by Calculated Risk on 5/14/2009 10:19:00 AM

Thursday, May 14, 2009

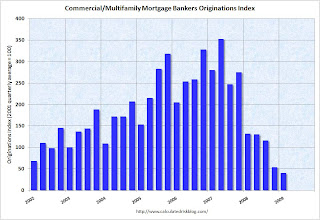

MBA: Commercial/Multifamily Mortgage Loan Originations Decline in Q1

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Mortgage Bankers Association Commercial/Multifamily Mortgage Originations index since 2001.

A couple of points:

Here is the press release from the Mortgage Bankers Association (MBA): MBA Survey Shows Continued Slowdown of Commercial/Multifamily Mortgage Lending in First Quarter 2009

Commercial and multifamily mortgage loan originations continued to drop in the first quarter of 2009, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. First quarter originations were 70 percent lower than during the same period last year and 26 percent lower than during the fourth quarter of 2008. The year-over-year decrease was seen across all investor groups and most property types.There are more details in the quarterly report.

“In the first quarter of 2009 we saw the effects of the continued recession coupled with little demand from borrowers and a constrained supply from lenders as a result of the credit crunch,” said Jamie Woodwell, Vice President of Commercial Real Estate Research at the Mortgage Bankers Association. ...

Decreases in total commercial/multifamily mortgage originations continued to be led by a drop in commercial mortgage-backed security (CMBS) conduit loans.