Since subprime imploded first, the number of units sold at the low end decreased to 40 from 50. Everything else stayed the same - and just the change in the mix (higher percentage of high end homes) pushed up the median price! Note that the median price (light blue) increased WITHOUT any actual prices increasing. This happened at the beginning of the housing bust in many areas.

In the period I marked as 2009, the low end prices have fallen all the way back to 2002 prices. However the high end prices have only fallen 20%. The low end is seeing fairly high activity (40 units), but at the high end sales activity has collapsed (10 units). Look at the median price (in orange) - it has fallen more than the prices have declined for even the low end!

And finally, in 2010, prices fall further at the high end - and have stabilized at the low end. As prices fall, the volume picks up at the high end. And what happens to the median price? It increases by 200% (marked in red)!

UPDATE: Oops - I used average instead of median a couple of places (sorry - technical problems today),

This illustrates why we need to be very careful with median prices (like from NAR, DataQuick or other sources). The mix can distort the price, and I expect to read about median prices increasing later this year or in 2010, even though actual prices are still falling!

Market and GM Update

by Calculated Risk on 5/19/2009 04:01:00 PM

From Reuters: GM Bankruptcy Would Include Quick Sale to Feds

If General Motors files for bankruptcy ... plans include a quick sale of the automaker's healthy assets to a new company owned by the U.S. government, a source familiar with the situation said Tuesday.

...the plan also called for the government to forgive the bulk of $15.4 billion worth of emergency loans that the U.S. has already provided to GM.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is still the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990. The dashed line is the closing price today.

The market is only off 42% from the peak.

SoCal House Sales: "Hot Inland, Cool on Coast"

by Calculated Risk on 5/19/2009 02:46:00 PM

Note: I think California data provides an overview of the key dynamics in the housing market.

From DataQuick: Southland home sales hot inland, cool on coast; median price dips

Southern California homes sold at a faster pace than a year ago for the 10th consecutive month in April as first-time buyers and investors continued to target distressed inland properties. ...Key points:

A total of 20,514 new and resale houses and condos closed escrow in the six-county Southland last month. That was up 5.2 percent from 19,506 in March and up 31.4 percent from 15,615 a year ago ... Last month’s sales were the highest for that month since April 2006, when 27,114 homes sold, but were 18.2 percent below the average April sales total since 1988, when DataQuick’s statistics begin.

Foreclosure resales – homes sold in April that had been foreclosed on in the prior 12 months – accounted for 53.6 percent of all Southland resales last month. It was the seventh consecutive month in which post-foreclosure properties made up more than half of all resales.

The deep discounts associated with foreclosures have created stiff competition for builders, who last month sold the lowest number of newly constructed homes for an April since at least 1988.

At the same time, the number of single-family houses that resold last month was at record or near-record-high levels for an April in many of the more affordable, foreclosure-heavy inland markets. They included Palmdale, Lancaster, Moreno Valley, Perris, Indio, San Jacinto, Lake Elsinore and Victorville.

The sales picture was dramatically different in many older, high-end communities closer to the coast, where foreclosures and deep discounts are less common. Sales of existing houses remained at or near record lows for an April in markets such as Beverly Hills, Malibu, Palos Verdes Peninsula, Manhattan Beach and Pacific Palisades.

Fed Announces TALF for Legacy CMBS

by Calculated Risk on 5/19/2009 02:15:00 PM

From the Federal Reserve: Federal Reserve announces that certain high-quality commercial mortgage-backed securities will become eligible collateral under the Term Asset-Backed Securities Loan Facility (TALF)

The Federal Reserve Board on Tuesday announced that, starting in July, certain high-quality commercial mortgage-backed securities issued before January 1, 2009 (legacy CMBS) will become eligible collateral under the Term Asset-Backed Securities Loan Facility (TALF).Term Asset-Backed Securities Loan Facility (Legacy CMBS): Terms and Conditions

...

The CMBS market, which has financed approximately 20 percent of outstanding commercial mortgages, including mortgages on offices and multi-family residential, retail and industrial properties, came to a standstill in mid-2008. The extension of eligible TALF collateral to include legacy CMBS is intended to promote price discovery and liquidity for legacy CMBS. The resulting improvement in legacy CMBS markets should facilitate the issuance of newly issued CMBS, thereby helping borrowers finance new purchases of commercial properties or refinance existing commercial mortgages on better terms.

To be eligible as collateral for TALF loans, legacy CMBS must be senior in payment priority to all other interests in the underlying pool of commercial mortgages and, as detailed in the attached term sheet, meet certain other criteria designed to protect the Federal Reserve and the Treasury from credit risk. The FRBNY will review and reject as collateral any CMBS that does not meet the published terms or otherwise poses unacceptable risk.

Eligible newly issued and legacy CMBS must have at least two triple-A ratings from DBRS, Fitch Ratings, Moody’s Investors Service, Realpoint, or Standard Poor’s and must not have a rating below triple-A from any of these rating agencies.

Term Asset-Backed Securities Loan Facility (Legacy CMBS): Frequently Asked Questions

TARP Repayment Restrictions

by Calculated Risk on 5/19/2009 01:28:00 PM

From CNBC: Banks Are Facing Restrictions On Repaying TARP: Sources

Among the conditions: no bank will be allowed to repay the TARP until after June 8, when 10 of the 19 biggest banks must present plans to boost their capital under the government's stress tests.I'm not sure what "another stress test" means or why they will only be approved in batches. Being able to issue non-government guaranteed debt makes sense.

...

The government also won't allow any one bank to repay the TARP first but will approve them in batches.

...

The banks face other restrictions: they still have to pass another stress test, issue debt that isn't government guaranteed, demonstrate the ability to self-fund in the market and win the approval of their banking supervisor.

...

The Treasury will also announce a process for auctioning TARP warrants ...

Quarterly Housing Starts and New Home Sales

by Calculated Risk on 5/19/2009 10:58:00 AM

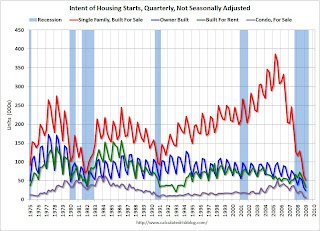

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q1 2009 today.

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 52,000 single family starts, built for sale, in Q1 2009 and that is less than the 87,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions), although this is not perfect because homebuilders have recently been stuck with “unintentional spec homes” because of the high cancellation rates. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last six quarters, starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts have collapsed to almost zero (5,000 started in Q1 2009) and owner built units have fallen by about 75% from the peak. Units built for rent have held up the best, and they are still off about 60% from the highs of recent years.

Condo starts in Q1 were the all time record low for Condos built for sale (5,000), breaking the previous record of 8,000 set in Q1 1991 (data started in 1975). Owner built units set a new record low (24,000 units compared to 35,000 units in Q1 1982), and of course single family units built for sale set a record low (52,000 compared to 64,000 in Q4 2008 and 71,000 in Q4 1981).

FDIC Receives Bids for BankUnited

by Calculated Risk on 5/19/2009 10:31:00 AM

Form Bloomberg: WL Ross, Carlyle Group Said to Make Bid for BankUnited Assets

WL Ross & Co. and private-equity firms including Carlyle Group made a bid to buy BankUnited Financial Corp. assets out of receivership from the government, a person familiar with the matter said."Out of receivership" says it all. This is unusual in that the bidders are picking over the carcass in public (usually the FDIC is more secretive about bank seizures).

The firms, which also include Blackstone Group LP and Centerbridge Capital Partners LLC, submitted their offer to the Federal Deposit Insurance Corp. this morning ...

emphasis added