by Calculated Risk on 5/08/2009 06:13:00 PM

Friday, May 08, 2009

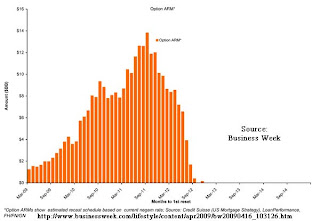

Loan Reset / Recast Schedule

Before reading, please see Tanta's: Reset Vs. Recast, Or Why Charts Don't Match

"Reset" refers to a rate change. "Recast" refers to a payment change.Here are two Credit Suisse charts:

Click on image for larger graph in new window.

Click on image for larger graph in new window.The first chart is from Business Week in April: Good News: Option ARM Resets Delayed

The reset and recast confusion continues! The x-axis is labeled "months to 1st reset", but the notes to the graph says: "estimated recast schedule".

And here is more from a Credit Suisse research report released in February (no link):

It appears Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans. Resets are not a huge problem with low interest rates, but recasts could be significant.

It appears Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans. Resets are not a huge problem with low interest rates, but recasts could be significant.Looking at these charts it would be easy to conclude that the recast problem last through 2012. However there is a difference between the original recast date, and the actual recast date - because negatively amortizing loans hit the recast ceiling earlier than the original forecast. I suspect the peak in recasts for Option ARMs will be in 2010.

FDIC to Open Temporary Florida Office

by Calculated Risk on 5/08/2009 04:39:00 PM

From the FDIC: FDIC to Open a Temporary East Coast Satellite Office

The Federal Deposit Insurance Corporation (FDIC) today announced it will open a temporary satellite office in Jacksonville, Florida, to manage receiverships and to liquidate assets from failed financial institutions primarily located in the eastern states.Unrelated - of course - BKUNA has been given an extension until May 14th. From the Miami Herald: N.Y. investment firm courting BankUnited

...

The new office will provide facilities for up to 500 nonpermanent staff and contractors. ... Throughout its history, the FDIC has used these offices to keep temporary asset resolution staff closer to the concentration of failed bank assets they oversee. As the work diminishes, the temporary satellite offices are closed.

A third potential buyer has emerged for ailing BankUnited.

JC Flowers & Co., a New York investment firm run by J. Christopher Flowers, is looking at acquiring the Coral Gables-based thrift, according to a person familiar with the situation.

BankUnited, the main unit of BankUnited Financial Corp., is under federal regulatory orders to merge or find a buyer to strengthen its capital base. The Federal Deposit Insurance Corp. extended until May 14 the deadline for prospective investors or buyers of the thrift to submit their bids.

Mothballed Condo Project in Irvine, CA

by Calculated Risk on 5/08/2009 03:08:00 PM

I took this video this morning (my first YouTube, so please excuse the quality).

This is a project in Irvine, CA called Central Park West. The project was built by Lennar and mothballed in 2007. I was surprised the area was open and fountains were all running, but unfortunately the information center was closed.

New condos like this are shadow inventory - they are not included in the Census Bureau new homes report, and they are not listed in the MLS. But they do exist.

Here are the Las Vegas "Manhattan West" photos mentioned in the video.

Fannie Mae Asks for another $19 Billion

by Calculated Risk on 5/08/2009 01:03:00 PM

From Bloomberg: Fannie Mae to Tap $19 Billion in Treasury Capital

Fannie Mae ... asked the U.S. Treasury for a $19 billion capital investment and raised the possibility that its long-term survival may be dependent on continued government funding.Here is the section from the SEC 10-Q filing:

Fannie Mae, which took $15.2 billion in aid on March 31, cited the “unprecedented” housing market slump and government- mandated programs that are creating “conflicts in strategic and day-to-day decision making,” according to company filings today with the Securities and Exchange Commission.

We face a variety of different, and potentially conflicting, objectives, including:Notice they are concentrating on the first two objectives above, and that does not include "protecting interest of taxpayers", "returning long-term profitability" or "limiting the investment from Treasury".providing liquidity, stability and affordability in the mortgage market; immediately providing additional assistance to the mortgage market and to the struggling housing market; limiting the amount of the investment Treasury must make under our senior preferred stock purchase agreement with Treasury in order to eliminate a net worth deficit; returning to long-term profitability; and protecting the interests of the taxpayers.

These objectives create conflicts in strategic and day-to-day decision-making that could lead to less than optimal outcomes for some or all of these objectives. For example, limiting the amount of funds Treasury must invest in us under the senior preferred stock purchase agreement in order to eliminate a net worth deficit could require us to constrain some of our business activities, including activities targeted at providing liquidity, stability and affordability to the mortgage market. Conversely, to the extent we expand our efforts to assist the mortgage market, our financial results are likely to suffer, at least in the short term, which will increase the amount of funds that Treasury is required to provide to us and further limit our ability to return to long-term profitability. We regularly consult with and receive direction from our conservator on how to balance our objectives.

Accordingly, we currently are primarily focusing on the first two objectives listed above ...

Chrysler: Only Three Holdout Creditors Remain

by Calculated Risk on 5/08/2009 11:19:00 AM

Update: from Bloomberg: Chrysler’s Dissenting Lenders Give Up Fight Over Sale

Chrysler LLC’s secured lenders that opposed the automaker’s bankruptcy sale of assets to a company run by Fiat SpA are dropping their fight in the bankruptcy court case ...From Alan Ross Sorkin at the NY Times: 2 Funds Withdraw from Dissident Chrysler Group

The group, calling itself Chrysler’s Non-TARP lenders, doesn’t plan to defend earlier objections and may withdraw them formally, said Tom Lauria, the White & Case attorney representing the group.

OppenheimerFunds and Stairway Capital Management said on Friday that they were withdrawing from a group of dissident Chrysler creditors, days after it suffered a series of defeats in federal bankruptcy court...Now only three creditors remain.

Stairway also cited the shrinking roster of the dissident creditors as a reason to publicly withdraw its opposition to the Chrysler reorganization plan. “The fact simply is, however, our group has become too small to have a voice within the bankruptcy,” the firm said in its own statement.

...

At the outset last week, the group claimed about 20 members holding $1 billion in debt. When lawyers for the group filed a motion to disclose its membership under court seal, they said that the group held about $300 million.

Sorkin has statements from Oppenheimer and Stairway. Here is an excerpt:

OppenheimerFunds has determined that the senior creditors can no longer reasonably expect to increase the recovery rate on the debt they hold by opposing the Taskforce’s restructuring plan.It looks like the government's restructuring plan will prevail.

Employment: Comparing Recessions and Diffusion Index

by Calculated Risk on 5/08/2009 09:25:00 AM

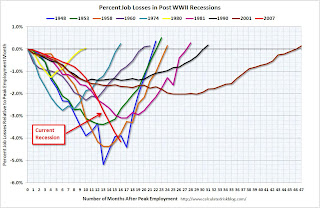

Note: earlier Employment post: Employment Report: 539K Jobs Lost, 8.9% Unemployment Rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up over the last 6 months (4 million jobs lost, red line cliff diving on the graph), and the current recession is now the worst recession since WWII in percentage terms after 16 months - although not in terms of the unemployment rate.

In the early post-war recessions (1948, 1953, 1958), there were huge swings in manufacturing employment and that lead to large percentage losses. For the current recession, the job losses are more widespread.

In April, job losses were large and widespread across nearly all major private-sector industries.Here is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

BLS, April Employment Report

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.So it is possible for the diffusion index to increase (like manufacturing increased from 12.7 to 26.5) not because industries are hiring, but because fewer industries are losing jobs.

Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before September, the all industries employment diffusion index was close to 40, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In December, the index hit 20.5, suggesting job losses were very widespread. The index has recovered since then (28.5 in April), although job losses are still widespread.

The manufacturing diffusion index has fallen even further, from 40 in May 2008 to just 6 in January 2009. The manufacturing index recovered slightly to 26.5 in April.

Employment Report: 539K Jobs Lost, 8.9% Unemployment Rate

by Calculated Risk on 5/08/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to decline in April (-539,000), and the unemployment rate rose from 8.5 to 8.9 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Since the recession began in December 2007, 5.7 million jobs have been lost. In April, job losses were large and widespread across nearly all major private-sector industries. Overall, private sector employment fell by 611,000.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 539,000 in April. March job losses were revised to

699,000. The economy has lost almost 4 million jobs over the last 6 months, and over 5.7 million jobs during the 16 consecutive months of job losses.

The unemployment rate rose to 8.9 percent; the highest level since 1983.

Year over year employment is strongly negative (there were 5.2 million fewer Americans employed in Apr 2009 than in Apr 2008).

The second graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

The second graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link). This is a quarterly forecast: in Q1 the unemployment rate was higher than the "more adverse" scenario. For Q2, April is already higher than the "more adverse" scenario, and will probably rise further in May and June.

Note also that the unemployment rate has already reached the peak of the "baseline scenario".

This is another weak employment report ... more soon.

Thursday, May 07, 2009

Even More on Stress Tests

by Calculated Risk on 5/07/2009 11:00:00 PM

Earlier I pointed out that some of the numbers seemed puzzling.

Peter Eavis at the WSJ has a similar reaction, but uses a different example: U.S. Banks' Not-So-Stressful Test

The government's 13.8% worst-case loss-rate for second-lien mortgages seems fair. But it is a stretch to think Wells Fargo, with its large home-equity book focused on stressed housing markets, will have a lower-than-sector loss rate of 13.2%.That doesn't make sense.

And on commercial real estate:

The government may have been too optimistic in positing an 8.5% commercial-real-estate loss rate. This sector is just starting to fall apart, and defaults may move sharply higher as borrowers struggle to refinance loans.Unfortunately the Fed grouped Construction & Development loans (C&D) in with other CRE loans. The losses on C&D at loans are rising sharply, and it would have been easier to analyze if the Fed had released the data by each separate CRE category.

Mortgage Rates and the Ten Year Treasury Yield

by Calculated Risk on 5/07/2009 09:29:00 PM

With the recent increase in treasury yields, reader shortcourage asked for a graph comparing the 30 year fixed mortgage rate and the ten year treasury yield. Sometimes we do requests ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the weekly 30 year fixed rate conforming rate from Freddie Mac, and the 10 year treasury yield. The black line is the spread between the two rates.

The spread is back down near the lower end of the range - and this suggests any further increase in the ten year yield will push up morgage rates.

Freddie Mac reported today:

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.84 percent with an average 0.7 point for the week ending May 7, 2009, up from last week when it averaged 4.78 percent. Last year at this time, the 30-year FRM averaged 6.05 percent.

More Stress Test

by Calculated Risk on 5/07/2009 07:04:00 PM

The Fed released the stress test results earlier today.

The projected $600 billion in losses over the next two years under the "more adverse" scenario are in addition to the estimated $400 billion in losses and write downs are already taken by these 19 banks. Because of existing resources, future earnings, and planned transactions, the Fed estimates the banks need to raise $75 billion in capital. This is a huge question mark: Is this enough?

Note: Shuffling preferred to common doesn't really help with solvency (except with some ratios). See Paul Kasriel's Preferred Equity into Common Equity – Accounting Alchemy?

Some of the numbers don't make much sense. Using BofA as an example, the indicative two year loss rates for first lien mortgages are 7% to 8.5%, and I believe BofA is in worse shape (because of their acquisition of Countrywide) than most banks. So I would expect losses substantially higher than the indicative rates. Instead they were lower (only 6.8% of first lien mortgages).

And I was expecting more details. Under Commercial Real Estate (CRE), the Fed grouped Construction & Development (C&D), Multi-family, and other non-residential in the same category. However the indicative loss rates suggest these assets perform very differently (C&D the worst), and it would help to break out each category. Especially since it appears the banks have under reserved for CRE losses.

How can BofA only have 9.1% in CRE losses over two years under the "more adverse" scenario? I'd like to see their exposure to C&D, and other categories.

Also, I was expecting to see the losses and loss rates for both the baseline and more adverse scenarios. Although the "more adverse" is the new baseline, I was hoping to construct a new scenario based on differences in these losses. Without the baseline data, this is impossible.

On the Obama dinner with several economists, Michael Hirsh writes: No-Stress Tests

It’s not that Barack Obama isn’t aware of what’s at stake. That’s very likely why on April 27, the president gathered in some of his chief outside economic critics —including two of the most vociferous, Nobelists Joseph Stiglitz and Paul Krugman—for a secretive dinner in the old family dining room of the White House. Also in attendance: Paul Volcker, who has one foot in and one foot out of the administration as the head of Obama’s largely cosmetic economic recovery board; Princeton economist and former Fed vice chairman Alan Blinder; Columbia’s Jeff Sachs; and Harvard’s Ken Rogoff. Representing the home team, as it were: Obama’s chief economic adviser Larry Summers, Treasury Secretary Tim Geithner and Chief of Staff Rahm Emanuel. Why did Obama hold the meeting? “I think he wanted to hear the [opposing] arguments right in front of him,” says Blinder. “All I can say is if the president of the United States devotes that much personal time, and it was about two-hour dinner, he must want to hear what people outside the administration are saying and hear what his own people say in rebuttal to that. Why would you do that if you aren’t at least turning over your mind what to do next?”What to do next? If this fails, nationalize.

Fed Releases Stress Test Results

by Calculated Risk on 5/07/2009 05:00:00 PM

The results of a comprehensive, forward-looking assessment of the financial conditions of the nation's 19 largest bank holding companies (BHCs) by the federal bank supervisory agencies were released on Thursday.Overview of Results (333 KB PDF)

The exercise--conducted by the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation--was conducted so that supervisors could determine the capital buffers sufficient for the 19 BHCs to withstand losses and sustain lending--even if the economic downturn is more severe than is currently anticipated. In a detailed summary of the results of the Supervisory Capital Assessment Program (SCAP), the supervisors identified the potential losses, resources available to absorb losses, and resulting capital buffer needed for the 19 participating BHCs.

The SCAP is a complement to the Treasury's Capital Assistance Program (CAP), which makes capital available to financial institutions as a bridge to private capital in the future. Together, these programs play a critical role in ensuring that the U.S. banking sector will be in a position of strength.

The results of the SCAP suggest that if the economy were to track the more adverse scenario, losses at the 19 firms during 2009 and 2010 could be $600 billion. The bulk of the estimated losses –approximately $455 billion – come from losses on the BHCs’ accrual loan portfolios, particularly from residential mortgages and other consumer‐related loans. The estimated two‐year cumulative losses on total loans under the more adverse scenario is 9.1 percent at the 19 participating BHCs; for comparison, this two‐year rate is higher than during the historical peak loss years of the 1930s. Estimated possible losses from trading‐related exposures and securities held in investment portfolios totaled $135 billion.Ten banks need $185 billion in additional capital:

After taking account of losses, revenues and reserve build requirements, in the aggregate, these firms need to add $185 billion to capital buffers to reach the target SCAP capital buffer at the end of 2010 under the more adverse scenario. But a number of these firms have either completed or contracted for asset sales or restructured existing capital instruments since the end of 2008 in ways that increased their Tier 1 Common capital. These actions substantially reduced the final SCAP buffer. In addition, the preprovision net revenues of many of the firms exceeded what was assumed in the more adverse scenario by almost $20B, allowing them to build their capital bases. The effects of these transactions and revenues rendered the additional capital needed to establish the SCAP buffer equal to $75 billion.Note: It's important to note these are future losses in addition to write-downs already taken.

State Street: No Capital Needed

by Calculated Risk on 5/07/2009 03:32:00 PM

Initial leaks suggested State Street would need to raise capital.

Now, from the WSJ: State Street Doesn't Need to Boost Capital

State Street Corp. does not need to boost its capital levels as a result of the government's recently concluded stress tests ...The stress test results will be released at 5 PM ET.

UPDATE: Morgan Stanley to raise $5 billion through stock, debt offerings

Wells to sell $6 billion in new common stock

Commercial Mortgage Delinquencies Increase Sharply

by Calculated Risk on 5/07/2009 02:10:00 PM

From Bloomberg: Commercial Mortgage Delinquencies in U.S. Rise to 11-Year High

The percentage of loans 30 days or more behind in payments rose to 2.45 percent, Trepp LLC said in a report. The delinquency rate was more than five times the year-ago number, Trepp said. The New York-based researcher’s records go back to 1998.These are delinquencies - not losses - but it will be interesting to see the expected losses (and loss rates) for multifamily and non-residential real estate reported this afternoon.

...

Commercial property values fell 21.5 percent through February from their October 2007 peak, according to Moody’s Investors Service.

Properties bought in 2006 are now worth on average 11 percent less than their original price, and those bought in 2007 are worth almost 20 percent less, Moody’s said.

...

Mortgages on rental apartment buildings posted the highest delinquency rate of securitized commercial property loans in April, rising to 5.24 percent from 3.86 percent in March, Trepp said.

The Fed provides charge-off and delinquency rate for commercial real estate back to 1991. However, the Fed data includes C&D (construction and development) in CRE, so isn't directly comparable to the Trepp data.

Hotel RevPAR in Q1: "Worst year-over-year decline in History"

by Calculated Risk on 5/07/2009 11:06:00 AM

"OK, so now it’s official. The first quarter of 2009 experienced the worst year-over-year revenue per available room drop in the U.S. lodging industry’s organized history."Note: RevPAR is Revenue per available room - a key measure in the hotel industry.

Jeff Higley: Catching up on hotel topics

From HotelNewsNow.com: STR reports U.S. data for week ending 2 May

In year-over-year measurements, the industry’s occupancy fell 11.6 percent to end the week at 55.7 percent. Average daily rate dropped 8.6 percent to finish the week at US$99.42. Revenue per available room for the week decreased 19.1 percent to finish at US$55.33.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.1% from the same period in 2008.

The average daily rate is down 8.6%, so RevPAR is off 19.1% from the same week last year.

Bernanke on Lessons Learned for Bank Supervision

by Calculated Risk on 5/07/2009 09:36:00 AM

There is no question that the Fed failed to adequately perform their regulatory responsibilities during the housing and credit bubble. However part of the problem was supervisory responsibility were split between various state and Federal regulators. As Fed Chairman Ben Bernanke notes in this speech, under the Gramm-Leach-Bliley Act of 1999, the Fed "serves as consolidated supervisor of all bank holding companies, including financial holding companies." Although the Fed missed significant problems at these holding companies, many of the problems were at mortgage brokers, and commercial banks that were not regulated by the Fed.

The regulators that I spoke with in 2005, at various agencies, were all concerned about the impact of the housing bubble and lax lending standards. But it was difficult to get the various regulators to coordinate. And several people told me confidentially that the Fed and the OTS were blocking efforts to tighten lending standards. So more consolidated supervision is required - but part of the problem during the bubble was that a few key individuals were able to block the efforts of other regulators.

So I think a framework to identify systemic problems would be an important addition.

Fed Chairman Ben Bernanke offers some suggestions: Lessons of the Financial Crisis for Banking Supervision

Looking forward, I believe a more macroprudential approach to supervision--one that supplements the supervision of individual institutions to address risks to the financial system as a whole--could help to enhance overall financial stability. Our regulatory system must include the capacity to monitor, assess, and, if necessary, address potential systemic risks within the financial system. Elements of a macroprudential agenda includePrecisely how best to implement a macroprudential agenda remains open to debate. Some of these critical functions could be incorporated into the practices of existing regulators, or a subset of them might be assigned to a macroprudential supervisory authority. However we proceed, a principal lesson of the crisis is that an approach to supervision that focuses narrowly on individual institutions can miss broader problems that are building up in the system.monitoring large or rapidly increasing exposures--such as to subprime mortgages--across firms and markets, rather than only at the level of individual firms or sectors; assessing the potential systemic risks implied by evolving risk-management practices, broad-based increases in financial leverage, or changes in financial markets or products; analyzing possible spillovers between financial firms or between firms and markets, such as the mutual exposures of highly interconnected firms; ensuring that each systemically important firm receives oversight commensurate with the risks that its failure would pose to the financial system; providing a resolution mechanism to safely wind down failing, systemically important institutions; ensuring that the critical financial infrastructure, including the institutions that support trading, payments, clearing, and settlement, is robust; working to mitigate procyclical features of capital regulation and other rules and standards; and identifying possible regulatory gaps, including gaps in the protection of consumers and investors, that pose risks for the system as a whole.

Weekly Unemployment Claims Decline; Record Continued Claims

by Calculated Risk on 5/07/2009 08:37:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 2, the advance figure for seasonally adjusted initial claims was 601,000, a decrease of 34,000 from the previous week's revised figure of 635,000. The 4-week moving average was 623,500, a decrease of 14,750 from the previous week's revised average of 638,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 25 was 6,351,000, an increase of 56,000 from the preceding week's revised level of 6,295,000. The 4-week moving average was 6,207,250, an increase of 125,250 from the preceding week's revised average of 6,082,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four-week moving average is at 623,500, off 35,250 from the peak 4 weeks ago.

Continued claims are now at 6.35 million - an all time record.

The second shows the four-week average of initial unemployment claims and recessions.

The second shows the four-week average of initial unemployment claims and recessions.Typically the four-week average peaks near the end of a recession.

Also important - in the last two recessions, initial unemployment claims peaked just before the end of the recession, but then stayed elevated for a long period following the recession - a "jobless recovery". There is a good chance this recovery will be very sluggish too, and we will see claims elevated for some time (although below the peak).

The 35,250 decline in the four-week average from the peak appears significant, and there is a good chance that we've seen the peak for weekly unemployment insurance claims. If this is the peak, continued claims should peak soon.

The level of initial claims (over 600 thousand) is still very high, indicating significant weakness in the job market.

Government: Stress Test Results to be released at 5 PM ET

by Calculated Risk on 5/07/2009 12:36:00 AM

Joint statement from Treasury, Fed, FDIC and Comptroller: The Treasury Capital Assistance Program and the Supervisory Capital Assessment Program

During this period of extraordinary economic uncertainty, the U.S. federal banking supervisors believe it to be important for the largest U.S. bank holding companies (BHCs) to have a capital buffer sufficient to withstand losses and sustain lending even in a significantly more adverse economic environment than is currently anticipated. In keeping with this aim, the Federal Reserve and other federal bank supervisors have been engaged in a comprehensive capital assessment exercise--known as the Supervisory Capital Assessment Program (SCAP)--with each of the 19 largest U.S. BHCs.So the Fed will release the losses and loss rates for each of the 12 categories in outlined in the Fed White Paper. And these are the losses for the "more adverse" scenario.

The SCAP will be completed this week and the results released publicly by the Federal Reserve Board on Thursday May 7th, 2009 at 5pm EDT. In this release, supervisors will report--under the SCAP "more adverse" scenario, for each of the 19 institutions individually and in the aggregate--their estimates of: losses and loss rates across select categories of loans; resources available to absorb those losses; and the resulting necessary additions to capital buffers. The estimates reported by the Federal Reserve represent values for a hypothetical 'what-if' scenario and are not forecasts of expected losses or revenues for the firms. Any BHC needing to augment its capital buffer at the conclusion of the SCAP will have until June 8th, 2009 to develop a detailed capital plan, and until November 9th, 2009 to implement that capital plan.

emphasis added

There is much more ...

Wednesday, May 06, 2009

Stress Test Table: Morgan Stanley Needs $1.5 Billion

by Calculated Risk on 5/06/2009 08:01:00 PM

Here are some updates to the table: Morgan Stanley has been changed to needing $1.5 billion, Capital One passed, State Street needs an unspecified amount.

| Name | Total Assets (Billions) | Stress Test Results |

|---|---|---|

| 1. Bank of America | 2,500 | Needs $34 billion |

| 2. JPMorgan Chase | 2,175 | Pass |

| 3. Citigroup | 1,947 | Needs $5 billion |

| 4. Wells Fargo | 1,310 | Needs $15 billion |

| 5. Goldman Sachs | 885 | Pass |

| 6. Morgan Stanley | 659 | Needs $1.5 billion |

| 7. MetLife | 502 | Pass |

| 8. PNC Financial Services | 291 | ??? |

| 9. U.S. Bancorp | 267 | ??? |

| 10. Bank of New York Mellon | 238 | Pass |

| 11. GMAC | 189 | Needs $11.5 billion |

| 12. SunTrust | 189 | ??? |

| 13. State Street | 177 | Needs $$$ |

| 14. Capital One Financial Corp. | 166 | Pass |

| 15. BB&T | 152 | ??? |

| 16. Regions Financial Corp. | 146 | Needs $$$ |

| 17. American Express | 126 | Pass |

| 18. Fifth Third Bancorp | 120 | Needs $3.3 billion (1) |

| 19. KeyCorp | 105 | Needs $3.3 billion (1) |

(1) Citi estimate. (ht Turbo)

Senate Passes Expanded FDIC Credit Line

by Calculated Risk on 5/06/2009 06:05:00 PM

From Reuters: US Senate expands credit lines to FDIC reserves

The U.S. Senate on Wednesday approved a measure to expand a government credit line for the Federal Deposit Insurance Corp ... The FDIC ... has been able to tap the Treasury Department for up to $30 billion since 1991. That credit line would be increased to $100 billion under the new bill.Part of this is for the PPIP, see: Sorkin's ‘No-Risk’ Insurance at F.D.I.C.

The House of Representatives has already passed its version of the legislation ...

Besides raising the cap on FDIC borrowing, the bill gives the federal insurer a $500 billion credit limit that will sunset at the end of next year.

[The F.D.I.C. is] going to be insuring 85 percent of the debt, provided by the Treasury, that private investors will use to subsidize their acquisitions of toxic assets. The program ... is the equivalent of TARP 2.0. Only this time, Congress didn’t get a chance to vote.

...

The F.D.I.C. is insuring the program, called the Public-Private Investment Program, by using a special provision in its charter that allows it to take extraordinary steps when an “emergency determination by secretary of the Treasury” is made to mitigate “systemic risk.”

Foreclosures: The 2nd Wave

by Calculated Risk on 5/06/2009 04:30:00 PM

From Nick Timiraos at the WSJ: Another Sign of Foreclosure Trouble in California

The homeowner association delinquency rate can serve as a leading indicator of sorts because homeowners usually stop paying dues before they stop paying their mortgage. The 90-day delinquency rate on dues for the 260 homeowner associations in California managed by Merit Property Management jumped to 5.3% in March from 2.8% last June. Delinquencies first spiked to 2.6% in December 2007 from 0.8% in March 2007.

... The rising number of HOA delinquencies and the boost in pre-foreclosure notices could be a harbinger of things to come. “There’s reason to believe in California there may be a second wave of foreclosures,” [Andrew Schlegel, Merit communities financial vice president] says.