by Calculated Risk on 5/14/2009 10:19:00 AM

Thursday, May 14, 2009

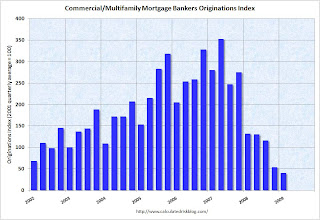

MBA: Commercial/Multifamily Mortgage Loan Originations Decline in Q1

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Mortgage Bankers Association Commercial/Multifamily Mortgage Originations index since 2001.

A couple of points:

Here is the press release from the Mortgage Bankers Association (MBA): MBA Survey Shows Continued Slowdown of Commercial/Multifamily Mortgage Lending in First Quarter 2009

Commercial and multifamily mortgage loan originations continued to drop in the first quarter of 2009, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. First quarter originations were 70 percent lower than during the same period last year and 26 percent lower than during the fourth quarter of 2008. The year-over-year decrease was seen across all investor groups and most property types.There are more details in the quarterly report.

“In the first quarter of 2009 we saw the effects of the continued recession coupled with little demand from borrowers and a constrained supply from lenders as a result of the credit crunch,” said Jamie Woodwell, Vice President of Commercial Real Estate Research at the Mortgage Bankers Association. ...

Decreases in total commercial/multifamily mortgage originations continued to be led by a drop in commercial mortgage-backed security (CMBS) conduit loans.

Unemployment Claims: Continued Claims Surge Past 6.5 Million

by Calculated Risk on 5/14/2009 08:31:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 9, the advance figure for seasonally adjusted initial claims was 637,000, an increase of 32,000 from the previous week's revised figure of 605,000. The 4-week moving average was 630,500, an increase of 6,000 from the previous week's revised average of 624,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 2 was 6,560,000, an increase of 202,000 from the preceding week's revised level of 6,358,000. The 4-week moving average was 6,337,250, an increase of 128,750 from the preceding week's revised average of 6,208,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four-week moving average is at 630,500, off 28,250 from the peak 5 weeks ago.

Continued claims are now at 6.56 million - an all time record.

The second graph shows the four-week average of initial unemployment claims and recessions.

The second graph shows the four-week average of initial unemployment claims and recessions.Typically the four-week average peaks near the end of a recession.

The four-week average increased this week by 6,000, and is now 28,250 below the peak. There is a reasonable chance that claims have peaked for this cycle, but it is still too early to be sure, and if so, continued claims should peak soon.

The level of initial claims (over 630 thousand) is still very high, indicating significant weakness in the job market.

Summary, Futures and the Tan Man

by Calculated Risk on 5/14/2009 12:11:00 AM

Here is a summary for Wednesday:

The administration asked Congress to move quickly on legislation that would allow federal oversight of many kinds of exotic instruments, including credit-default swaps ... The Treasury secretary, Timothy F. Geithner, said the measure should require swaps and other types of derivatives to be traded on exchanges or clearinghouses and backed by capital reserves, much like the capital cushions that banks must set aside in case a borrower defaults on a loan. ...

The proposal will probably force many types of derivatives into the open, reducing the role of the so-called shadow banking system that has arisen around them.

[T]he SEC sent a "Wells" notice to Mozilo weeks ago alerting him of the planned charges, which included alleged violations of insider-trading laws, as well as failing to disclose material information to shareholders.The U.S. futures are off slightly tonight:

CBOT mini-sized Dow

Futures from barchart.com

CME Globex Flash Quotes

And the Asian markets are mostly off 1% to 3%.

Best to all.

Wednesday, May 13, 2009

MEW, Consumption and Personal Saving Rate

by Calculated Risk on 5/13/2009 09:29:00 PM

Here is a new paper on Mortgage Equity Withdrawal (MEW): House Prices, Home Equity-Based Borrowing, and the U.S. Household Leverage Crisis by Atif Mian and Amir Sufi (both University of Chicago Booth School of Business and NBER) (ht Jan Hatzius)

From the authors abstract (the entire paper is available at the link):

Using individual-level data on homeowner debt and defaults from 1997 to 2008, we show that borrowing against the increase in home equity by existing homeowners is responsible for a significant fraction of both the sharp rise in U.S. household leverage from 2002 to 2006 and the increase in defaults from 2006 to 2008. Employing land topology-based housing supply elasticity as an instrument for house price growth, we estimate that the average homeowner extracts 25 to 30 cents for every dollar increase in home equity. Money extracted from increased home equity is not used to purchase new real estate or pay down high credit card debt, which suggests that consumption is a likely use of borrowed funds. Home equity-based borrowing is stronger for younger households, households with low credit scores, and households with high initial credit card utilization rates. Homeowners in high house price appreciation areas experience a relative decline in default rates from 2002 to 2006 as they borrow heavily against their home equity, but experience very high default rates from 2006 to 2008. Our estimates suggest that home equity based borrowing is equal to 2.3% of GDP every year from 2002 to 2006, and accounts for over 20% of new defaults in the last two years.A couple of key points:

emphasis added

And this brings us to the personal saving rate.

In an earlier post I argued that the saving rate declined into the early '90s because of demographic changes, however I expected the saving rate to start to rise as the boomers reached their mid-40s (in the late 1990s). Obviously this didn't happen.

I posited that the wealth effect from the twin bubbles - stock market and housing - had led the boomers into believing they had saved more than they actually had.

This research suggests that MEW played a significant role in suppressing the saving rate too. And since the Home ATM is now closed, this is more evidence that the saving rate will increase (probably back to 8% or so) - and keep pressure on the growth of personal consumption expenditures (PCE).

For background, here are couple of graphs:

Click on graph for large image.

Click on graph for large image.The first graph shows the annual saving rate back to 1929.

Notice that the saving rate went negative during the Depression as household used savings to supplement income. And the saving rate rose to over 25% during WWII.

There is a long period of a rising saving rate (from after WWII to about 1974) and a long period of a declining saving rate (from the early '80s to 2008). (corrected text)

Some of the change in saving rate was related to demographics. As the large baby boom cohort entered the work force in the mid '70s, the saving rate declined (younger families usually save less). But, as I noted above, I expected the saving rate to start to increase in the last '90s.

And here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction through Q4 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

NOTE: Anyone who wants the Equity Extraction data, please see this post for a spreadsheet and how to credit Dr. Kennedy's work.

This graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".This measure is near zero ($7.2 billion for the quarter) and is an estimate of the impact of MEW on consumption. When people refinance with cash out or draw down HELOCs, they usually spend the money.

William Seidman

by Calculated Risk on 5/13/2009 07:02:00 PM

From Bloomberg: William Seidman, Who Led Cleanup of S&L Crisis, Dies

In his memoir [published in 1993], Seidman offered a set of lessons learned. They included, “Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid.”Those two sentences should be emblazoned above every desk of every financial regulator.

My condolences to Mr. Seidman's family and friends.

Regulatory Reform for Derivatives

by Calculated Risk on 5/13/2009 05:38:00 PM

From the U.S. Treasury: Regulatory Reform Over-The-Counter (OTC) Derivatives

As the AIG situation has made clear, massive risks in derivatives markets have gone undetected by both regulators and market participants. But even if those risks had been better known, regulators lacked the proper authorities to mount an effective policy response.The press release has the details, but basically the Obama Administration is proposing all derivatives must be centrally cleared and subject to oversight and regulation.

Today, to address these concerns, the Obama Administration proposes a comprehensive regulatory framework for all Over-The-Counter derivatives.

From Reuters: U.S. regulators propose OTC derivatives crackdown

Authorities proposed subjecting all over-the-counter derivatives dealers to "a robust regime of prudential supervision and regulation," including conservative capital, reporting and margin requirements.About time.

Treasury Secretary Timothy Geithner, Securities and Exchange Commission Chairman Mary Schapiro, and Mike Dunn, acting chairman of the Commodity Futures Trading Commission, announced the proposal at a news conference.

Under current law, over-the-counter (OTC) derivatives are largely excluded or exempted from regulation.

"We're going to require for the first time all standardized over-the-counter derivative products be centrally cleared," said Geithner.

Market Update

by Calculated Risk on 5/13/2009 04:00:00 PM

Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is still the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The market is only off 43.5% from the peak.

Note: I'm still looking for Derivatives announcement (previous thread)

Geithner to Announce Tougher Derivatives Rules at 4 PM ET

by Calculated Risk on 5/13/2009 03:50:00 PM

From Dow Jones: Treasury, SEC, CFTC To Unveil OTC Derivatives Regulatory Plan

The Treasury Department will unveil its plan for regulatory reform of over-the-counter derivatives late Wednesday afternoon, Michael Dunn, the acting chairman of the Commodity Futures Trading Commission, said Wednesday.Here is the CNBC feed. (hopefully)

Speaking at an advisory committee meeting at the CFTC's offices, Dunn said he will appear alongside Treasury Secretary Timothy Geithner and Securities and Exchange Commission Chairman Mary Schapiro at 4 p.m. EDT to discuss the details.

"Green Shoots Wilting"

by Calculated Risk on 5/13/2009 01:32:00 PM

A few excerpts from Economists React: ‘Green Shoots Withering’ in Retail

We now have to expect flat consumption in April, which means there has been no net increase since January ... the freefall is over but shredded balance sheets and declining incomes mean a broadly flat trend is about the best we can expect. Greens shoots withering ...Some people mistook the end of "cliff diving" for "green shoots" and started predicting a "V-shaped" recovery. Although the worst of the declines is probably over, an immaculate recovery seems very unlikely. (See Immaculate Recovery? )

Ian Shepherdson, High Frequency Economics

Overall, these data suggest consumers could not sustain the modest first quarter gains in spending and at least one “green shoot” appears to be wilting.

Nomura Global Economics

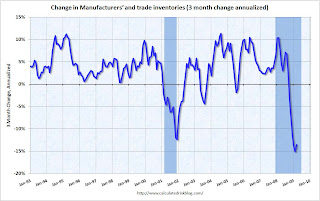

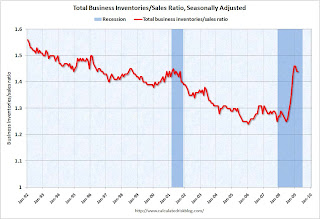

Update on Inventory Correction

by Calculated Risk on 5/13/2009 11:05:00 AM

The Q1 GDP report showed a strong inventory correction is under way, with the BEA reporting inventories declined -136.8 billion (SAAR) in Q1. The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed more evidence of declining inventories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Census Bureau reported:

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,404.1 billion, down 1.0 percent (±0.1%) from February 2009 and down 4.8 percent (±0.3%) from March 2008.The above graph shows the 3 month change (annualized) in manufacturers’ and trade inventories. The inventory correction was slow to start in this recession, but inventories are now declining sharply.

However, even with the sharp decline in inventories, the inventory to sales ratio was flat in March at 1.44.

However, even with the sharp decline in inventories, the inventory to sales ratio was flat in March at 1.44.There has been a race between declining sales and declining inventory. And even if sales start to stabilize, inventory levels are still too high, and further inventory reductions are coming.

LA Times: Sour CRE Loans

by Calculated Risk on 5/13/2009 10:13:00 AM

This is a story we've discussed for a few years, but it is probably worth repeating: Small and regional banks couldn't compete in the residential mortgage market during the housing bubble (with some exceptions), so they focused on Construction & Development (C&D) and other Commercial Real Estate (CRE) loans. The C&D loans are defaulting in large numbers now and this is impacting a number of regional banks (like BankUnited and Corus).

And defaults are just starting to increase on other CRE loans. Most of the coming bank failures will be due to C&D and CRE loans.

From the LA Times: Sour commercial real estate loans threaten to hurt regional banks

The slumping market for commercial real estate -- viewed by many as the next big shoe to drop on the economy -- now threatens to drag down regional banks as they struggle to collect on loans made against shopping centers and office buildings.For a few graphs on C&D loan concentrations and noncurrent rates (from the FDIC Q4 Quarterly Banking Profile), see: Bank Failures and C&D Loans . The Q1 FDIC report should be released in a few weeks.

Seriously overdue loans against commercial developments have shot up dramatically in recent months, as delinquencies snowball on construction loans and mortgages for office buildings, malls and apartments.

...

"Commercial lending is our bread and butter, the lion's share of our business," said Dominic Ng, chairman of East West Bancorp, which with $12 billion in assets is the second-largest bank based in Los Angeles County.

The Pasadena bank ... set aside $226 million to cover loan losses last year, up from $12 million in 2007. The bank lost $49 million in 2008, compared with a profit of $161 million in 2007.

Land development and construction loans, the main problem so far for East West, total about 20% of the bank's loan portfolio. Now Ng says he is nervously watching delinquencies on commercial mortgages -- about 40% of East West's loans.

Retail Sales Decline in April

by Calculated Risk on 5/13/2009 02:07:00 AM

On a monthly basis, retail sales decreased 0.4% from March to April (seasonally adjusted), and sales are off 11.4% from April 2008 (retail and food services decreased 10.1%).

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (April PCE prices were estimated as the average increase over the previous 3 months).

Although the Census Bureau reported that nominal retail sales decreased 11.4% year-over-year (retail and food services decreased 10.1%), real retail sales declined by 11.9% (on a YoY basis). The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and are still declining - but at a slower pace.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $337.7 billion, a decrease of 0.4 percent (±0.5%)* from the previous month and 10.1 percent (±0.7%) below April 2008. Total sales for the February through April 2009 period were down 9.2 percent (±0.5%) from the same period a year ago. The February to March 2009 percent change was revised from -1.2 percent (±0.5%) to -1.3 percent (±0.3%).No green shoots here.

Retail trade sales were down 0.4 percent (±0.7%)* from March 2009 and 11.4 percent (±0.7%) below last year. Gasoline stations sales were down 36.4 percent (±1.5%) from April 2008 and motor vehicle and parts dealers sales were down 20.7 percent (±2.3%) from last year.

RealtyTrac: Record Foreclosure Activity in April

by Calculated Risk on 5/13/2009 12:12:00 AM

From RealtyTrac: Foreclosure Activity Remains at Record Levels in April

RealtyTrac ... today released its April 2009 U.S. Foreclosure Market Report(TM), which shows foreclosure filings - default notices, auction sale notices and bank repossessions - were reported on 342,038 U.S. properties during the month, an increase of less than 1 percent from the previous month and an increase of 32 percent from April 2008. The report also shows that one in every 374 U.S. housing units received a foreclosure filing in April, the highest monthly foreclosure rate ever posted since RealtyTrac began issuing its report in January 2005.

"Total foreclosure activity in April ended up slightly above the previous month, once again hitting a record-high level," said James J. Saccacio, chief executive officer of RealtyTrac. "Much of this activity is at the initial stages of foreclosure - the default and auction stages - while bank repossessions, or REOs, were down on a monthly and annual basis to their lowest level since March 2008. This suggests that many lenders and servicers are beginning foreclosure proceedings on delinquent loans that had been delayed by legislative and industry moratoria. It's likely that we'll see a corresponding spike in REOs as these loans move through the foreclosure process over the next few months."

emphasis added

Tuesday, May 12, 2009

BKUNA Needs $1 Billion in Capital

by Calculated Risk on 5/12/2009 09:04:00 PM

BankUnited filed a Notification of Late Filing with the SEC today (ht Brian). Here are a few excerpts:

We are not able to file a timely Second Quarter 2009 Form 10-Q because we have not completed the preparation of our financial results for either the fiscal year ended September 30, 2008 (the “fiscal 2008”) or the fiscal quarters ended March 31, 2009 and December 31, 2008. This delay results from the continuing adverse market conditions, the complexity of accounting and disclosure issues, which increased the need for additional review and analysis of our business including, without limitation, regulatory issues, liquidity and capital and the material weaknesses in internal control over financial reporting discussed below.And the bank needs approximately $1 billion in capital:

Most recently, on April 14, 2009, the Board of Directors of the Bank entered into a Stipulation and Consent to Prompt Corrective Action Directive (the “PCA Agreements”) with the OTS. ... The PCA Agreements further required the Bank to achieve and maintain, at a minimum, the following ratios: (i) Total Risk Based Capital Ratio of 8%; (ii) Tier I Core Risk Based Capital Ratio of 4%; and (iii) Leverage Ratio of 4% within twenty days of the effective date of the PCA Agreements. Based on our March 31, 2009 reported capital levels, we would need to raise approximately $1.0 billion to meet the Total Risk Based Capital Ratio of 8%, approximately $706 million to meet the Tier I Core Risk Based Capital Ratio of 4% and approximately $937 million to meet the Leverage Ratio of 4%. The twenty-day period to raise capital and achieve the mandatory minimum capital requirements under the PCA Agreements expired on May 4, 2009 without compliance by the Bank.It was reported in the Miami Herald that BKUNA was granted an extension until Thursday May 14th:

The Federal Deposit Insurance Corp. allowed a two-week extension and extended the deadline until May 14 for prospective buyers or investors to submit their bids ...I couldn't find mention of the extension in BKUNA's NT 10-Q filing.

Something to watch this Friday.

Freddie Mac: Falling Prices "significantly affecting behavior" of Borrowers

by Calculated Risk on 5/12/2009 06:25:00 PM

From MarketWatch: Freddie reports quarterly net loss of $9.9 billion

Freddie's first-quarter loss widened to $9.85 billion ... Freddie set aside $8.8 billion in provisions to cover credit losses during the first quarter. That's up from $7 billion in the final three months of 2008. The rise was driven by increases in the number and rate of delinquent mortgages and the rising severity of losses from foreclosures, Freddie explained.From the SEC filing:

Freddie also invests in mortgage-backed securities and is suffering as rising delinquencies and foreclosures cut into the value of these holdings. The company recorded $7.1 billion in impairments on securities that are available for sale.

...

Freddie Mac said its conservator asked for $6.1 billion in extra funding from the Treasury Department.

Home prices nationwide declined an estimated 1.4% in the first quarter of 2009 based on our own internal index, which is based on properties underlying our single-family mortgage portfolio. The percentage decline in home prices in the last twelve months has been particularly large in the states of California, Florida, Arizona and Nevada, where we have significant concentrations of mortgage loans.There are several key points:

...

While temporary suspensions of foreclosure transfers reduced our charge-offs and REO activity during the first quarter of 2009, our provision for credit losses includes expected losses on those foreclosures currently suspended. We also observed a continued increase in market-reported delinquency rates for mortgages serviced by financial institutions, not only for subprime and Alt-A loans but also for prime loans, and we experienced an increase in delinquency rates for all product types during the first quarter of 2009. This delinquency data suggests that continuing home price declines and growing unemployment are significantly affecting behavior by a broader segment of mortgage borrowers. Additionally, as the slump in the U.S. housing market has persisted for more than a year, increasing numbers of borrowers that began with significant equity are now “underwater,” or owing more on their mortgage loans than their homes are currently worth. Our loan loss severities, or the average amount of recognized losses per loan, also continued to increase in the first quarter of 2009, especially in the states of California, Florida, Nevada and Arizona, where home price declines have been more severe and where we have significant concentrations of mortgage loans with higher average loan balances than in other states.

emphasis added

Sounds like walking away ... in prime time!

Can't Sell? Try Renting

by Calculated Risk on 5/12/2009 04:24:00 PM

From CNBC: Homeowners Turn to Renting, Waiting for Market to Recover

Still having trouble selling your house? More homeowners are deciding to rent out their homes while they wait for the market to recover.And here is a video I took this morning in Newport Beach (note: this also fits with the Home Sales: One and Done post too. Who will buy in these more expensive beach communities when there are no move up buyers?

"I had my condo on the market for three months and I didn't have any bites," says Molly Smith, a public relations executive in Newburyport, Massachusetts. "I realized if I was going to sell it, I'd take a big loss."

So the 29-year-old Smith, who wanted a shorter commute to her job, decided to rent out her house and move into a rental herself.

Please be patient with me - I'm still working on this video stuff!

The construction noise at the beginning of the video is a new Senior Center being built (still demolishing the old structure and grading the property).

Although rentals are common in Newport Beach, the market is usually very tight. Not right now.

Immaculate Recovery?

by Calculated Risk on 5/12/2009 02:32:00 PM

GE Chief Executive Jeff Immelt is uncertain when growth will resume ...

From Reuters: GE CEO says economy stabilized, growth a question

Improved credit markets have brought stabilization to the economy but it is still not clear when growth will resume, General Electric Co Chief Executive Jeff Immelt said on Tuesday.And from PIMCO's El-Erian:

"The credit picture, we think, is improving and that's really one of the fundamentals to getting the broader economy doing better," Immelt said in an interview with Reuters. "Things certainly have stabilized and now the goal is to see where growth goes in the second half of the year."

It was clear to us that, despite the very high hurdle that we always apply to such a statement, the world has changed in a manner that is unlikely to be reversed over the next few years. Put another way, markets are recovering from a shock that goes way, way beyond a cyclical flesh wound.And Bloomberg quotes Paul Krugman:

...

For the next 3–5 years, we expect a world of muted growth ...

“It looks to me now as if the markets are now pricing in a rapid recovery, that they’re pricing in a V-shaped recession, which I consider extremely unlikely,” Krugman said at a forum in Shanghai today. “The market seems to be looking as if this is going to be an average recession, but it’s not.”I thought a depression was unlikely, and I think an immaculate recovery is also unlikely. Something in the middle - that will feel like a recession to many - is more likely.

As I noted last week (see A Return to Trend Growth in 2010? and The Impact of Changes in the Saving Rate on PCE ), the usual engines of recovery - personal consumption expenditures (PCE) and residential investment (RI) - will both remain under pressure (even if they show some sluggish growth).

My forecast is for unemployment to stay elevated for some time, and the suggests minimal wage growth. And I also think household will increase their saving rate to repair their household balance sheet (and because of an aging population). This suggests PCE growth will probably be below trend.

And for RI, there is far too much inventory for any significant rebound in new home construction. So where will the growth come from?

Home Sales: One and Done

by Calculated Risk on 5/12/2009 11:32:00 AM

The NAR reported today: Foreclosure and Short Sale Discounts Weigh Down Metro Area Median Prices

" ... first-time buyers account[ed] for half of all purchases during the first quarter ..."Most of the press release discusses the median price (something to ignore because of the change in mix), but there is a key point being missed - many of these sales are "one and done" with no move up buyer.

“Close to 455,000 buyers purchased their first home during the first quarter, and those are likely just the first wave of new buyers coming into the market – they’re critical for a housing recovery,” [Lawrence Yun, NAR chief economist] said.

Click on graphis for larger image in new window.

Click on graphis for larger image in new window.Here is a graphic I created a couple years ago to show a normal market chain reaction.

At that time I wrote: "Not all chain reactions start with a first time buyer using a subprime loan, but the loss of a large number of subprime buyers will impact the entire chain."

Where are the move up buyers going to come from?

There is no "chain reaction" in the housing market - over half the sales are to first time buyers, and frequently the sellers are banks.

I hear this from real estate agents all the time: the agents (low end) are plenty busy with REOs and short sales, but the deals are mostly "one and done".

Advanta Halts New Credit-Card Lending

by Calculated Risk on 5/12/2009 09:25:00 AM

From Bloomberg: Advanta Shuts Down Credit-Card Lending Amid Surging Charge-Offs

Advanta Corp., the issuer of credit cards for small businesses, will halt new lending for its 1 million customers next month as the recession causes a surge in loan defaults. ... Advanta said ... charge-offs, or uncollectible debt, reached 20 percent on some cards as of March 31.This is much higher loss rate than for consumer credit cards - the Fed's two year indicative loss rate was 18% to 20% for consumer credit cards - Advanta is seeing that in one year for some cards!

...

“We’ll be shutting down accounts for future transaction activities, but many of the customers will maintain balances and pay us off over time,” [Chief Financial Officer Philip Browne] said yesterday in a telephone interview.

Advanta was the 11th-biggest U.S. credit-card issuer at the end of 2008 with about $5 billion in outstanding balances, and the only major lender focused on small business borrowers ...

U.S. March Trade Deficit: $27.6 billion

by Calculated Risk on 5/12/2009 08:31:00 AM

The Census Bureau reports:

The ... total March exports of $123.6 billion and imports of $151.2 billion resulted in a goods and services deficit of $27.6 billion, up from $26.1 billion in February, revised. March exports were $3.0 billion less than February exports of $126.6 billion. March imports were $1.6 billion less than February imports of $152.8 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through March 2009.

Both imports and exports declined in March, although it appears the cliff diving in trade might be over.

On a year-over-year basis, exports are off 17.4% and imports are off 27%!

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices increased slightly to $41.36 in March following eight consecutive monthly declines. Spot prices have increased since March, so it appears the decline in the trade deficit due to lower oil prices is over for now.

The trade deficit is mostly oil and China now, so any further significant decline in the deficit is unlikely in the short term. Although the NY Times reports: Chinese Exports Fall 22.6% in April

Exports from mainland China slumped 22.6 percent in April from a year earlier, official statistics showed — a fall that was not only larger than economists had expected but also bigger than that in March, when overseas shipments declined 17.1 percent.