by Calculated Risk on 4/02/2009 03:24:00 PM

Thursday, April 02, 2009

The Financial Crisis: An Inside View

Here is the link to the essay by Phillip Swagel (excerpts in previous post): The Financial Crisis: An Inside View (ht Clay)

Former Treasury Assistant Secretary writes: "What was going on?"

by Calculated Risk on 4/02/2009 01:08:00 PM

From the WSJ: Paulson Expected Criticism for Changing Course on TARP (ht Belinda)

Phillip Swagel, who was assistant Treasury secretary for economic policy under Henry Paulson ... in a 50-page essay to be presented Friday at the Brookings (Institution) Panel on Economic Activity ... says his former boss "truly meant" to the use the $700 billion that Congress gave him to buy assets from banks, not to buy shares, and knew he would be criticized when he changed course late last year in the face of a deteriorating economy and deepening banking crisis.And the WSJ Real Time Economics has a few excerpts from the essay: What Was Going on Inside the Paulson Treasury?

Here is a short excerpt from the excerpts:

This shows three of the key problems with the Paulson Treasury:The Treasury predicted in May 2007 that “we were nearing the worst of it in terms of foreclosure starts” and the problem would subside after a peak in 2008. “What we missed is that the regressions didn’t use information on the quality of the underwriting of subprime mortgages in 2005, 2006 and 2007,” Swagel said — Federal Deposit Insurance Corp. staff pointed that out at the time. The ill-fated 2007 Treasury proposal to create a privately funded entity — called MLEC, or Master Liquidity Enhancement Conduit – to buy up toxic assets from the banks was developed by the Treasury’s Office of Domestic Finance and shared with market participants without involvement from other Treasury senior staff. “The MLEC episode looked to the world and to many within Treasury like a basketball player going up in the air to pass without an open teammate in mind — a rough and awkward situation,” he said. Paulson “truly meant” to the use the $700 billion in TARP money to buy assets from the banks, not to buy shares in the banks, because he saw it as “a fundamentally bad idea to have the government involved in the ownership of banks.” He changed is mind when markets deteriorated and “he well understood that directly adding capital to the banking system provided much greater leverage.”

1) Paulson didn't understand the problem until very late:

Paulson also said the fallout in subprime mortgages is "going to be painful to some lenders, but it is largely contained."2) The ill-fated MLEC, and three page initial TARP proposal showed poor planning and coordination.

March 13, 2007

"All the signs I look at" show "the housing market is at or near the bottom," Paulson said.

April 20, 2007

"In terms of looking at housing, most of us believe that it's at or near the bottom," [Paulson] told Reuters. "It's had a significant impact on the economy. No one is forecasting when, with any degree of clarity, that the upturn is going to come other than it's at or near the bottom."

July 2, 2007

“The MLEC episode looked to the world and to many within Treasury like a basketball player going up in the air to pass without an open teammate in mind — a rough and awkward situation.”3) Paulson was blinded by ideological concerns. The FDIC effectively takes over failed banks all the time, but somehow Paulson saw this as a "fundamentally bad idea".

Assistant Treasury secretary Phillip Swagel

Hopefully the entire essay will be available online.

Credit Crisis Indicators

by Calculated Risk on 4/02/2009 01:02:00 PM

Here is a quick look at a few credit indicators:

First, the British Bankers' Association reported that the three-month dollar Libor rates were fixed at 1.166%. The LIBOR was at 1.30% a couple of weeks ago, and peaked at 4.81875% on Oct 10, 2008. This is near the January 14th low of 1.0825%. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

There has been some increase in the spread the last few weeks, but the spread is still below the recent peak. The spreads are still very high, even for higher rated paper, but especially for lower rated paper.

Of course the default risk has increased significantly, especially for lower rated paper. Yesterday, Moody's warned of the worst corporate default rate since at least WWII.

Corporate America's credit quality collapsed in the first quarter, with Moody's Investors Service downgrading an estimated $1.76 trillion of debt, a record high ... The downgrades included a record number to the lowest rating categories, signaling the approach of the worst defaults since at least World War Two, Moody's chief economist John Lonski said in an interview.The Moody's data is from the St. Louis Fed:

emphasis added

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

There has been improvement in the A2P2 spread. This has declined to 0.93. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

There has been improvement in the A2P2 spread. This has declined to 0.93. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread has decreased further over the last week, and is now at 95.3. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.The recent surge in this index was a cause for alarm, but the index appears to have stabilized - and has declined over the last week.

All of these indicators are still too high, but there has been some progress.

Hotel Occupancy: RevPAR Off 20%

by Calculated Risk on 4/02/2009 11:08:00 AM

First a quote:

"The deteriorating trends in revenue and earnings ... accelerated during the first quarter of 2009. We expect this situation to continue as long as competitors in the Las Vegas market follow a strategy of sacrificing ADR (average daily room rate) to maximize room occupancy ... " emphasis addedIt's not just in Las Vegas ...

William L. Westerman, CEO, Riviera Holdings Corp, March 31, 2009

From HotelNewsNow.com: STR reports U.S. data for week ending 28 March

In year-over-year measurements, the industry’s occupancy fell 12.3 percent to end the week at 56.6 percent (64.6 percent in the comparable week in 2008). Average daily rate dropped 8.8 percent to finish the week at US$99.77 (US$109.34 in the comparable week in 2008). Revenue per available room for the week decreased 20.0 percent to finish at US$56.50 (US$70.61 in the comparable week in 2008).

Click on graph for larger image in new window.

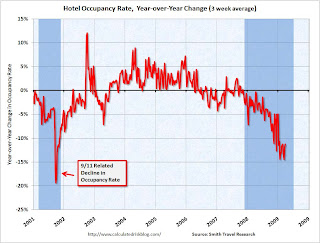

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.3% from the same period in 2008.

The average daily rate is down 8.8%, so RevPAR (Revenue per available room) is off 20.0% from the same week last year.

FASB on Mark-to-Market Rules

by Calculated Risk on 4/02/2009 09:18:00 AM

From Bloomberg: FASB Eases Fair-Value Rules Amid Lawmaker Pressure (ht Mark)

... The changes approved today to fair-value, also known as mark-to-market, allow companies to use “significant” judgment in valuing assets to reduce writedowns on certain investments, including mortgage-backed securities. Accounting analysts say the measure, which can be applied to first-quarter results, may boost banks’ net income by 20 percent or more. FASB approved the changes during a meeting in Norwalk, Connecticut.Update: From Housing Wire:

If you read the headlines (and most people don’t bother to go much farther beyond the headline than the lead paragraph –- to our collective disgrace), you already think FASB eased the rules for measuring fair value on Thursday. You might believe that it has at last caved in to pressure from banks and Congress, and decided to allow “preparers” and their auditors to use judgment when valuing illiquid assets.

Not so. They are reiterating for the third time that “fair value is the price that would be received to sell the asset in an orderly transaction (that is, not a forced liquidation or distressed sale) between market participants at the measurement date.”

And for the second time it is “highlighting and expanding on the relevant principles in FAS 157 that should be considered in estimating fair value when there has been a significant decrease in market activity for the asset.”

The first time, of course, was when they issued FAS 157. The second is the SEC/FASB staff clarifications on fair value accounting issued September 30, 2008. This is the third statement, second clarification and expansion.

Monster Employment Index Declines in March

by Calculated Risk on 4/02/2009 08:44:00 AM

"The decline in U.S. online recruitment activity during March was a sober follow-up to February’s seasonal rise, as uncertainty in the future economic situation continued to keep employers on the sidelines of the hiring field.”From Monster.com: Monster Employment Index Dips Slightly in March

Jesse Harriott, senior vice president, Monster Worldwide April 2, 2009

The Monster Employment Index fell 4 points in March, and is now down 29% year-over-year, indicating a continued deceleration in online recruitment activity at the end of the first quarter.Just another indicator showing substantial weakness in the job market.

The ADP report showed private employment decreased 742,000 from February to March 2009. The weekly initial unemployment claims report showed insured unemployment is at a record 5.73 million, and initial weekly claims at a cycle high of 669 thousand.

The BLS report for March will be released tomorrow. The consensus is for a decline of 650 thousand in payroll employment ... I'll take the under.

Unemployment Insurance: More Weakness

by Calculated Risk on 4/02/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 28, the advance figure for seasonally adjusted initial claims was 669,000, an increase of 12,000 from the previous week's revised figure of 657,000. The 4-week moving average was 656,750, an increase of 6,500 from the previous week's revised average of 650,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 21 was 5,728,000, an increase of 161,000 from the preceding week's revised level of 5,567,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

The four week moving average is at 656,750. The record was 674,250 in 1982, although that was much higher as a percent of covered employment (covered employment was 87.6 million in 1982 compared to 133.9 million today).

Continued claims are now at 5.73 million - the all time record.

Note: I'll add the normalized graph next week. This is another very weak report and shows continued weakness for employment.

LA Times on Jim the Realtor

by Calculated Risk on 4/02/2009 12:40:00 AM

From Peter Hong at the LA Times: The Hunter S. Thompson of real estate

Real estate salesman Jim Klinge ... has become a notorious Internet chronicler of the real estate crash in north San Diego County, where he has lived and worked for decades.Here is one of my favorites - Jim the Realtor showcases an investment opportunity in San Diego - enjoy!

Rather than downplay the greed and excess that caused the region's travails, he revels in exposing them.

He surveys the wreckage with a pocket video camera, shooting footage of vacant, once-pricey houses turned into eyesores, voiced over with his deadpan narration. Then he posts them on his website, at www.bubbleinfo.com.

They're shaky, noisy clips full of coarse images and language.

More from the LA Times:

In one clip, the camera pans across the kitchen of a million-dollar fixer near Interstate 5. He pointedly notes the house's proximity to the freeway, which he calls the "De-troit river." There's mold under the sink and a foot-sized hole in the drywall just above the floor.I really enjoy Jim's videos ... Here is a compilation video Jim posted today:

"December 2006 this house sold for a million dollars," he says. "Nineteen hundred square feet, built in '78, right across the freeway. One million."

...

His wife, Donna, who helps manage the family brokerage, was nervous. "He was really pushing the envelope with the blog, taking people on, naming names," she said. "I took deep breaths. I didn't know how it would turn out."

She said she was shocked one day to see a photo on the blog of two young men sitting on the floor of a house with their wrists bound like prisoners. They had been squatting in a foreclosed house Jim was selling, and he had sneaked up on them as they slept and tied them up with plastic zip ties in a brazen citizen’s arrest.

Wednesday, April 01, 2009

NPR: Anatomy Of A Bank Takeover

by Calculated Risk on 4/01/2009 10:59:00 PM

From NPR (with Chicago Public Radio: This American Life), here is a story about the FDIC takeover of Bank of Clark County: Anatomy Of A Bank Takeover (ht Ted)

Here is the audio from NPR.

Here is the FDIC announcement from January: Umpqua Bank Acquires the Insured Deposits of Bank of Clark County, Vancouver, WA

| At least they get free ice cream! Click on photo for larger image in new window. Photo Credit: Otishertz, January 2009 |

Auto Sales: Ray of Sunshine?

by Calculated Risk on 4/01/2009 08:25:00 PM

In Looking for the Sun, I suggested there might be three areas to look for "rays of sunshine in a very dark season": housing starts, new home sales, and auto sales.

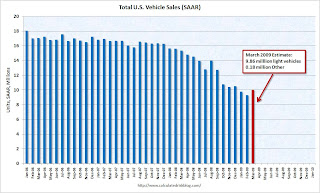

Just like for housing starts and new home sales, it is way too early to call a bottom for auto sales - but it does look like vehicle sales increased in March on a seasonally adjusted annual rate (SAAR) basis. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical vehicle sales from the BEA (blue) and an estimate for March (light vehicle sales of 9.86 million SAAR from AutoData Corp).

Note: this graph includes a small number of heavy vehicle sales to compare to the BEA.

From the WSJ: Auto Makers See a Ray of Hope

The annualized sales pace ... came in at 9.86 million vehicles, well below the 16 million or more the industry typically logged a few years ago, but up from February's pace of 9.12 million.Even if this is the bottom for auto sales (way too early to call), the pickup will probably be very sluggish - especially considering the grim unemployment news and continuing financial crisis.

"I believe we are in a bottoming process for the industry," Bob Carter, a group vice president at Toyota Motor Corp., said in a conference call. ...

Michael DiGiovanni, the top sales analyst at General Motors Corp., said he expects a "very, very gradual pickup" in vehicle sales in the second quarter. He cited "the first signs of brightening" in the market. ...

Moody's Warns of Worst Corporate Default Rate since WWII

by Calculated Risk on 4/01/2009 06:09:00 PM

From Reuters: Moody's downgraded $1.76 trln U.S. corp debt in Q1

... Moody's Investors Service downgrading an estimated $1.76 trillion of debt, a record high ...Hopefully the bank stress tests have all these defaults factored in ...

The downgrades included a record number to the lowest rating categories, signaling the approach of the worst defaults since at least World War Two ...

"The most prominent new driving force behind credit rating reductions would be deterioration of commercial real estate," [Moody's chief economist John Lonski] said. ...

Moody's has forecast that the U.S. default rate will peak around 14.5 percent in November.

emphasis added

Moody's: Record High Credit Card Charge-Offs

by Calculated Risk on 4/01/2009 05:57:00 PM

From Reuters: Credit card charge-offs hit record high -Moody's (ht Brad)

Credit card write-downs soared to record levels in February, representing an all-time high in the 20-year history of the Moody's Credit Card Index ....Moody's reported the charge-off rate at 5.59% in February 2008, and 4.51% in February 2007.

Credit card charge-offs, the write-down of uncollectable debt, advanced decisively to 8.82 percent in February, marking the sixth consecutive month of increases. The level, is more than 300 basis points higher than a year ago.

...

[Moody's] predicts the charge-off rate index will peak at about 10.5 percent in the first half of 2010, assuming a coincident unemployment rate peak at 10 percent.

Case Shiller House Prices Seasonal Pattern

by Calculated Risk on 4/01/2009 04:04:00 PM

First, the market graph from Doug ... Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. This graph shows the seasonal pattern for the Case-Shiller Composite 10 house price index.

This graph shows the seasonal pattern for the Case-Shiller Composite 10 house price index.

The percentage change is the month-to-month change annualized.

It is important to remember this clear seasonal pattern when looking at the Case-Shiller data.

Wile E. Coyote Indicator

by Calculated Risk on 4/01/2009 03:03:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Posted with permission.

Credit: Buzz Potamkin in Animation World Magazine

See: The Macro Economy's Impact on Animation: Will Wile E. Coyote Dodge the Anvil?

"Economists and commentators are increasingly citing Wile E. Coyote to explain the macro economy, with Nobel-laureate Paul Krugman first hoisting the anvil in 2007. Cartoon image courtesy of Warner Bros. Animation. Graphs courtesy of Project X."

Ford U.S. March sales fall 40.9%

by Calculated Risk on 4/01/2009 12:04:00 PM

Update2: Toyota sales off 36.6%. GM Sales off 47%. Chrysler off 39%. From MarketWatch:

Chrysler LLC on Wednesday reported a 39% drop in March U.S. sales to 101,001 cars and trucks from 166,386 a year earlier.Update: from MarketWatch: Ford U.S. March sales drop 40.9%

Ford Motor Co. said Wednesday that U.S. March sales fell 40.9% ... At the end of March, Ford said that Ford, Lincoln and Mercury inventories totaled 408,000 units, about 27% lower than a year ago.This is reported as Year-over-year (March 2009 vs. March 2008)

Last month (February) Ford sales were off 46.3% YoY

And in January Ford sales were off 42.1%

December: 32.4%

November: 31%

Ford's numbers will probably be better than GM or Chrysler!

Thornburg Mortgage to file BK

by Calculated Risk on 4/01/2009 11:50:00 AM

From Bloomberg: Thornburg Mortgage to File for Bankruptcy, Liquidate

Thornburg Mortgage Inc., the “jumbo” residential loan specialist battling a slump in home sales and the collapse of mortgage markets, plans to file for bankruptcy protection and shut down.Thornburg specialized in prime Jumbos.

...

Thornburg specialized in mortgages of more than $417,000, typically used to buy more expensive homes.

It was an early report of Thornburg's problems that prompted Tanta to famously exclaim: "We're all subprime now!"

Construction Spending Declines in February

by Calculated Risk on 4/01/2009 10:00:00 AM

Residential construction spending is 59.3% below the peak of early 2006.

Non-residential construction spending is 8.5% below the peak of last September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is now slightly negative on a year-over-year basis, and will turn strongly negative going forward. Residential construction spending is still declining, although the YoY change will probably be less negative going forward.

These are two key stories for 2009: the collapse in private non-residential construction, and the probably bottom for residential construction spending.

From the Census Bureau: February 2009 Construction at $967.5 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $665.9 billion, 1.6 percent (±1.1%) below the revised January estimate of $676.9 billion. Residential construction was at a seasonally adjusted annual rate of $275.1 billion in February, 4.3 percent (±1.3%) below the revised January estimate of $287.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $390.7 billion in February, 0.3 percent (±1.1%)* above the revised January estimate of $389.5 billion.

Pending Home Sales Index

by Calculated Risk on 4/01/2009 09:59:00 AM

From the NAR: Gain Seen In Pending Home Sales, Housing Affordability Sets New Record

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in February, rose 2.1 percent to 82.1 from a reading of 80.4 in January, but is 1.4 percent below February 2008 when it was 83.3.This suggests a possible slight increase in existing home sales from March to April (February was the most recent report).

Note: Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so the February report suggests existing home sales will increase slightly from March to April.

Note: Ignore all the affordability nonsense. That just tells you interest rates are low.

ADP: Private Sector Loses 742,000 Jobs

by Calculated Risk on 4/01/2009 09:06:00 AM

I don't have much confidence in the ADP report in predicting the BLS employment number, but this is pretty ugly ...

From ADP:

Nonfarm private employment decreased 742,000 from February to March 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®.

...

March’s ADP Report estimates nonfarm private employment in the service-providing sector fell by 415,000. Employment in the goods-producing sector declined 327,000, the twenty-seventh consecutive monthly decline. Employment in the manufacturing sector declined 206,000, its thirty-seventh consecutive decline.

...

In March, construction employment dropped 118,000. This was its twenty-sixth consecutive monthly decline, and brings the total decline in construction jobs since the peak in January 2007 to 1,135,000.

Tuesday, March 31, 2009

Evening Summary and Open Thread

by Calculated Risk on 3/31/2009 10:59:00 PM

Here is an open thread for discussion.

Case-Shiller reported house prices fell sharply in January.

The Philly Fed State indexes showed all 50 states in recession (check out the map!).

The Restaurant Performance Index showed continued contraction.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.